Which Funds Had Heavy Holdings of Russian Debt?

With Russian bonds and the ruble collapsing, these emerging-markets funds had big weights ahead of the invasion.

The Russian attack on Ukraine and rounds of economic sanctions against the country are shining a light on mutual funds with heavy exposure to Russian bonds.

In the wake of sanctions against Russia, the value of Russian bonds has plummeted. On Friday, S&P Global Ratings lowered its rating on Russian debt to junk status. The value of the ruble has also collapsed as aggressive economic sanctions were put in place.

For the most part, debt issued by Russia is confined to emerging-markets bond funds and emerging-markets local-currency bond funds. While these funds own bonds from a large number of countries, the holdings of Russian bonds in both Morningstar Categories were relatively large.

Before the crisis, the average emerging-markets bond fund held 2.9% of its portfolio in Russia. That made Russia the fifth-largest individual country by exposure according to Morningstar Direct data for end-of-January portfolios, behind Colombia at 3% and China at 3.7%.

Among emerging-markets local-currency bond funds, the average weight was 4.8%, sixth on the list behind Brazil at 6.2%. These funds were hit not just by the steep drop in the value of Russian bonds, but also the ruble falling to a record low.

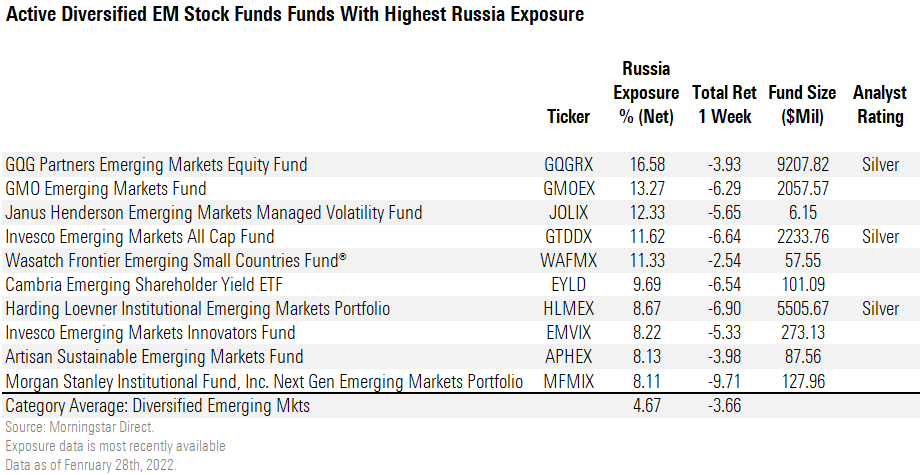

Which funds were the most exposed going into the crisis?

Below is a list of funds where managers have opted to hold a hefty stake in Russia's debt and how they performed during Thursday’s collapse of Russian bond prices.

- source: Morningstar Analysts

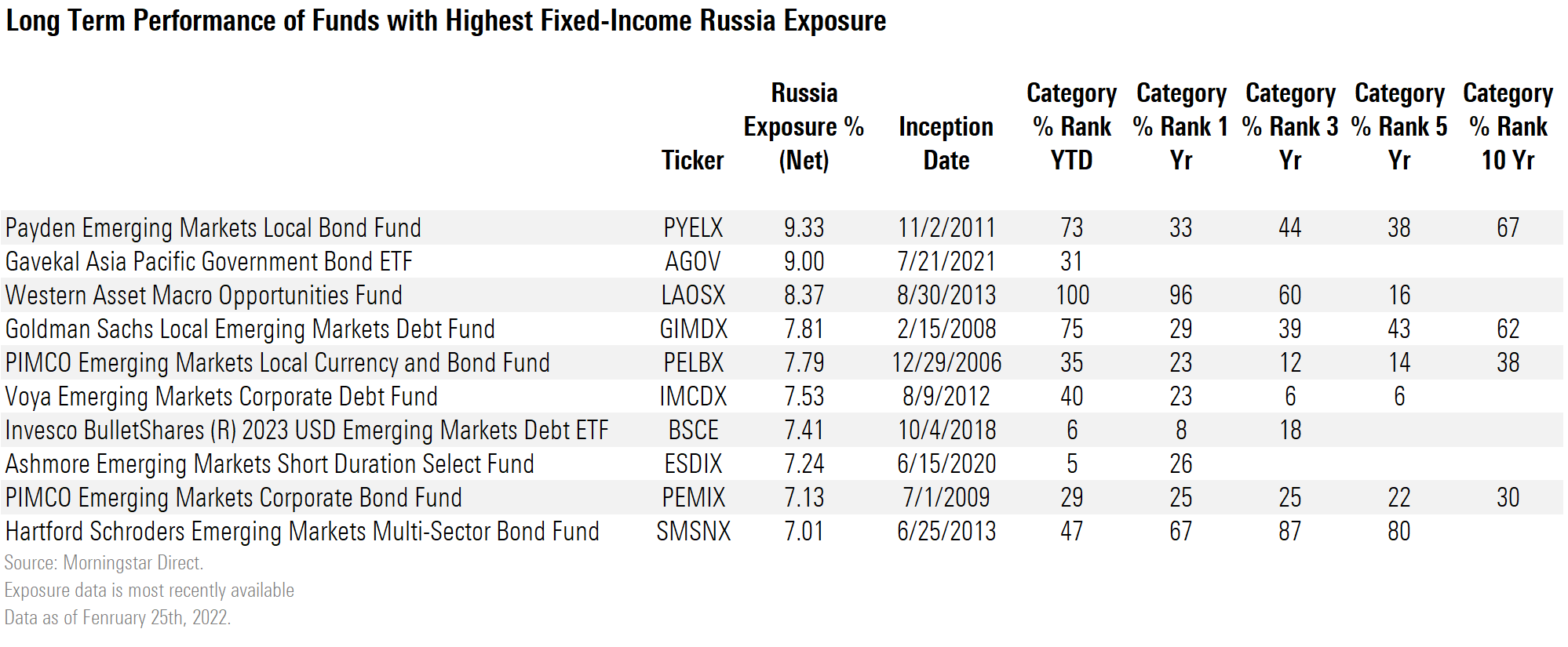

Among funds with heavy Russian debt exposure, only one is under coverage by Morningstar analysts. Neutral-rated Pimco Emerging Markets Local Currency and Bond PELBX slid 2.73% Thursday, landing it in the bottom half of the category’s performers for that session. Analyst Karin Anderson wrote that for larger positions the fund does not stray far from its JPMorgan GBI-Emerging Markets Global Diversified Index benchmark. Instead, she adds, the fund tries to make “more-pronounced bets with its emerging-markets rates positioning” to try and add value.

Payden Emerging Markets Local Bond PYELX had the highest exposure at 9.33%. The fund's weight was 2.5 percentage points higher than its benchmark, the JPMorgan GBI-Emerging Global Diversified Index. Despite losing 2.67% Thursday, the fund did outperform its bogy, which lost 3.41%.

Payden’s Russian exposure has increased steadily since the beginning of 2019. At the beginning of that period, it was 7.46%.

Western Asset Macro Opportunities LAOSX is the lone fund outside of the two emerging-markets categories with heavy Russia exposure. The strategy aims to capitalize on attractive relative value opportunities principally in fixed-income markets around the globe. The fund has fewer restrictions than other fixed-income funds and expects to trade actively. The fund increased its Russian debt stake in June of 2019 to 8.7% from 5.3%, according to Morningstar Direct. Exposure has reached as high as 10.8% of the portfolio since then.

Despite the rocky performance on Thursday, over a longer period the funds making the list of top Russia holdings on average have outperformed their peers.

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)