ETF Flows Cool Off as Stocks Stumble Out of the Gate

Tepid ETF flows accompanied turbulent markets in January.

Global stock markets hit reverse in January 2022 after barreling full speed ahead last year. The Morningstar Global Markets Index--a broad gauge of global equities--followed last year's 17.8% return in 2021 with a 5.2% slide last month. That was the benchmark's worst monthly showing since its pandemic-fueled 14.2% drawdown in March 2020. Bonds offered no shelter. The Morningstar US Core Bond Index retreated 2.1% in January, its worst month since November 2016.

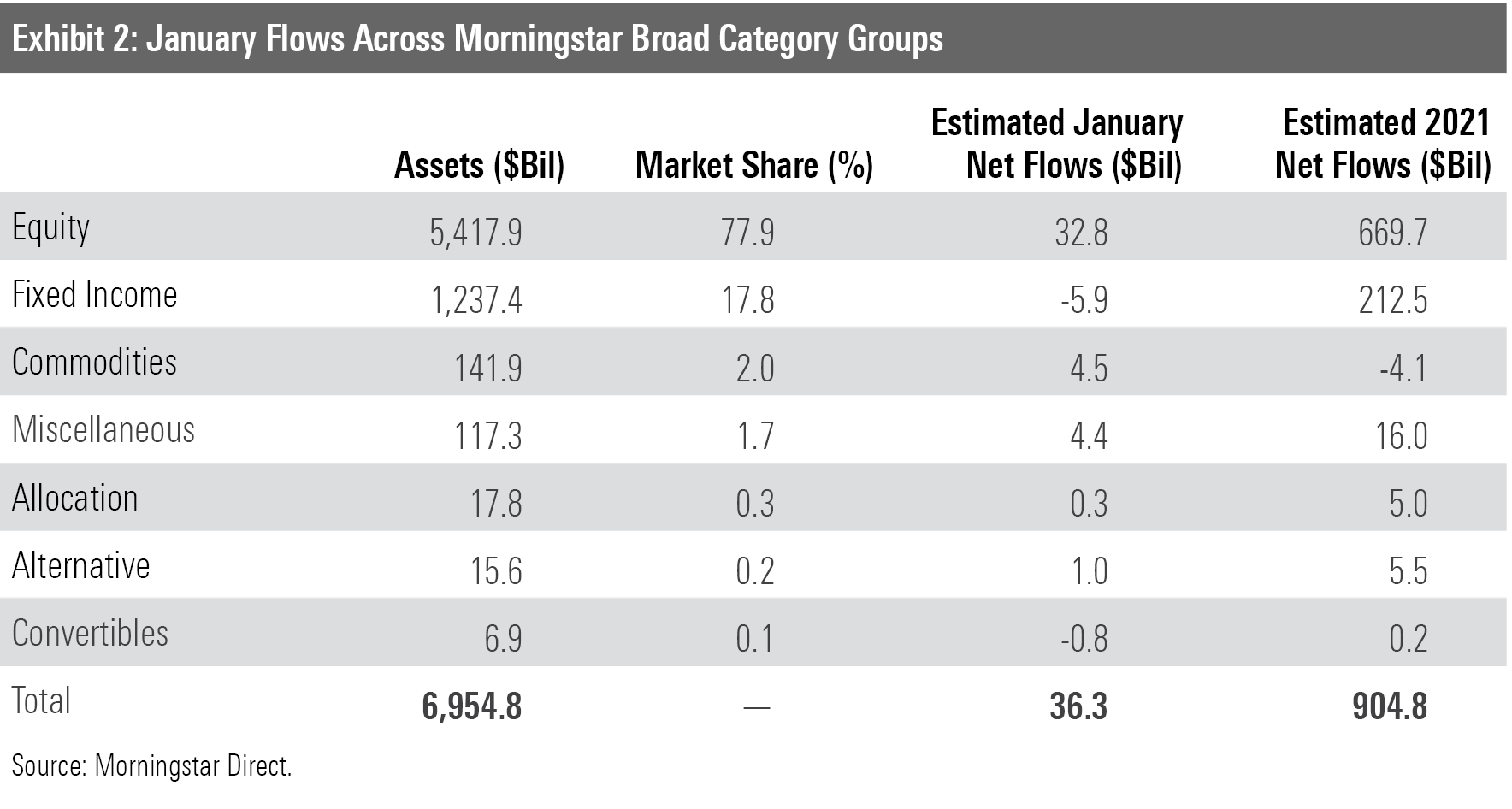

Investors in U.S. exchange-traded funds took note. ETFs collected $36.3 billion of new money in January, which would have ranked as the lowest monthly total of 2021. Fixed-income ETFs surrendered $5.9 billion to withdrawals--their first month of outflows since March 2020.

Here, we'll take a closer look at how the major asset classes performed last month, where investors put their money, and which corners of the market looked rich and undervalued at month's end, all through the lens of ETFs.

Reversing Course

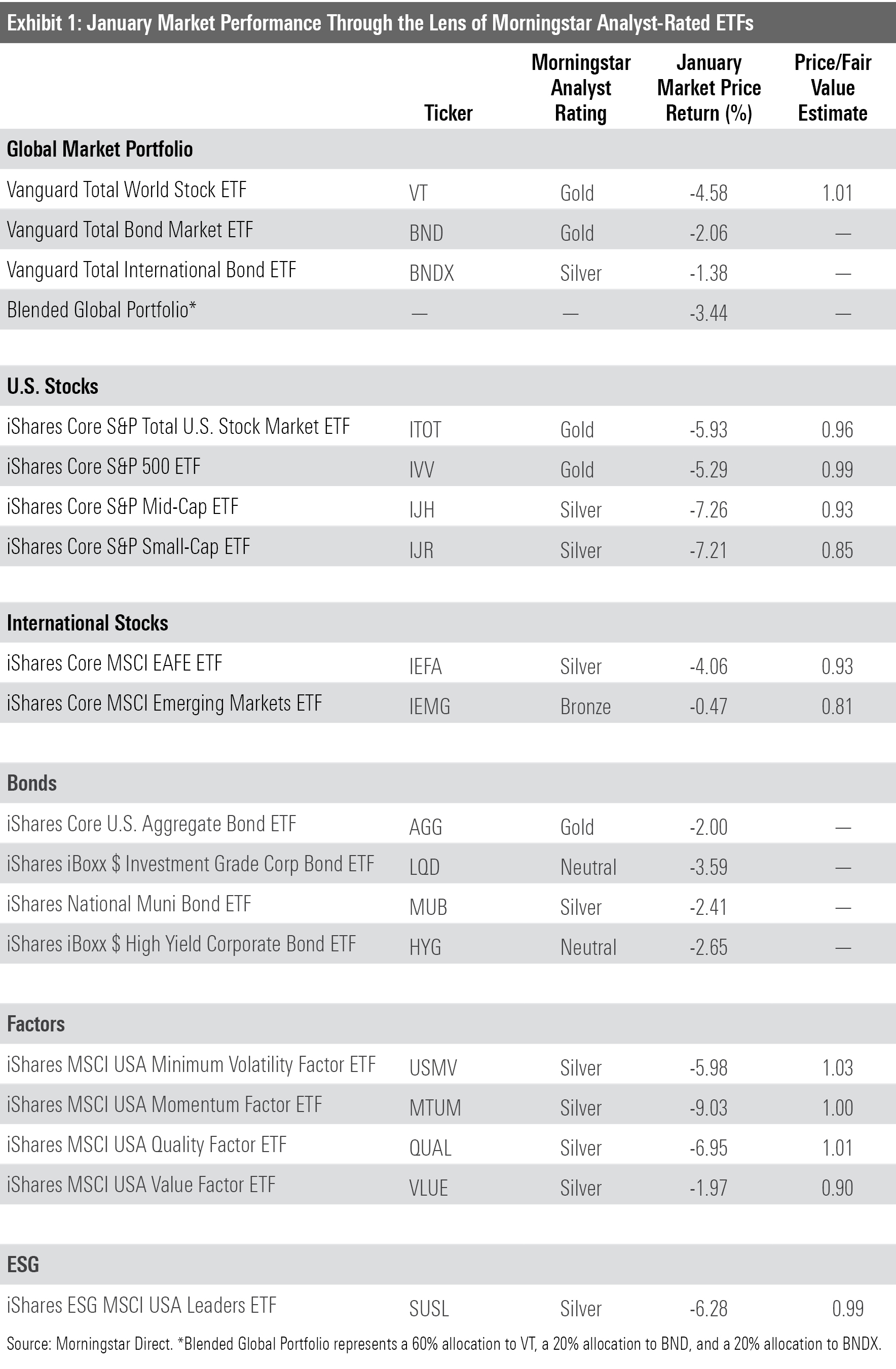

Exhibit 1 shows the January returns for a sample of ETFs rated by Morningstar analysts that serve as proxies for major asset classes. Investors in a blended global portfolio lost 3.44% last month. Vanguard Total World Stock ETF VT, which constitutes the stock sleeve and powered the portfolio forward in 2021, shed 4.58% last month. The portfolio's fixed-income allocation fared better but still lost value in January. Vanguard Total Bond Market ETF BND and Vanguard Total International Bond ETF BNDX lost 2.06% and 1.38%, respectively. These funds have historically shown little correlation with VT, but that doesn't mean they will always shoulder the load when stocks slump.

International stocks held up a bit better than their domestic brethren last month. Vanguard Total International Stock ETF's VXUS 2.38% slide was enough to beat U.S.-focused Vanguard Total Stock Market ETF VTI for the first time since last May.

Emerging-markets stocks helped the cause. IShares Core MSCI Emerging Markets ETF IEMG limited its dip to 0.47% last month. Resilient performance from stocks in Brazil, Saudi Arabia, and South Africa--which IEMG weights about 3 times as heavily as VXUS does--helped the fund stay afloat. IEMG traded at a 19% discount at January's end, according to Morningstar's fair value estimates for the stocks in its portfolio. The fund finished last year in the red while its developed-market twin iShares Core MSCI EAFE ETF IEFA cruised to an 11.29% return, but IEMG took the early lead this year.

U.S. stocks did not carry their momentum from 2021 into the new year. IShares Core S&P Total U.S. Stock Market ETF ITOT was down as much as 10.23% before a two-day rally at the end of the month sealed a 5.93% loss for January. The promise of interest-rate hikes likely drove the swift sell-off. Federal Reserve Chairman Jerome Powell crystallized plans to increase interest rates in March--the first of what appears to be a series of bumps throughout the year. March should also conclude the Fed's asset purchasing program, which has infused cash into the economy since the onset of the pandemic.

Growth stocks bore the brunt of the interest-rate news. Since these companies' anticipated cash flows are further in the future than their value peers', they are hit harder when interest rates increase. Indeed, Vanguard Growth ETF VUG slid 9.41% last month. Its value twin, Vanguard Value ETF VTV, peeled back 1.07%.

The interest-rate-inflicted pain was acute for consumer discretionary and tech stocks, two of the market's most richly valued sectors. Consumer Discretionary Select Sector SPDR ETF XLY lost 9.53% in January, as key holdings Amazon.com AMZN, Tesla TSLA, and Nike NKE lost between 10% and 12% apiece. In the tech arena, semiconductor manufacturers Nvidia NVDA and Advanced Micro Devices AMD both fell over 15% after excelling in 2021.

On the other hand, some steadier market elders weathered the broad pullback well. Consumer staples stalwarts Coca-Cola KO, Altria Group MO, and General Mills GIS all finished January with positive returns. These firms' steady hands helped VTV minimize its decline. Last month's real winner, however, was 2021's best-performing sector: energy. Energy Select Sector SPDR ETF XLE notched a standout 18.77% return in January, which exceeded the next-closest sector ETF, Financial Select Sector SPDR ETF XLF, by more than 18 percentage points. Left for dead in the spring of 2020, firms like Exxon Mobil XOM and Occidental Petroleum OXY have rebounded as energy prices have reached their highest levels in years.

Sector constraints prevented iShares MSCI USA Value Factor ETF VLUE from fully channeling energy stocks' success, but its 1.97% January dip still led iShares' suite of single-factor strategic-beta funds. IShares MSCI USA Minimum Volatility Factor ETF's USMV 5.98% slide last month continued a troubling pattern: USMV trailed the S&P 500 in each of the past five months that the broad benchmark finished in the red. From the start of 2020 through January 2022, the fund captured 99% of the S&P 500's downside but only 73% of its upside. This serves as an important reminder for investors looking to dial back risk: Low-volatility stocks are still stocks, and there is no substitute for curbing risk with a more conservative asset allocation.

A Tough Act to Follow

Investors dipped their toes into ETF waters in January after last year's $902 billion of inflows. Stock ETFs, which set a fresh annual flows record by last July, collected $32.8 billion of new money last month. That represented about three fourths of all January inflows.

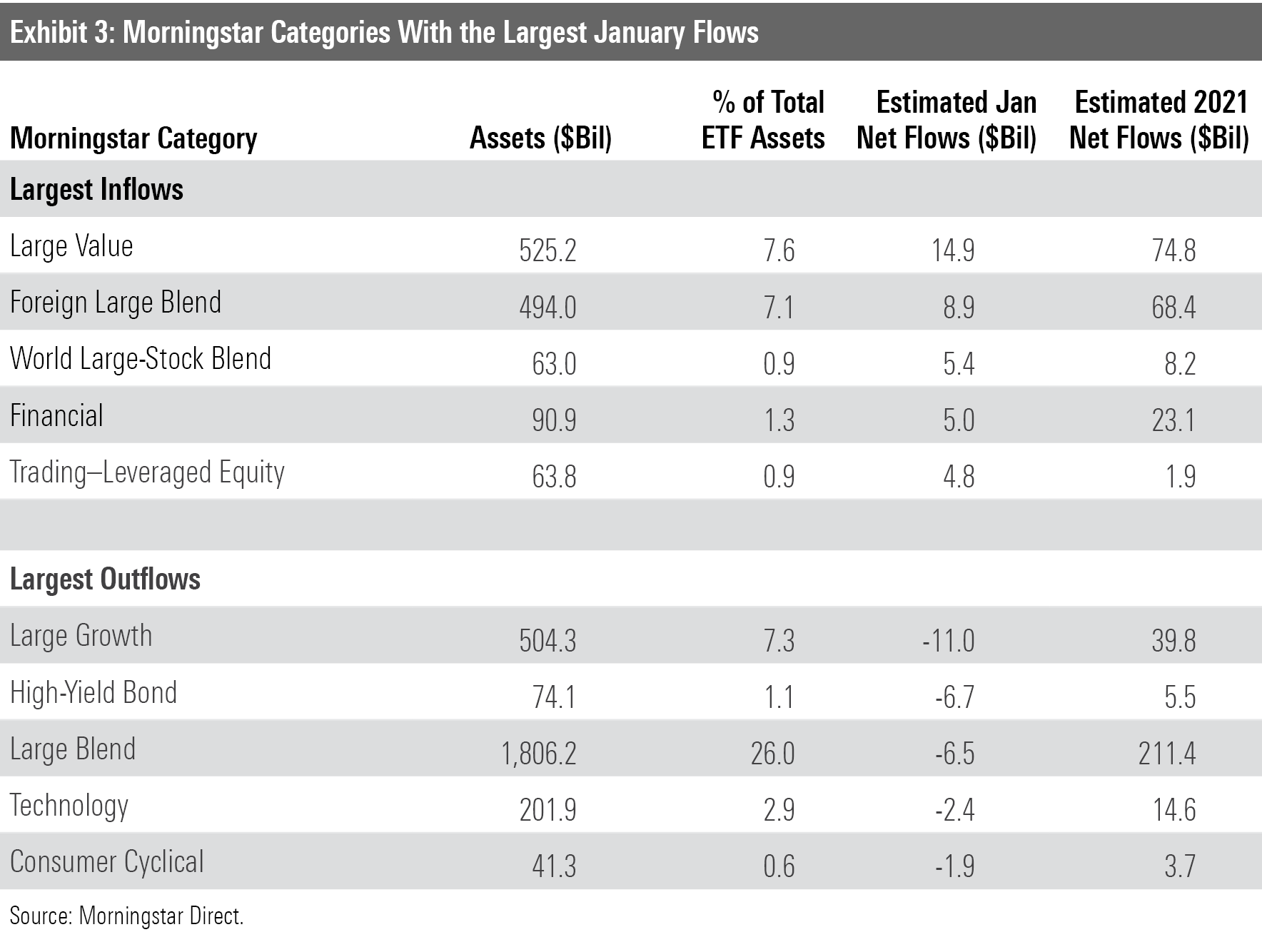

It's no surprise to see stock ETFs lead the way, but large-growth and large-blend funds' January outflows marked a turnaround from last year. Those two Morningstar Categories ranked first and fifth in 2021 inflows, respectively, with large-blend funds alone accounting for nearly one fourth of all ETF flows.

Flows into value and growth funds followed relative performance in January, which continues a trend that persisted in 2021. U.S. value funds collectively reeled in nearly $17 billion of new money last month, with U.S. large-value ETFs leading all Morningstar Categories. Growth funds bled nearly $13 billion. Performance between value and growth stocks was fairly even in 2021. Time will tell if last month was a harbinger for a sustained value comeback--and perhaps the flows that follow--but investors seemed to bet on it in January.

Sector ETF flows reflected investors' appetite for potentially undervalued corners of the market as well. Funds that invest in financial stocks--mainstays of most value index funds--added $5.0 billion in January. Consumer defensive and utilities ETFs saw lucrative months as well, as they hauled in $2.5 billion and $1.2 billion, respectively. Meanwhile, investors rotated out of faster-growing sectors. Technology, consumer discretionary, and communication-services ETFs collectively leaked $5.2 billion last month after absorbing $19.6 billion last year. While these pivots may have worked in investors' favor in January, it can be difficult to effectively use sector funds over the long run.

Fixed-income funds bled $5.9 billion in January in their first month of outflows since $20.7 billion flooded out in March 2020. High-yield bond funds suffered the worst of it. Their $6.7 billion January outflow ranked second-most among all categories. These funds hold risky debt that tends to be more closely correlated with the ebbs and flows of the stock market, so it makes sense that a rocky month for equities accompanied their outflows. Corporate-bond ETFs, which also tend to exhibit more stocklike performance than better-diversified bond portfolios, parted with $1.8 billion last month.

Inflation-protected bond funds lost steam in January as well. Their $368 million outflow snapped a monthly inflow streak that started in April 2020 and underpinned a record-setting 2021. As the Fed starts to make more concrete strides to dial back inflation, it seems that investors' enthusiasm for these offerings has waned.

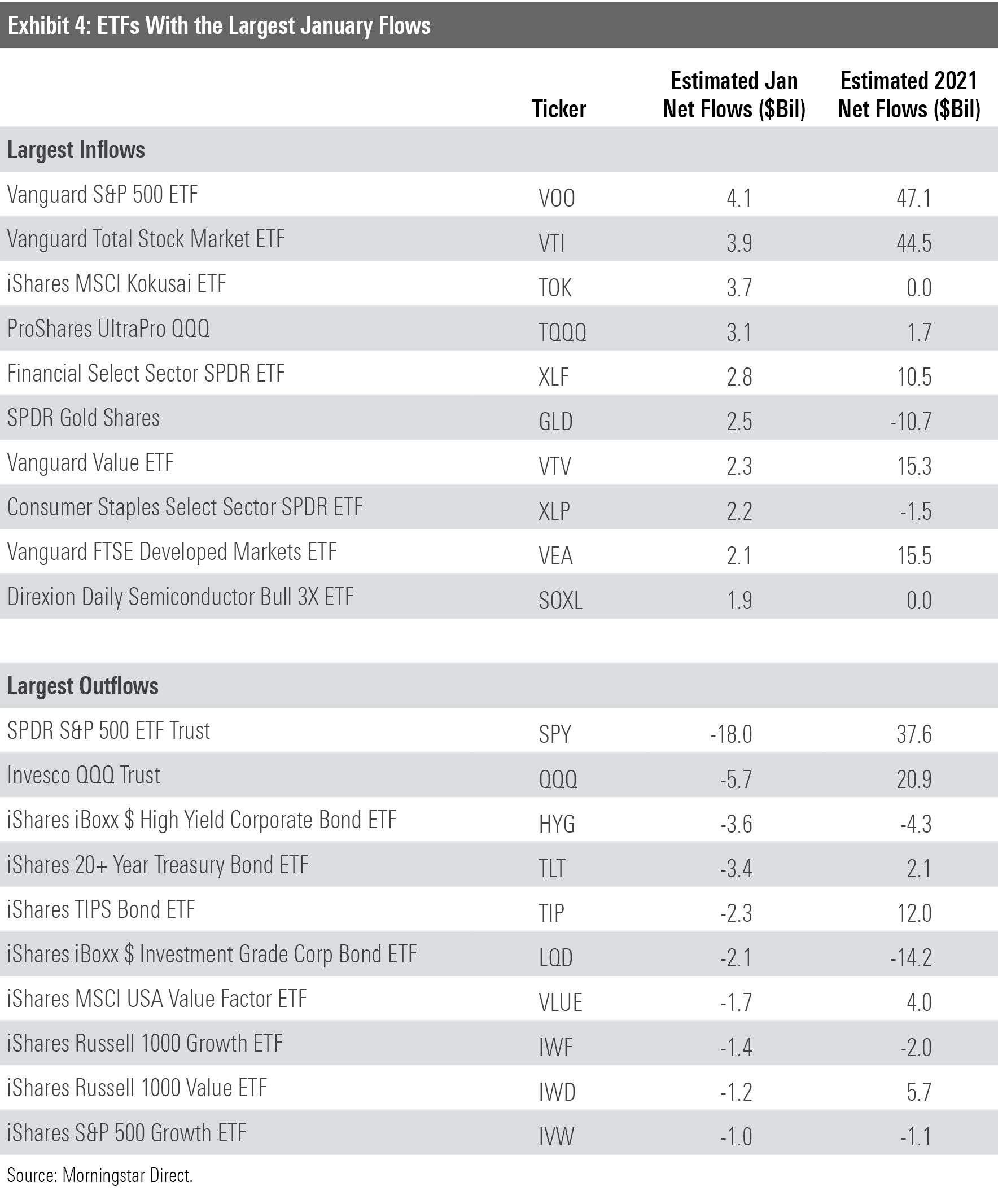

After finishing 2021 as the only broad category group to see outflows for the year, commodities funds bounced back, posting their largest inflows since May 2020. SPDR Gold Shares ETF GLD saw the most pronounced turnaround. It welcomed $2.5 of fresh money last month after surrendering $10.7 billion last year, which ranked second-most among all ETFs. Gold, often heralded as safe-haven asset, tends to attract investment during times of turmoil. It was not immune from January's tribulations, however; GLD sunk 1.68% last month.

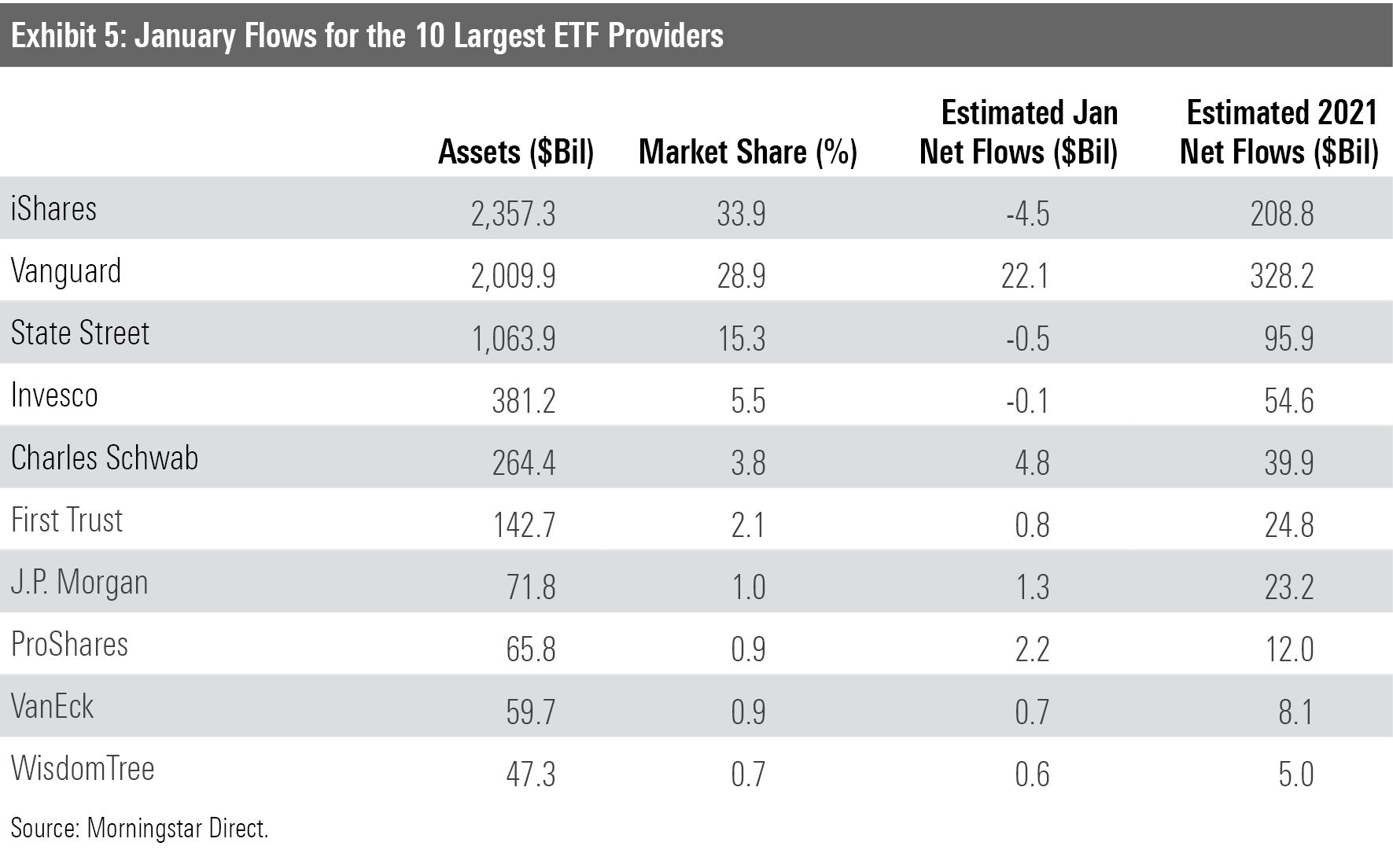

Vanguard Rights the Ship

Vanguard dominated the ETF provider flows leaderboard in January after conceding the top spot to iShares in the final two months of 2021. The $22.1 billion it brought in last month accounted for nearly half of all ETF inflows.

Vanguard's clientele tend to be long-term investors who are inclined to leave their money alone during volatile markets. More-tactical investors tend to favor offerings from iShares and State Street, both of which endured net outflows last month. IShares' lineup of fixed-income products is mostly to blame for the firm's first month of outflows since March 2020. IShares iBoxx $ High Yield Corporate Bond ETF HYG and iShares 20+ Year Treasury Bond ETF TLT leaked over $3.0 billion each. IShares TIPS Bond ETF TIP, one of its most lucrative funds last year, parted with $2.3 billion.

Dimensional Fund Advisors narrowly missed the top-10 cut as flows into its ETF lineup have gained momentum. Somewhat late to the ETF party, the systematic investing shop launched its first two ETFs in January 2020. Two years later, it offers 13 such products that collectively count $44.7 billion in assets. DFA U.S. Core Equity 2 ETF DFAC, the largest of the bunch, led the way with $307 million of inflows in January. Should the market consistently reward the value factor--a core tenet of the firm's investment philosophy--DFA may find itself cracking the top-10 ETF provider list soon.

Drug and Digital-Asset ETFs Look Cheap

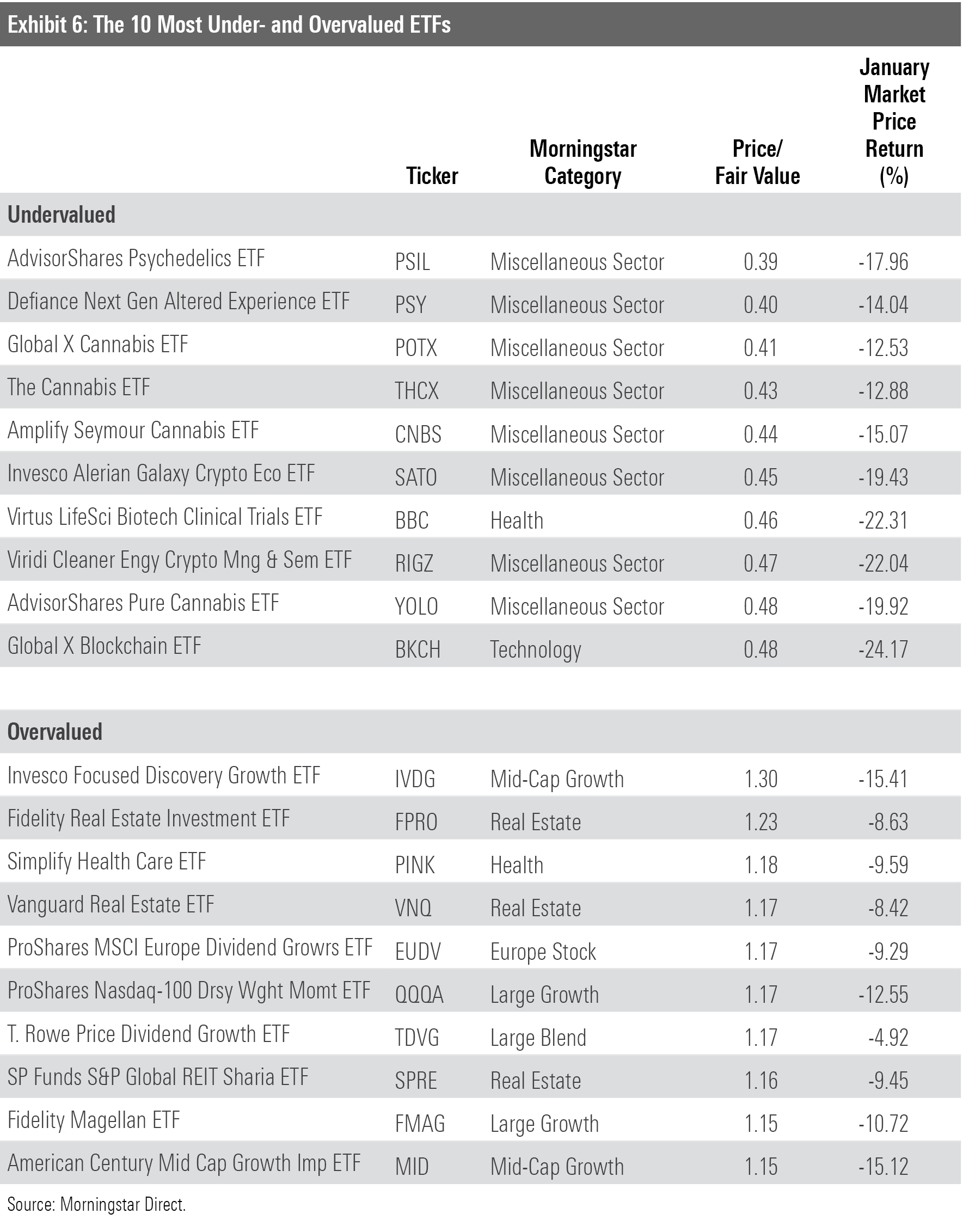

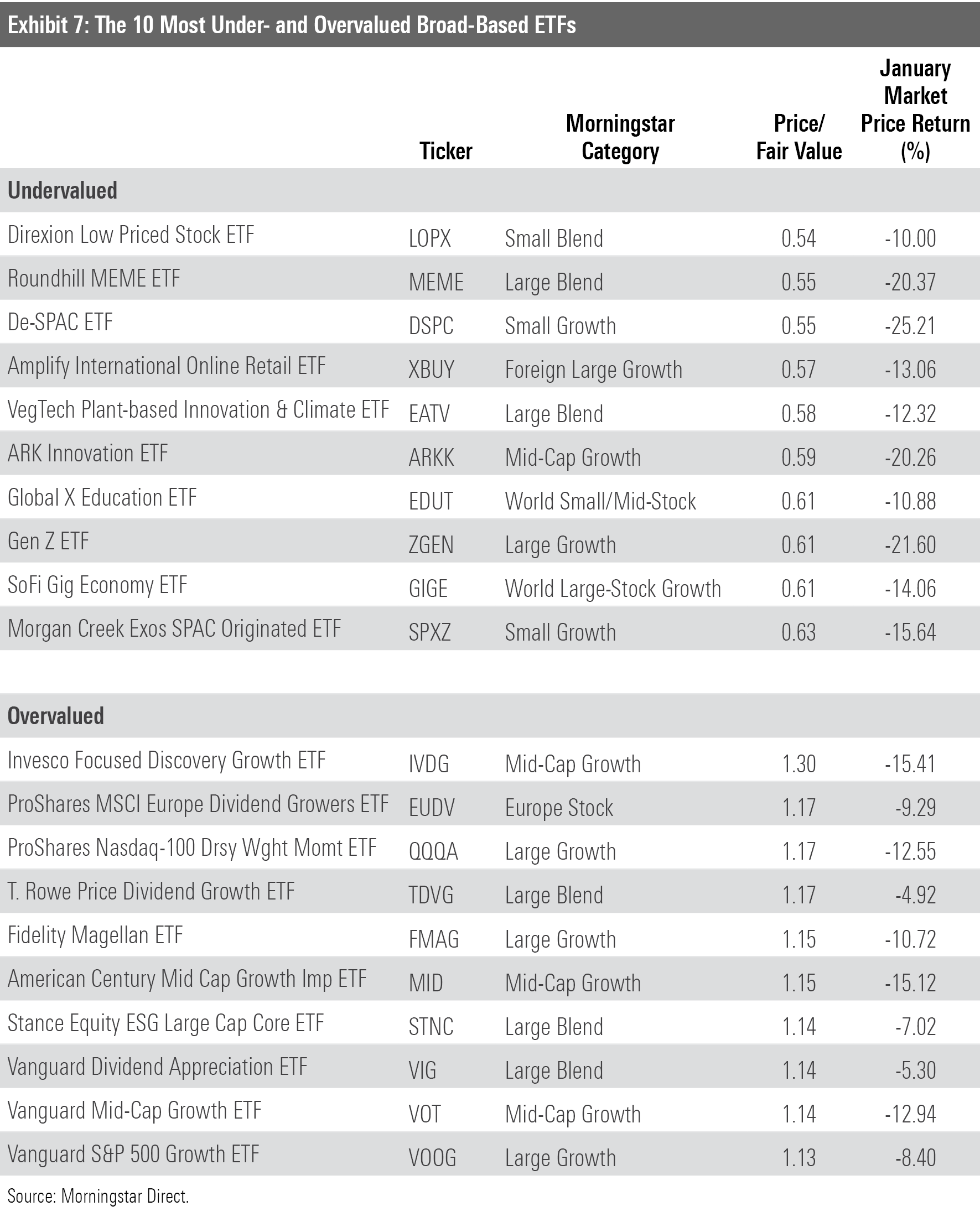

The fair value estimate for ETFs rolls up our equity analysts' fair value estimates for individual stocks and our quantitative fair value estimates for stocks not covered by Morningstar analysts into an aggregate fair value estimate for stock ETF portfolios. Dividing an ETF's market price by this value yields its price/fair value ratio. This ratio can point to potential bargains and areas of the market where valuations are stretched.

ETFs that aim to leverage the legalization of cannabis or other drugs dominated the cheaper half of Exhibit 6, which features funds that traded at the lowest prices relative to their fair value at January's end. Turbulence from 2021 spilled into the new year for these funds. Global X Cannabis ETF POTX lost 12.53% after shedding 39.3% of its value last year, for example. However, as Morningstar's Kris Inton explains, better days may lie ahead for beaten-down cannabis companies.

A trio of crypto-centric ETFs found themselves at the cheaper end of Exhibit 6 as well. Viridi Cleaner Energy Crypto-Mining & Semiconductor ETF RIGZ, Invesco Alerian Galaxy Crypto Economy ETF SATO, and Global X Blockchain ETF BKCH invest in companies whose operations center around digital assets or the underlying technology. Each fund hit the market shortly after bitcoin and other cryptocurrencies took off in early 2021. They have seen shoddy results. BKCH has shed 31.15% since its launch last July, for example. While these funds should benefit if cryptocurrencies return to their early 2021 form, their early tribulations illustrate the risk that comes with trendy thematic ETFs.

When Ark Innovation ETF ARKK manager Cathie Wood claimed in January that the fund's holdings were trading in deep-value territory, she was met with widespread skepticism. But after a sparkling 2020, the fund shed 44.7% over the past 12 months. At the end of January, the fund that once inhabited the pricier side of Exhibit 7 traded at a 41% discount to its fair value.

Vanguard Real Estate ETF VNQ ranked as one of the most richly valued funds at January's close. This fund earns a Morningstar Analyst Rating of Gold because it accurately represents the U.S. real estate market at a low cost, which implies that real estate stocks may be holistically overvalued. This seems a surprise, as their weight in the Russell 1000 Value Index (5.1%) nearly tripled that of the Russell 1000 Growth (1.8%). Real estate securities tend to have asset-heavy balance sheets that condense their price/book ratios, a key component in the Russell indexes' style definition. Even value index funds can be stuck with relatively rich constituents at times.

T. Rowe Price Dividend Growth ETF TDVG may be one of the more attractive names on the pricier side of Exhibit 7. A proven manager and patient, dividend-focused approach earn this fund a Silver rating. The fund's focus on financially healthy firms that are poised to steadily increase dividends sticks out next to its growth-at-all-costs comrades in Exhibit 7. It mostly outperformed such funds in January, which may have helped it ascend the price/fair value list.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)