Which U.S. Equity Funds Outperformed Their Benchmark the Most?

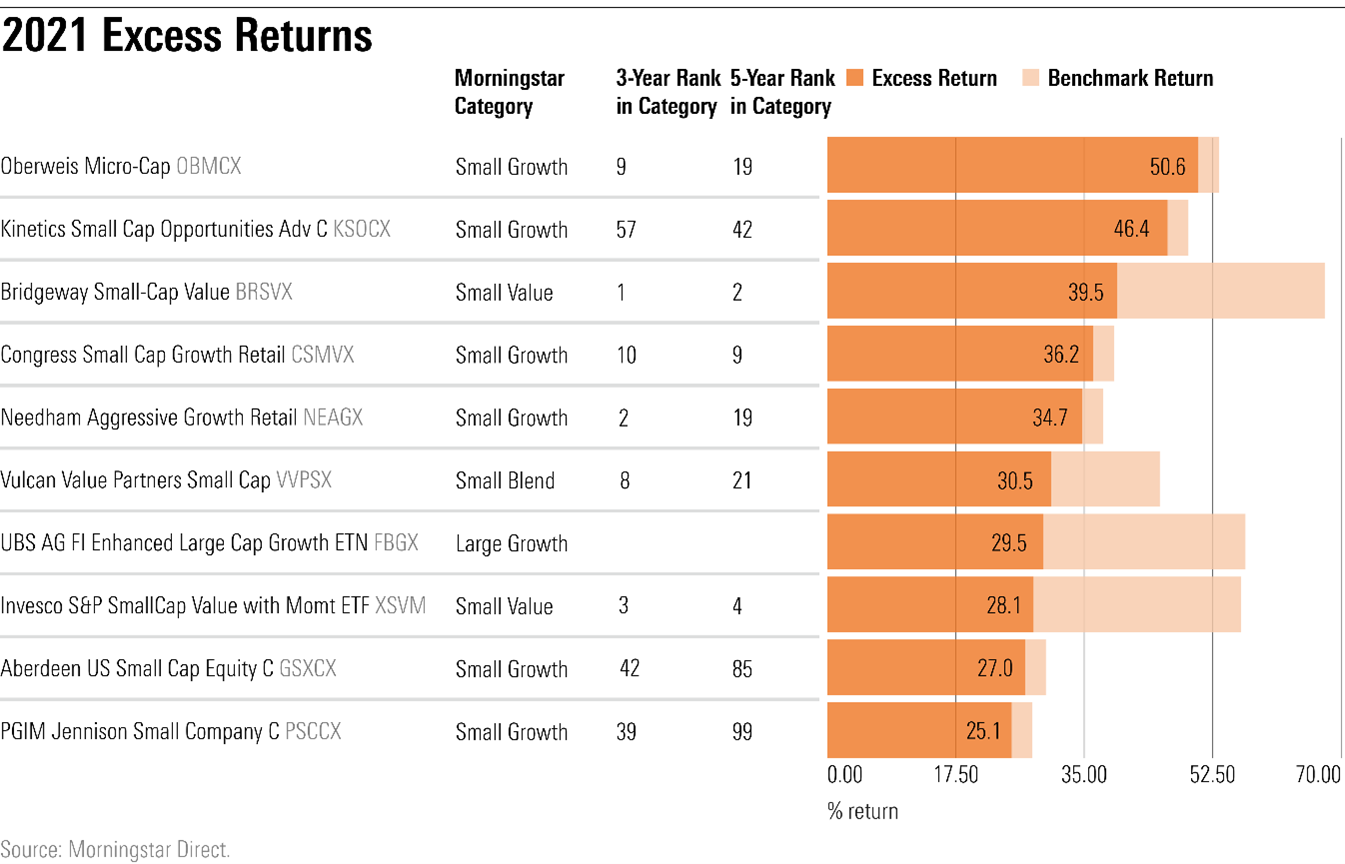

The small-cap growth benchmark gained only 2.8% in 2021, and six funds managed to best it by more than 25 percentage points.

Morningstar Style Box performance was mixed in 2021--small-value funds gained nearly 31.7% on average while small-growth funds advanced only 11.1%--but managers in in every area found ways to outperform.

We screened for all U.S. equity funds incepted prior to 2021 with over $100 million in assets and looked at their 2021 excess returns against their Morningstar Category index to determine which managers performed best.

The small-cap growth benchmark gained only 2.8% in 2021, and six funds managed to best it by more than 25 percentage points. Oberweis Micro-cap Opportunities OBMCX gained 47.2%, the most of any fund in the category, and the highest excess return of any fund. The fund’s 22.2% five-year return is well ahead of the category index’s 14.4% return.

A large stake in energy companies propelled Kinetics Small Cap Opportunities KSOCX, which came in second in the small-growth category. As of Sept. 30, nearly 56% of the portfolio was invested in energy sector stocks, one of 2021's top performing sectors. The fund gained only 1.5% in 2020, though, significantly underperforming the benchmark. It ranks in the 42nd percentile in the small-cap growth category over the past five years.

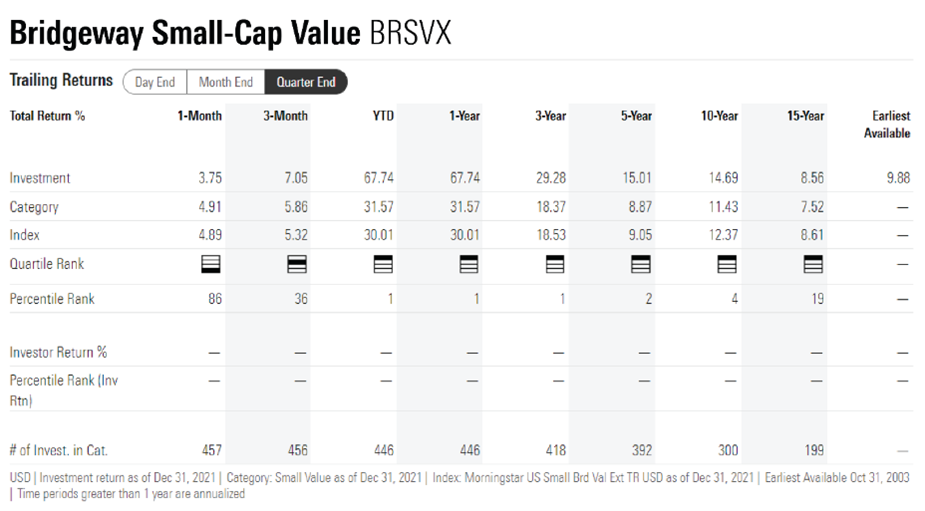

Although it comes in third on excess return, Bridgeway Small-cap Value BRSVX is in the lead on absolute terms: Its 67.7% return puts it first among all U.S. equity funds. The deep-value fund started 2021 with an overweight in some energy names that took off this year, including SM Energy SM and CONSOL Energy CEIX. The 5-star fund also boasts a strong long-term track record: It ranks in the top 5% of small-value funds over the past three-, five-, and 10-year periods.

Invesco S&P SmallCap Value with Momentum ETF XSVM is another small-value fund that came out ahead in 2021 and carries a strong long-term track record. Alex Bryan wrote in 2020 that the fund screens for value before momentum, so stocks won't make the cut unless they have strong value characteristics, and it weights it holdings by their value score, which deepens the value tilt. The strategy worked well in 2021; the fund gained 56.4%, 26 percentage points above the category index.

In the small-blend category, Vulcan Value Partners Small Cap VVPSX came out on top. The fund gained 45.3%, well above the benchmark’s 16.5% return. The fund is more concentrated than most with only 27 holdings, and it held 20% of its portfolio in real estate stocks--which outperformed all other sectors in 2021--compared with the small-blend category average of 7% as of Sept. 30, 2021.

In the large-growth category, UBS AG FI Enhanced Large Cap Growth ETN FBGX gained 57.0%, outpacing the large-growth index's 29.1%. The exchange-traded note recently stopped issuing new notes.

Neutral-rated Aberdeen US Small Cap Equity C GSXCX is the only fund on Morningstar’s analyst coverage list to land among the top 10. The fund is less exposed to the struggling biotech companies that dragged down other small-cap growth funds. Eric Schultz wrote in April that the team identifies well-capitalized businesses with competitive advantages and opportunities for steady growth--such as industrials and consumer staples stocks--and underweight less-predictable areas like biotech. The fund gained 29.8% last year, 25 percentage points above the index.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)