Why Sector Funds Are a Bad Bet

These funds sound good on paper but can be difficult to use effectively.

Sector funds--which focus on stocks issued by companies in a specific corner of the economy--have become increasingly popular. These funds attracted about $97.6 billion in net new dollars during 2021. In addition, fund companies have rolled out about 100 newly minted sector-focused funds and exchange-traded funds over the past 12 months. These funds often appeal to investors looking to take advantage of emerging economic trends, such as growth in technology, infrastructure, and healthcare.

But these funds can be surprisingly difficult to use in a portfolio. In this article, I’ll highlight some of the shortfalls of sector funds and suggest some ways to use them more effectively.

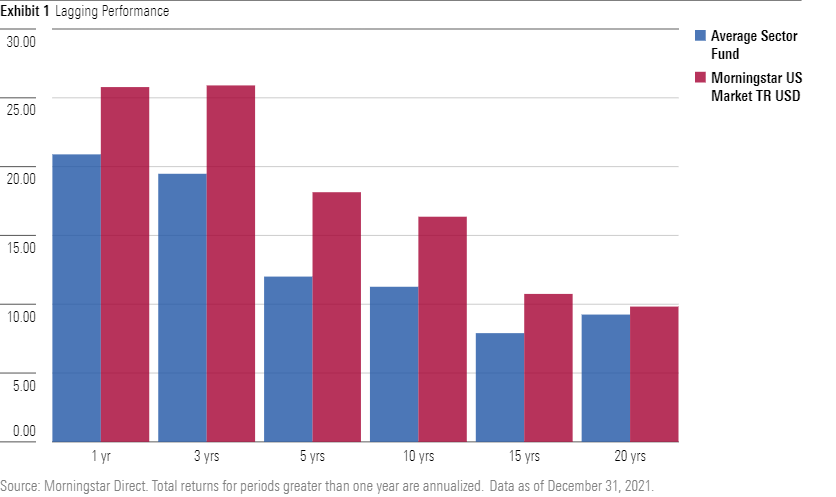

Performance Has Lagged

Performance for sector funds has been unusually bad. Because sector funds focus on different areas of the economy, you might think that their overall performance would be in line with the market. In fact, though, sector funds’ annualized total returns have lagged broad market benchmarks by a wide margin over most trailing periods, as shown in the exhibit below.

One reason for this underperformance is an oddity related to the type of sector funds on offer: The number of funds available in each sector doesn’t match the makeup of the market. In aggregate, about 18% of sector funds are in the real estate sector, which makes up only about 4% of the overall market. Real estate also claims an outsize percentage of total assets invested in sector funds. Yet real estate has underperformed the broader market by a wide margin for the trailing three-, five-, and 10-year periods. On the flip side, only about 6% of sector funds (and an even smaller percentage of sector-fund assets) are in the communications sector, which accounts for nearly 10% of the overall market and was one of the better-performing sectors until its recent slump.

Performance looks more competitive for the trailing 20-year period, but that partly reflects survivorship bias, as many of the worst-performing funds have quietly disappeared. About 180 of the roughly 410 sector funds (including mutual funds and ETFs and excluding multiple share classes) that were around in December 2002 no longer exist. Once high-flying funds like RS Internet Age, Scudder Global Biotechnology, and Nuveen Innovation have been either merged or liquidated out of existence.

Not only has performance lagged the overall market, but most sector funds have failed to keep up with passively managed market benchmarks for their designated sectors. The average sector fund has lagged its respective Morningstar Category benchmark by about 1 percentage point per year for the trailing 10-year period ended Dec. 31, 2021.

Bad Timing

Sticking with low-cost, passively managed offerings is an obvious way to avoid the performance shortfall, but even those funds aren’t problem-free. For one, focusing on a specific area of the market makes these funds inherently more difficult to live with than more broadly diversified offerings.

As different areas of the market go in and out of favor, investors are often tempted to buy and sell at exactly the wrong time. Sector-fund investors often pile into popular sectors after a strong showing and then bail out when they fall out of favor. The specialty-financial category, for example, attracted large inflows in 2007 and 2008, followed by billions in outflows in the wake of damage from the global financial crisis. Healthcare funds experienced significant asset growth from 2013 through 2015, but many of those assets fled after the medical sector lagged in 2016. More recently, investors have piled into real estate funds, but many of these asset flows happened after the real estate sector had already started its strong rebound in the first half of 2021.

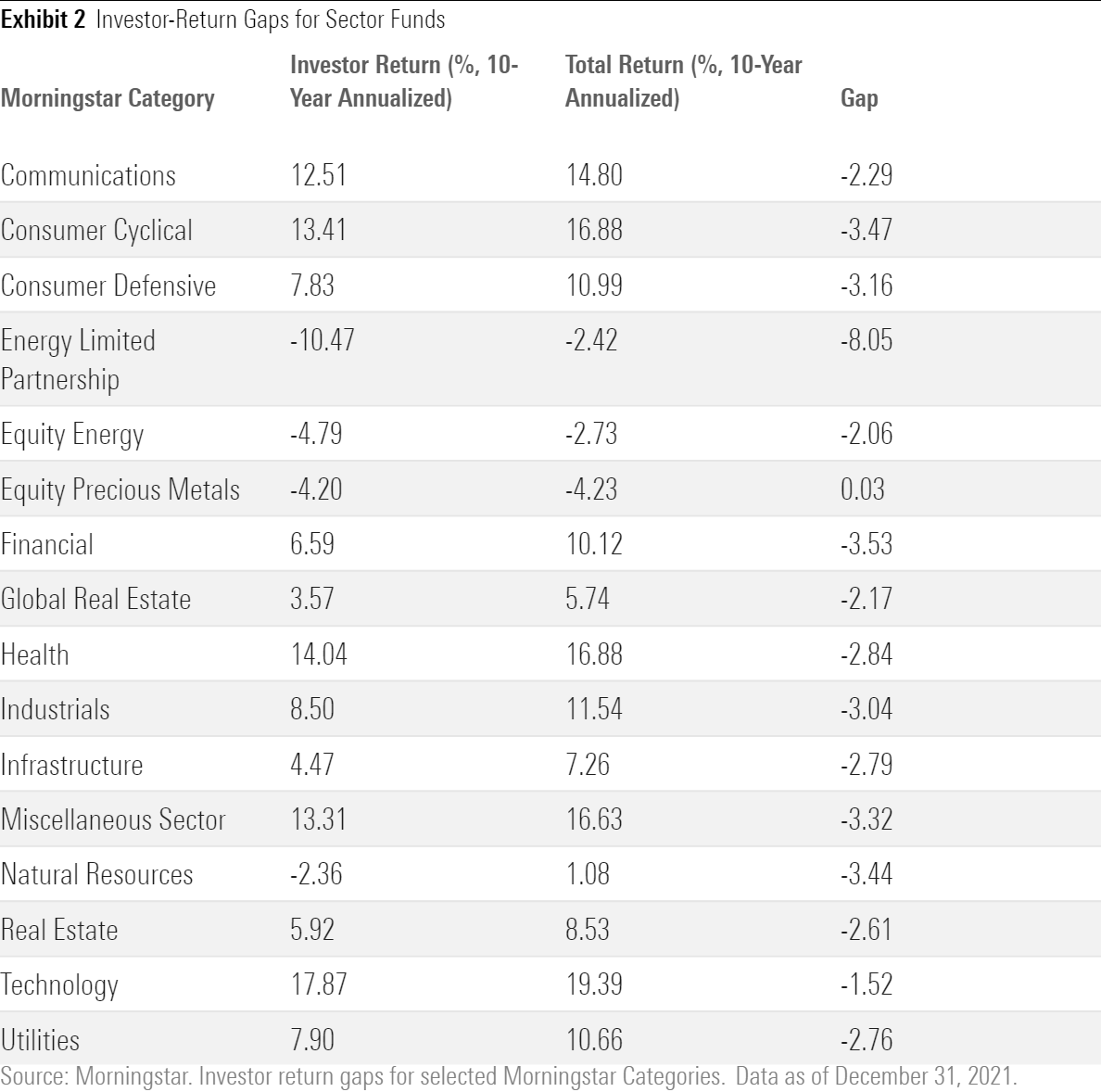

Because of poorly timed asset flows, the returns that investors in sector equity funds have actually experienced have lagged far behind reported total returns. As I’ve covered in previous articles, a fund’s investor returns (also known as dollar-weighted returns or internal rates of return) often differ from its reported total returns because of the timing of cash inflows and outflows. Because of poorly timed cash flows, sector equity funds have generated exceptionally poor results in dollar-weighted terms. On average, sector fund investors gave up close to 4 percentage points per year for the 10-year period ended Dec. 31, 2020, which is worse than any other category group except for alternatives.

As shown in the table below, the gap between investor returns and total returns was negative for nearly every sector-fund category over the trailing 10-year period we looked at.

Another worrisome trend is the increasing interest in "thematic" funds, which are funds that are even more narrowly defined around a specific subset of a given sector, such as genomics, cybersecurity, nanotechnology, legalized marijuana, and clean energy. It's easy to get caught up in the exciting potential for these areas. But investment themes that make a good narrative don't necessarily generate high-enough returns to compensate for their risk, and investors who buy into thematic funds are making even more concentrated bets on specific areas of the market, many of which are trading at steep valuations.

How to Get Better Results With Sector Funds

As Warren Buffett might say, most investors can live a long and happy life without using sector funds at all. There’s nothing wrong--and a lot right--with sticking with a broadly diversified portfolio that includes exposure to various market sectors. Investors who still want to dip a toe into the sector-fund waters, though, can improve their results by following some of the strategies below.

1. Consider dollar-cost averaging. Dollar-cost averaging often gets a bad rap because it typically leads to lower total returns. That's because equity market returns are positive more often than not, so keeping any money on the sidelines is generally detrimental. But we've found that in practice, dollar-cost averaging can help improve investors' results because it helps enforce discipline and avoid the pitfalls of bad timing--namely, buying in after a huge runup and selling after a decline. That's especially true when it comes to more-specialized types of funds.

As part of our annual Mind the Gap study, we estimated the results for dollar-cost-averaging by assuming equal monthly investments made within each category and then calculating an internal rate of return. We found that for the 10-year period ended Dec. 31, 2020, investors in sector funds would have improved their results by nearly 3 percentage points per year, on average, by following this strategy.

2. Use sector funds to fill a specific strategic role in your portfolio. One of the more effective ways to use sector funds is as a counterbalance to other areas of your portfolio that might be overweighted. For example, if you receive company stock as a significant portion of your overall compensation, you might find yourself with a large position in a certain sector that's difficult to cut back because of the potential tax consequences.

Allocating a small percentage of your portfolio to a sector that has a relatively low correlation with the overweighted sector (such as precious metals or natural resources as a partial offset to technology exposure) is one way to partially mitigate the risk. (This strategy obviously won’t alleviate the company-specific inherent in concentrated stock positions, though.)

3. Take a value-oriented approach. As mentioned above, one of the key problems with sector funds is that they tend to attract bigger cash flows after they've already posted eye-catching performance numbers. That market enthusiasm often leads to higher stock prices, leading to elevated valuations that are more apt to decline when market trends reverse. Focusing on areas that have been out of favor--and are trading at discounted or reasonable valuations--is one way to mitigate this risk.

As of this writing, Morningstar’s equity analysts were finding the best values in the communications and consumer cyclical sectors, which have both sold off so far in 2022.

4. Keep position sizes small. If you decide to include sector funds in your portfolio at all, they should play a limited role. Keeping sector-fund exposure to 5% of assets or less can help limit the damage from their idiosyncratic risks.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)