The Best Active Bond ETFs for 2022 and Beyond

Fidelity and Pimco lead the way.

Choosing the right investment vehicle for your bond funds can be a daunting task, but we’re here to help. It’s 2022, and it might finally be time to add some active bond exchange-traded funds to your portfolio.

The pandemic-driven sell-off in early 2020 presented the biggest challenge yet for actively managed bond ETFs, but they held their own against--and many even beat--their mutual fund siblings. Still, as my colleague Ben Johnson has noted, significant market volatility can cause ETFs to trade at steep discounts to their net asset values, so investors should understand ETF premiums and discounts and how to best navigate them during turbulent times before investing.

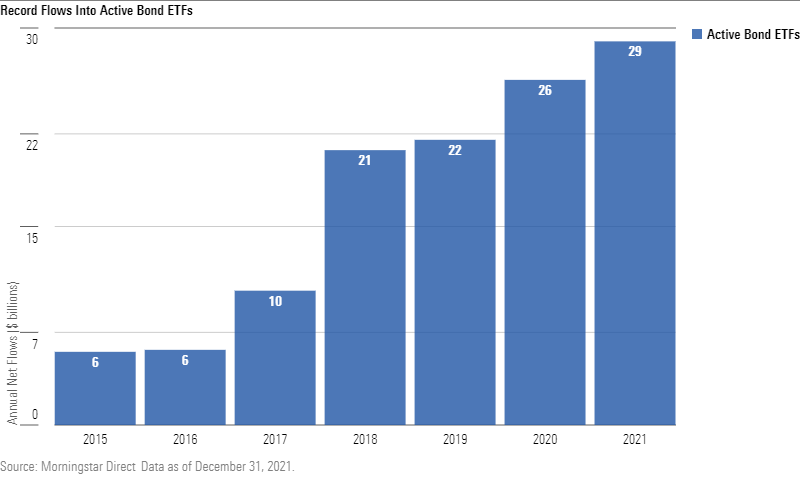

For the past several years, investors have piled into actively managed ETFs in record numbers; depending on the investor, that may make sense. Actively managed bond ETFs sport many of the same benefits over actively managed bond mutual funds that their stock-picking counterparts do. Notably, their lower fees are a big draw, especially for do-it-yourself investors who may not have access to cheaper institutional share classes.

Equity ETFs are known for their tax-efficiency, but that's not the case with active bond ETFs, even compared with their active mutual fund counterparts. Regardless, most investors are still better off keeping their taxable fixed-income exposure in a tax-advantaged account, such as an IRA or 401(k), whenever possible. Even if you successfully sidestep capital gains, the very nature of bonds and the income they generate will translate to taxable distributions if they're in a regular account. As such, any sheltering of capital gains by ETFs is likely to be of less value to many fixed-income investors.

Still, taxable bonds remain a key part of investors' portfolios for their diversification and income components. So, let's take a closer look at our Morningstar Medalists for active bond ETF strategies and highlight our top picks in 2022 and beyond.

Our Top Active Bond ETFs

The table below shows U.S. active bond ETFs with a Morningstar Analyst Rating of Bronze or better, as of January 2022, along with each one's prospectus-adjusted expense ratio. As we have shown time after time, fees are the most proven predictor of future fund returns.

This list offers a diverse pool of active bond ETF options to choose from across several categories, which can be especially helpful for investors looking to broaden their fixed-income portfolios.

Source: Morningstar.

The Standouts

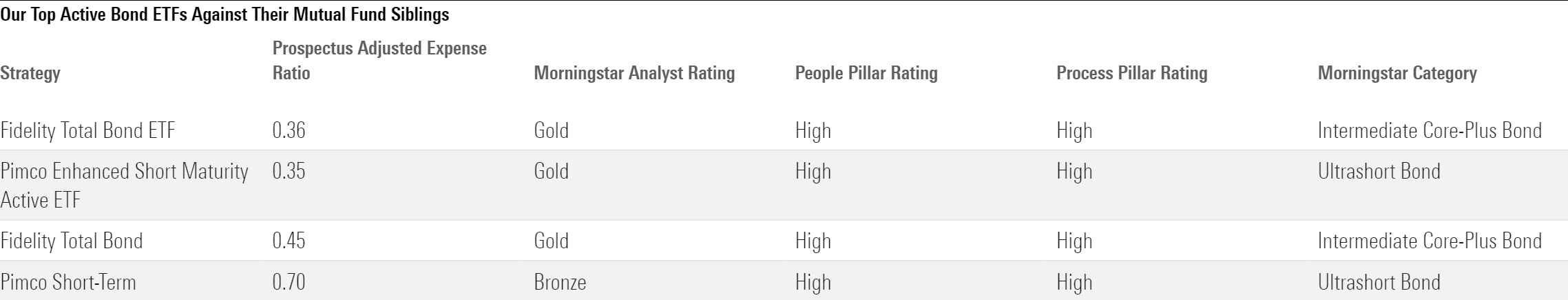

Below you'll find our highest-conviction active bond ETFs from the list, which we've awarded Analyst Ratings of Gold, along with their more expensive retail share class mutual fund siblings.

Source: Morningstar.

Fidelity Total Bond ETF FBND Fidelity launched this ETF in October 2014 hoping to imitate the success of its mutual fund sibling, Fidelity Total Bond FTBFX--and it has done just that. As seen above, the strategy's ETF and mutual fund retail shares are both rated Gold. This means we expect both vehicles' volatility-adjusted returns to beat their intermediate core-plus bond Morningstar Category as well as their category index over a full market cycle. Although they sport the same highly regarded team and process, there are a few meaningful differences in portfolio construction meant to address the liquidity needs of the ETF.

Both vehicles invest in U.S. Treasuries, investment-grade corporate credit, and agency mortgages, and the proportion allocated to each of these sectors varies depending upon the team's assessment of relative valuations across a broad universe that also includes high-yield credit, REITs, and emerging-markets debt. Additionally, both vehicles can hold up to 20% in below-investment-grade fare.

Unlike its mutual fund sibling, however, the ETF's higher liquidity standard means that it avoids securities that might clash with those needs, such as high-yield commercial mortgage-backed securities, collateralized mortgage obligations, or collateralized loan obligations.

These limits haven't damped returns much. From its inception through December 2021, FBND's 3.8% annualized return lagged the retail share class of its mutual fund sibling by roughly 10 basis points per year, mainly owing to falling behind when rates have risen, as they did in the first quarter of 2021. Much of that can be traced to the strategy’s comparatively lighter exposure to bank loans and CLOs, which have little sensitivity to interest rates. That said, the ETF has held up slightly better in credit and liquidity sell-offs, such as the pandemic-driven one in early 2020, given its general avoidance of bank loans and CLOs, which tend to be more vulnerable in dicey markets.

Regardless of these differences, Fidelity's commitment to ensuring there is ample liquidity in the ETF gives us confidence that it will continue to beat its peers and bogy over the long term, alongside its mutual fund sibling.

Pimco Enhanced Short Maturity Active ETF MINT Pimco launched this ETF in November 2009, intending to replicate the success of its mutual fund sibling, Pimco Short-Term PSHAX, which launched in January 1997. As noted in the table above, the ETF sports a Gold rating while the retail share class of its mutual fund sibling receives a Bronze. Although we expect both vehicles to beat the ultrashort bond category and the category index, we have a higher conviction in the ETF given its much cheaper fees. As with Fidelity's offerings, while these two sport the same highly regarded team, their goals and approaches are slightly different, and there are a few meaningful deviations in portfolio construction.

Similar to its open-end sibling, the ETF's aims are modest: Provide slightly better-than-cash returns while preserving capital. Manager Jerome Schneider and his team use Pimco's vast resources to identify mispricings at the short end of the yield curve, combining macroeconomic forecasting and bottom-up analysis to make interest-rate, yield-curve, sector, and issue-level decisions. The team has the expertise and resources to employ a wider range of sectors than many of its ultrashort bond category competitors.

Schneider follows a more constrained process here, though, which means taking on a bit less risk. The ETF doesn't use derivatives (which means Schneider won't take its duration much shorter than 0.3 years), avoids currency risk and high-yield corporate debt, and typically caps exposure to emerging-markets debt at 5.0%. By contrast, Pimco Short Term has had as much as 11.9% in emerging-markets debt in the past (March 2017).

MINT’s limits haven’t hampered absolute returns much, though, and have actually led to better volatility-adjusted returns. From the ETF’s inception through December 2021, its 1.4% return slightly lagged Pimco Short-Term, but its volatility-adjusted returns (as measured by Sharpe ratio) were much better. The ETF’s slightly more conservative approach has added the most value during liquidity crunches, such as the early 2020 sell-off. From Feb. 20 through March 23 that year, the ETF’s 3.2% loss was less severe than its mutual fund sibling’s 3.7% loss given its lighter exposure to less-liquid securities.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c6bd816b-3f1a-49af-ae14-2efdb6122500.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c6bd816b-3f1a-49af-ae14-2efdb6122500.jpg)