Buy the Unloved: 2022 Edition

Big 2021 outflows may signal decent returns in the future for the large-growth, mid-growth, and world large-stock value Morningstar Categories.

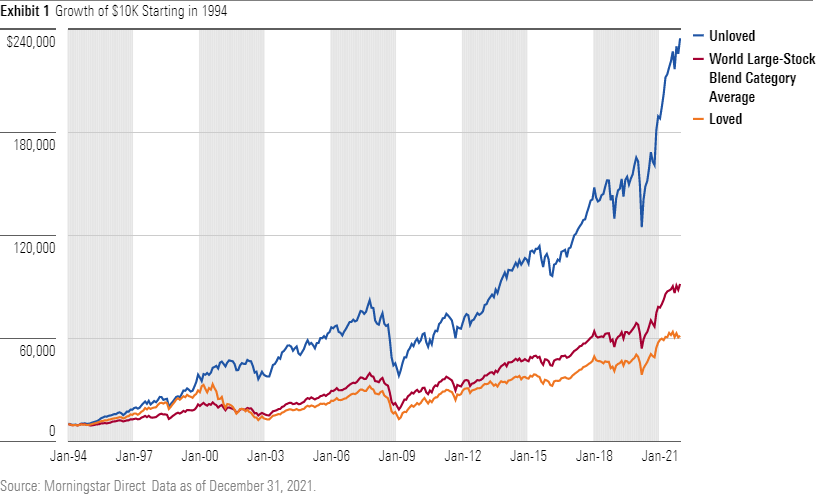

Last year, stocks continued their rebound from March 2020's pandemic-induced crash. Fund investors also bought more equities--mostly through exchange-traded funds--but not all Morningstar Categories saw inflows. There's useful information in that fact for those willing to go against the grain. Since 1994, Morningstar has counseled investors at the start of each year to look to the most shunned fund groups for contrarian investment ideas as part of its ongoing Buy the Unloved study. Shopping among out-of-favor Morningstar Categories has been a decent approach because groups seeing outflows are also often out-of-favor areas that are poised for resurgence.

There are two versions: The original that dates to 1994 (version 1) and a slightly tweaked, two-year old iteration (version 2).

Version 1 considers the long-only categories with the most absolute outflows to be the most out of favor. It excludes categories in which flows are less useful indicators, such as target-date, trading, and leveraged funds. The original buy-the-unloved approach recommends investing equal sums in the three categories that saw the most dollars leave in the previous year, holding them for at least three years and then repeating the process. It has been rewarding.

Two years ago, we added a version that considers more categories and their percentage change of flows in addition to absolute dollars to select the unloved groups. Version 2 includes bond and allocation categories and equally weights dollar flows and the percentage change in assets to determine the loved and unloved. We measure the performance of version 2 against a custom 60/40 stock/bond benchmark that comprises the MSCI All-Country World and Bloomberg U.S. Universal indexes. In early 2021, when Morningstar divided its old world large-stock category by style, we also started comparing version 2 with the world large-stock blend category average. Since version 2 launched in January 2019 through 2021, the unloved group's 14.4% annualized gain topped the loved categories' 12.6%, but both groups trailed the world large-stock blend category average.

What are this year's unloved and loved categories? Based on open-end and exchange-traded fund net flows through December 2021, version 1's unloved categories were large growth, mid-growth, and world large-stock value; the loved were large blend, foreign large blend, and large value. Here are some ideas from the unloved categories.

Large Growth

As an out-of-favor fund in one of the categories with the most outflows, Primecap Odyssey Growth POGRX is doubly unloved, but still a gem. Its trailing five-year results as of year-end lagged more than 90% of its large-growth peers and relevant benchmarks, and it has seen more than $7.5 billion in outflows in the past three years. The fund, however, retains a Morningstar Analyst Rating of Gold for the patient, contrarian, benchmark-agnostic approach of its five skilled and seasoned managers. They seek stocks with above-average but unappreciated or temporarily interrupted growth potential for the independent portfolio sleeves they run. Stock-picking drives portfolio construction, so it often lets assets pile up in certain sectors, such as healthcare. You must be as patient as this fund's managers, who keep turnover in the single digits, to benefit. Below-average fees make the wait easier, though.

Mid-Growth

Investors have a rare shot at one of the mid-cap growth category's best. T. Rowe Price Mid-Cap Growth RPMGX reopened to new investors in December 2021 after being closed since May 2010. Veteran manager Brian Berghuis has led the Gold-rated fund since its 1992 launch and has proved to be a great stock-picker. He looks for mid-caps with strong business models and good management teams at decent valuations. This has historically held the fund back in frothier markets, like 1999 and 2020, but Berghuis has delivered over the long term. He hasn't hinted at retirement, but T. Rowe Price seems to be lining up potential successors by recently adding associate managers. Still, the firm has managed successions well in the past, and this fund also charges low relative fees.

World Large-Stock Value

Dodge & Cox Global Stock DODWX is an exemplary choice. A seven-member global equity committee runs the Gold-rated fund at a measured pace. Like T. Rowe Price, Dodge & Cox is as deliberate about managing people as it is with investments. Turnover on the firm's large and talented staff is low, and it telegraphs transitions well-ahead of time. This fund, which joined the world large-stock value category in April 2021, also has stayed true to the firm's contrarian approach. It has a competitive long-term record against other global value strategies, as well as peers in its former world large-stock category. Modest fees give it another advantage.

Version 2

The most unloved categories according to version 2 were world large-stock value, Latin America stock, and energy. The most loved were bank loan, financial, and natural resources. We touched on world large-stock value above; below are some options for version 2's other two unloved categories.

Latin America Stock

Silver-rated T. Rowe Price Latin America PRLAX is the lone Morningstar Medalist in this thin group. Verena Wachnitz, who boasts the category's longest track record, runs this fund with the support of a five-person Latin America-focused team and scores of other international-equity analysts and portfolio managers. Wachnitz plies a growth-oriented approach but keeps risk in check by avoiding extreme country and sector overweights and keeping an eye on macroeconomic factors. This has led to better total and risk-adjusted returns than the fund's small peer group and the MSCI Emerging Markets Latin America Index over her tenure. Still, expect volatility given the concentrated stock universe, which largely consists of Brazilian and Mexican equities.

Energy

Investors may have sold energy funds in 2021, but the stocks rebounded with a vengeance. Silver-rated Vanguard Energy VGENX, the only medalist within the category, is worth considering in this volatile group. Current manager Tom Levering, one of several Wellington Management stock-pickers to take a turn at this fund, has broad experience in this sector and with utilities stocks, which is one of the reasons the fund switched its benchmark in 2020 from the MSCI ACWI Energy Index to the MSCI ACWI Energy + Utilities Index, a custom bogy. The idea was to position the fund to capitalize on the global economy's evolution away from fossil fuels and toward renewables by investing more in electric and other utilities. That makes this fund a less traditional energy offering, but also a less variable one.

Conclusion

Buy the Unloved isn't a core strategy; use it on the margins of a diversified portfolio. It can be a disciplined and longer-term way to help scratch your tactical itch, though.

/s3.amazonaws.com/arc-authors/morningstar/19600385-fb06-404d-9876-a1d5f7cdae8a.jpg)

/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/19600385-fb06-404d-9876-a1d5f7cdae8a.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)