6 Questions to Answer About Your 401(k) Plan Today

There’s no need to panic, but checking in on these items can help keep your retirement on track.

Is My Overall Savings Rate on Track?

It's easy to put off contributions to a workplace retirement plan, especially if competing financial priorities don't leave you with much left over. During periods of market volatility and global political turmoil, it can also be tempting to wait until things settle down before making any investments. But it's impossible to time the market bottom, and markets often bounce back faster than investors expect. Even during periods of war and other global crises, markets are often more resilient than panic-inducing headlines might imply. As a result, time in the market is far more important than timing the market.

Many experts recommend contributing at least 10%-15% of your gross salary to your 401(k) plan, and the earlier you start, the better. If it’s impossible to reach that target, try to contribute at least up to the percentage that your company will match. Otherwise, you’re basically leaving free money on the table.

In addition, many 401(k) plans will allow you to set up an automatic increase in contributions--for example, increasing contributions as a percentage of salary by 1% per year. This can be a relatively painless way to increase retirement savings over time.

Do I Have the Right Mix of Stocks and Bonds?

How your portfolio is split between major asset classes is arguably one of the most important factors to consider when evaluating your 401(k) plan. Stocks typically generate better long-term returns, but bonds can fill a valuable role as a buffer against market volatility. In addition, stocks and bonds typically don't move in lockstep. Because their performance patterns are usually fundamentally different, combining the two can improve a portfolio's diversification and improve risk-adjusted returns.

What's the right mix? Younger investors in their 20s or 30s might be comfortable keeping all of their retirement assets in stocks as long as they have a high enough risk tolerance to ride out short-term market declines without panicking, as well as sufficient emergency savings readily available. Other investors will probably want to keep some assets in fixed-income securities, especially as they get closer to retirement age.

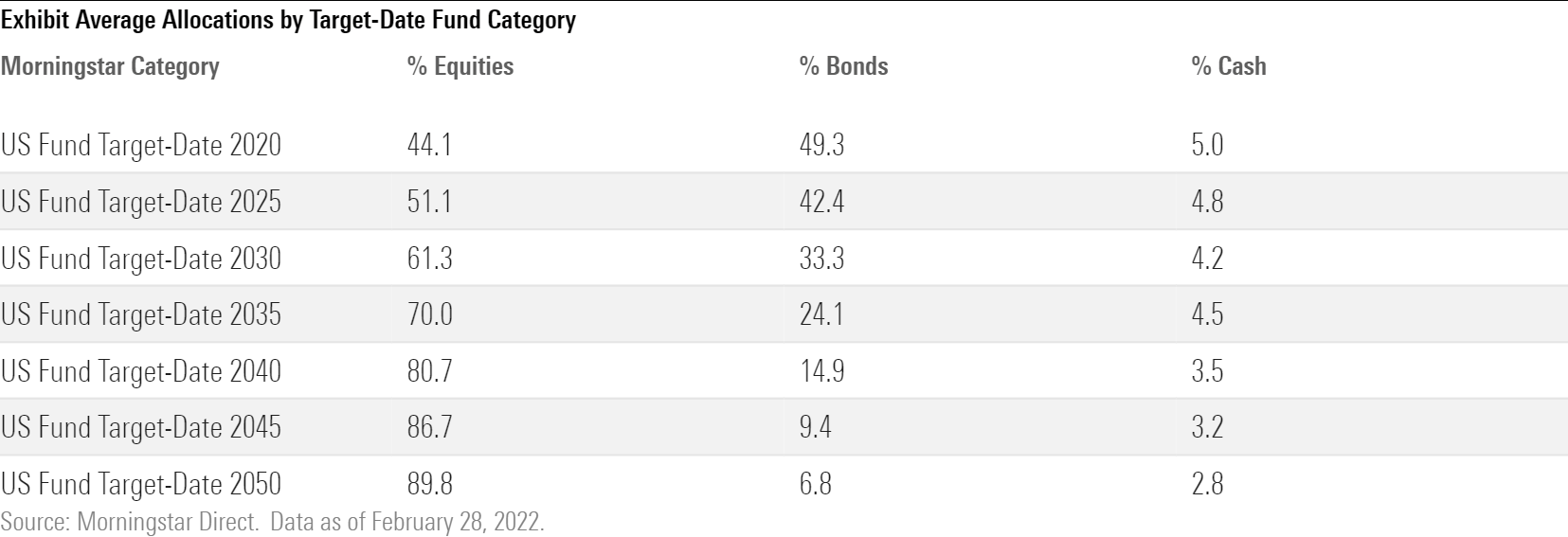

As a general guideline, the rule of thumb of setting equity exposure equal to 120 minus your age can be a good place to start. The stock/bond allocations for target-date funds can also be a useful reference point. The table below shows the average stock/bond mix for target-date funds tailored to investors with different retirement dates.

Do I Have Too Many Funds?

It’s easy to get overwhelmed by the number of options in a 401(k) lineup. Many employees deal with this feeling of overwhelm by following a seemingly simple strategy: putting a little bit of everything in their 401(k). This approach doesn’t usually lead to optimal results. Depending on the choices available, you might end up with a hodge-podge of different fund types that might not be a good match for your goals. Putting your retirement dollars into highly specialized funds--such as sector funds or funds that focus on a specific geographic region--is another major risk. These funds can be difficult for investors to use because they tend to swing in and out of favor, and investors are often tempted to buy in after they’ve already experienced several years of strong performance.

In most cases, it's better to stick with a handful of funds that focus on major asset classes: U.S. stocks, international stocks, and investment-grade bonds. We're also big fans of target-date funds, which provide built-in diversification and automatically adjust their asset mix to become more conservative as shareholders reach retirement age. Because of their built-in diversification, these funds can be a great option for keeping things simple while getting diversified exposure to major asset classes. If your 401(k) plan includes a solid target-date fund with a reasonable expense ratio, you don't necessarily need to add any other asset classes.

Do I Have the Right Mix of Value and Growth?

Value stocks (which typically have lower prices relative to metrics such as book value, earnings, sales, or profitability) and growth stocks (which typically have higher prices but faster underlying revenue and earnings-growth rates) often perform differently in different types of markets. After a long run of outperformance by growth stocks, value stocks have recently fared better thanks to the strong economic recovery. For the trailing six-month period ended in February 2022, the Morningstar US Value Index has generated total returns of about 4%, compared with a loss of 14% for the Morningstar US Growth Index. But if your 401(k) plan includes an allocation to growth-oriented mutual funds, you might still be overweight in growth simply because that investment style outperformed by such a wide margin over the past 10 years.

One option is to add a value-oriented fund to bring things into better balance, but easier yet would be to shift assets to funds that track broad market indexes, which typically have a blend of value and growth characteristics. As mentioned above, target-date funds can also simplify things. Not only do they offer a built-in mix of stocks and bonds that gradually adjusts over time, but they also usually don’t have a pronounced bias toward either value or growth.

Are My 401(k) Investments Globally Diversified?

Adding international exposure is one of the first steps toward a diversified portfolio. Although many investors favor investments closer to home, that can limit exposure to a lot of opportunities. Non-U.S. stocks currently make up about 40% of global market capitalization.

Although international markets have generally fallen behind the U.S. market for the past several years, they’ve pulled ahead in some previous periods, such as 1983-88 and 2002-07. In particular, adding international exposure often shores up returns during periods of U.S. dollar weakness.

As a rough guideline, it’s reasonable to carve out about a third of total equity exposure for non-U.S. stocks. As with the value-growth split, many investors are probably currently underweight in international stocks given the relative strength of the U.S. market in recent years.

Do I Have Too Much Exposure to Long-Term Bonds?

Bonds with long-term maturities have been strong performers over most of the past four decades, as they’ve benefited from the secular decline in interest rates. As yields on the 10-year Treasury have gradually declined from a peak of more than 15% in the early 1980s to less than 2% more recently, long-duration funds have generated above-average returns.

Given recent strength in the U.S. economy, the Federal Reserve has signaled that it will raise rates to help rein in inflation, which has recently been running at a 7% annualized rate. Moreover, it has indicated not simply a modest increase but a series of increases that would provide the central bank with the leeway to lower rates again should the economy experience a shock. The Fed's board of governors has signaled as such, and many market participants anticipate anywhere from two to seven hikes in the coming year.

Any rate hikes would be negative for long-duration assets. With likely rate hikes on the horizon, most investors would be better off keeping their fixed-income exposure in the short- or intermediate-term range. If you own a bond fund with “long-term” in its name, that’s a red flag that it probably would be more exposed to losses from rising interest rates. You can find more detail on a fund’s interest-rate exposure in the Portfolio section of a fund’s profile page on Morningstar.com.

Conclusion

If your 401(k) plan is still aligned with your long-term goals, there’s no need to make any changes. But periodically checking in on the items outlined above can make sure your retirement savings stay on track.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)