Experts Forecast Stock and Bond Returns: 2022 Edition

U.S. equity expectations drop further still, but most firms spy better values overseas.

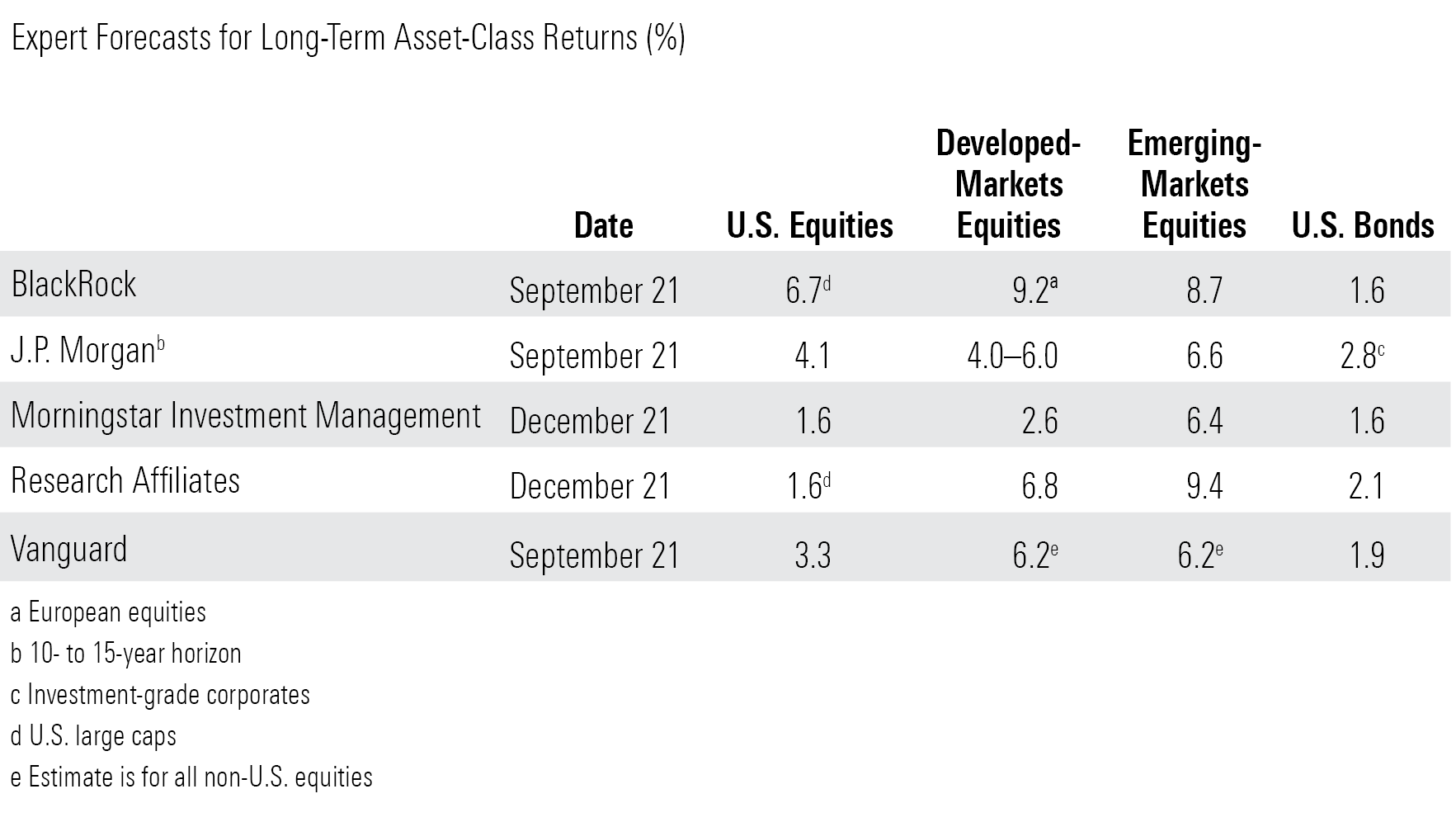

Lower U.S. equity market returns. Better prospects for non-U.S. stocks. Slightly better--but still low--returns for bonds.

Those were some of the commonalities among various investment providers' asset-class return forecasts in my now-annual compendium. While firms differ in their methodologies, the specifics of their outlooks, and even the time frames covered by their forecasts, every firm in our compilation expects that U.S. equity returns over the next seven to 10 years will be well below the 16% annualized return that the S&P 500 has posted over the past decade. The U.S. equity return forecasts were also generally lower than was the case a year prior.

But firms are also expecting better things from various cuts of the equity market. As has been the case for the past several years, all of the firms in our survey forecast higher returns from non-U.S. stocks than U.S., although firms varied in whether they expect better returns from developed or emerging markets. Firms also expect to see better results from the value stocks than they do growth names.

And with the Federal Reserve indicating that it's planning to lift the federal-funds rate starting this year, firms are crediting bonds with slightly higher return expectations than has been the case in the past several surveys. That said, high-quality return expectations are by no means robust--and negative on an inflation-adjusted basis in many cases.

How to Use Them

It might be tempting to write off all forecasting as folly. Doesn't everyone know it's impossible to predict what the market might do? While it's almost impossible to guess the market's direction on a short-term basis, return expectations can be useful--and are arguably even mission-critical--when setting up your financial plan. After all, you need to plug in some type of long-term return assumption when deciding whether your savings rate and time horizon are appropriate given what you’d like to achieve. And if you're retired, being realistic about return expectations is also essential when determining an sustainable withdrawal rate. Low return expectations for U.S. stocks and bonds are key reasons that recent research from our team suggested that new retirees start off conservatively with respect to their withdrawals. (We embedded the forecasts from our colleagues in Morningstar Investment Management, cited below.)

Before you take these or any other return forecasts and run with them, however, it's important to bear in mind that these return estimates are more intermediate-term than they are long. The firms I've included below all prepare capital markets forecasts for the next seven to 10 years, not the next 30. (BlackRock does provide a 30-year forecast, but it's an outlier in terms of making such far-reaching forecasts available to the public.) As such, these forecasts will have the most relevance for investors whose time horizons are in that ballpark, or for new retirees who face sequence-of-return risk in the next decade. Investors with very long time horizons (20-30 years or longer) can reasonably employ long-term historical returns, but they may want to give them a little bit of a haircut to incorporate what could be a tough next decade.

It's also important to note that the parameters for these return estimates vary a bit; some of the return expectations are inflation-adjusted, while most are not (nominal). In addition, some of the experts forecast returns for the next decade, while others employ slightly shorter time horizons. The firms also vary in their approaches to formulating the forecasts, though most rely on some combination of valuations, current yields, and earnings growth and inflation expectations to arrive at return expectations. Finally, it's worth noting that the market is always moving, so expect these forecasts to be pretty ephemeral, too.

BlackRock

Highlights: 6.7% 10-year expected nominal return from U.S. large-cap equities; 9.2% 10-year average expected return from European equities; 8.7% average expected return from emerging-markets equities; 1.6% for U.S. aggregate bonds (September 2021). All return assumptions are nominal (non-inflation-adjusted).

BlackRock's asset-class return expectations in September 2021 were generally a bit higher than was the case the year prior. For example, the firm was expecting a 5% 10-year return for U.S. equities in September 2020, but a nearly 7% return as of September 2021. Reflecting the prospect of higher interest rates, the firm's expectation for U.S. aggregate bond returns was also a touch higher--a 1.6% expected 10-year return as of September 2021, versus 0.8% in the previous year.

BlackRock continues to be more sanguine in its outlook for international stocks, assuming nominal 10-year returns of roughly 9% for emerging-markets and European equities over the next decade. BlackRock reserves its highest return expectations for private equity: It's expecting an average nominal return of nearly 19%, albeit with a huge amount of variability/uncertainty, over the next decade. BlackRock's capital markets assumptions are easy to use, and the time frames are adjustable, allowing investors to adjust the time horizon to suit their own.

Grantham Mayo Van Otterloo (GMO)

Highlights: Negative 6.7% real (inflation-adjusted) returns for U.S. large caps over the next seven years; negative 3.9% real returns for U.S. bonds; 1.9% real returns for emerging-markets equities; negative 1.1% real returns for emerging-markets debt (November 2021).

They're getting worse! GMO's asset return expectations have historically been the most pessimistic in our roundup, and the firm's late-2021 forecast for the next seven years was no exception. GMO expects a real (inflation-adjusted) loss of nearly 7% from U.S. large caps over the next decade, a touch worse than its return estimate in late 2020. The firm isn't expecting a whole lot from bonds, either, forecasting losses in the neighborhood of 4% for U.S. bonds and 5% for hedged non-U.S. credits.

Even emerging-markets equities, one of the few pillars of strength in GMO's forecast in years past, are forecast to land only modestly in the black over the next seven years, with a 2% real return. That represents a sharp turnabout from just a few years ago: In 2019, GMO was expecting a 4.5% real annualized return from emerging-markets equities over the next seven years. The firm's sole pocket of enthusiasm remains the value slice of emerging-markets equities, though even that has declined: In late 2019, the firm was expecting a 9% real return from the asset class, but the forecast had declined to less than 6% by late 2021.

J.P. Morgan

Highlights: 4.1% nominal returns for U.S. equities over a 10- to 15-year horizon; 2.8% nominal returns for U.S. investment-grade corporate bonds over a 10-15 year holding period (October 2021).

J.P. Morgan's Long-Term Capital Markets Assumptions report provides a good deal of data, as well as thorough background on the firm's economic and market forecasts, which are based on qualitative and quantitative inputs.

Even though the U.S. market performed spectacularly in 2021, J.P. Morgan's 2022 forecast is the same as it was for 2021--a 4% nominal return for U.S. large-cap stocks. Return assumptions for small-cap U.S. stocks and real estate equities were a bit higher--4.4% and 5.8%, respectively. Developed-markets equities are a touch higher: 5.8% for European equities, 5% for Japanese equities, and 4% for U.K. equities. The firm's return expectations for emerging markets equities have dropped a bit from the 2021 forecast but are still at a robust 6.6% in U.S.-dollar terms.

On the fixed-income side, the firm has nudged up return expectations: It's expecting a 2.8% nominal return from U.S. investment-grade corporates, a touch better than its forecast in 2021. J.P. Morgan's return expectation for U.S. high-yield bonds is obviously higher, at 3.9%, but that's down from 4.8% a year earlier. The firm is also enthusiastic about the prospects for emerging-markets debt, forecasting a return of 5.2%, in line with the 2021 forecast.

Morningstar Investment Management

Highlights: 1.6% 10-year nominal returns for U.S. stocks; 1.6% 10-year nominal returns for U.S. aggregate bonds (Dec. 31, 2021).

The Morningstar Investment Management team's forecast for U.S. equities leans toward the pessimistic side of our collected forecasts: While it isn't expecting sizable losses like GMO, it's still expecting a nominal return from U.S. stocks that's only modestly positive n the decade ahead. MIM's outlook for non-U.S. stocks is a bit sunnier: a 2.6% return (nominally) for developed-markets equities and 6.4% for emerging-markets equities.

MIM expects U.S. aggregate bonds to land in the black--albeit just slightly--on a nominal basis over the next decade. Owing to tightening yield spreads, the firm's outlook for high-yield bonds isn't a lot better, at 2%.

Research Affliliates

Highlights: 1.6% nominal (negative 1% real) returns for U.S. large caps during the next 10 years; 2.1% nominal (negative 0.4% real) returns for aggregate U.S. bonds (Dec. 31, 2021; valuation-dependent model).

Research Affiliates' expected returns model is customizable and fun to use. Whereas most firms show expected returns for five or six asset classes, the Research Affiliates model gets more granular, allowing users to home in on smaller segments of the stock and bond markets. Better yet, it's updated monthly, incorporating more recent market action.

The firm's return expectations for U.S. stocks have declined a bit from December 2020. Although its fixed-income return expectations are a bit higher, Research Affiliates is still predicting a negative real return from high-quality U.S. bonds over the next decade. The firm sees slightly better results for Treasury Inflation-Protected Securities--a 2.6% nominal and 0.1% real return.

The firm is more optimistic in its expectations for non-U.S. stocks and bonds, however. Its valuation-dependent model is forecasting a whopping 9.4% nominal (6.9% real) return from emerging-markets equities over the next 10 years and 6.8% nominal (4.2% real) for the MSCI EAFE Index of developed-markets stocks.

Vanguard

Highlights: Nominal median U.S. equity market return of 3.3% during the next decade; 6.2% median expected returns for non-U.S. equities (unhedged); 1.9% median expected return for U.S. fixed income (September 2021).

Vanguard's recently published equity return expectations were generally a bit lower than was the case a year earlier. The headline is that the firm is continuing to expect better performance from non-U.S. equities than U.S. equities over the next decade, mainly owing to developed-markets foreign stocks' lower valuations. Vanguard is also expecting value stocks to outperform growth, with a 4.1% median expected 10-year return for U.S. value stocks versus a 0.1% median expected return for U.S. growth names.

The firm's estimates for high-quality fixed-income assets were a bit higher in September 2021 than was the case the year prior—a 1.9% median expected return for U.S. fixed income versus 0.75%-1.75% 10-year expected returns in 2020. Not surprisingly, the firm is expecting higher returns for high-yield and emerging-markets bonds, albeit with substantially higher volatility.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)