Fed: Get Ready for Rate Liftoff

With inflation high, there's nothing holding the Fed back from multiple rate increases starting in March.

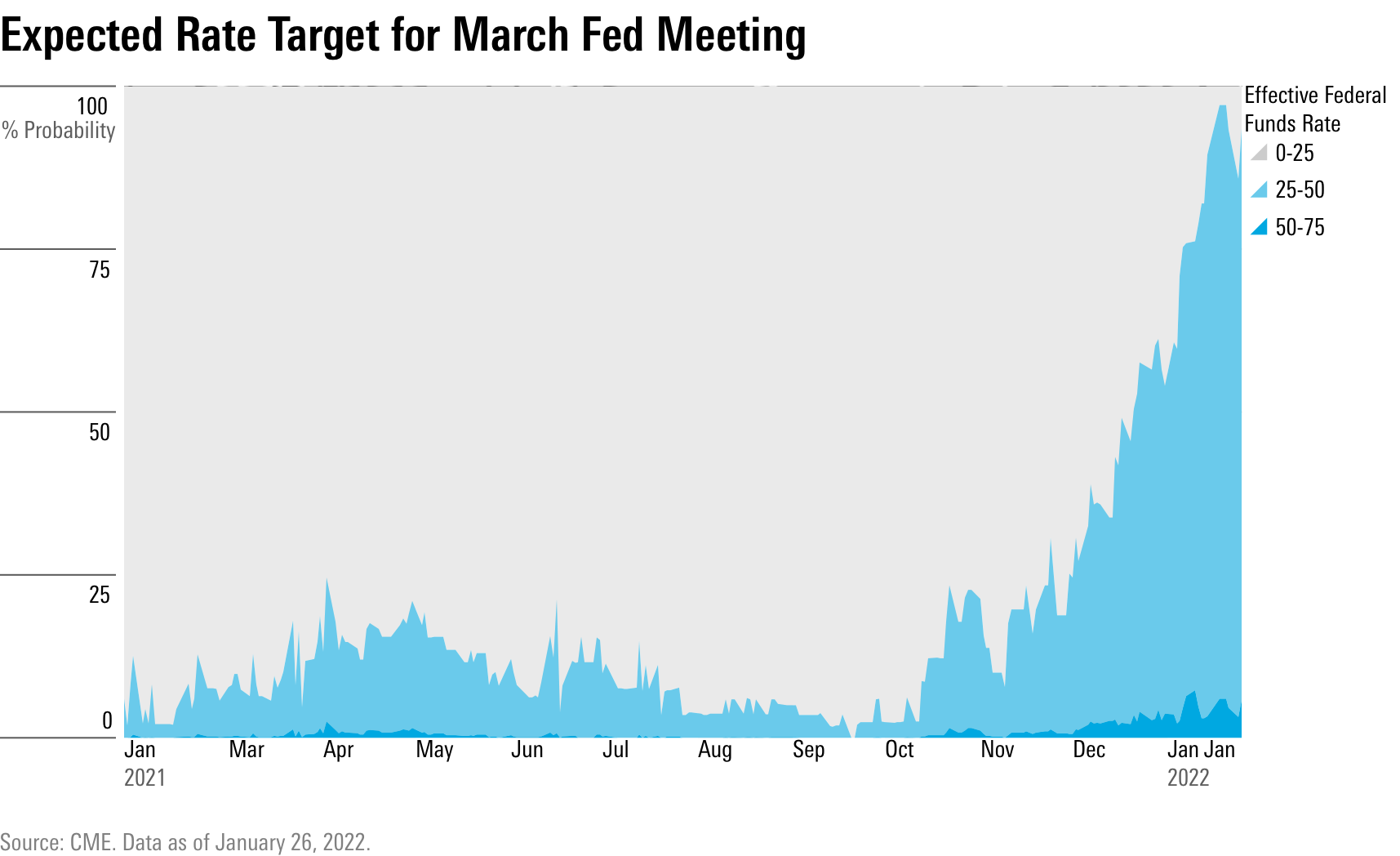

Federal Reserve officials continued to lay the groundwork for a series of interest-rate increases in 2022, letting investors know that the first step would be on its way as soon as March.

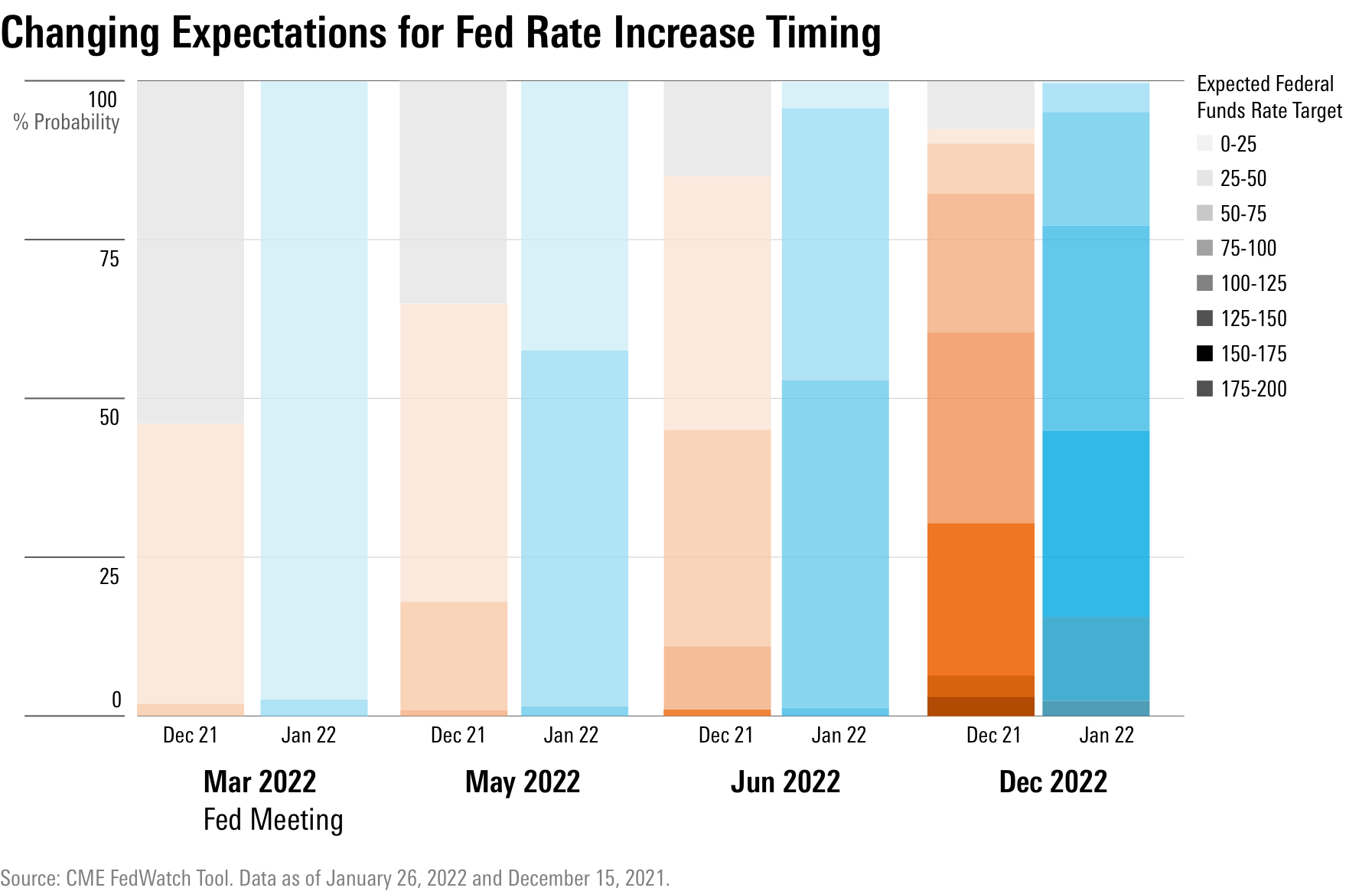

While the results of the meeting were largely as expected, they give investors a somewhat clearer road map of where the Fed plans to take monetary policy as long as the outlook for inflation and the economy doesn't offer up any surprises in coming months.

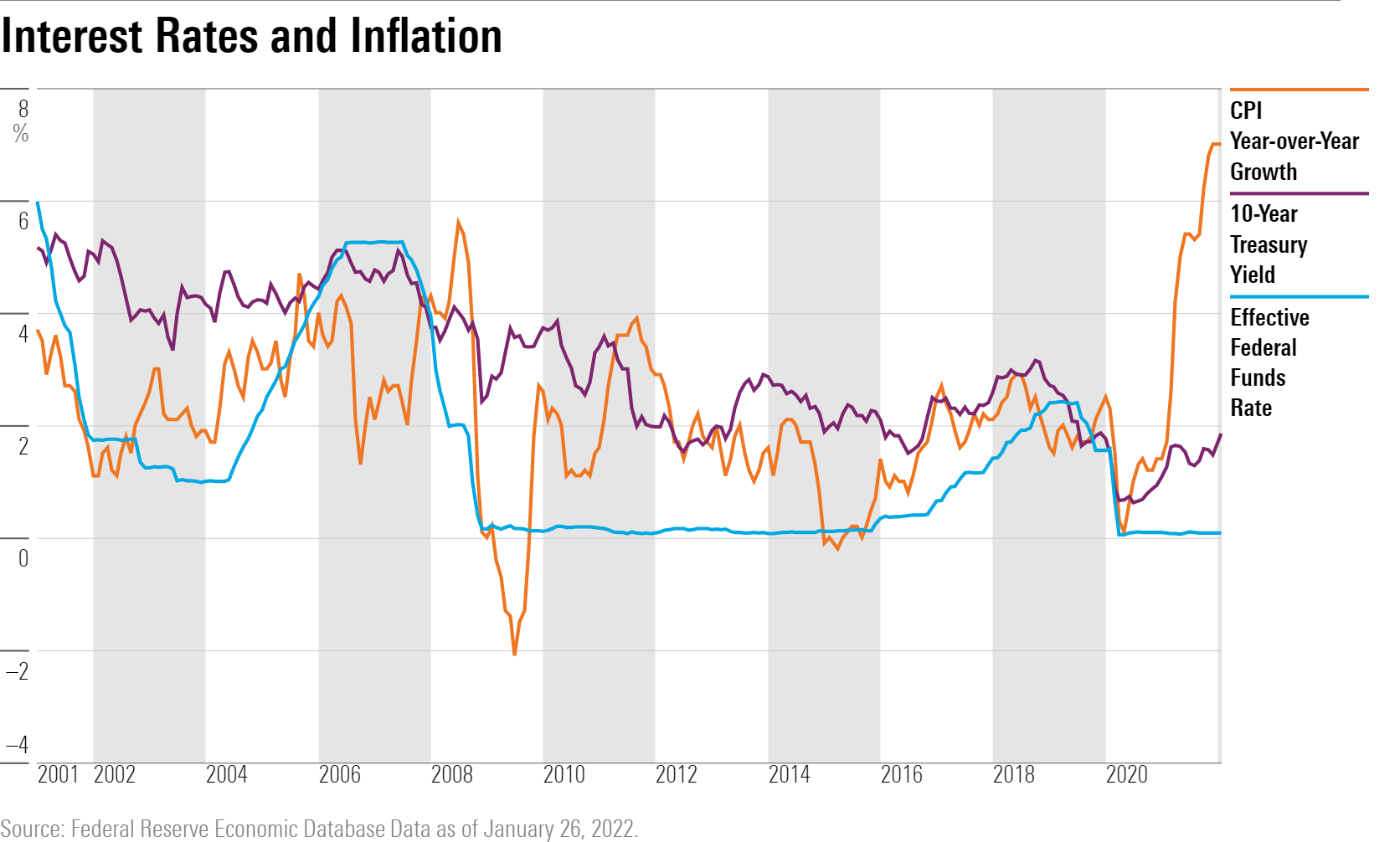

This bit of added clarity comes as stock and bond markets have been wrestling with changing expectations for where the Fed will take interest rates in response to the strong rise in inflation in recent months. Expectations for a more aggressive Fed have sent bond yields higher and stock prices lower, with this past week seeing particularly wild swings in the equities market.

In its first meeting of 2022, the Federal Open Market Committee held the federal-funds rate at 0.0%-0.25%, and nobody expected a change in rates at this meeting. However, there was a high expectation for the committee to hint that rates will begin rising at the March meeting, and here the committee delivered. There was also a focus on further details regarding how the Fed will navigate reducing its balance sheet once its asset purchases wind down in early March. Here, the Fed released some "principles" for how they will approach the issue, but no concrete details on the amount of or specific timing for balance sheet reductions.

The committee added that "it will soon be appropriate to raise the target range for the federal-funds rate," clearly signaling that the next meeting in March is the likely start date.

After pivoting in a rather dramatic fashion at the Federal Open Market Committee's previous meeting in a more hawkish direction, there was plenty of buildup to the latest meeting. As a result, today’s release did not contain any real surprises. In its release, the committee flatly acknowledged that inflation is "well above 2%" and that the labor market is "strong." In other words, there's nothing holding the committee back from a series of rate hikes at this point.

The debate now centers around just how many hikes will occur in 2022. Will it be three, or four, or even more? For now, given that we already have three rate hikes penciled in for 2022 and another three in 2023, we don't plan to materially change our forecast. However, we acknowledge that the risks seem to be to the upside here (that is, for more rate hikes than this). Interest-rate markets, for example, are currently pricing in four increases for this year.

In the meantime, we expect yields will move higher as rate hikes occur and the Fed's balance sheet shrinks.

As this plays out, the Fed will have to walk a delicate tightrope of removing accommodative monetary support as economic growth begins to slow, although a willingness to fight inflation is a welcome change and the consumer is still in a great position with excess savings. Watch for more discussion and debate about how the economy is handling higher rates as the current series of rate hikes plays out. For now, we think the economy can handle it, but we expect the debate to become more heated in the second half of 2023 as we likely start to reach a federal-funds rate of close to 2%.

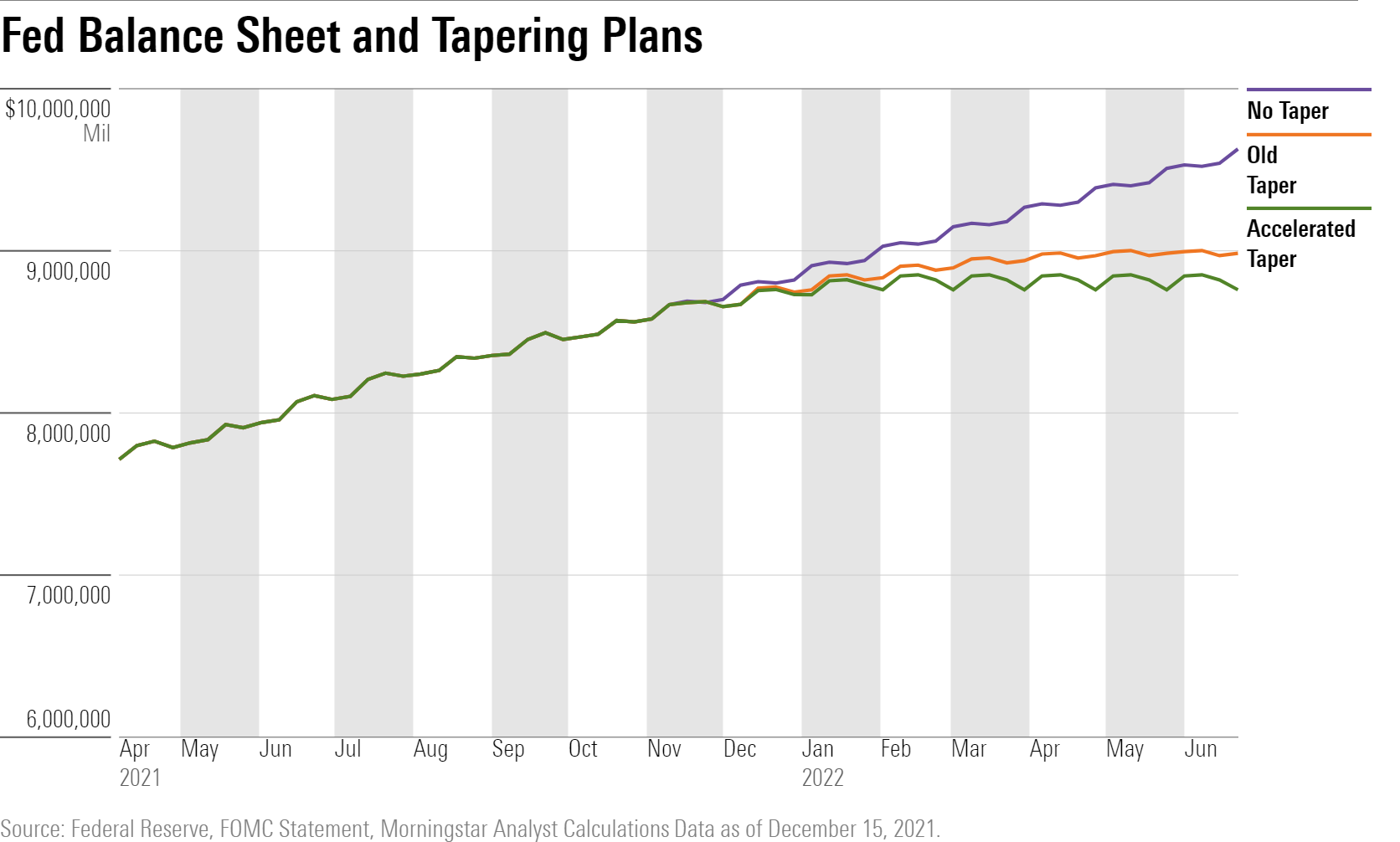

The other major focus of this week's meeting was when the Fed would start reversing the bond-buying program--known as quantitative easing--that it used to pump money into the economy during the pandemic. In December, the Fed announced that it would be tapering off the pace at which it has been doing that buying. The next question was when the Fed would begin to outright reduce the amount of bonds it holds on its balance sheet, known as quantitative tightening. (Our explainer on how the Fed operates can be found here.)

The Fed's didn't offer specific details on when that would start, however the committee did release a set of "principles" that it intends to follow. The committee intends to begin reducing the size of the balance sheet "after the process of increasing the target range for the federal-funds rate has begun," so we would expect specific details to emerge at the March meeting.

The committee seems likely to use an approach similar to what it did in 2015, setting a fixed runoff amount, allowing the balance sheet to gradually shrink in a relatively consistent manner. At a total size of nearly $9 trillion compared with closer to $4 trillion at the start of the pandemic, there seems to be plenty of room for runoff. Remember that the last time the Fed had to reverse its runoff when pressure emerged in short-term funding markets, which was attributed to a decline in bank reserves. Bank reserves now stand at above $4 trillion compared with below $2 trillion at the start of the pandemic, again implying ample room for runoff.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)