7 Charts on the Big CPI Rise, Fed Rate Hike Outlook

Inflation pressures broadened in January and expectations for a bigger move by the Fed grew.

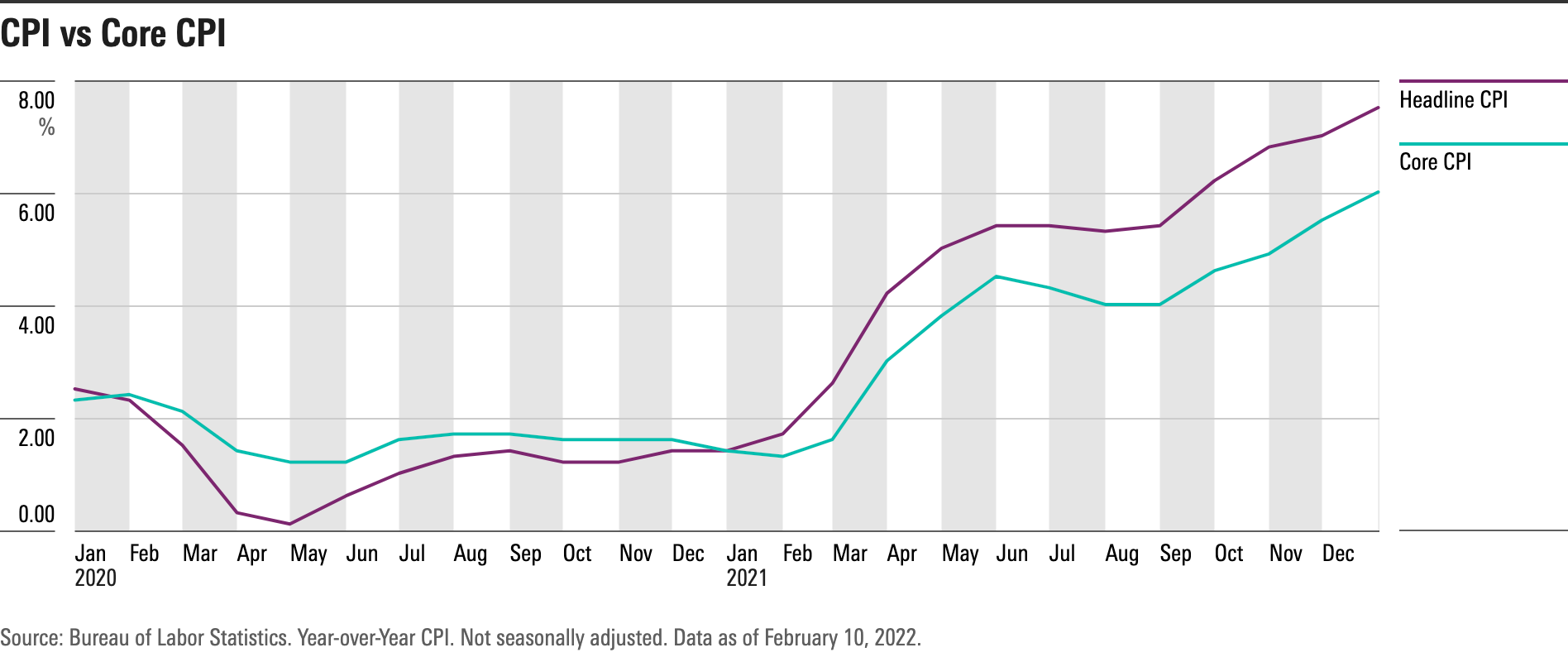

Inflation pressures remained stubbornly high in January, keeping hopes for a peak in the upward pressure on prices on hold for now and setting the Federal Reserve up for an aggressive first interest rate increase in March.

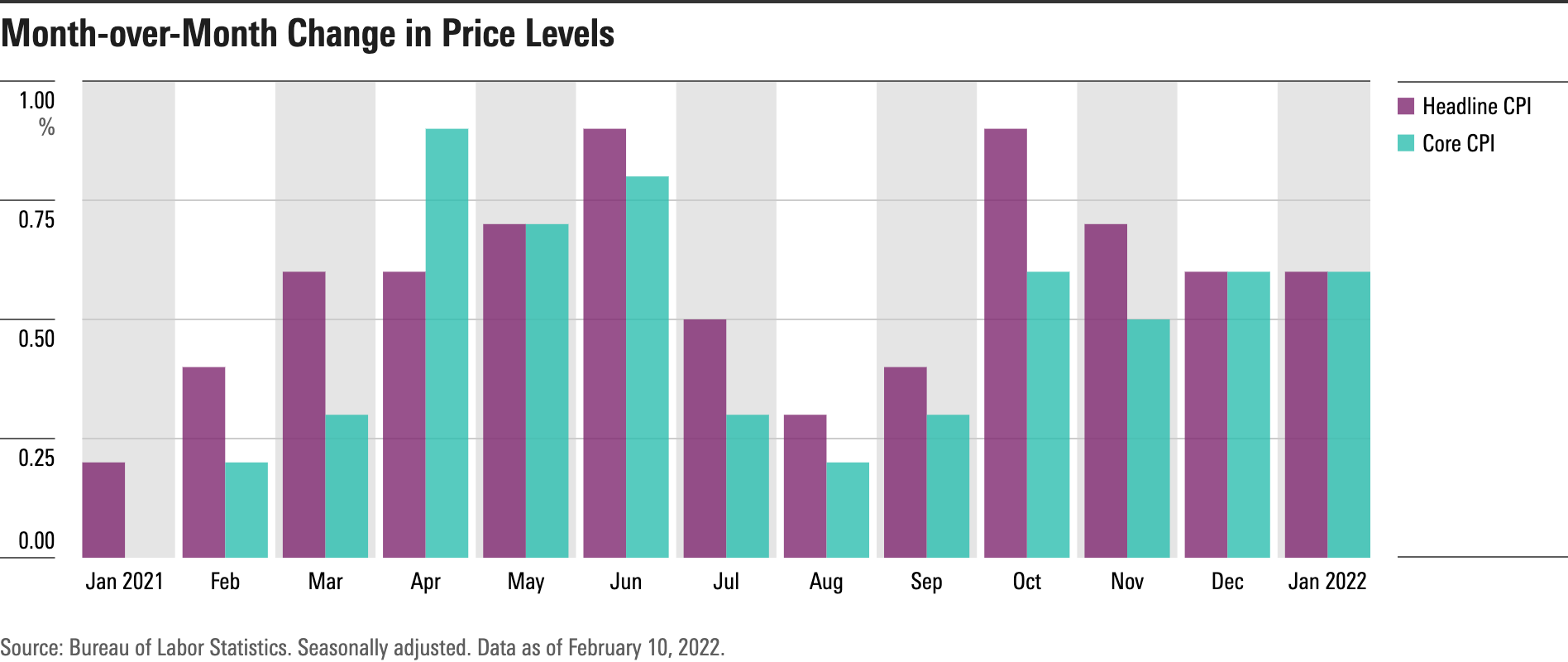

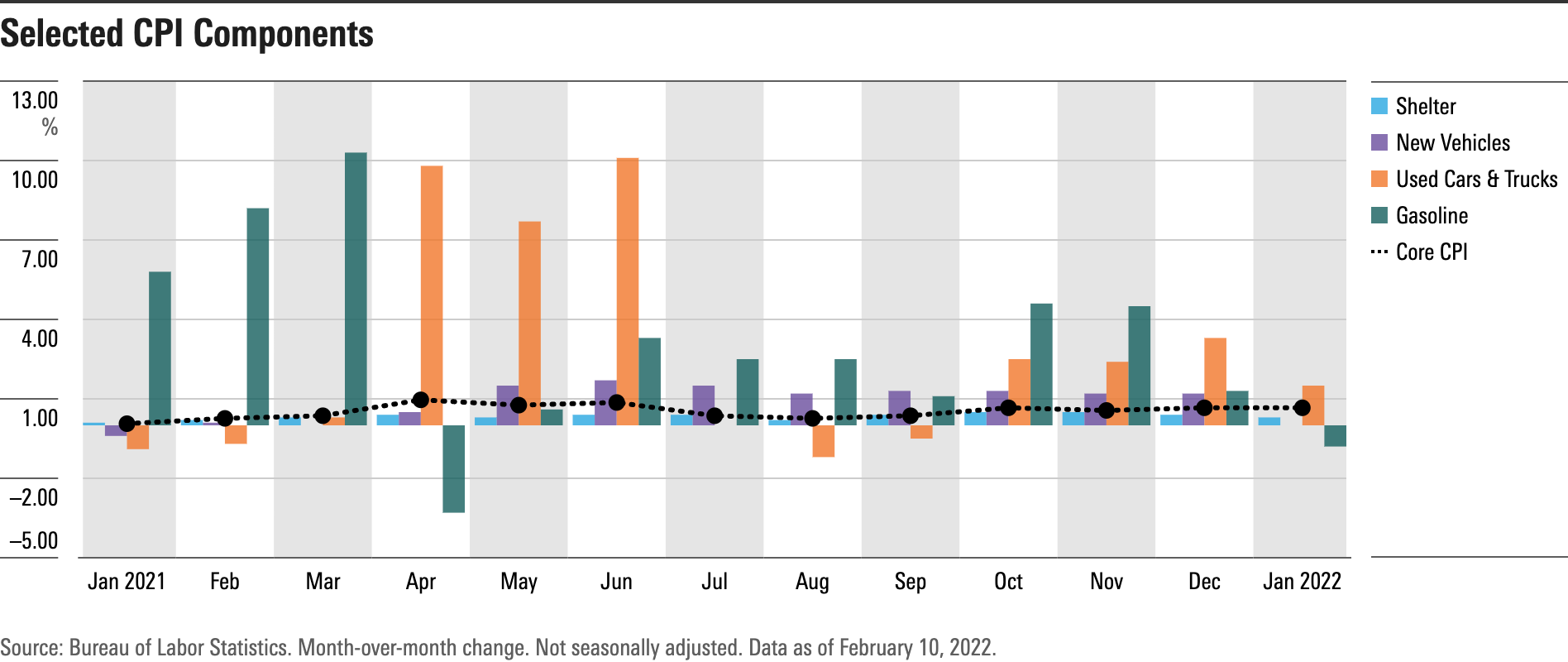

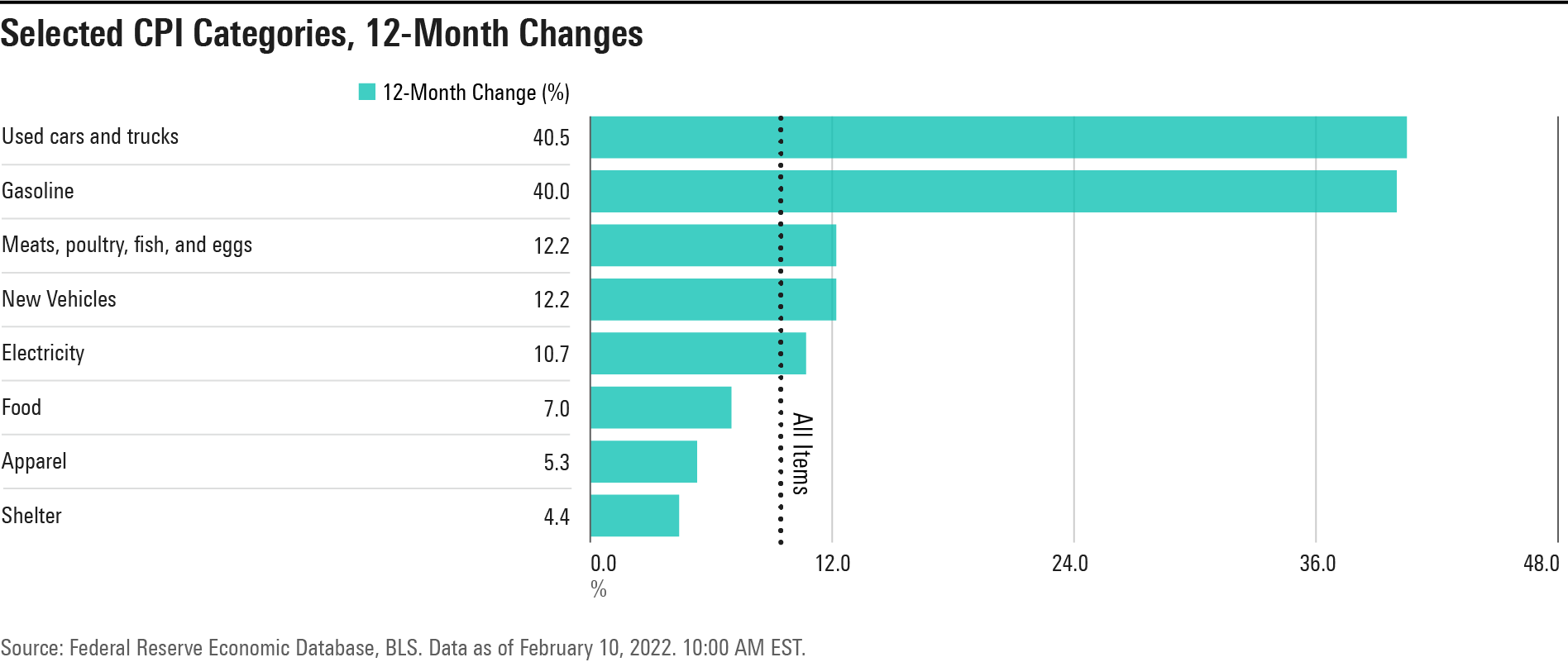

The Bureau of Labor Statistics reported the consumer price index was up a stronger-than-predicted 0.6% in January from December and rose an above-expectations 7.5% from 12 months ago. Thanks to big year-over-year increases in energy, used cars and food, the CPI posted its largest 12-month increase in 40-years.

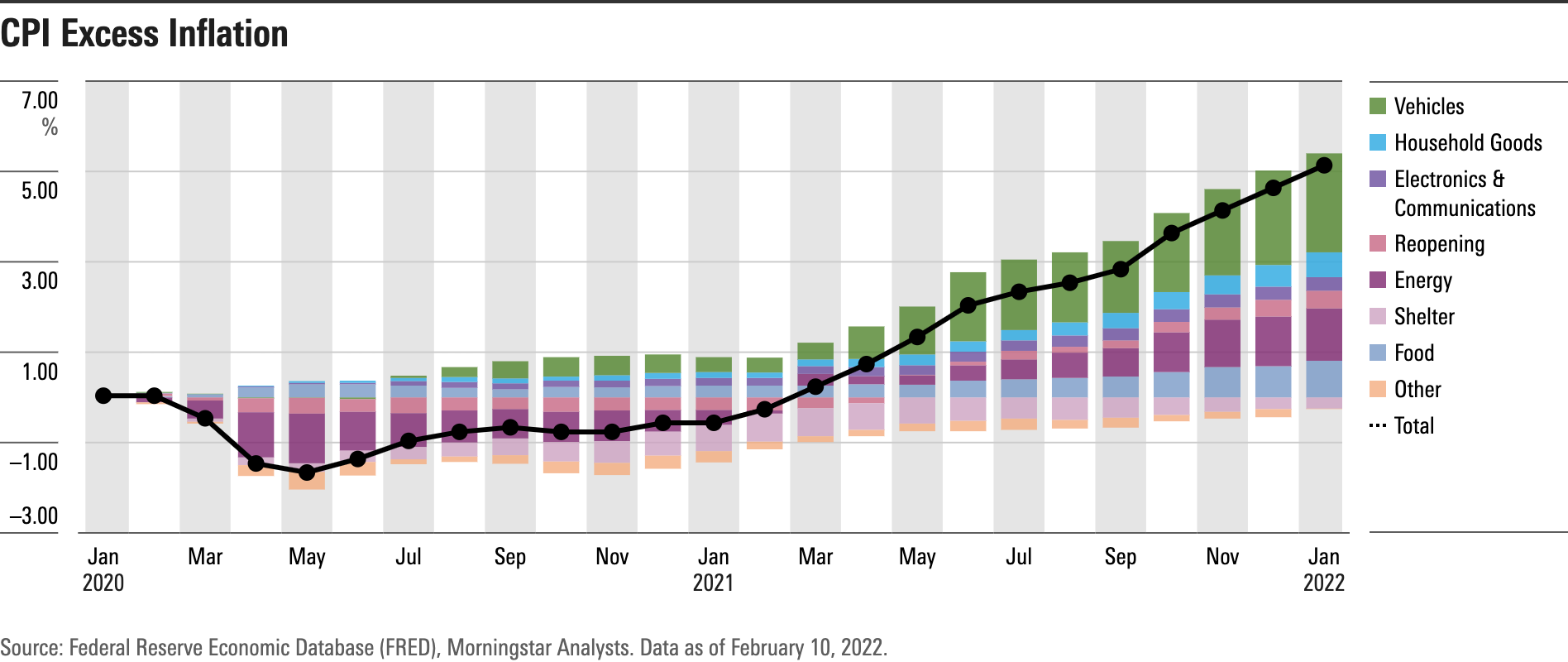

“It's still the case that most of the excess inflation since the start of the pandemic has been driven by a handful of categories, namely energy, vehicles, and other durable goods,” says Preston Caldwell, Morningstar’s chief economist. “We continue to expect that the resolution of supply constraints in these categories will provide significant relief from inflation in the near future, possibly starting by mid-2022.”

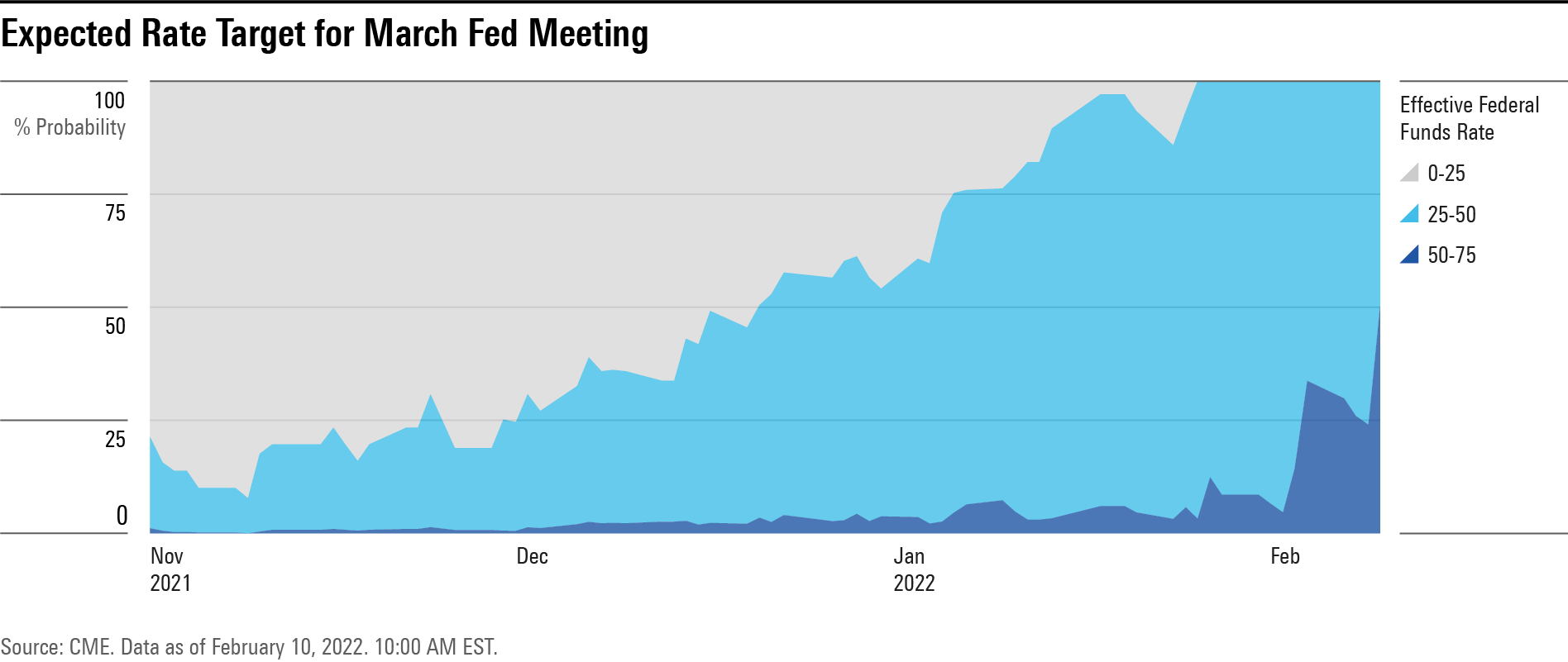

Fed Rate Hike Expectations Jump

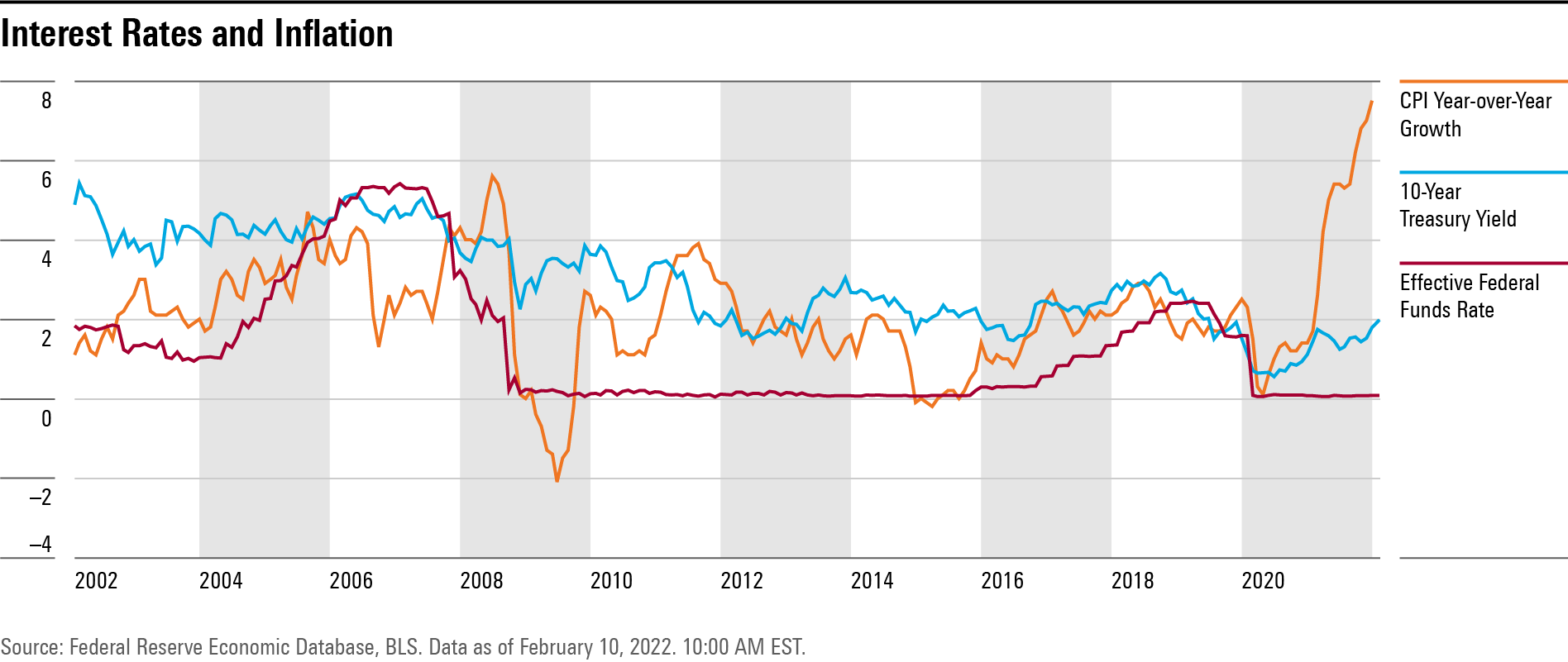

The CPI report has investors rethinking yet again the pace of Fed interest rate increases as the central bank switches gears to fighting inflation from supporting the economy during the pandemic recession.

The bond market is signaling a 50% chance of a .5 percentage point increase in the federal funds rate at the March meeting of the policy-setting Federal Open Market Committee. That’s up from a 25% chance before the CPI report and a less than 10% odds given in early January. A month ago, most expectations centered around a 0.25 percentage point increase in March, and back in November, most investors had been thinking the Fed wouldn’t even be raising interest rates until May or June.

“Given the apparent broadening of inflationary pressures in today's release, we don't think this is an unreasonable reaction by the bond market,” Caldwell says.

Even as many in the markets continue to expect inflation to begin heading lower over the course of 2022, bond prices fell after the CPI data, sending yield on the widely-followed U.S. Treasury 10-year note toward 2%, its highest level since July 2019. Short-term bond yields also rose.

A Broadening of Inflation Pressures

Within the report, Caldwell points to a broadening of inflation pressures. The data showed “significant month-over-month price increases in medical care, up 0.6%, cable/tv services, up 1.3%, personal care services up 1.2%, among other areas,” he says. “Many industries which infrequently change their prices do so on January 1st, which likely was a proximate driver for the uptick in inflation.”

“On the one hand, this suggests that following months will see less of a price increase from such industries,” Caldwell says. “On the other hand, this is worrying because the implementation of price increases by "sticky price" industries suggest that inflation could be becoming more entrenched.”

While some of the month-to-month upward moves in prices have begun to level off or ease, the comparisons from year-ago levels continue show significant increases, especially in items that consumers feel most significantly in their wallets.

The Base Effect

Caldwell uses an “excess inflation” measure that compares cumulative inflation growth since the start of the pandemic to pre-pandemic trend rate. This also helps identify areas that are seeing particularly high inflation now, as distinguished from those which already were experiencing high inflation prior to the pandemic.

Vehicles are one example, given that prices were flat in the years prior to the pandemic, but have soared higher. By contrast, shelter price inflation, about 3% annualized since the start of the pandemic, is actually slightly below its pre-pandemic trend.

“Of the 0.5 percentage point uptick in our "excess inflation" measure in January, many of the usual suspects played a key role, with energy, vehicles, and household goods contributing about one-half of the uptick,” Caldwell says.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)