Which Funds Are Feeling the Meta Stock Pain the Most?

Some Fidelity and T. Rowe Price strategies have big stakes in the battered stock.

Big-name mutual funds are taking a hit from the plunge in Meta Platforms FB shares.

Meta, the parent company of Facebook, dropped roughly 25% Thursday after reporting mixed fourth-quarter earnings. That shaved $200 billion off Meta’s market value--an amount greater than the entire market valuation for McDonald's MCD.

For years Meta has been one of the largest stocks by market cap and one of the most widely held names by mutual funds, and a handful of them have particularly large weightings in the company in their portfolio.

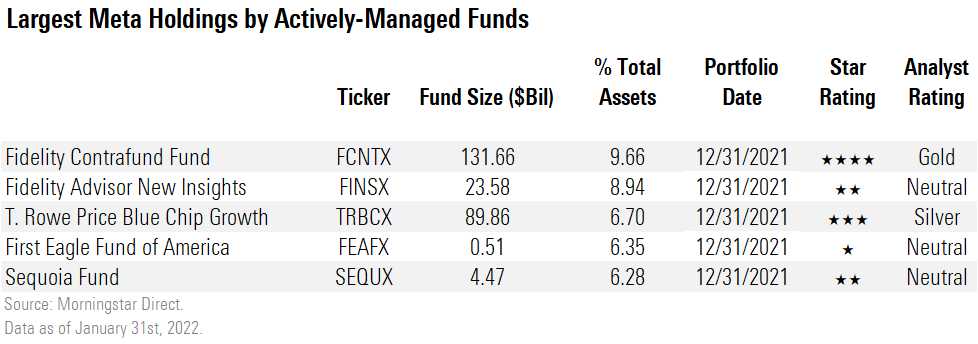

We looked at which funds invested the most in Meta, and which had the highest exposure within their portfolio. Below is a list of actively managed funds where managers have opted to hold a hefty stake in the social-media company.

In comparison, the Morningstar US Market Index had a weighting of 1.7% and the Morningstar Large Growth Index a 3.7% weighting in the social-media company.

The U.S. stock fund with the most riding on Meta is one of the best-known with an actively managed strategy, Fidelity Contrafund FCNTX, which has a Morningstar Analyst Rating of Silver and is run by veteran manager Will Danoff. The $132 billion fund had a 9.66% weight in Meta as of Dec. 31, a position that has grown in recent years. In 2020, the fund held 7.4% of its assets in the company.

To put this into perspective, an investor with $10,000 in Fidelity Contrafund owned almost $1,000 worth of Meta stock based on the last reported data. All else being equal, Thursday’s decline would have shaved $250, or 2.5%, off that investment.

Despite a portfolio with 305 stocks, Danoff will hold big positions. Morningstar strategist Robby Greengold says that in the past Danoff has indicated that he likes Meta’s ability to generate healthy operating margins and free cash flow. Broadly, Danoff often favors founder-led firms, with competitive advantages and improving earnings potential, Greengold says.

At Fidelity 22 funds have a weighting of 3% or more in Meta.

T. Rowe Price also ranks high for having big stakes in Meta. Silver-rated T. Rowe Price Blue Chip Growth TRBCX has the third-highest weight in Meta. The $89.9 billion fund’s weight in Meta is currently 6.7%, although that has dropped from its peak of 7.5% at the end of June. The $11.5 billion T. Rowe Price Communications and Technology PRMTX has a 5.7% position in Meta. Morningstar senior analyst Adam Sabban says manager James Stillwagon last October expressed some hesitancy around high expectations for Meta’s ad growth but has only modestly trimmed his positions in the stock since then. Sabban says Stillwagon was positive overall about the company, saying that Meta has become the new “landlords” for businesses, especially small and midsize companies that need a digital footprint to advertise.

Across T. Rowe Price, there are a total of six funds with stakes in Meta of more than 3%.

While Meta’s shares have tended to be popular among growth managers, it’s also found interest with one contrarian value shop. As of the end of December, Meta was FPA Crescent’s FPACX fifth-largest holding at about 2.9% of assets.

Morningstar director Daniel Culloton says that in FPA Crescent’s fourth-quarter webcast for clients Wednesday, the fund’s managers Steve Romick, Brian Selmo, and Mark Landecker said they were comfortable with the long-term thesis for Meta.

In response to a question, Landecker said at this point they put a minimal value on the metaverse because it will be a few years at least before anyone knows what the metaverse will look like. They don’t need Facebook’s metaverse investments to be successful for it to be an attractive investment, he said. Landecker also said Meta’s chief executive Mark Zuckerberg has made good technology investments in the past, such as Instagram, and they are willing to give him some room to run.

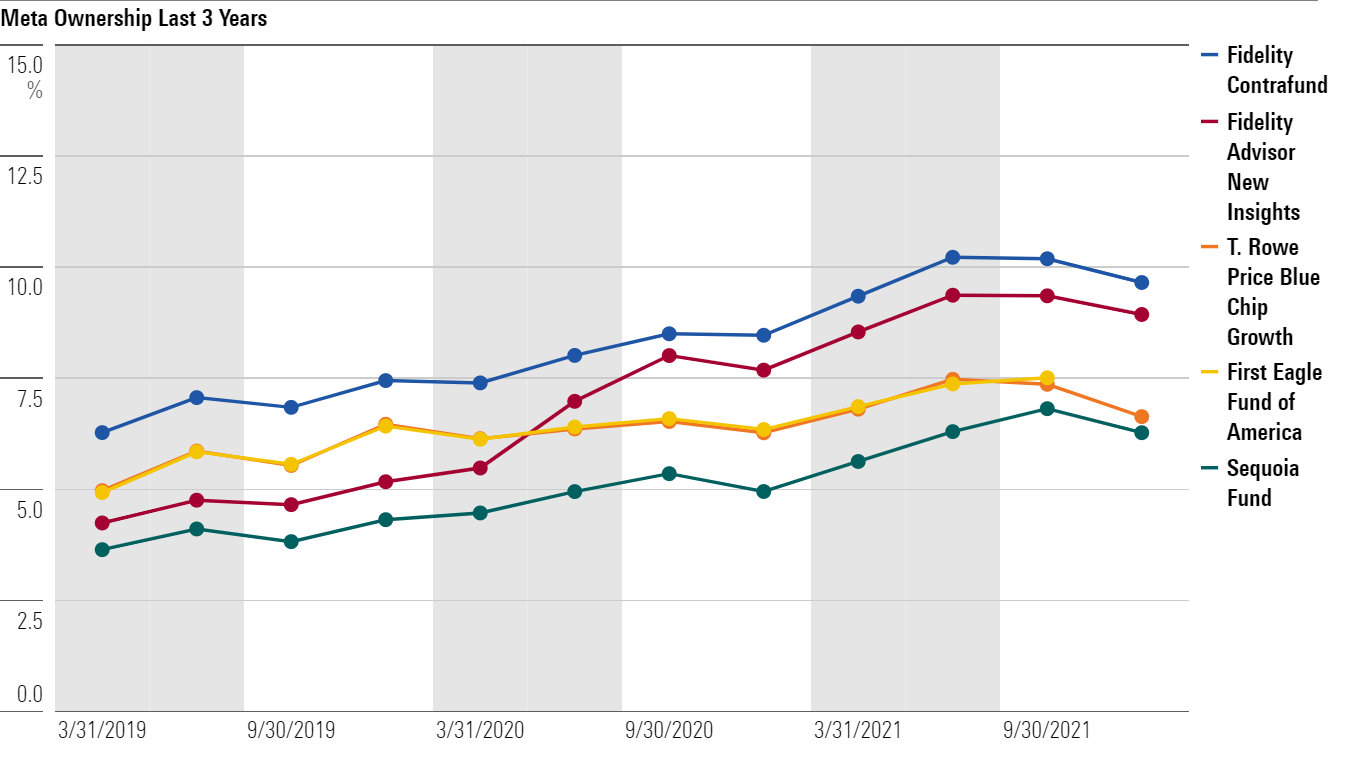

Looking back the history of funds with hefty Meta stakes, these managers let their positions grow as Meta’s stock rallied in recent years.

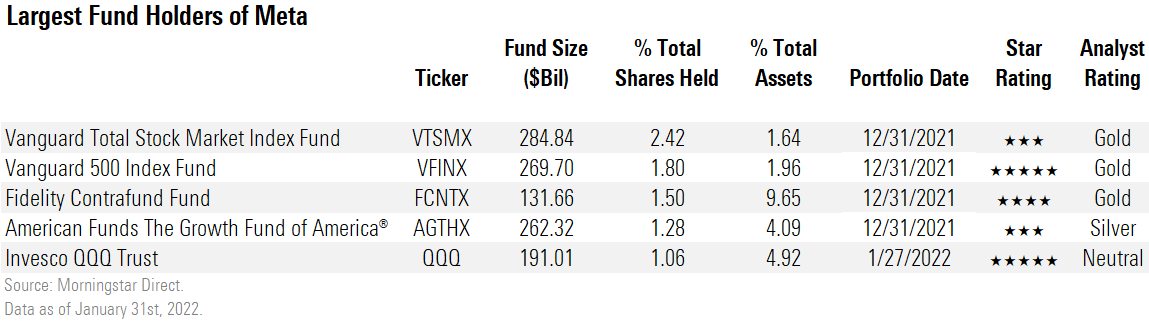

When it comes Meta’s holdings by overall market value, index-tracking funds dominate the list. Given that it was among the 10 largest stocks in the market, those funds mimicking the market would hold large numbers of shares. For example, Vanguard Total Stock Market Index VSMPX, which aims to replicate the composition of the U.S. market, had 1.64% of its holdings in Meta at the end of December, according to the most recent data available.

A few of Capital Group’s American Funds also have larger holdings of Meta, as reflected in Growth Fund of America’s AGTHX 4% stake. Overall, three of the team-managed American Funds portfolios have more than 3% in Meta.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)