AT&T Shares Deserve a Return Call

AT&T is significantly undervalued, and even after an expected dividend cut, will offer an attractive yield.

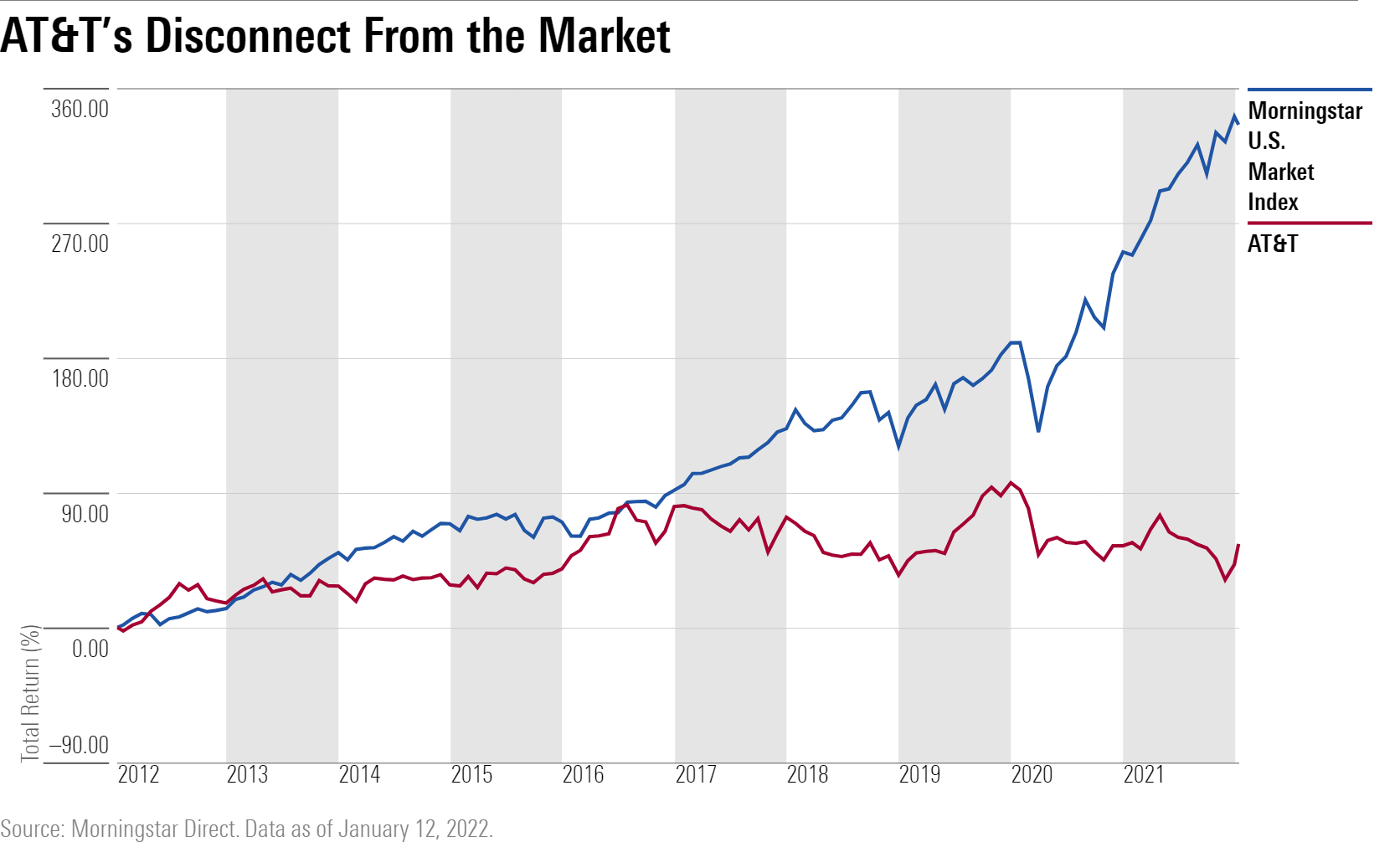

For most of the past five years, investors haven’t been able to enjoy a good connection with AT&T’s T stock. But we think there is now a strong opportunity to catch the company as it returns to its roots.

At the same time, AT&T’s planned spinout of its WarnerMedia unit provides shareholders a chance to hold shares of a potentially appealing new media company, Warner Bros. Discovery.

The difference today is that AT&T is in the midst of reversing a strategy that took the company’s focus away from its traditional communications business. In 2015, AT&T announced its acquisition of DirecTV, and the next year it pushed further into consumer entertainment with its purchase of WarnerMedia (then Time Warner) for $85 billion.

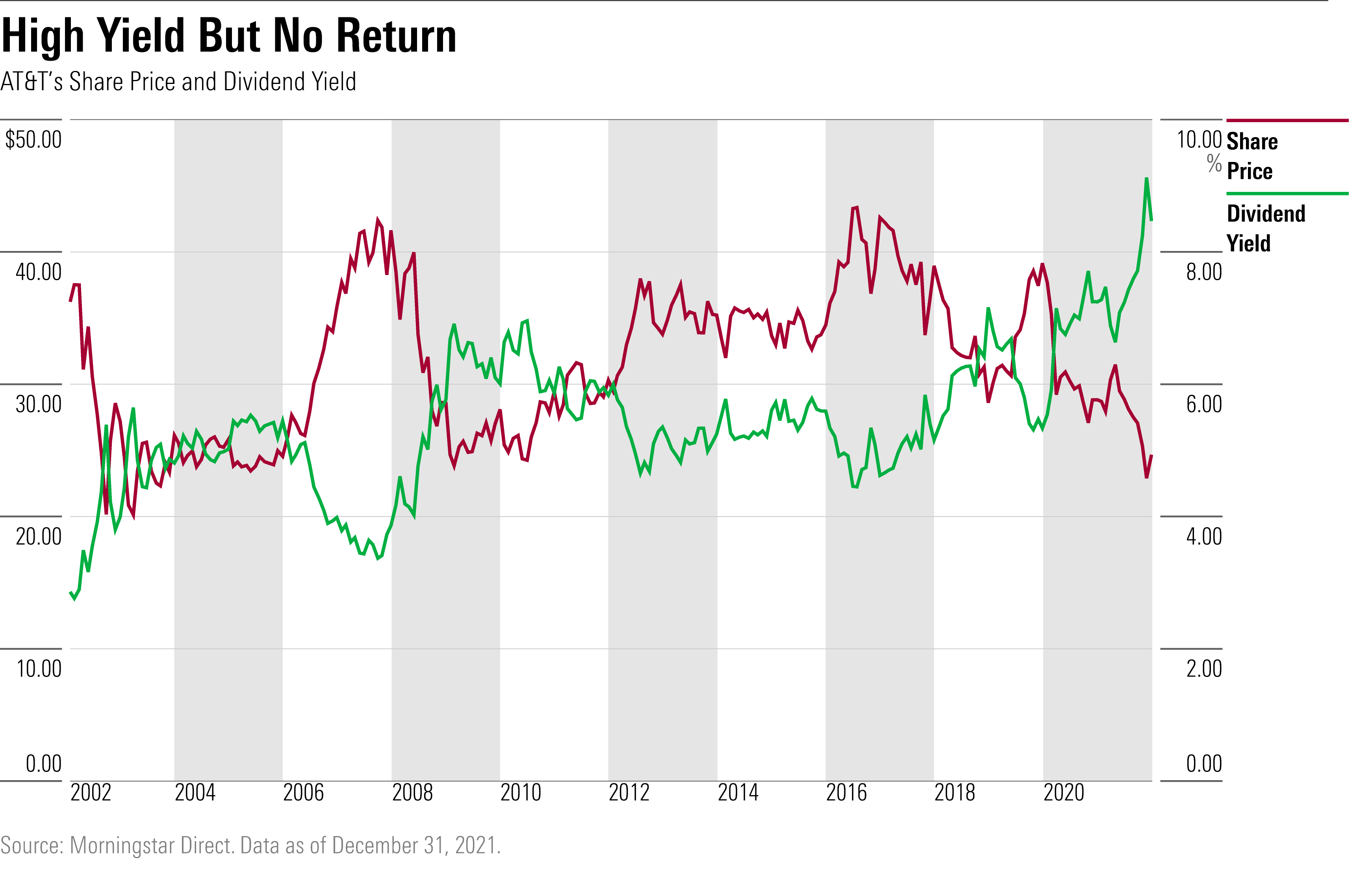

In our opinion, AT&T squandered shareholder value on this ill-conceived strategy and overpaid for numerous acquisitions. Despite its extremely high dividend yield, the stock was a difficult one for many investors to stomach.

But now AT&T is changing gears again. In July 2020, a new chief executive took the reins at AT&T and has quickly undertaken a number of corporate actions in order to refocus the company’s strategy, reposition its business lines to address the ongoing evolution within the telecommunications and media sectors, and unlock shareholder value.

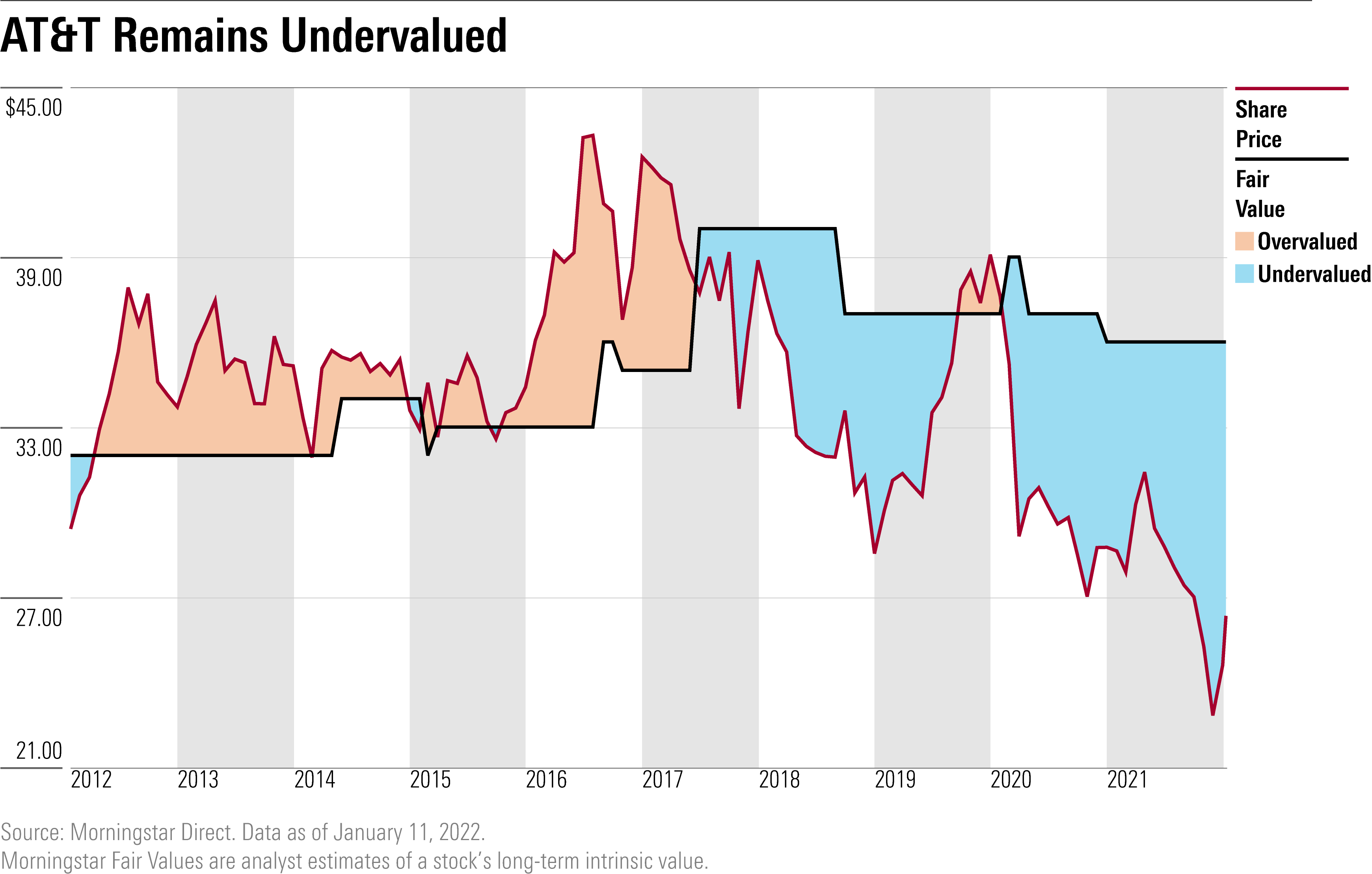

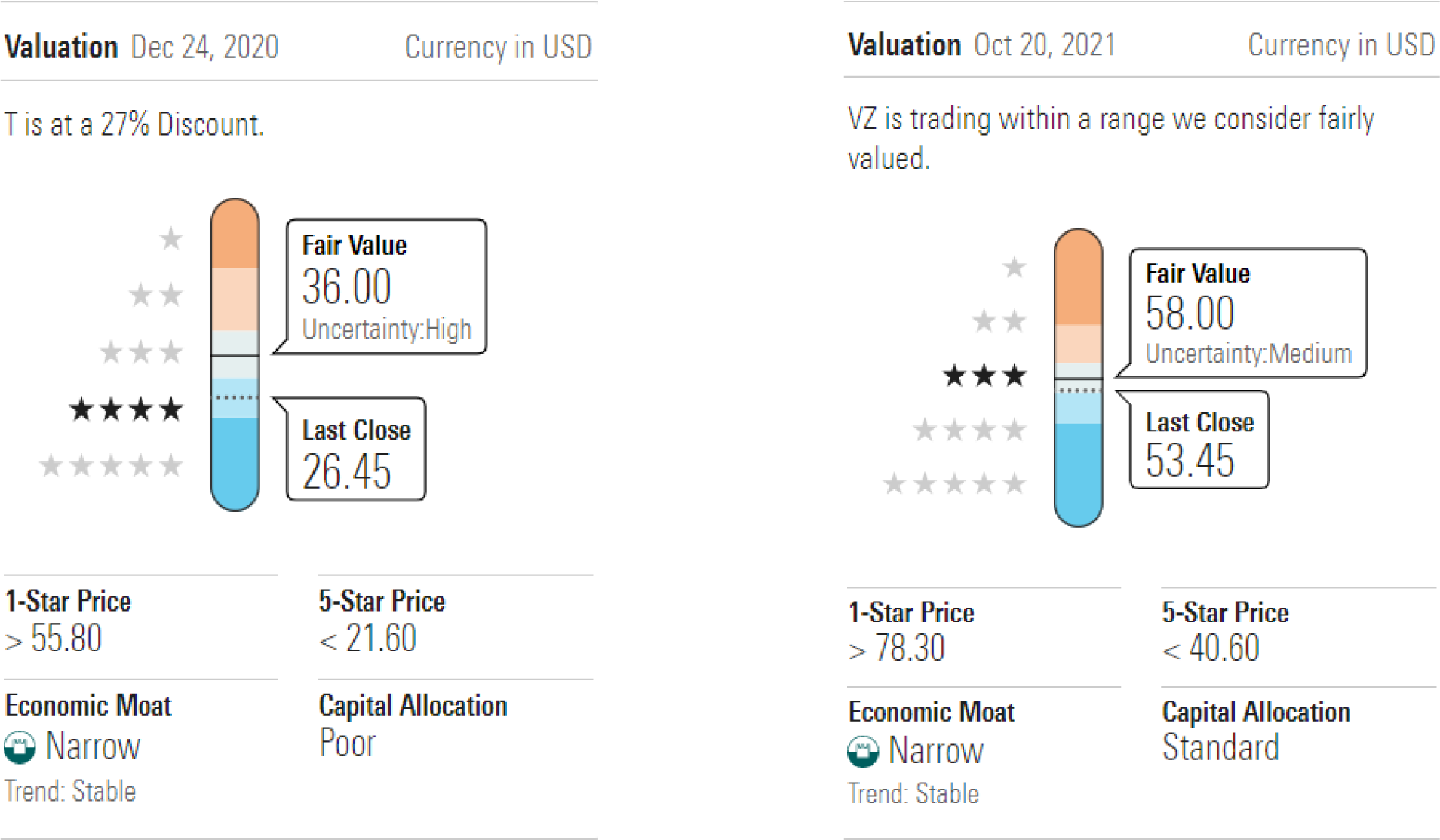

At its current payout, AT&T is the fourth highest-yielding stock under our U.S. coverage and one of the most undervalued across the large-cap Morningstar Category. The stock trades at a substantial 27% discount to our $36 fair value estimate and is currently rated 4 stars.

However, as a result of the decision to spin off its WarnerMedia subsidiary in 2022, AT&T’s management estimates that the current dividend payout will be cut to a little more than half of its current level of 7.9%. Yet, even after accounting for the dividend cut, the dividend yield would still place the stock in the highest 7% of our U.S. stock coverage.

We think the combination of its refocused strategy centered on its core competencies, high dividend yield, and substantial margin of safety as compared with its fair value deserve a look from investors. Michael Hodel, director for communications services research at Morningstar, thinks the combination of its refocused strategy centered on its core competencies, high dividend yield, and substantial margin of safety as compared with its fair value deserve a look from investors.

Shedding Unconnected Assets: WarnerMedia and DirectTV

When AT&T’s current CEO John Stankey took the helm in July 2020, he did not waste any time in implementing his strategic vision. In February 2021, AT&T announced it had reached an agreement to restructure its U.S. television business by selling a 30% stake in DirecTV to private equity investor TPG. While the transaction is not that large in relation to the overall size of the company, it was the first step in the path toward refocusing AT&T on its core telecommunications business.

In May 2021, AT&T announced plans to spin off WarnerMedia and merge it with media company Discovery. AT&T shareholders will own 71% of the new combined entity, which will be called Warner Bros. Discovery. We believe the decision to shift WarnerMedia to a stand-alone entity makes strategic sense as we have long doubted the benefits of combining telecom and media assets.

The spin-off provides strategic benefits to both Warner Bros. Discovery and AT&T. We think independence and larger scale will enhance the value of the new media firm, as it will be in a stronger position to negotiate distribution agreements with media and communications outlets. The shift leaves AT&T with the flexibility to pursue content distribution relationships across the spectrum of firms looking to build content services rather than be beholden to HBO Max.

As part of this transaction, AT&T announced that following the spin-off, it would cut its dividend, aiming to pay 40% of remaining free cash flow to shareholders. Based on management’s cash flow estimates, the firm expects to pay about $8 billion in dividends per year, down from $15 billion currently. If AT&T’s share count is unchanged, that would put the dividend at approximately $1.15 per share. That would equate to a roughly 4.3% dividend yield at the current share price.

The remainder of the company’s free cash flow would be used to repay debt; reinvest in its communications business; and, when necessary, acquire additional spectrum as needed to further build out and add capacity for its network.

At this point, AT&T has not yet announced how it will conduct this spin-off. We expect that either AT&T either will issue a stock dividend in which each existing shareholder will receive their pro rata share of the new media firm, or will utilize a subscription mechanism. In a subscription, AT&T shareholders may elect to receive a different proportion of AT&T and Discovery shares subject to specified minimums and maximums.

What Will AT&T Look Like Going Forward?

Strategically, AT&T is refocusing on its core communications business by stepping up investments in both its wireless and fixed-line networks. For example, the firm will accelerate the deployment of the C-band spectrum licenses it acquired earlier this year, with plans to cover 200 million people by the end of 2023.

In addition, AT&T is accelerating its fixed-line spending, rolling out fiber infrastructure with the hope of connecting 30 million customer locations with fiber by the end of 2025, roughly double its current footprint. In our view, we think the consumer broadband opportunity is attractive for AT&T. We estimate that about one fourth of homes in its service area subscribe to its services, but only one third of those are served by fiber today. Additional fiber infrastructure should also enable AT&T to efficiently increase the density of wireless network and reach additional enterprise customers.

Looking forward, we expect competition in the wireless business will be more rational. Following the merger of T-Mobile and Sprint in April 2020, there are only three main competitors in the U.S.: AT&T, Verizon VZ, and T-Mobile TMUS. Most recently, in the auction for C-band spectrum conducted in February 2021, these three main wireless competitors purchased 95% of the spectrum that was up for sale, keeping most of the spectrum out of the hands of upstart competitors who may have used pricing as an entry to gain market share.

What Should I Do With the Discovery Shares?

The newly formed combination of Discovery and WarnerMedia will not pay a dividend. For investors that are more interested in capturing a high dividend yield today, those investors could sell the shares they receive in the newly combined Discovery and WarnerMedia and use those proceeds to purchase additional AT&T stock.

However, depending on an investor's investment parameters, we think that Discovery stock is worth a look itself. We rate the stock at 4 stars and calculate that it is trading at a 33% discount to our fair value. Our $42 fair value estimate reflects the merger with WarnerMedia based on projected 2023 EBITDA of $14 billion and a 13.5 EV/EBITDA multiple. Details on our valuation for Discovery can be found here.

Investment Conclusion

Investors that are relying on AT&T's current dividend payout will likely be disappointed once the current dividend is cut in 2022; however, from the viewpoint of a long-term investor, we think the actions that management is taking today will better position the firm to address future competition.

Even following the dividend cut, in a world of low interest rates, AT&T’s dividend will remain high as compared with the average dividend yields across equity markets and as compared with the fixed-income markets. Based on the current stock price, if AT&T's dividend is cut in half as we expect, the yield will still be competitive to AT&T’s nearest rival, Verizon, whose dividend yield is 4.8%. We rate Verizon’s stock at 3 stars, as we don’t believe it has the same upside potential as AT&T. Currently, Verizon is only trading at an 8% discount to our fair value as compared with AT&T’s 27% discount.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZM7IGM4RQNFBVBVUJJ55EKHZOU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_d910b80e854840d1a85bd7c01c1e0aed_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)