Energy Funds' Leading Returns Defy the January Trend

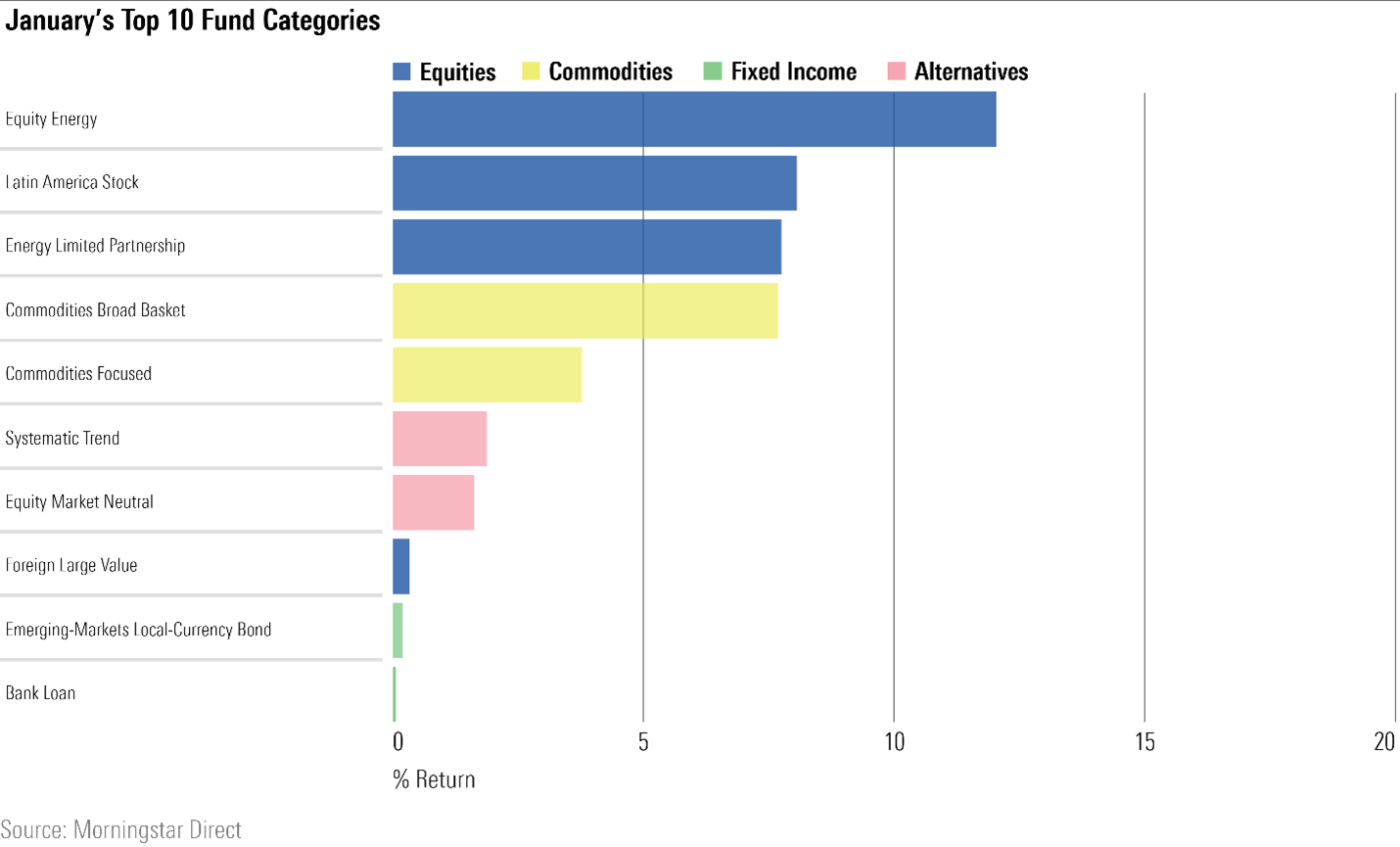

Only a small number of Morningstar Categories managed to benefit in a month filled with volatility.

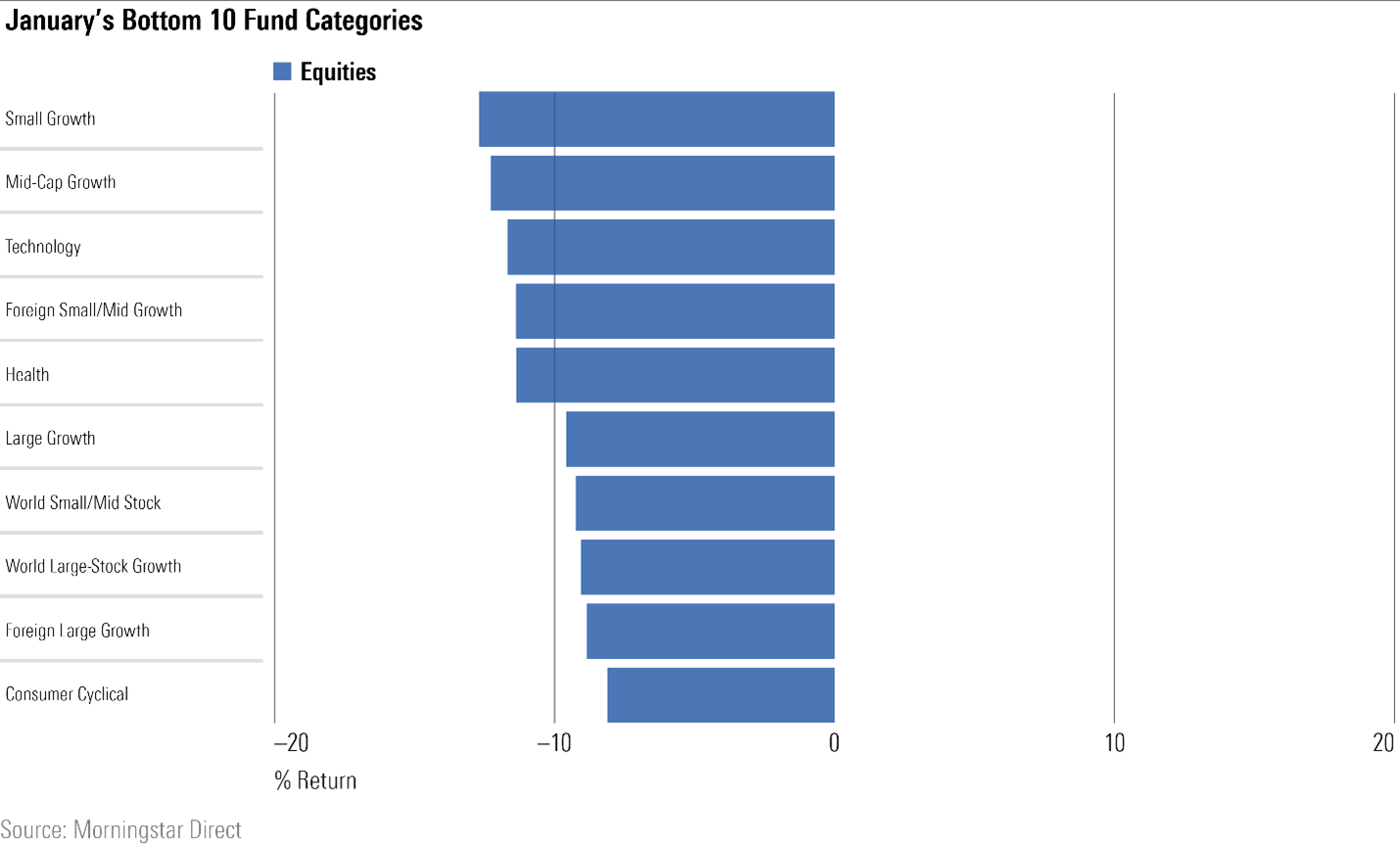

Stock and bond funds saw their worst performance in almost two years last month as returns fell amid a jittery stock market and concerns about the Federal Reserve’s path to higher interest rates.

Just 10 of 108 Morningstar Categories, a little over 9%, were up in January 2022, their worst showing since March 2020. Those categories include more than 10,000 individual funds.

Equity energy funds stood out with a 12% average return. On the other end of spectrum, the small- and mid-cap growth categories averaged losses of greater than 12%--their worst showing since the pandemic started. Morningstar's analyst coverage list of funds saw a wide range of performances.

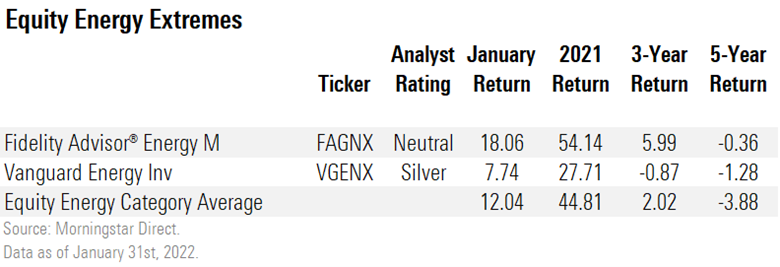

Vanguard Energy VGENX, which has a Morningstar Analyst Rating of Silver, trailed the broader category in January and 2021. Neutral-rated Fidelity Advisor Energy FAGNX outperformed in both periods.

Vanguard Energy was hurt again by its outsize allocation to utilities. As of Dec. 31, the fund had 39.6% of its assets in the sector versus the category average of 6.8%. NextEra Energy NEE, which fell 22% in January, was the largest detractor to performance.

This allocation is a feature and not a bug since it results from Vanguard's decision to change the fund's benchmark in 2020 from the MSCI ACWI Energy Index to the MSCI ACWI Energy + Utilities Index, Morningstar senior analyst William Samuel Rocco says. That is a custom benchmark that splices the MSCI ACWI Energy and MSCI ACWI Utilities indexes and has dynamic sector weights. Rocco says in his report that "the firm made the change so the fund could capitalize on the evolution away from fossil fuels and toward renewable energy sources by investing significantly more in electric and other utilities."

The opposite is true for Fidelity Advisor Energy, which sported an almost 97% stake in energy stocks at the start of January, 8 percentage points higher than the category average. Boosting the fund's performance was its 21% stake in Exxon Mobil XOM, which rose 22.8% last month as oil prices gained. The fund's short- and longer-term returns beat the category average, but as Morningstar analyst Paul Ruppe notes in his latest report, the fund's Neutral rating reflects fairly recent changes to its team and approach.

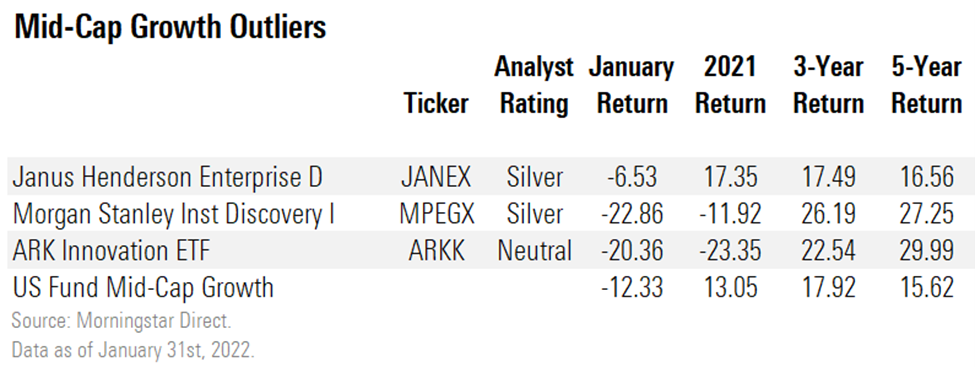

The 10 worst performers were all equity funds, with mid-growth and small-growth funds at the bottom with losses of 12.7% and 12.3%, respectively. The outliers here were funds that fell in the mid-cap growth category.

Silver-rated Janus Henderson Enterprise JANEX was the top performer in the two categories, losing 6.5% in January. The fund had 38.9% in technology at the end of December, compared with the mid-growth category average of 28.1%. While that should have been a headwind, the managers' tech picks performed relatively well.

Morningstar's performance attribution analysis shows that the fund's tech stake lost much less than the average mid-cap growth fund's tech stake, with stock selection here contributing significantly to the fund's overall outperformance. The fund is designed to outperform in down markets. Morningstar analyst Eric Schultz says in his report that managers Brian Demain and Cody Wheaton are "patient and risk-conscious growth investors, aiming to protect on the downside."

Silver-rated Morgan Stanley Institutional Discovery MPEGX had the worst showing among funds in the mid- and small-growth categories. Similar to Janus Henderson Enterprise, this fund was overweight technology with a 46% allocation to the sector on Dec. 31. In this case, performance attribution shows that its technology allocation and other picks were its biggest detractors. Morningstar director Katie Rushkewicz Reichart acknowledges the downside potential in her most recent report, and that "as of December 2020, the portfolio skewed toward volatility and momentum and away from quality, which affects its risk profile."

Neutral-rated ARK Innovation ETF ARKK had the second-worst return in these two categories. Funds that return over 100% in a year, which was the case for ARK in 2020, rarely continue on that path. The fund extended its 2021 losses into the new year, with 22 of its 43 holdings as of Jan. 31 dropping by 20% or more.

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)