In the Pursuit of Equality, Gender Lens Investing Can Help Tip the Scale

This investment strategy can positively affect society--and your portfolio.

- source: Morningstar Analysts

In the past, investing and women’s rights made for strange bedfellows. No longer.

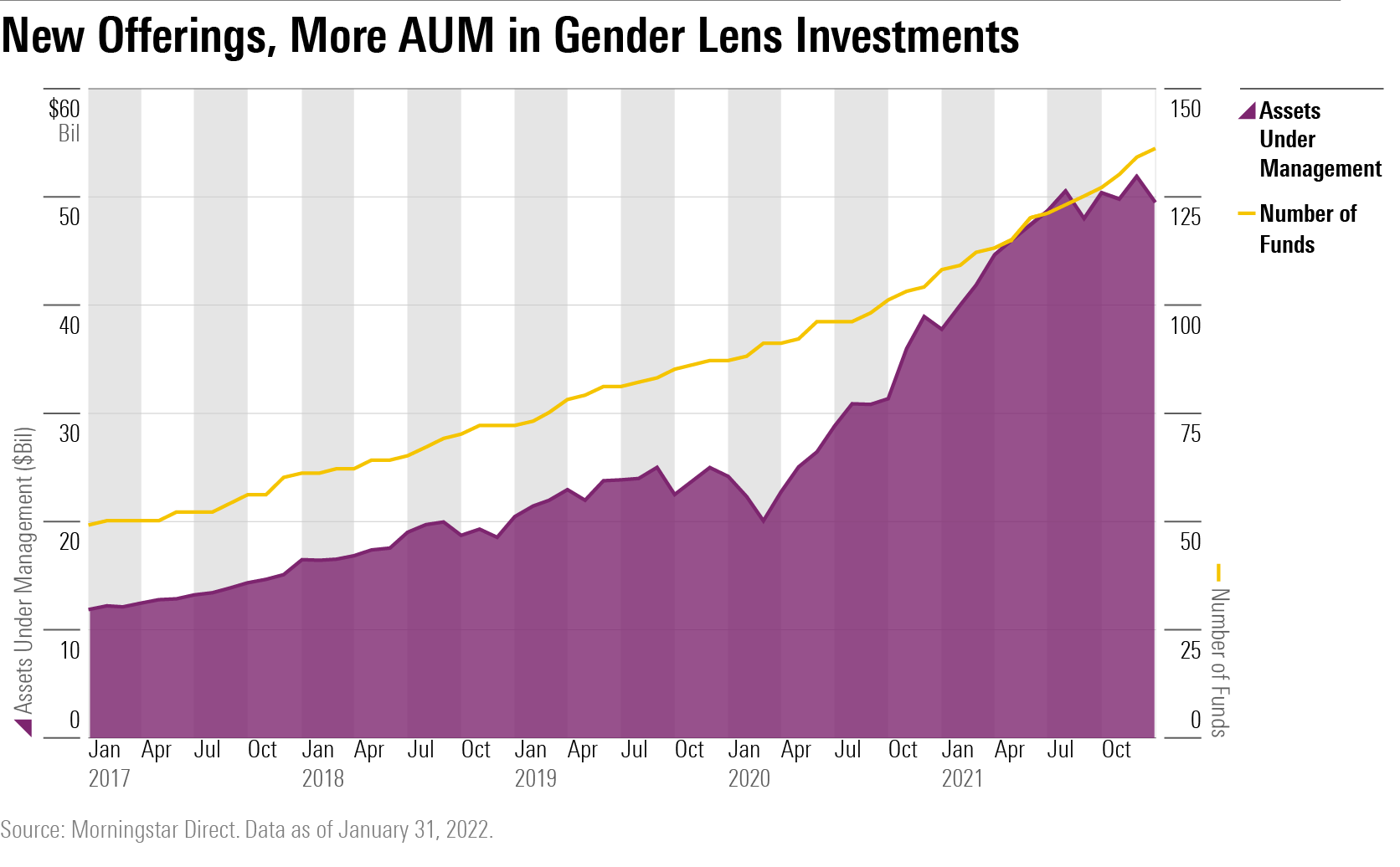

As International Women's Day approaches, assets invested in funds that specialize in companies growing female leadership, or focus on metrics like equal pay for women, are expanding. According to data collected by Parallelle Finance, a gender lens investing research and advocacy group, assets invested in such funds have risen to roughly $4 billion as of Jan. 31. That's not even including the wider pool of vehicles that consider women's issues in their investment process. According to Morningstar data, these funds contain $49 billion in assets, more than twice their $24 billion just two years before.

Gender lens investing has become a way for investors to put their money where their values are without necessarily sacrificing returns. And as more investors look for ways to make a positive impact with their investments, the industry is taking notice.

"The workplace gender gap both reflects and perpetuates broader societal and economic inequalities, says Jackie Cook, director of stewardship, product strategy and development for Sustainalytics. "Gender lens investing is grounded in an understanding of the systemic nature of the problem and takes a holistic approach to directing capital and economic influence to support gender equity."

Cook adds, "Women in leadership positions are role models, and that is valuable. Perhaps more importantly, they can be agents of change. Women can use their experience and influence to create workplace environments and build business practices that support equal participation."

What Is Gender Lens Investing?

Generally speaking, gender lens, or gender-smart, investing is the consideration of women or gender equity when making investment decisions. It’s a broad term. In practice, gender lens investing can take on many forms.

The Global Impact Investing Network breaks it down into two broad categories. The first is "investing with the intent to address gender issues or promote gender equity." That includes investing in women-owned or women-led businesses, businesses that promote workplace equity, or businesses whose products or services benefit women. They also include funds that engage in shareholder activism and use their proxy voting power to make proposals that benefit women. (In the Morningstar Sustainable Investing Framework, this type of investing falls under the "Assess Impact" approach, in which investors seek to make a positive societal impact through their investments.)

The second category uses a gender lens to help assess the quality of an investment. For example, it might include strategies that examine workplace culture and a company’s commitment to gender equality as part of their due diligence. Individual investors can take this approach when assessing companies. This approach can help mitigate environmental, social, and governance risk--companies with greater gender diversity and better workplace environments face less potential reputation risk from inappropriate behavior by senior management, for example.

But picking individual stocks or bonds isn’t the only way to apply a gender lens to investing. Investors can also seek out women financial advisors, women fund managers, and women-run wealth management solutions.

The Gender Lens Investing Landscape Is Growing But Hard to Define and Measure

This growing has spurred the creation of new investment vehicles and products, from private equity funds, to exchange-traded funds, to bonds.

Parallelle Finance identified 26 gender lens investing equity funds with $3.56 billion in assets as of Sept. 30, 2021. Total net assets climbed to roughly $4 billion as of Jan. 31, 2022. Meanwhile, fixed-income funds and products had assets of $8.41 billion as of Sept. 30, 2021, according to Parallelle's Gender Lens Investing Q3 2021 Review.

While Parallelle Finance has a narrower view of the funds it considers gender lens investments, a wider pool of funds incorporates a gender lens into their investment processes. These funds often consider gender factors in conjunction with other diversity considerations. Morningstar tracks strategies that seek to make a measurable impact on gender and diversity disparities or limit their investments to companies that meet certain diversity guidelines. These may include, for example, having a certain number of women on a company board and in management, and/or a positive record on racial and LGBTQ issues. These funds consider gender-specific issues to varying degrees, so it’s important that investors understand a fund’s investment strategy.

This broader screen for gender lens investments yields 138 equity mutual funds and ETFs. This group of funds has amassed over $49 billion in assets as of Jan. 31. New fund launches have helped fuel this growth--the group has gained 50 new funds since the start of 2020.

Index providers have also hopped on the gender lens investing train, creating indexes that target gender diversity and women in leadership. Morningstar’s own offerings include the Morningstar Women’s Empowerment index, which is designed to provide exposure to U.S. companies that have strong gender diversity policies embedded in their corporate culture and that ensure equal opportunities to employees. Index offerings like these can help make new gender lens investment vehicles more accessible by providing benchmarks for lower-cost, passively managed funds.

Gender lens investing has also picked up in wealth management and separately managed accounts. Investment manager Nia Impact Capital has been at the forefront of the movement--its Global Solutions Equity Portfolio has roughly $470 million in assets. The portfolio consists of companies that offer products and services that benefit women and have women in leadership. According to Veris Wealth Partners, an impact wealth management firm, gender lens separately managed account assets totaled $1 billion in 2021, compared with $500 million two years prior.

Robo-advisor investment platform Ellevest, which is designed to serve and educate women in investing, also offers impact equity portfolios that apply a gender lens.

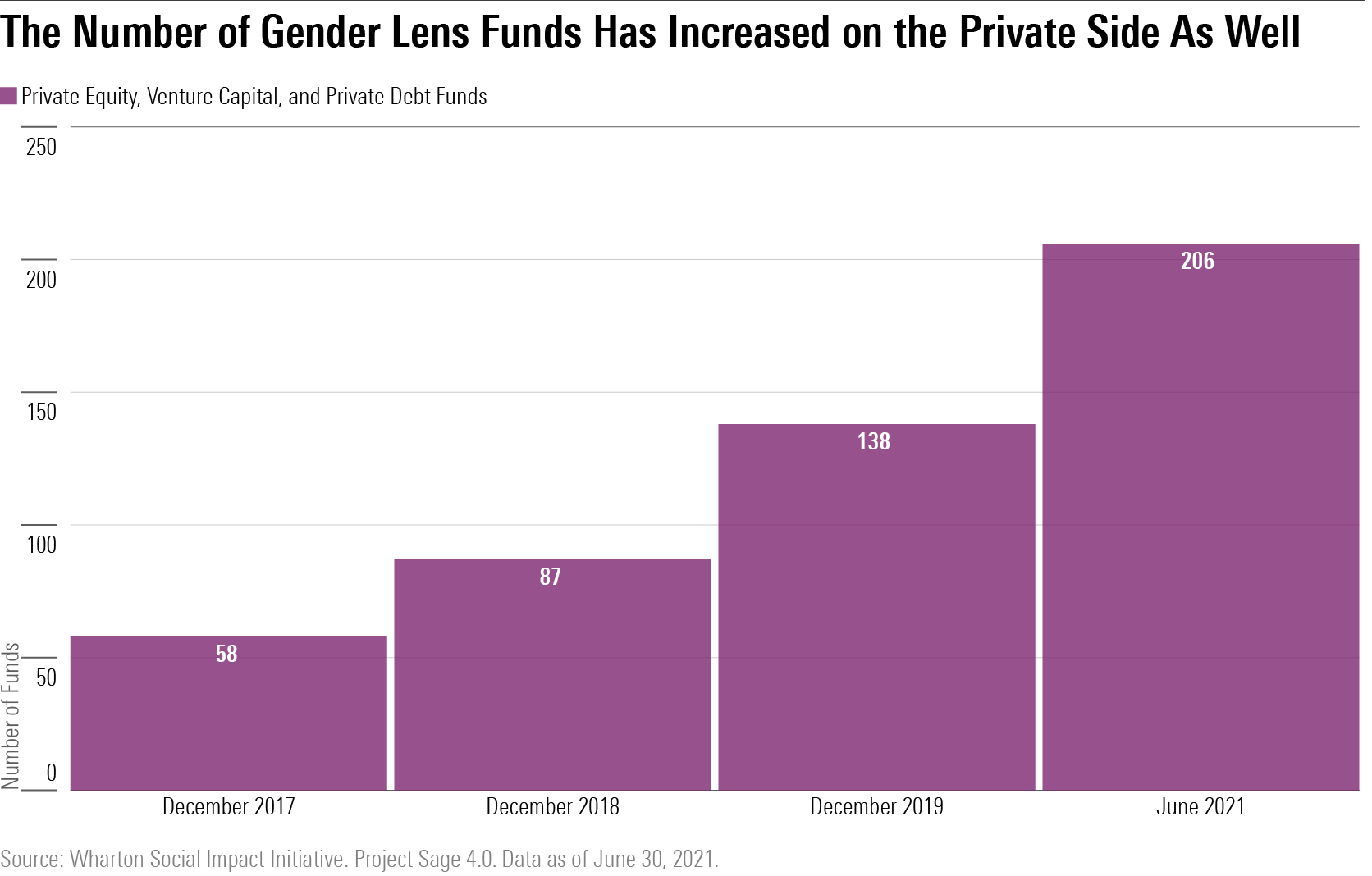

Gender lens investing growth isn't limited to the public markets. Research by Wharton Social Impact Initiative, Project Sage 4.0, found that the number of gender lens funds that invest in private equity, venture capital, and private debt increased nearly 50% from July 2020 to June 2021.

Gender Lens Investing Can Be a Useful Tool, but It Doesn’t Guarantee Fund Performance

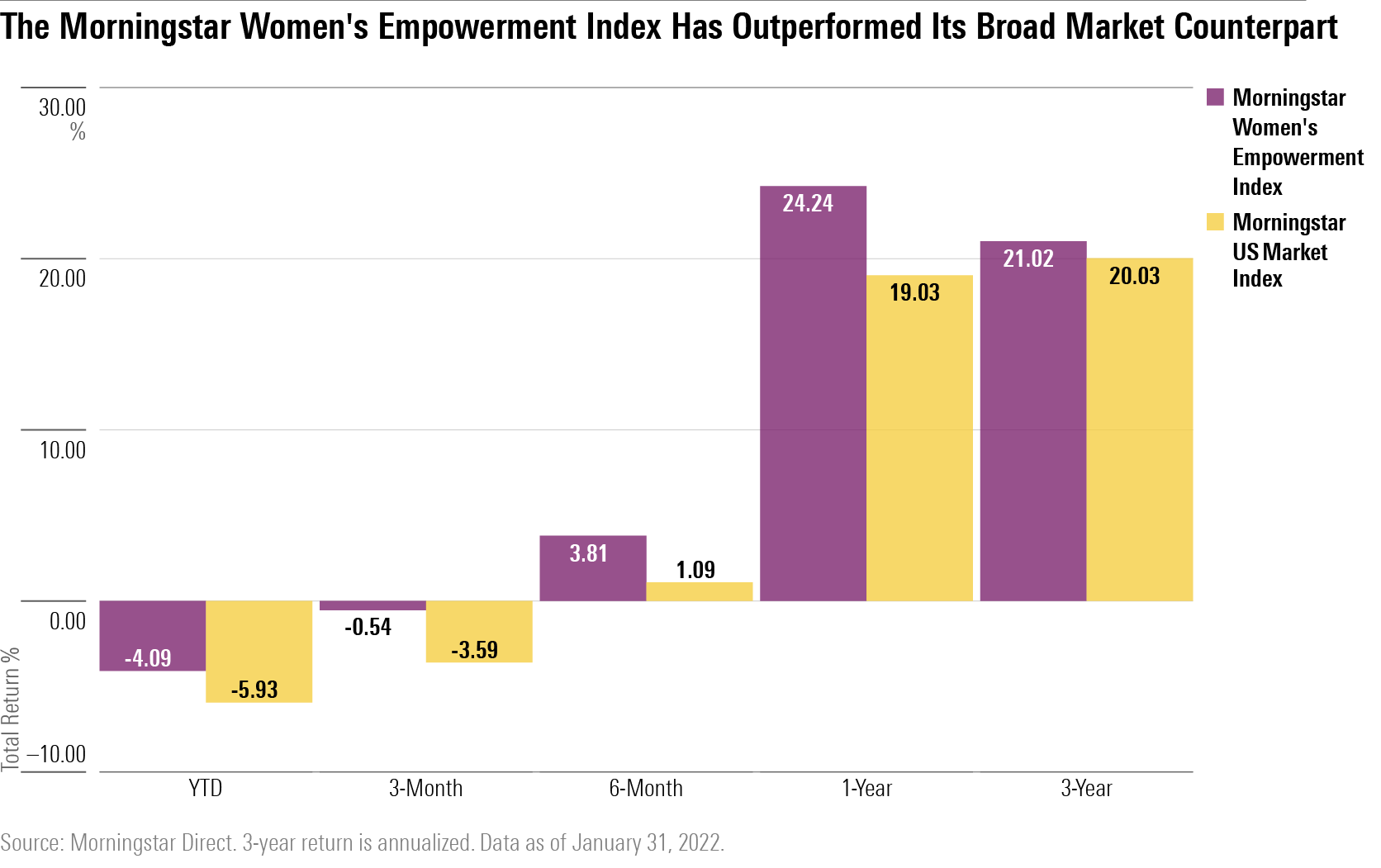

Research has shown that businesses with strong gender diversity policies are often more successful than those without. These companies are better equipped to recruit and retain talent from a larger, and more diverse, talent pool. The Morningstar Women’s Empowerment index, which provides exposure to companies with strong gender diversity policies, has consistently outperformed the broad U.S. Market index since its launch in 2018.

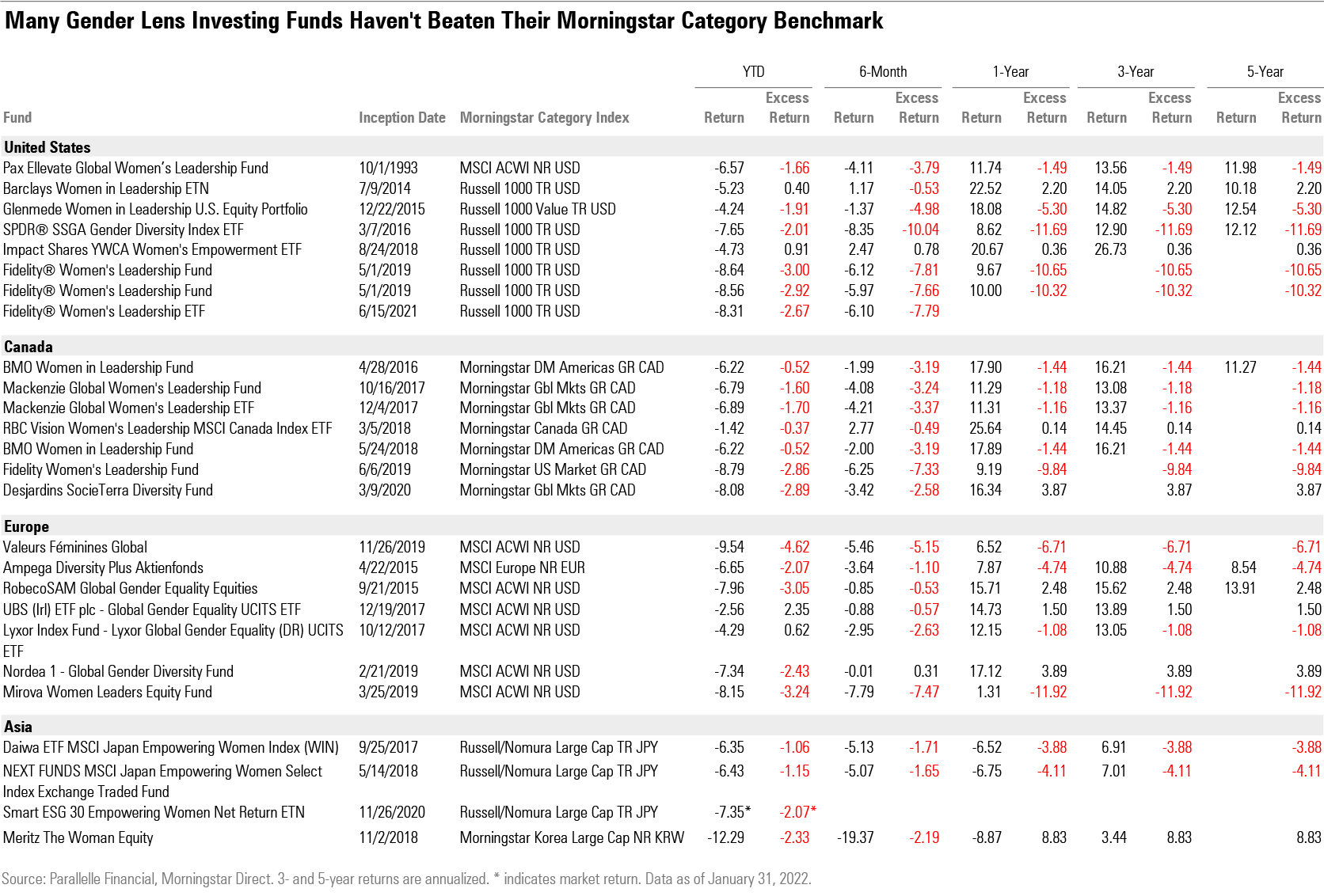

While robust gender diversity policies and women leadership are often indicators of solid businesses, a gender lens doesn’t guarantee outperformance, particularly at the fund level. Many of the gender lens investing funds identified by Parallelle have lagged their relevant benchmarks in both the short and longer term.

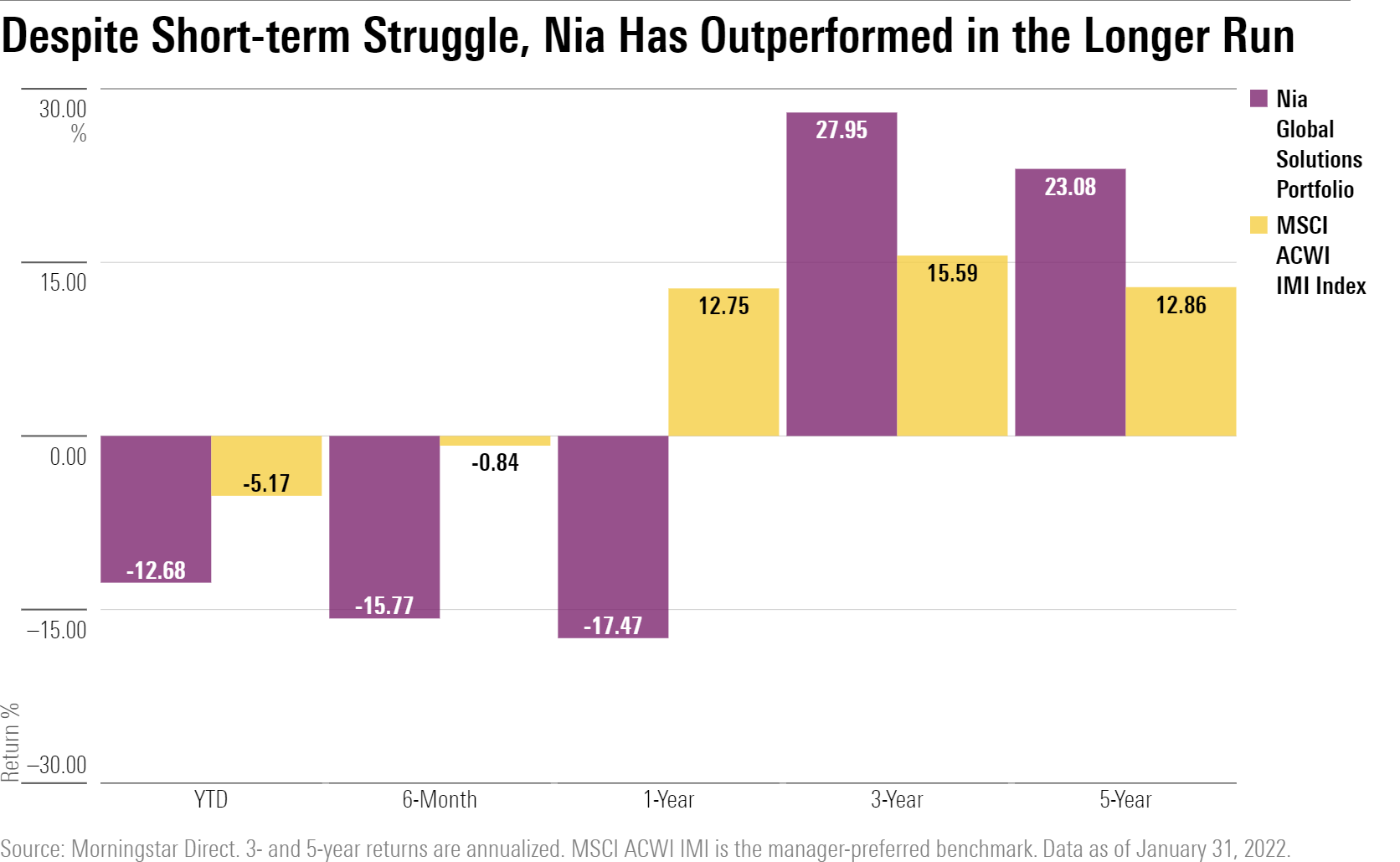

Exhibit 4

Nia Impact Capital’s Global Solutions Portfolio, a separately managed account, has outperformed its open-end and ETF counterparts over the last three and five years. And that’s despite lagging the group in the short term.

Applying a gender lens is just one piece of building a robust investing process. Screening for companies with women in leadership or strong gender diversity policies can help both individual investors and portfolio managers identify quality companies, but it can’t guarantee performance--especially in the short term.

What’s Next for Gender Lens Investing?

Since the term was first coined in 2009, gender lens investing has gained momentum as investors have realized that investing in women benefits everyone--it can both drive positive social outcomes and lead to positive returns.

The range of gender lens investing products available on the market is still limited, but there are promising signs of future growth. New indexes will make way for new and cheaper fund offerings, making gender lens investing more accessible for investors, including those who take a more hands-off approach. More disclosure on companies’ gender diversity policies and leadership demographics will also make it easier for investors and portfolio managers to make informed investing decisions using a gender lens.

As women continue to invest, they will continue to shape what has historically been a male-dominated and male-driven financial industry. Gender lens investing signals the value that women bring to the table.

/s3.amazonaws.com/arc-authors/morningstar/96c6c90b-a081-4567-8cc7-ba1a8af090d1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XTXQYAMAL5EKRLGIS3IDVAZ3R4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/3J75DKCBIZCTJMRFWSSJSHHCJ4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96c6c90b-a081-4567-8cc7-ba1a8af090d1.jpg)