Xylem, Ecolab, Aptiv, American Water, and Agilent Top List of S&P 500 Companies Widely Held by Sustainable Funds, RBC Capital Says

Beneficiaries of growing inflows into ESG, many are also high-quality companies with strong moats.

What stocks are most widely held by sustainable investors? You may well ask, because flows into sustainable funds have helped drive these names higher, and they’re likely to stay on the radar as the corporate world adopts more environmentally friendly and other sustainable practices.

One is Xylem XYL, the water technology company spun out by ITT in 2011, that treats and tests water for utilities, and industrial and residential customers. It has “consistently outearned its cost of capital,” with about half its revenue recurring, according to Morningstar analyst Krzysztof Smalec.

Another is Ecolab ECL, which provides cleaning and sanitizing services for a variety of industries--you might have seen its hand sanitizer dispensers in an office lobby--as well as wastewater treatment and other services. By making water use more efficient, it saves on energy costs, too. One fan is Bill Gates, who owns it through his Cascade Investment vehicle.

Those are just a couple of the names on a list provided by Sara Mahaffy, the environmental, social, and governance strategist at RBC Capital. Mahaffy regularly runs a screen of stocks in the S&P 500 that are the most widely held by actively managed sustainable funds, or funds that follow ESG principles, either to reduce risk or to achieve certain outcomes.

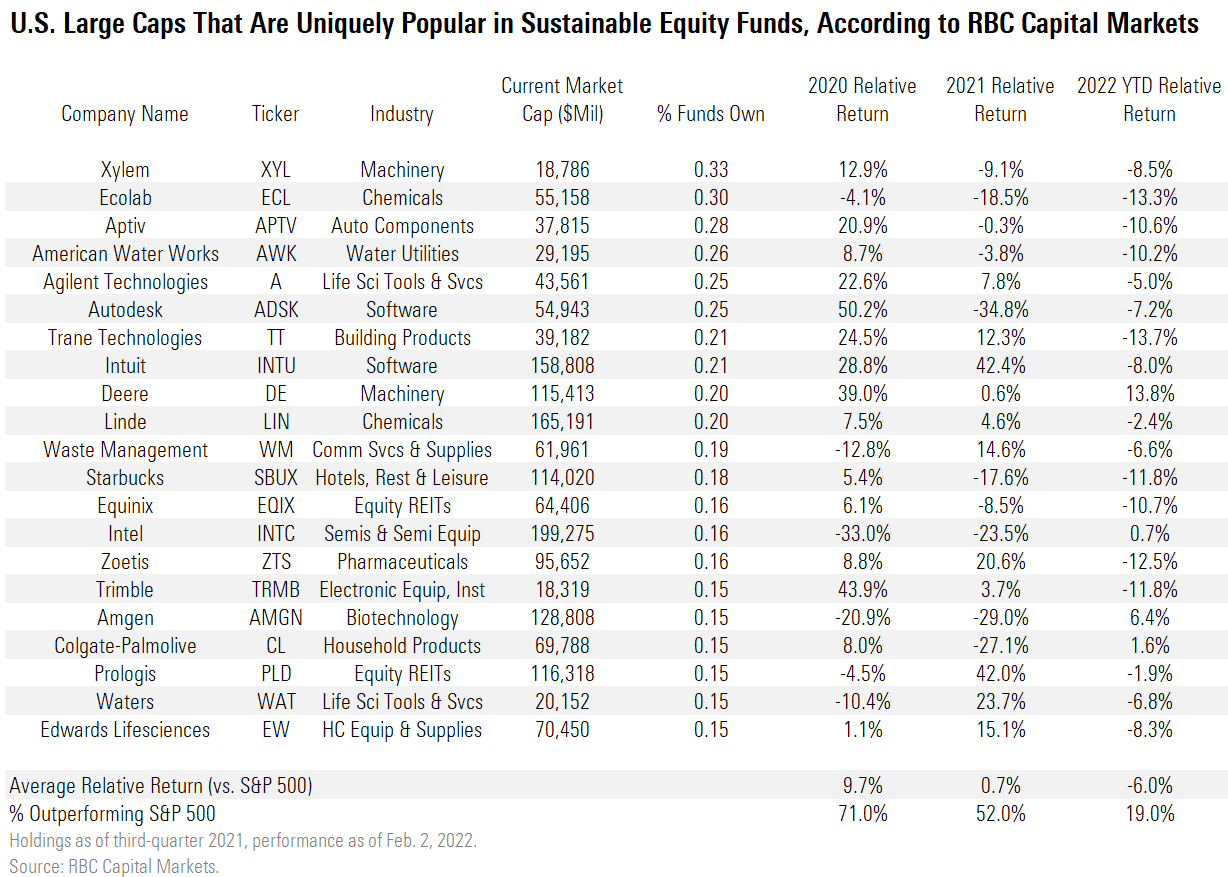

Specifically, Mahaffy looks for the 20 or so names that are in the top 10% of ownership by actively managed sustainable funds, but not in the top 10% of ownership by conventional, long-only big-cap stock funds and hedge funds. You can see the results in Exhibit 1.

Exhibit 1

Both Xylem and Ecolab are water-related companies. So is no. 4, American Water Works AWK, the largest investor-owned U.S. water and wastewater utility, as water use, cleanliness, and efficiency are increasingly important.

Other names on the list include Aptiv APTV, which sells software that powers electric and self-driving vehicles; Agilent Technologies A, which supplies lab tools for life sciences, chemicals, and other industries; and Autodesk ADSK, which makes software for construction, engineering, and other industries.

Mahaffy rebalances the list every quarter. These names are from the third quarter of 2021. What fell off the list? American Tower AMT and Tesla TSLA, which “barely missed” being on the list, simply because of the popularity of the names above them.

Why is this list so interesting? They are beneficiaries of the growing inflows into ESG funds, and shed light into the themes that are attracting capital as companies refashion themselves to become more sustainable, reshaping the market.

Many of the names are high quality, with economic moats, or a strong ability to keep competitors at bay over time, as well as low sustainability risk. Indeed, seven appear on Morningstar’s own list of top sustainable companies to own, including Agilent, Autodesk, financial software giant Intuit INTU, waste disposal and recycling outfit Waste Management WM, animal health specialist Zoetis ZTS, biotech company Amgen AMGN, and lab equipment supplier Waters WAT.

Mahaffy notes that the basket of stocks outperformed the broader S&P 500 “generally” in recent years, trouncing the index in 2020 in particular. (You can see the degree of outperformance in the exhibit). Nevertheless, it has moments of weakness. This year through Feb. 2, the basket lagged the S&P 500 by 6%.

That's creating some interesting opportunities, says Mahaffy. In July, the valuation of the basket was more than double that of the S&P 500. That's dropped back to about 1.5 times. "They're trading right around where they stabilized in early 2021," she says. The RBC strategist won't recommend particular names, but on a valuation basis, a handful are trading below Morningstar's fair value estimate, including:

- Ecolab: The 4-star name trades at a discount to Morningstar analyst Seth Goldstein's fair value estimate of $215 a share after the company recently missed its own earnings and revenue guidance amid supply chain disruptions.

- Linde LIN: A 3-star industrial gas producer that's developing carbon capture technologies and using green hydrogen in chipmaking, and which also trades below Smalec's fair value estimate of $316.

- Starbucks SBUX: The world's largest specialty coffee chain, it trades below analyst Sean Dunlop's fair value estimate of $106.

- Intel INTC: The chipmaker also trades under analyst Abhinav Davuluri's fair value estimate of $65.

- Amgen trades just below analyst Karen Andersen's fair value estimate of $260 a share.

If the market continues to languish, expect that even more names may be worth another look.

/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)