ETFs With Russian Exposure Plunge on Ukraine Invasion

Cybersecurity, clean energy, and uranium funds gain following Russian attack.

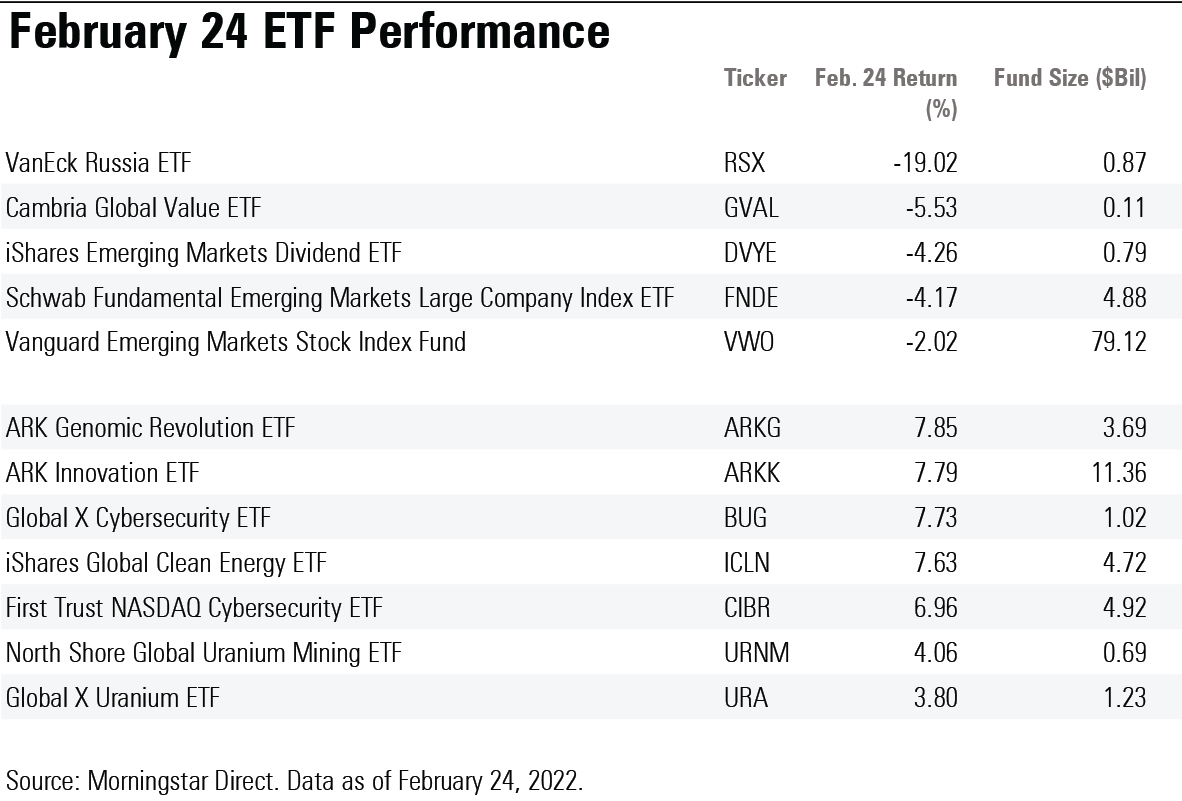

Funds with large stakes in Russian companies tumbled Thursday following the invasion of Ukraine while those investing broadly in the U.S. and global markets avoided sharp declines.

The $866 million VanEcK Russia ETF RSX slid 19.1%. iShares MSCI Russia ETF ERUS fell 19.1% on Thursday extending the the fund's one-week loss to 39%. Foreign funds with a focus on value-oriented or dividend stocks experienced larger declines. Senior manager research analyst Daniel Sotiroff says it's not uncommon for emerging market value funds to have larger stakes in Russia than broader indexes. Value strategies often overweight cyclical sectors like energy, financials, and materials—exactly the types of companies that dominate the Russian stock market, he says. The Cambria Global Value ETF GVAL lost 5.53% and the iShares Emerging Markets Dividend ETF DVYE, which holds 16% of its portfolio in Russian companies, fell 4.26%.

Vanguard FTSE Emerging Markets ETF VWO fell only 2.02%. The $79.1 billion fund is less exposed to Russian companies than the average emerging market fund. It holds a 2.75% weight in Russian companies compared to the 3.72% average stake emerging market funds tend to hold.

Schwab Fundamental Emerging Markets Large Company Index ETF FNDE holds a larger stake in Russian companies at 9.3% of its portfolio and fell 4.17%. As of Feb. 18, the fund held 2.69% of its portfolio in Gazprom GZPFY, a Russia-based integrated oil and gas company in which the government is a majority shareholder. The company's shares fell 15.8% Thursday. Sotiroff wrote in a March fund report that Gazprom and companies partially-owned by governments add ``a layer of political risk because they may not always prioritize the interests of public shareholders." Fears about possible Russian attacks on computer networks and systems pushed cybersecurity ETFs higher. Global X Cybersecurity ETF BUG gained 7.7%, and the First Trust NASDAQ Cybersecurity ETF CIBR advanced 6.9%. Investors also turned to uranium and clean energy ETFs as the price of oil, and a major Russian export, climbed. iShares Global Clean Energy ETF ICLN gained 7.63%. Funds that track uranium, a raw element material used as fuel at nuclear power plants, held up well. Global X Uranium ETF URA gained 3.8% and North Shore Global Uranium Mining ETF URNM advanced 4.06%.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)