6 New Undervalued Wide Moat Stocks

Disney, Microsoft in high-quality bargain bin thanks to the market sell-off.

The sell-off in equities that pushed the market briefly into a correction on Monday has sent a number of previously expensive stocks into undervalued territory.

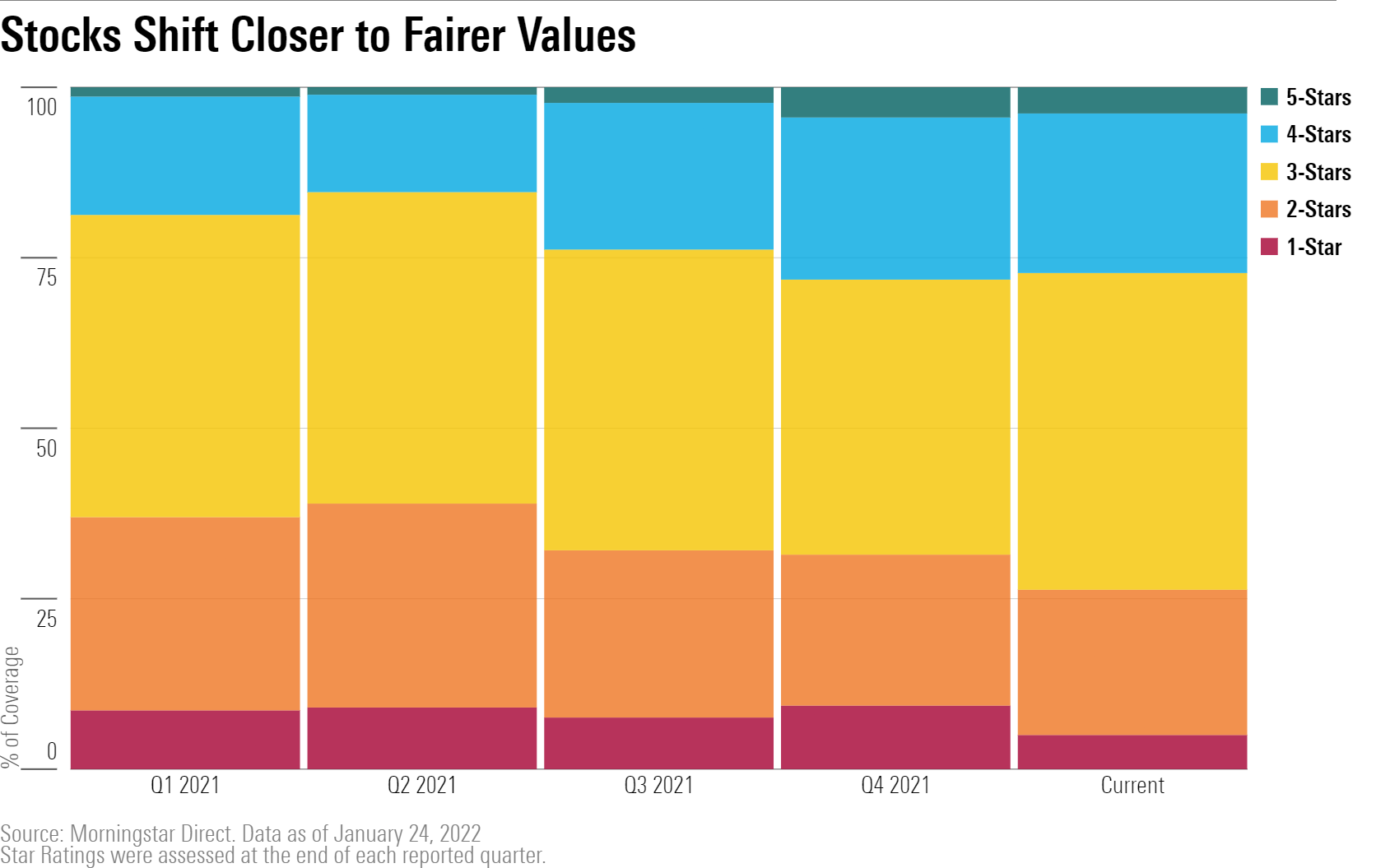

The market's slide has pushed prices for several companies closer to ranges that Morningstar analysts see as fair. Of the 859 stocks covered by Morningstar analysts, 399 now trade in the fairly valued 3-star territory, compared with 346 at the end of the last quarter. At the same time, the number of overvalued 1-star stocks has been cut nearly by half to 43 from 80.

The number of undervalued 5- and 4-star stocks dwindled slightly this month. That’s not to say there aren’t any new undervalued stocks. Through January, 242 stocks--nearly one third of the U.S.-listed companies Morningstar covers--had a change in star rating as many companies saw their valuations turn.

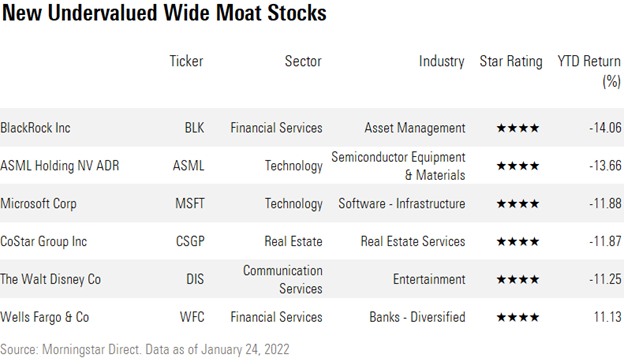

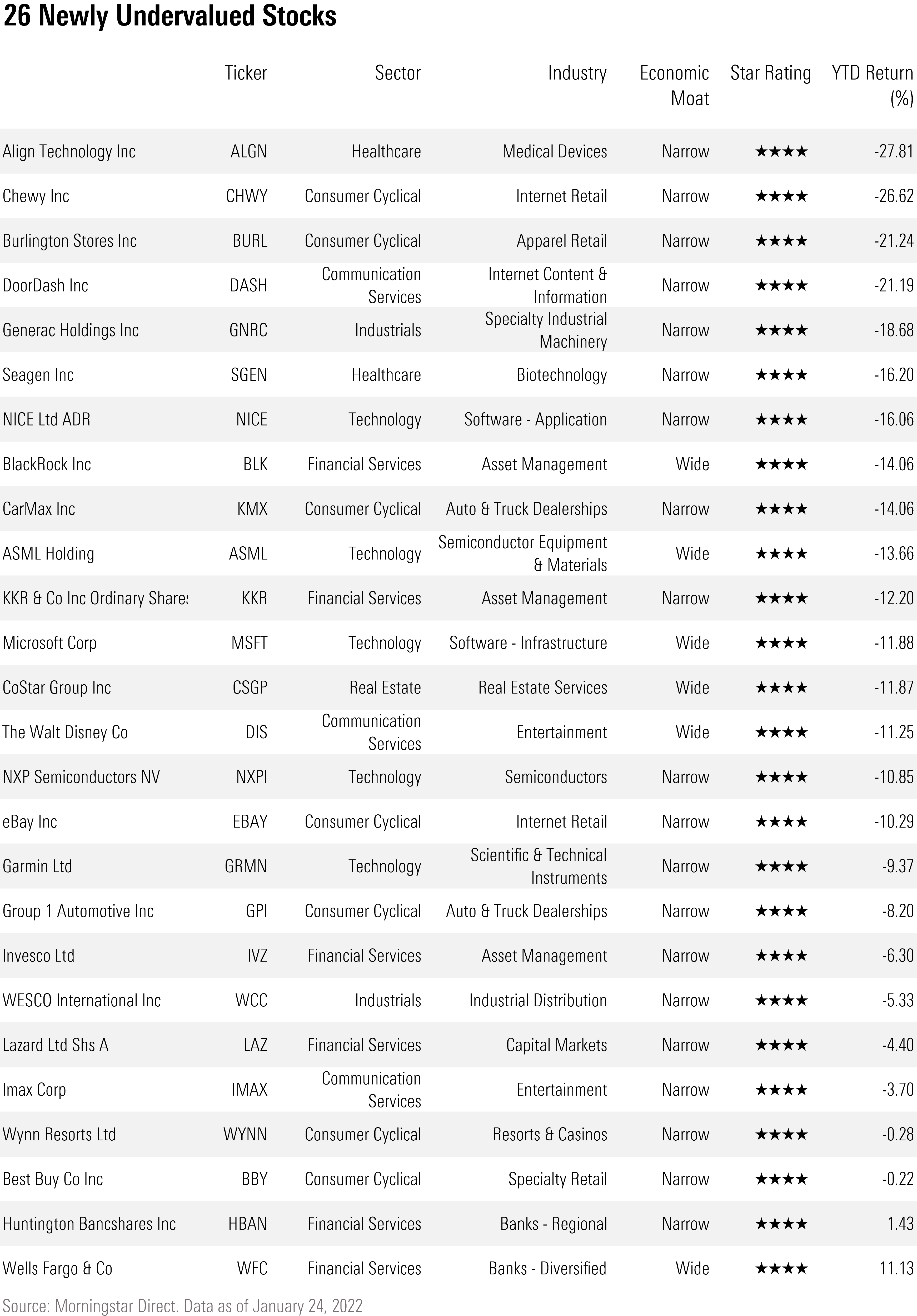

To highlight the newly attractive names, we screened for changes in the Morningstar Star Rating in our coverage list between January 17 and January 24. We added a Morningstar Economic Moat filter to screen for those with competitive advantages, and found that 26 stocks made the cut with either a narrow or wide moat. We highlighted the six stocks with wide moats below, along with all 26 stocks at the end of the article.

Microsoft MSFT recently listed itself among many other newly undervalued tech stocks, which we covered earlier this week. Here’s the story on the other five picks.

BlackRock BLK

The world’s largest asset manager, with $10 trillion in assets under management, slid 14.1% this month. However, after a 5.5% raise to its fair value estimate, the company now trades at an 18% discount.

“Unlike many of its competitors, the firm is currently generating solid organic growth with its operations with its iShares platform, the leading domestic and global provider of ETFs,” Morningstar analyst Gregory Warren says. What gives BlackRock an edge is its scale, ability to service both passive and active products, reasonable fees, strong brands, and their strong focus on institutional investors.

ASML Holding ASML

ASML is a leading provider of the photolithography equipment used by major semiconductor manufacturers, such as Intel INTC, Samsung SSNGY, and TSMC TSM. Shares slid 13.7% year-to-date and now trade at a 20% discount to fair value.

Analyst Abhinav Davuluri recently raised his fair value estimate to $800 from $715 after the company reported solid fourth-quarter results. "While we anticipate strong EUV growth thanks to robust demand from TSMC and Intel, non-EUV system revenue is also expected to grow over 20% due to broad-based demand from lagging-edge technologies and memory in addition to leading-edge logic and foundry customers," Davuluri says. Management also announced a 20% revenue growth target for 2022, which is ahead of Davuluri's expectations.

CoStar Group CSGP

CoStar, a subscription-based provider of real estate property and marketplace listing data, now trades at a 20% discount to its fair value after its shares fell 11.9% year-to-date. The company has four business units: CoStar Suite, Commercial Property and Land, Multifamily, and Information services.

The CoStar Suite is the largest business line, making up 37% of revenue in the first three quarters of 2021. Multifamily is the second-largest and fastest-growing unit, according to analyst Kevin Brown. The company has made several acquisitions to support its network of listing data, such as LoopNet in 2012 and Apartments.com in 2014. “Over the past several years, the company has continued to achieve impressive revenue and profitability growth,’’ Brown says. "We think it is poised to continue this growth trajectory by taking share in the apartment search industry and upselling current LoopNet users to its CoStar Suite platform.”

The Walt Disney Co DIS

Recent losses slashed the media group’s coronavirus pandemic recovery gains, leaving share prices trading at November 2020 levels. Disney has slid 11.3% since the start of the year but shares recently dipped back into a price range that Morningstar analyst Neil Macker sees as cheap. Currently, Disney trades at 19% discount to its fair value.

“Disney is successfully transforming its business to deal with the ongoing evolution of the media industry,” Macker says. “The firm’s direct-to-consumer efforts, Disney+, Hotstar, Hulu, and ESPN+ are taking over as the drivers of long-term growth as the firm transitions to a streaming future.”

Disney’s streaming business is set to benefit from a variety of new content being produced by their growing catalogue of studios such as Fox, Pixar, Marvel, Lucasfilm, and Disney Animation. According to Macker, Disney now owns 12 of the top 20 best films by worldwide box office grosses. “Each new franchise deepens the Disney library, which should continue to generate value over the years,” Macker says.

Wells Fargo WFC

While many stocks fell from the beginning of the year, Wells Fargo was an exception, rising 11.1% year-to-date. Analyst Eric Compton increased Wells Fargo’s fair value estimate to $62 from $55. Driving that change are expected interest-rate hikes later this year.

Compton views WFC as one of the most interest-rate sensitive companies his team covers. “The interest-rate hikes should help to offset some of the growth pressure from being unable to grow its balance sheet,” he says. The company currently trades at a 14% discount to fair value.

“Wells Fargo remains one of the top deposit gatherers in the U.S., with the third most deposits in the country behind JPMorgan Chase and Bank of America,’’ Compton say “Wells Fargo has one of the largest branch footprints in the U.S., excels in the middle-market commercial space, and has a large advisory network. We believe this scale and the bank's existing mix of franchises should provide the right foundation to eventually build out a decently performing bank.”

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)