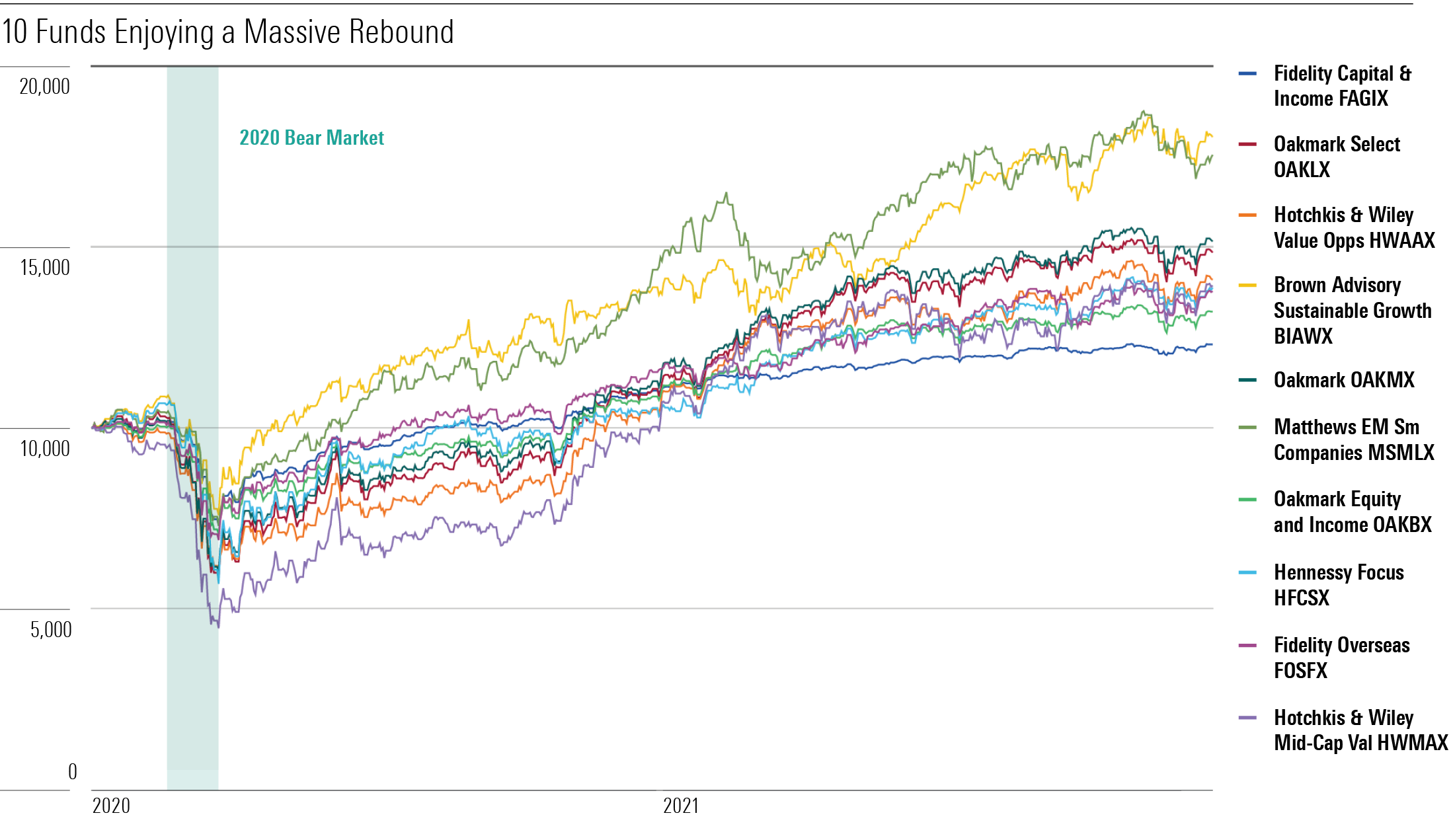

Were Last Year’s Top Funds Lucky or Smart?

These funds were mostly clobbered in the coronavirus sell-off but rebounded nicely in 2021.

The article was published in the December 2021 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

I often write about slumping funds because I know how hard it is to decide whether to hold on to losing investments. Here, I'm flipping the script to look at the biggest winners of 2021. It's easy to keep funds like these, but should you add more? Have they peaked? Is it too late to buy?

Or to put it another way, are they lucky or smart? Short-term performance is mostly about luck, and longer-term is more about skill, but it does vary from case to case. I looked at the top 10 funds in 2021 ranked by relative performance.

Fidelity Capital & Income FAGIX is a high-yield bond fund, but it's not so different from value funds. It also has exposure to indebted companies that are closely tied to the economy. Its 11.65%% return landed in the top 1% of its category. Mark Notkin runs an aggressive portfolio that swings between the top and bottom of the peer group depending on the environment. He takes on a fair amount of credit risk and has a big chunk of equities to boot--hence, the fund's 28% loss in the coronavirus sell-off.

It was a tough year for bonds, but funds with credit risk and equity came out on top. We give the fund a Morningstar Analyst Rating of Bronze, reflecting our opinion of Notkin and the analysts at Fidelity. However, high-yield spreads versus Treasuries are quite low, so it's not a very appealing time to buy.

Hennessy Focus HFCSX posted a robust 31.55% return, landing in the top 2% of its peer group, and I have to say it’s about time. The fund lagged the category benchmark five-straight years until this year, and it has also lagged Akre Focus AKREX since this fund's management team split with Chuck Akre.

This fund's winners were lower-valuation and more modest growth than the tech highfliers in other growth funds, but names like Brookfield BAM and CarMax KMX enjoyed strong gains in 2021. That said, we rate the fund Neutral for a reason. We haven’t seen much skill here, and the fund is super pricey.

Oakmark Equity and Income OAKBX enjoyed a 21.55% gain to land in the top 3% of the allocation--50% to 70% equity Morningstar Category. Clyde McGregor and team stuck with their favorite names in out-of-favor sectors and saw them rebound nicely starting in the fourth quarter of 2020. In addition, the fund added some corporate debt to its stake of Treasuries and cash, and that worked nicely in 2021. We must see how well the fund does with its corporate bonds in the long term, but the stock selection should continue to produce.

Matthews Emerging Markets Small Companies MSMLX gained a nifty 22.14%, landing in the top 3% of the Pacific/Asia ex-Japan stock category. The category performance isn't that meaningful because the fund is an outlier in two ways. First, it emphasizes small caps. Second, it recently moved to embrace all emerging markets.

That wide investment universe makes this something of an away game for Matthews, which has long focused exclusively on Asia. That led us to take the fund's Process rating down to Average and its overall rating to Neutral. Given the outlier nature, I'd say this year's returns are a little more about luck than smarts. In addition, the fund's 20% China weighting is a concern as China has crushed education stocks and threatens to intervene in other spheres. I think Vivek Tanneeru is a promising manager and Matthews has good analysts, but let's see them integrate the rest of the emerging-markets universe before we get carried away.

Fidelity Overseas FOSFX is another growth fund that is much more wide-ranging than its peers. Vincent Montemaggiore is a creative investor and is one of Fidelity's rising stars. The fund’s 15.42% gain puts it in the top 4% of foreign large-growth funds.

A big weighting in Europe and a big underweighting in Asia other than Japan really helped returns. Dutch semiconductor company ASML Holding and French IT firm Capgemini gained more than 50%. Montemaggiore aims for high-quality companies trading at modest prices. That places him right on the border of growth and blend. He looks for companies with strong competitive advantages and high switching costs but wants them at a 15% discount to his estimate of their intrinsic values.

Oakmark Select OAKLX surged 34.04%, landing in the top 5% of its peer group, and its close sibling Oakmark OAKMX rose 34.20%, placing in the top 4%. Once again, Bill Nygren has rebounded strongly from a dry spell. The funds' overweights in financials and energy and underweights in tech and healthcare had worked against it for years.

Nygren uses a variety of metrics to value a company, and he didn't give up on his out-of-favor names. So, I'd credit him for skill even though luck played a big part in this year's strong results and last year's losses in the coronavirus sell-off. Yes, this year favored his industries, but navigating through the COVID-19 recession to find winners in 2021 was quite a feat.

So, is it too late to buy? I don't think so because value has been out of favor for so long. This is a 401(k) holding of mine, so most likely I will continue to buy a little bit every paycheck. (I also have an automatic rebalance set for once a year, which could adjust my stake up or down a bit depending on how it performs relative to other funds in the lineup.)

Hotchkis & Wiley Value Opportunities HWAAX and Hotchkis & Wiley Mid-Cap Value HWMAX gained 34.09% and 38.94% this year, giving them top 5% and top 6% ranks, respectively. Man, did their shareholders need that. You may recall that Hotchkis funds featured prominently in my coverage of what funds got crushed the most in the February/March 2020 bear market. Unlike Oakmark, these funds are true deep-value investors.

That means they have lots of exposure to the economic cycle and often have big energy weightings. The funds lost 40% and 53% in the downturn. So, their willingness to stick to their discipline cost them dearly last year but was rewarded with a rebound in 2021. Luck played a big part in both years as did their deep-value outlook. Calling them lucky is admittedly a little odd as their scars suggest they can't feel all that lucky. Certainly, they deserve credit for not selling at the bottom despite the pain.

Although their deep-value approaches are similar, the funds have different managers and investment universes. We give Hotchkis & Wiley Value Opportunities an Analyst Rating of Bronze with an Above Average Process rating and Hotchkis & Wiley Mid-Cap Value a Neutral rating with an Average Process rating. Value Opportunities is wider-ranging, is in one of the allocation categories, and lost significantly less in the COVID-19 sell-off. I wouldn't be scared off by the rallies that the two funds have enjoyed, but 2020's losses make it clear you must tread carefully.

Brown Advisory Sustainable Growth BIAWX added to its 2020 gains better than most large-growth funds. The fund rose 29.88% in 2021, landing in the top 8% of its category. The environmental, social, and governance fund looks for companies with ESG-driven competitive advantages, and it's clear that the managers do good work on the fundamentals and the ESG side. Being overweight tech and healthcare could have worked against them, but their emphasis on sustainability kept the fund away from the highfliers that have been crashing to earth. Instead, they've enjoyed nice gains with Microsoft MSFT, Intuit INTU, and Alphabet GOOG.

This was the fund's seventh-straight year of outperformance versus the category. In addition, the managers' sector weights should have worked against them, so I'm crediting them with skill here. We rate the fund Silver, and I wouldn't shy away from investing here.

Conclusion

It turns out 2021 was something of a correction year as value finally outperformed growth after lagging for many years and interest rates backed up after a long bond rally. Many of these funds invest in areas that have been out of favor and therefore may yet have room to run.

Source: Morningstar. This graph shows the growth of $10,000 invested on Jan. 2, 2020, through Dec. 31, 2021.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)