Asset Allocation: The Power of Traditional Thinking

Improving upon the common practice is easier said than done.

A Little Knowledge

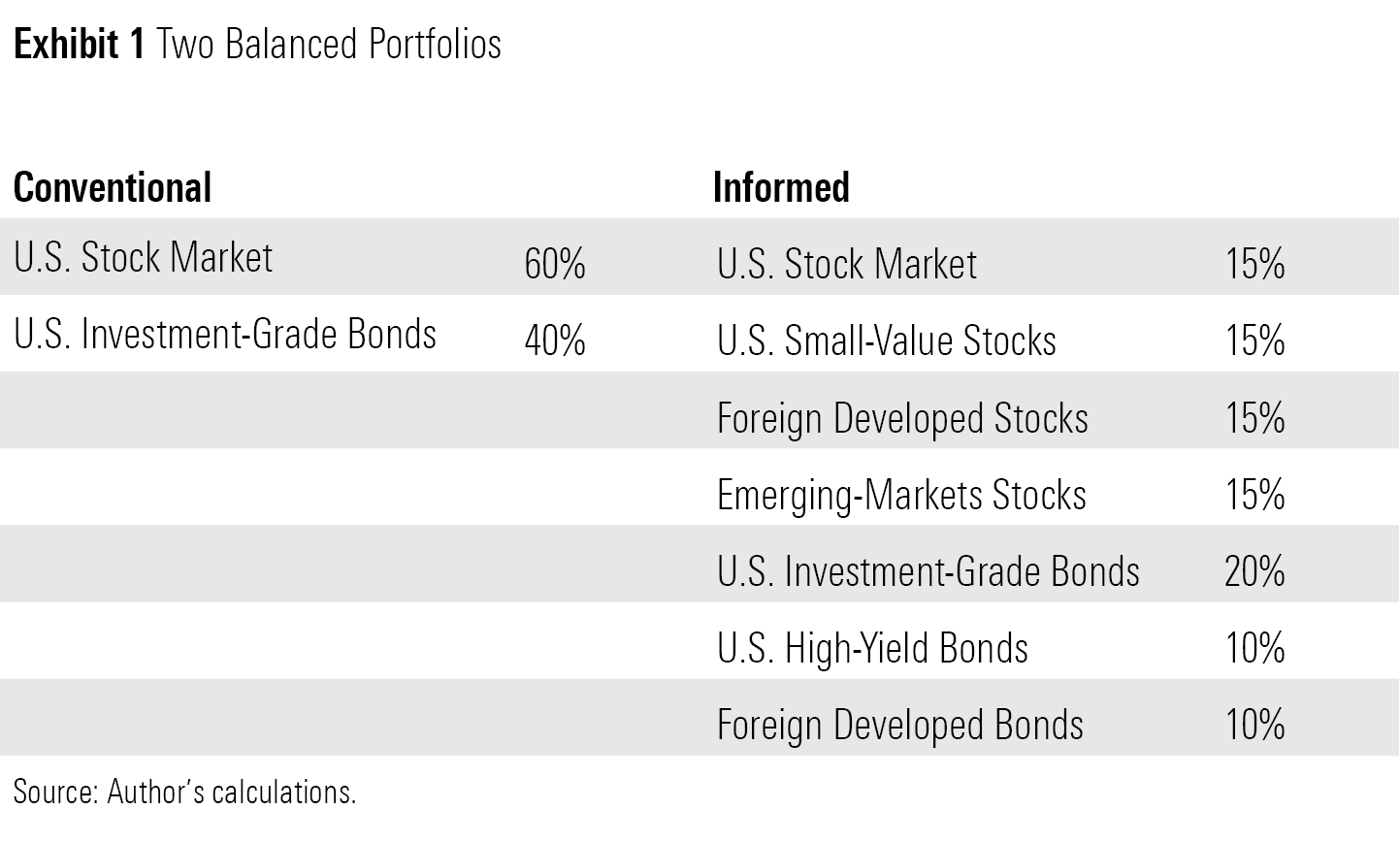

When 1991 ended, I had been working at Morningstar almost four years and was studying for my Chartered Financial Analyst designation. That made me something of an investment expert (or so I believed). When ordinary investors bought balanced funds, they were content to hold the traditional asset mix of 60% in U.S. stocks, 40% in investment-grade bonds. That would not have been for me.

What I would have selected, I cannot state for certain, since I didn't have much money at the time, and what I did hold went entirely into equities. But I can re-create my thinking, with reasonable accuracy. By then, I was thoroughly familiar with the core precept of Modern Portfolio Theory: Individually risky securities could be both prudent and safe when held within a diversified portfolio. For the informed investor, risk is to be embraced rather than feared.

In that light, and based upon both the latest academic research (the seminal Fama/French paper chronicling the achievements of small-value stocks was circulating, although the article had not yet been published) and what struck me as common sense, I would have altered the standard 60/40 formula by favoring: 1) small-value stocks, 2) high-yield bonds, and 3) and foreign securities. My informed portfolio would have looked like this:

(This version of a "sophisticated" allocation, of course, is very different than what later became known as the endowment model, which features alternative assets. But in 1991, even Yale's fund held mostly conventional assets. Also, as a mutual fund analyst, I considered only what could have been held by public funds.)

The Results

That portfolio still makes sense to me. There's always the danger that winning strategies will languish after their success becomes publicized. Even so, small-value stocks seem a sensible choice, as they clearly are less popular with investors than are growth companies, and thus should command higher gains. In the same light, emerging-markets stocks and high-yield bonds carry extra risks that deserve extra compensation. And, even if their returns are not higher, investments from foreign developed markets should deliver additional diversification.

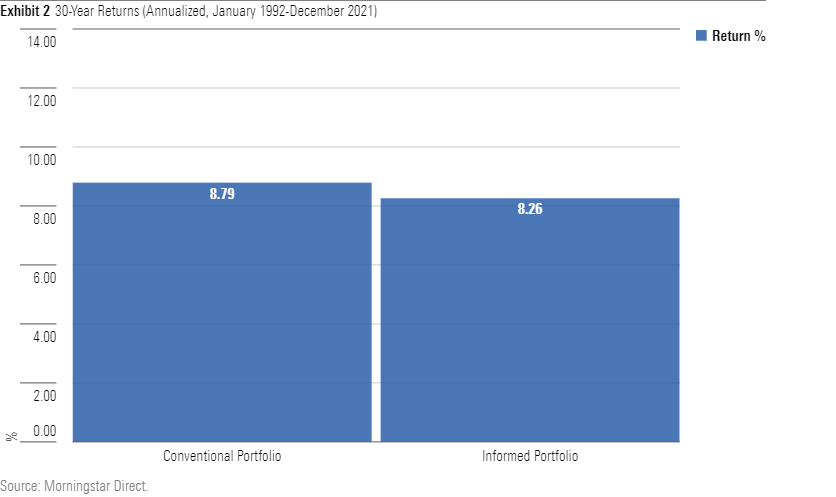

But in practice, I was wrong. Over the next 30 years, the traditional portfolio outgained my allegedly informed portfolio by half a percent per year. To be sure, the informed portfolio fared well, in absolute terms. Its nominal annualized return of 8.3%, when combined with the period's paltry 2.4% inflation rate, would have enabled investors to reach their goals. But the informed portfolio still would have trailed the simple, traditional strategy.

(Properly speaking, I should have depicted each portfolio's risk-adjusted performance, rather than its returns alone. However, the risks of the two approaches were quite similar. The informed portfolio had a slightly lower standard deviation, but that advantage was offset by steeper losses during the 2008 global financial crisis and 2020's coronavirus downturn. Call it a wash.)

Behind the Shortfall

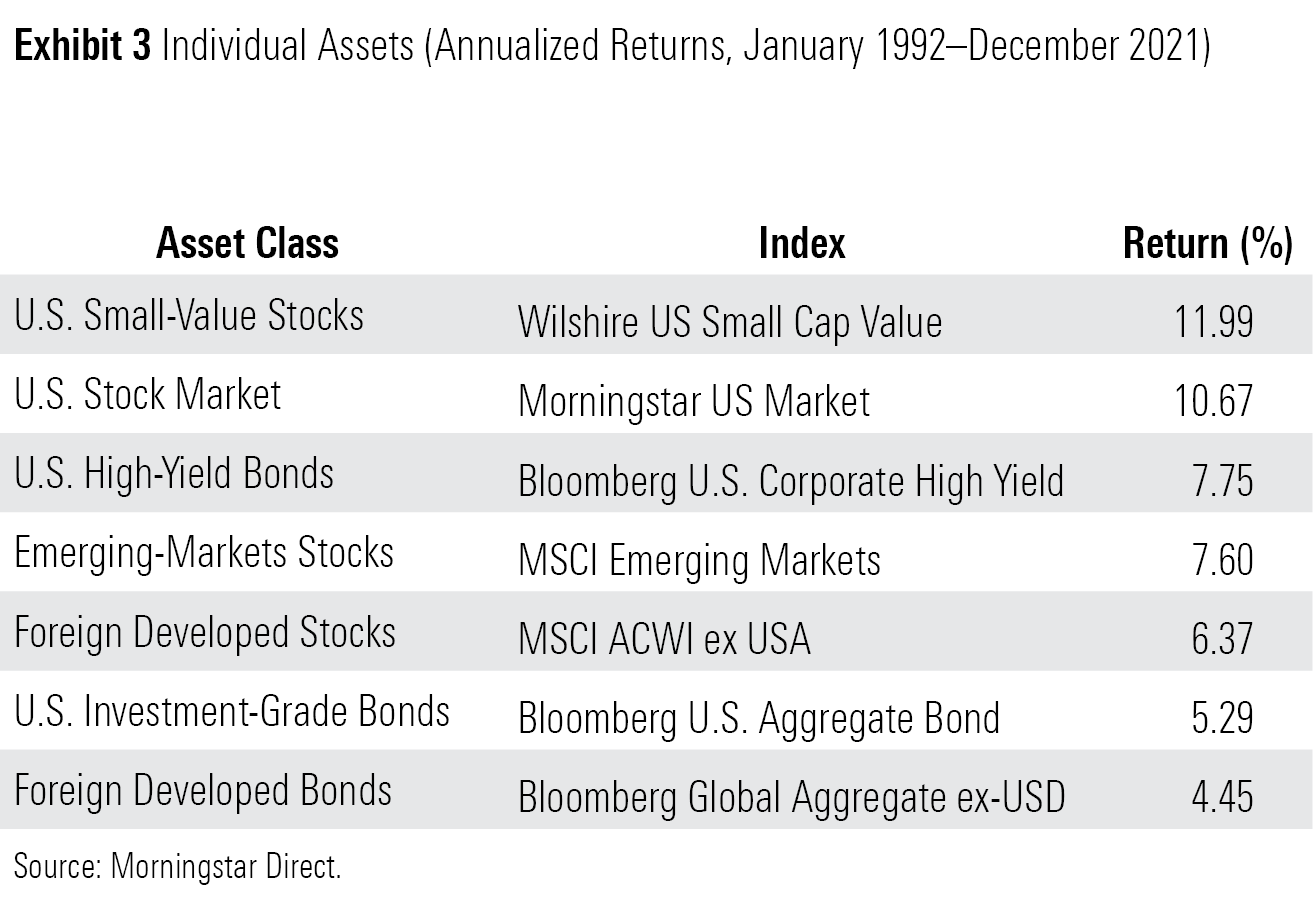

The next chart shows what went wrong. It provides the annualized returns for each of the seven asset classes, along with the indexes that I used for the calculations.

My first two decisions paid. Although small-value stocks trailed two major bull markets, during the late 1990s and then again last decade, they nevertheless topped the overall U.S. stock market. Score one for the professors! High-yield bond funds also justified my support by thumping their investment-grade rivals over the 30-year period. Selecting those two asset classes would have been both prescient and savvy. The first was decidedly unglamorous and the second had been deeply disgraced when the "junk bond" market collapsed in 1990.

Unfortunately, I would have fluffed my advantage entirely with my third decision, to invest aggressively overseas. Technically, investing half the portfolio's equities and 25% of its bonds internationally would still have been underweight foreign securities, which dominated both markets, but in practice, given that most investors strongly prefer investments from their home country, adopting such a global approach would have meant betting against the United States.

To channel Ronald Reagan, never make such a wager! Staying home worked for several reasons. The biggest was technology stocks. Over the years, U.S. stock-market indexes have owned about twice as much technology as their foreign counterparts--a great advantage, given that sector's success. Also important were avoiding the struggling Japanese stock market, and the American doctrine of shareholder value. Domestic businesses were likelier to reward their outside investors than were their overseas rivals. Finally, the U.S. dollar has strengthened over the past three decades, thereby lowering foreign-dominated returns.

Two Lessons

In hindsight, I would have made two mistakes.

One was relatively minor, and easy to address. When forming my portfolio, I didn't think enough about how it would behave when investors collectively ran for shelter. I knew that small-value stocks and high-yield bonds were related investments, as both are unusually vulnerable to recessionary fears. However, I failed to recognize that even though emerging-markets stocks often follow different economic cycles, they nonetheless suffer during such "flights to safety."

Thus, while the informed portfolio was not more volatile than the traditional portfolio, thereby supporting the key principle of Modern Portfolio Theory, it was riskier than it needed to be, had I combined the assets more carefully. That problem can be solved, by adjusting the mix to include investments that thrive during panics, such as long Treasury bonds.

The second error was major, and difficult to fix. That was my failure to appreciate national discrepancies. I did not foresee either that the U.S. would benefit heavily from its technology stocks, or that so many emerging-markets companies would squander the advantages conveyed by their countries' economic growth, through mismanagement and/or corruption. Nor did I realize that the dollar would rebound from what at the time had been a prolonged decline.

In short, improving upon traditional asset allocation meant not only knowing the requisite investment math and learning the asset-class histories, but also understanding the macroeconomic backdrop that would affect future results. Adding new asset classes was not enough. To outdo convention, I also needed to recognize which assets to omit. That is a stern assignment indeed.

Note: This column was updated to correct the 30-year return figures in Exhibit 2. The nominal annualized return of the informed portfolio was 8.3% and trailed the conventional portfolio by roughly 0.50%, not 10.8% to trail the conventional portfolio by 1.7 percentage points, as previously depicted.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)