Beyond Bitcoin: A Banner Year for New ETFs

A record number of active ETFs were launched in 2021.

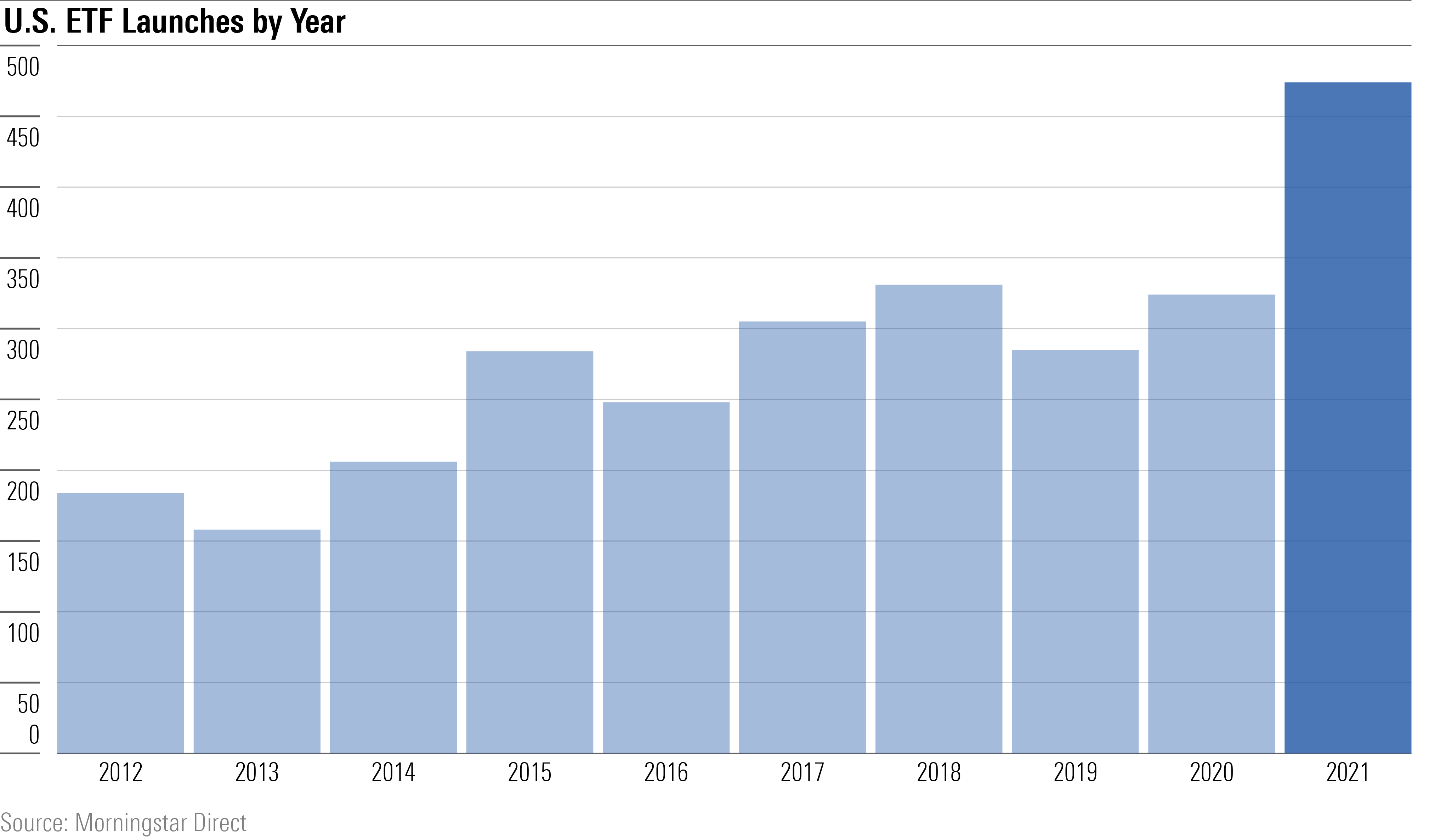

The exchange-traded fund boom showed no sign of letting up in 2021 as a record number of funds opened their doors.

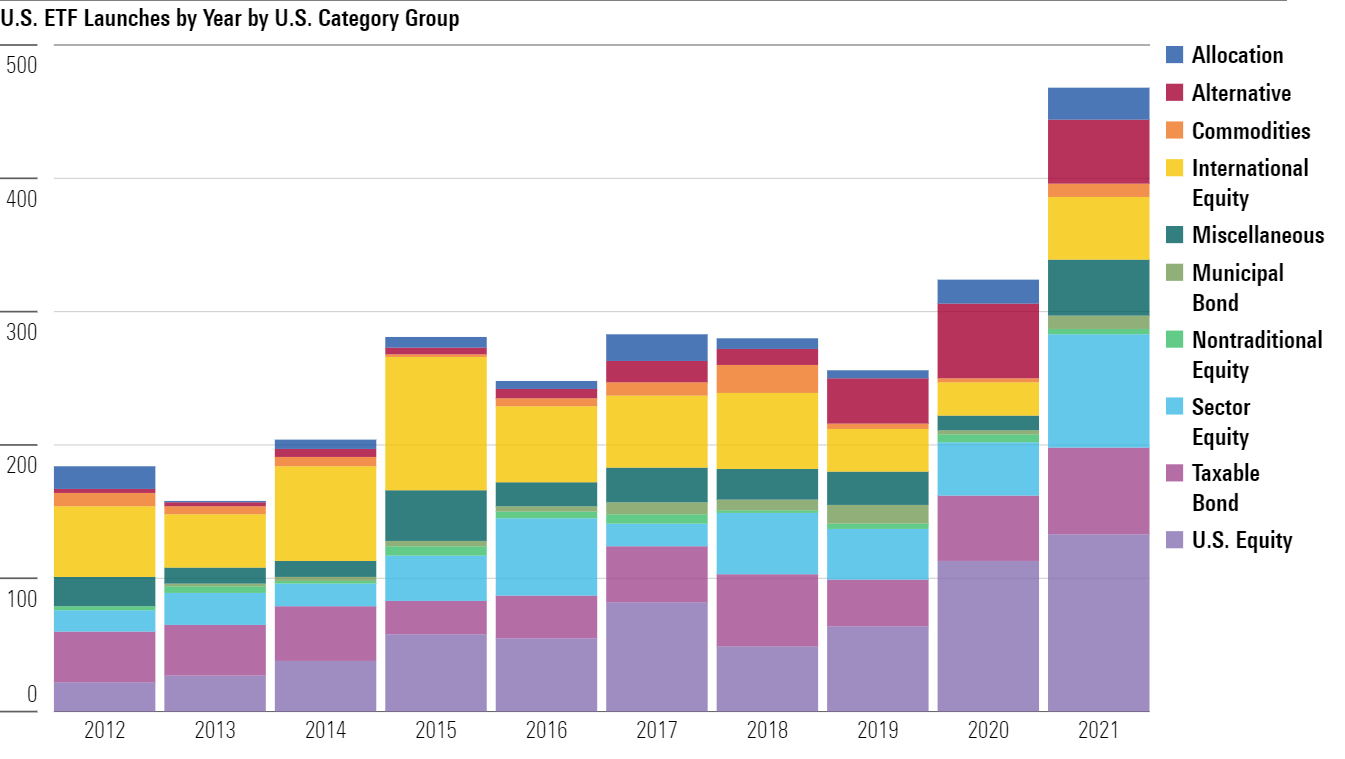

Investors poured $902.6 billion into the space overall, an almost 80% increase from the prior all-time high set in 2020. That included $24.4 billion directed to 480 new ETFs, topping the previous record of 329 new launches in 2020.

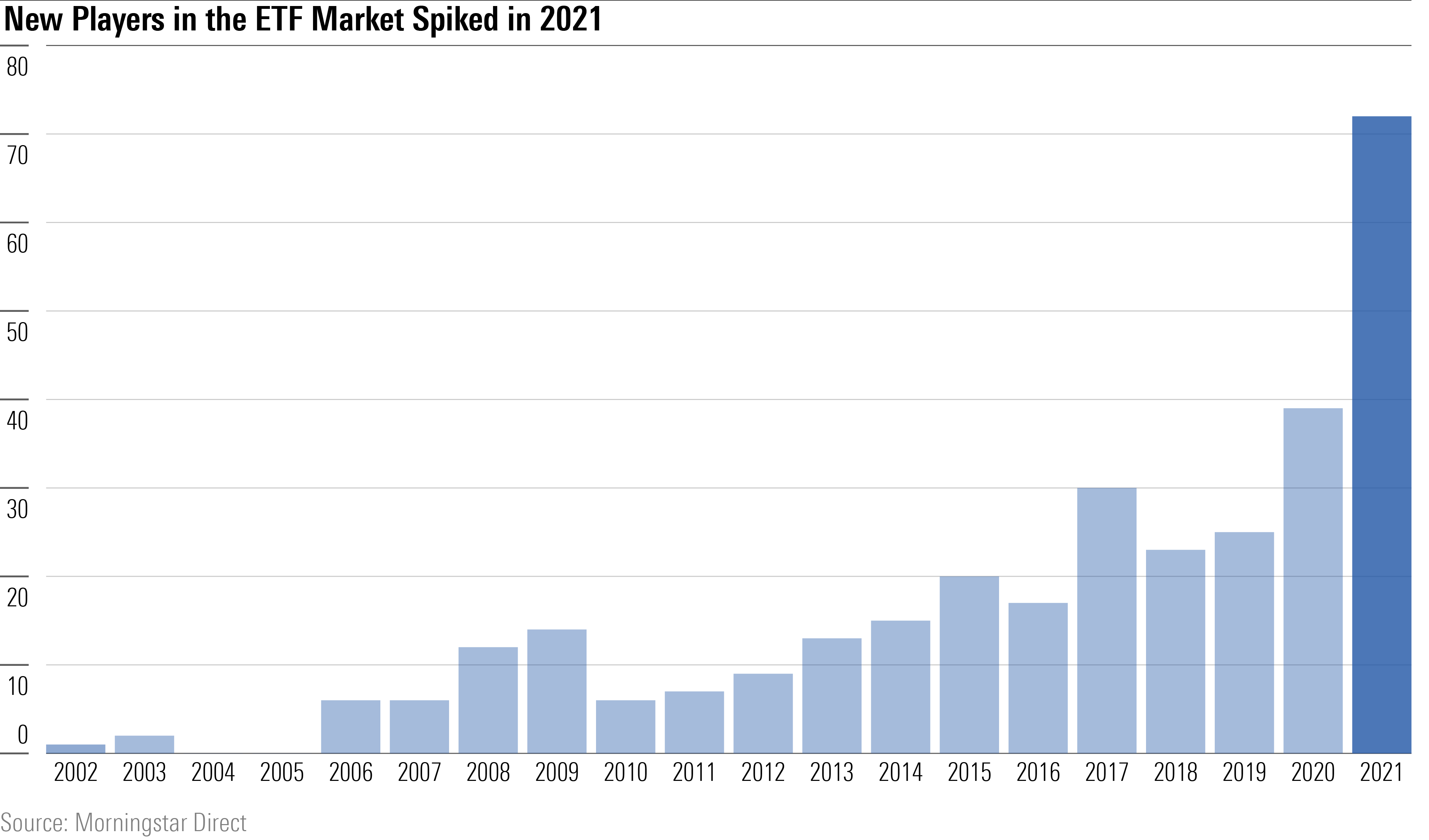

As Ben Johnson, Morningstar's global director of ETF research, puts it: "Record flows, record launches, a record number of new entrants, and the first-ever mutual-fund-to-ETF conversions all underscore the fact that ETFs have become the preferred investment wrapper for a large and growing number of investors."

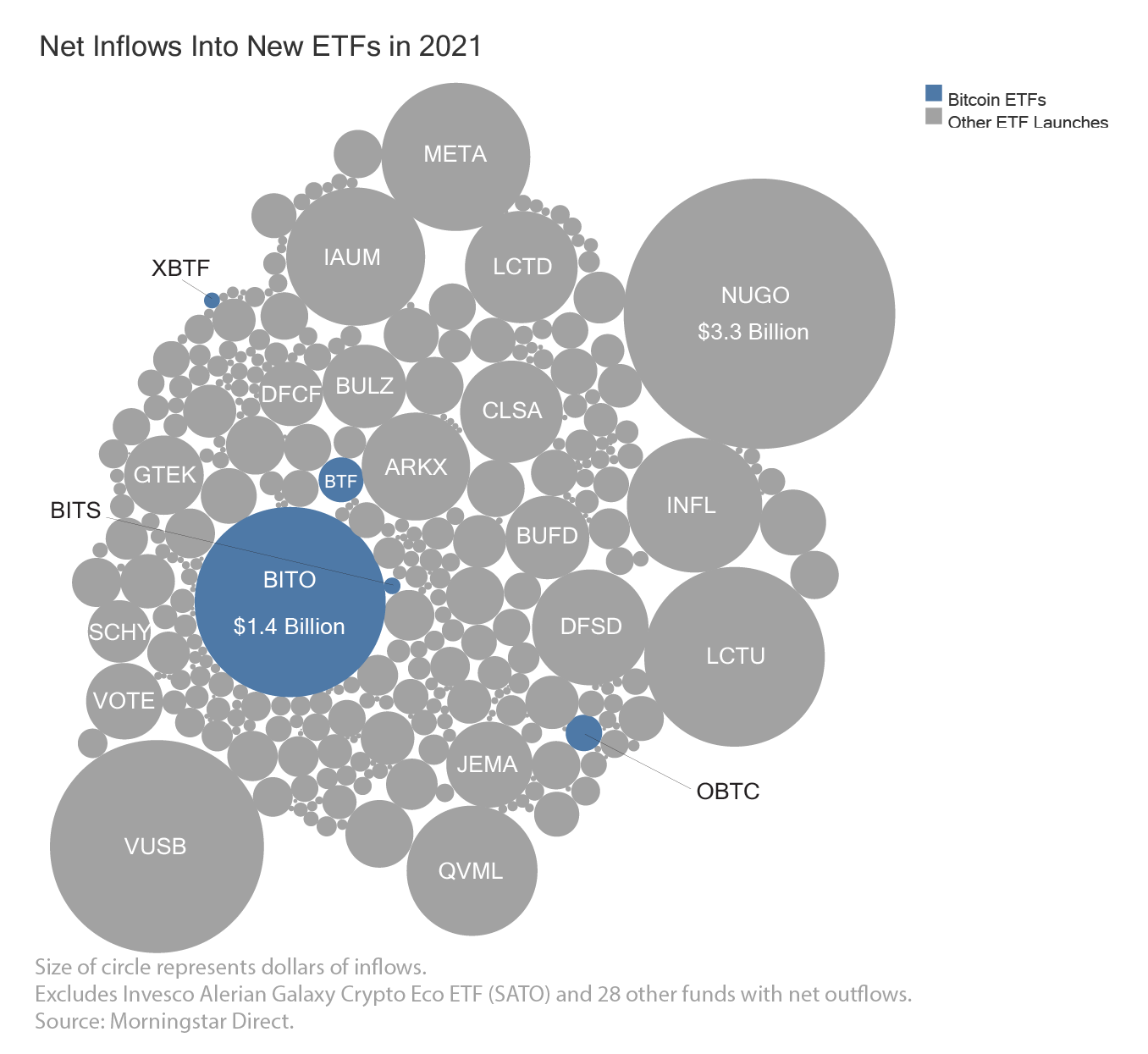

The first six funds to offer exposure to Bitcoin hit the market, with ProShares Bitcoin Strategy ETF BITO pulling in $1.6 billion between its October launch and year-end.

But bitcoin is only part of the story.

Horizon Kinetics' first ETF caught on with investors worried about inflation. The company’s Inflation Beneficiaries ETF INFL had net inflows of $811.7 million since launching in January.

Horizon Kinetics was one of 72 companies that made their debut in the ETF space last year, including Boston Partners, Federated Hermes, and Putnam. That’s nearly double the number of players that arrived on the scene in 2020.

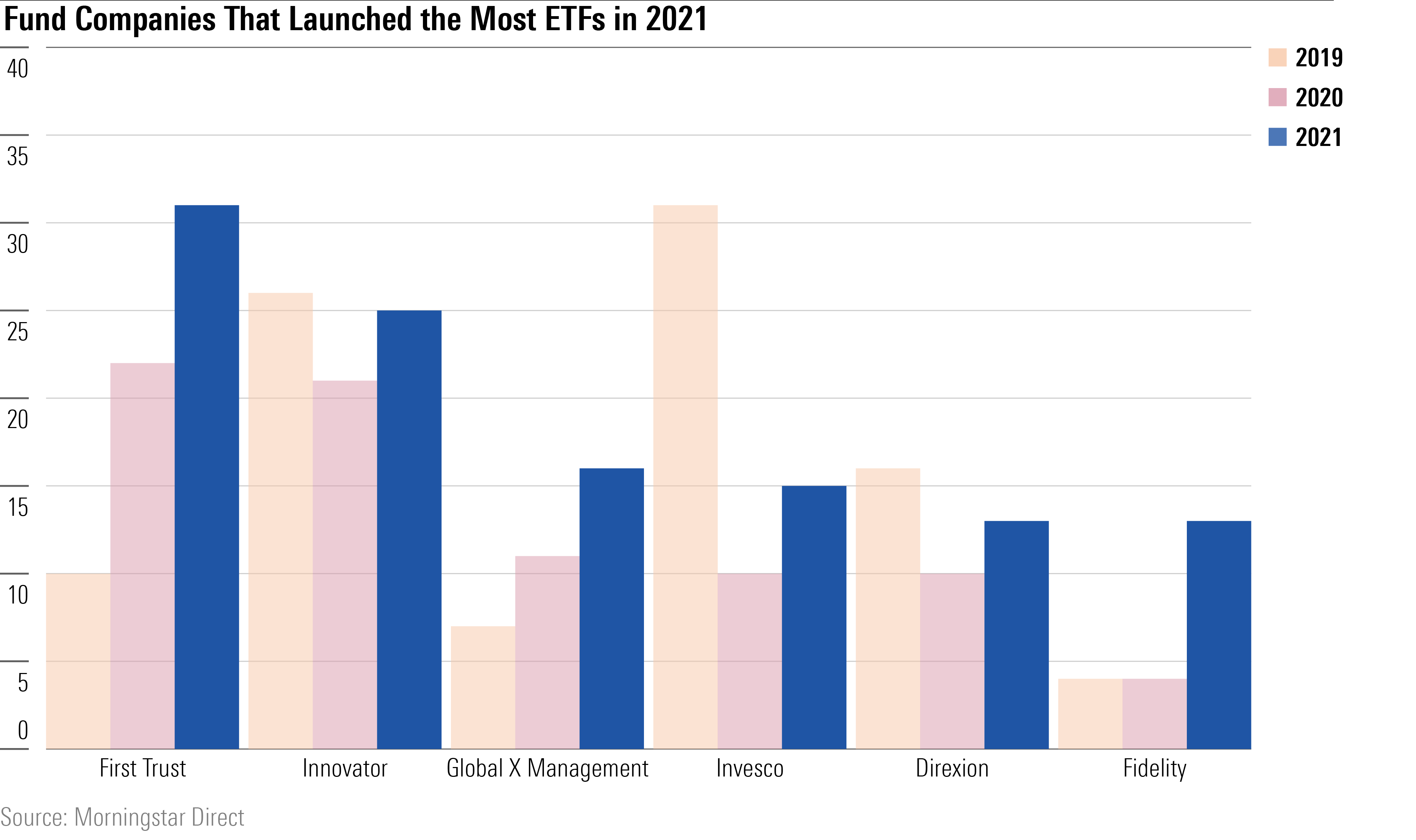

The companies that launched the most ETFs in 2021 have been in the lead for several years now. With 31 new funds in 2021, First Trust topped the list, followed by Innovator and Global X Management. This is the second straight year that First Trust and Global X Management are in the top five and the third straight year for Innovator and Direxion.

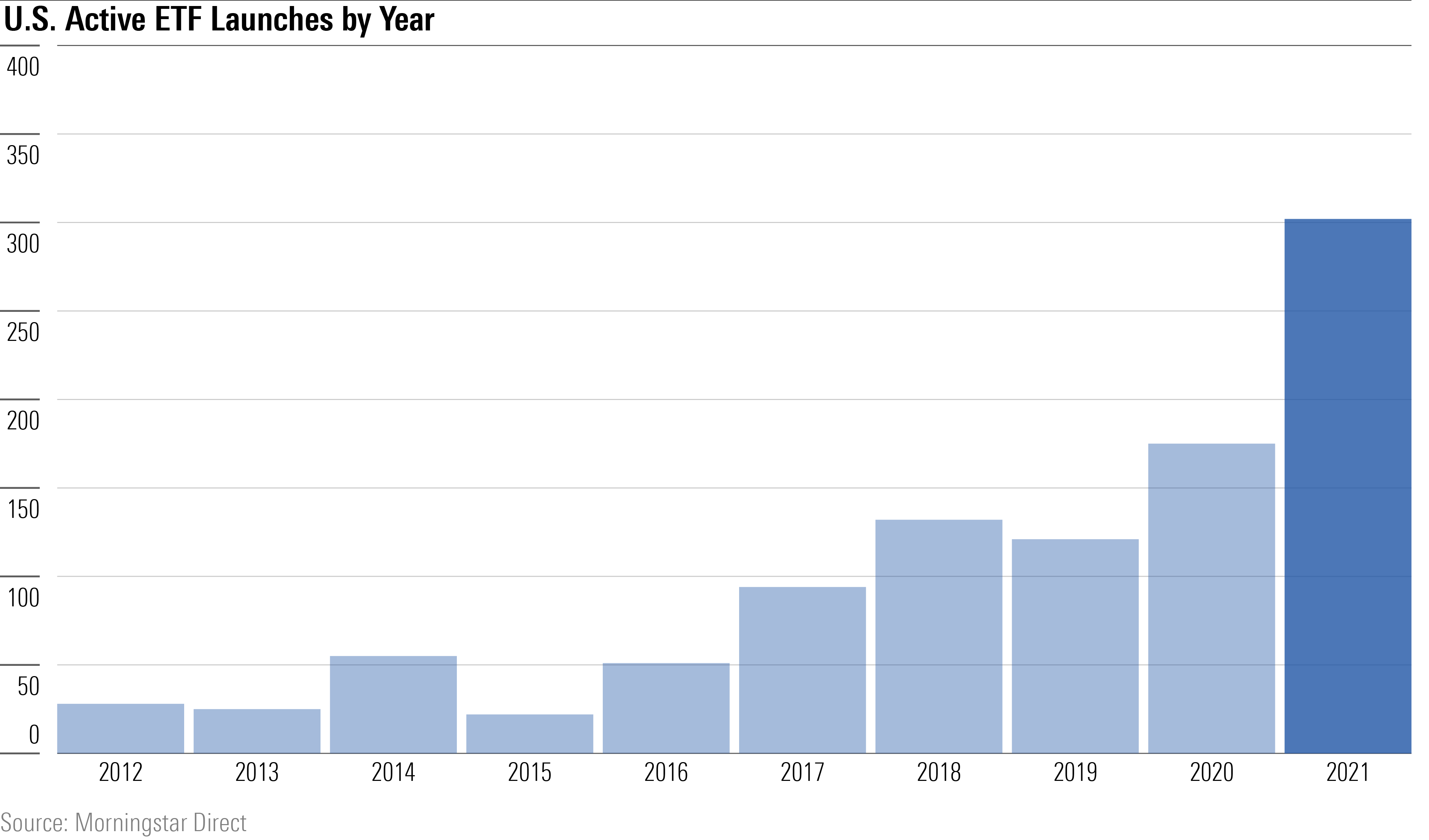

While the ETF market was originally the province of passive investors, active offerings are an increasingly large share of the market. Active ETFs launched in 2021 totaled 302, up from 175 in 2020. Here, too, First Trust and Innovator stand out. They offered the most active ETFs at 28 and 23, respectively. Nuveen Growth Opportunities ETF NUGO, in the large growth Morningstar Category, had the highest inflows at $3.3 billion for the year, even though it didn't come to market until late September. Large blend fund BlackRock U.S. Carbon Transition Readiness ETF LCTU took in $1.4 billion, reflecting continued institutional interest in sustainable investment offerings. Johnson notes that most of its flows came in the form of seed money from large institutions.

Sector equity ETFs saw a record number of launches in 2021, with twenty of these funds falling into the miscellaneous sector category, which includes up-and-coming themes such as crypto, clean water, and cannabis. Roundhill Ball Metaverse ETF METV amassed $885 million in assets, making it the biggest sector equity fund launched last year. ARK Space Exploration & Innovation ETF ARKX came in second with $521 million of inflows.

Taxable bond categories overall saw 65 new ETFs in 2021, besting the 54 seen in 2018. The corporate and high-yield bond categories were in the lead, with seven new ETFs each. Vanguard's Ultra-Short Bond ETF VUSB was the most popular new taxable bond ETF, with $2 billion of inflows.

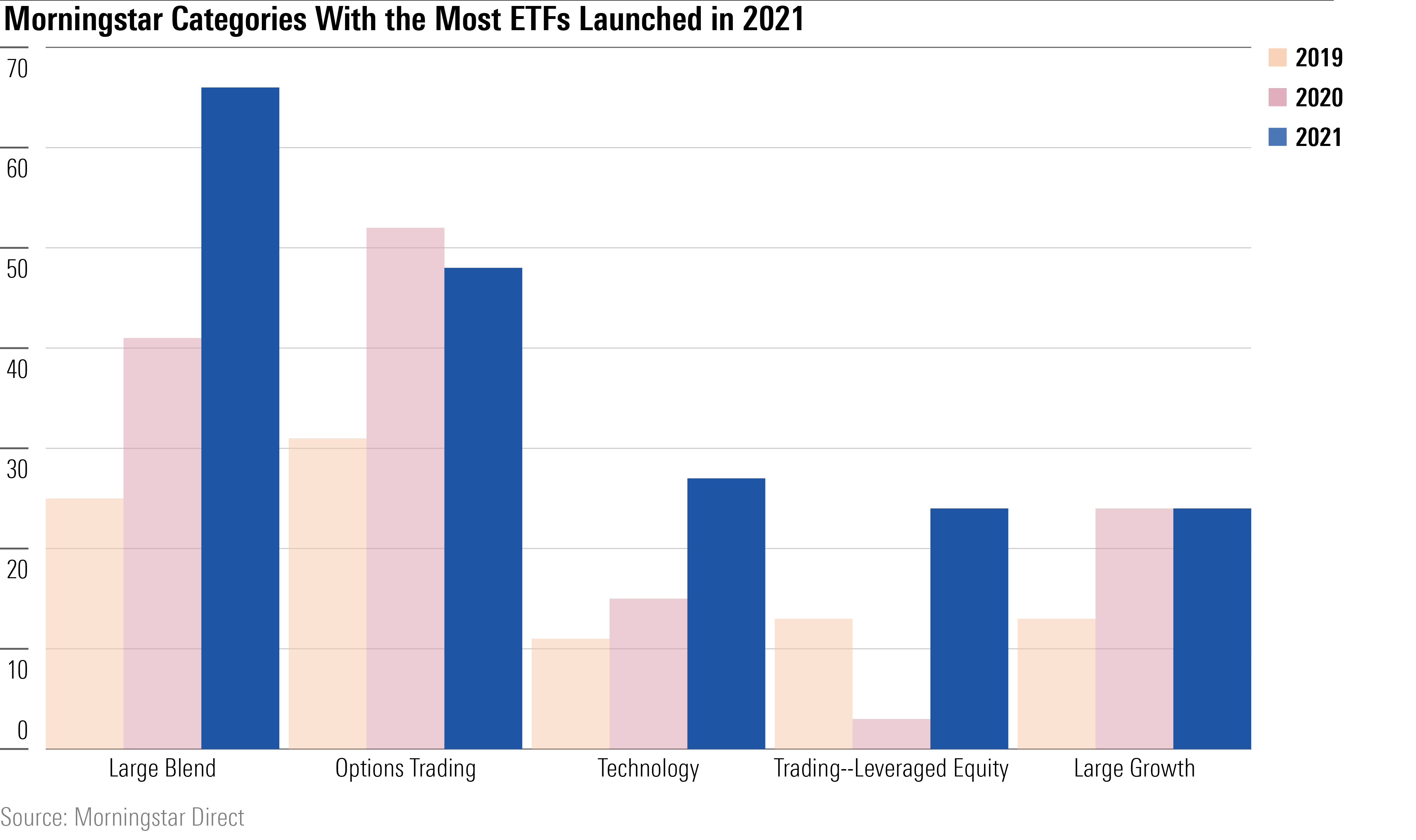

More ETFs launched in the large-blend Morningstar Category than in any other, as was the case for four of the past six years. Options trading, the category that saw the most new ETFs in 2019 and 2020, slid to second place in 2021 .

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)