27 Stocks and Fund Picks Based on 2022 Experts' Forecasts

Experts think international stocks are attractive. Here are some of Morningstar's best ideas for non-U.S. equity exposure.

There are a few things in life you can depend on. Unsolicited advice from your parents, for instance. Or being one sock short after washing a load of laundry.

And you can also rely on my colleague Christine Benz sharing the long-term stock and bond return forecasts of several highly respected investment firms--including BlackRock, JPMorgan, and Vanguard--each January.

Why does she engage in this annual ritual?

“Return expectations can be useful--and are arguably even mission-critical--when setting up your financial plan,” she explains. “After all, you need to plug in some type of long-term return assumption when deciding whether your savings rate and time horizon are appropriate given what you’d like to achieve. And if you’re retired, being realistic about return expectations is also essential when determining a sustainable withdrawal rate.”

What are the pros expecting from the markets in the next several years? Most firms expect much lower returns from U.S. equities than we’ve experienced during the past decade. With the Federal Reserve indicating that rate hikes are a go in 2022, the experts expect better--but still not spectacular--returns from bonds than they have in a while. The bright spot, say the pros, is international stocks. In fact, each of the firms surveyed is forecasting better returns for foreign stocks than for their U.S. counterparts.

Dig deeper: Experts Forecast Stock and Bond Returns: 2022 Edition

With that in mind, today we’re taking a look at some highly rated stocks and funds to consider if you’d like to increase your exposure to international equities.

Undervalued Stocks

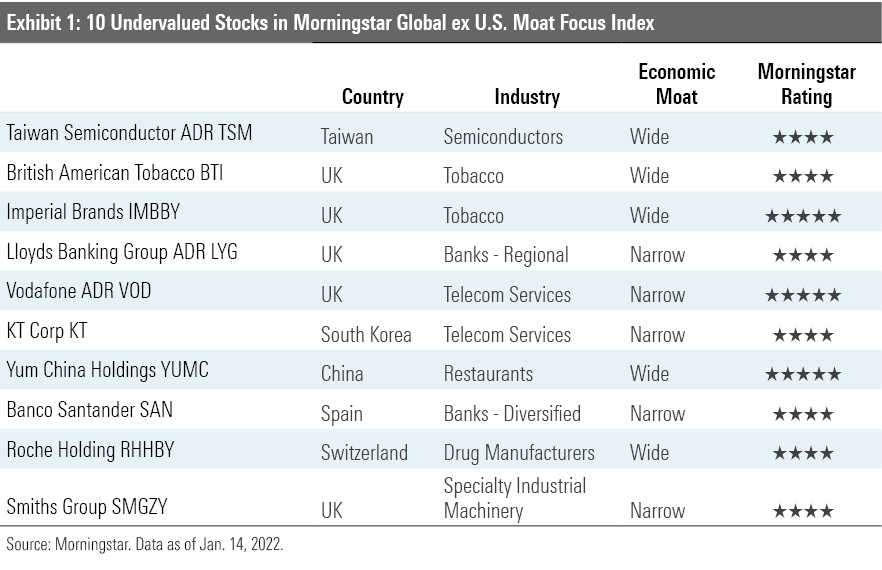

For those comfortable investing in individual stocks, Morningstar's approach to smart stock investing applies around the globe. First, favor companies with durable competitive advantages, or economic moats. These companies should be able to fend off competition and outearn their costs of capital for years to come. Then, buy these companies when they're trading below what they're worth--in our parlance, below our fair value estimates.

We've turned to the Morningstar Global ex U.S. Moat Focus Index to find undervalued foreign stocks today. This quality-focused index is a subset of the Morningstar Global Markets ex U.S. Index, a broad index representing 97% of the developed-markets (ex United States) and emerging-markets market capitalization. Morningstar ranks the wide- and narrow-moat stocks in the broad index by lowest price/fair value to find the 50 cheapest wide- and narrow-moat stocks. These stocks represent the most compelling values among the global moat universe, according to Morningstar analysts.

Here are 10 undervalued stocks that are among the index’s most heavily weighted constituents as of this writing.

Highly Rated Funds

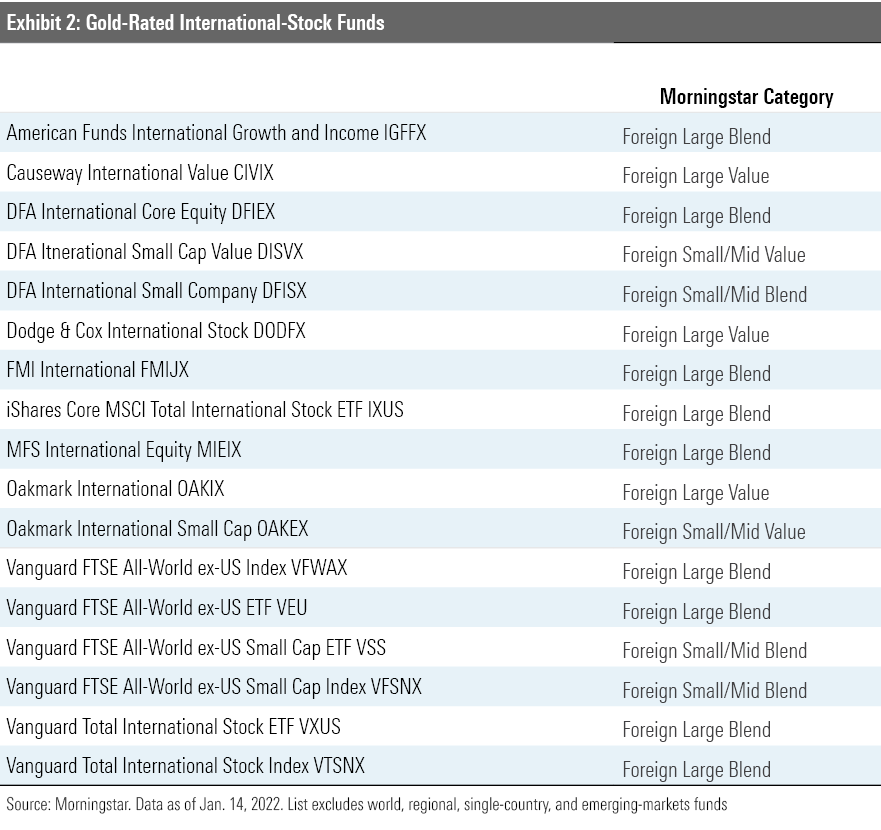

For investors who would rather not pick individual stocks, plenty of mutual funds and exchange-traded funds provide broad-based exposure to non-U.S. names. You can turn to our shortlist of the best international-stock mutual funds and ETFs--those funds with at least one share class earning a Morningstar Analyst Rating of Gold--for ideas to investigate further.

Clearly there is a range of different international Morningstar Categories represented among our Gold-rated list, along with passive and active options.

Foreign large-cap funds tend to focus on Europe, specifically, established markets in France, Germany, Switzerland, the Netherlands, Spain, Italy, and the United Kingdom. They often hold significant positions in Asia, as well. And although they dabble in emerging-markets stocks, they often cap their exposure to those markets at about 15% of assets. Foreign small/mid-cap funds often carry larger emerging-markets positions.

These figures are only averages, though; actual fund breakdowns differ. Knowing how a fund's market exposure diverges from the average allows for better performance expectations--and better investor outcomes. For instance, emerging-markets stocks tend to be more volatile than developed-markets stocks. As a result, stock funds with higher emerging-markets stakes will exhibit performance very different from their peers' when emerging markets soar or sink.

Low-cost index funds are well-represented on the list. Passive international-stock funds have posted competitive returns against their actively managed counterparts, thanks in large part to rock-bottom expenses and modest trading costs. They also tend to be more tax-efficient than active funds, and there's no star-manager flight risk.

That said, there are good reasons to go active in non-U.S. markets. As portfolio strategist Amy Arnott notes, studies have shown that active managers in our foreign large-blend and foreign large-value categories have a tougher time adding value than active managers plying smaller-company and growth strategies.

Regardless of whether an investor goes active or passive, there are dedicated large-cap funds, focused small-cap funds, and wide-ranging all-cap funds practicing different growth and value strategies. Understanding a fund's Morningstar Style Box placement and its strategy allows investors to find funds that match their risk profiles and set performance expectations.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)