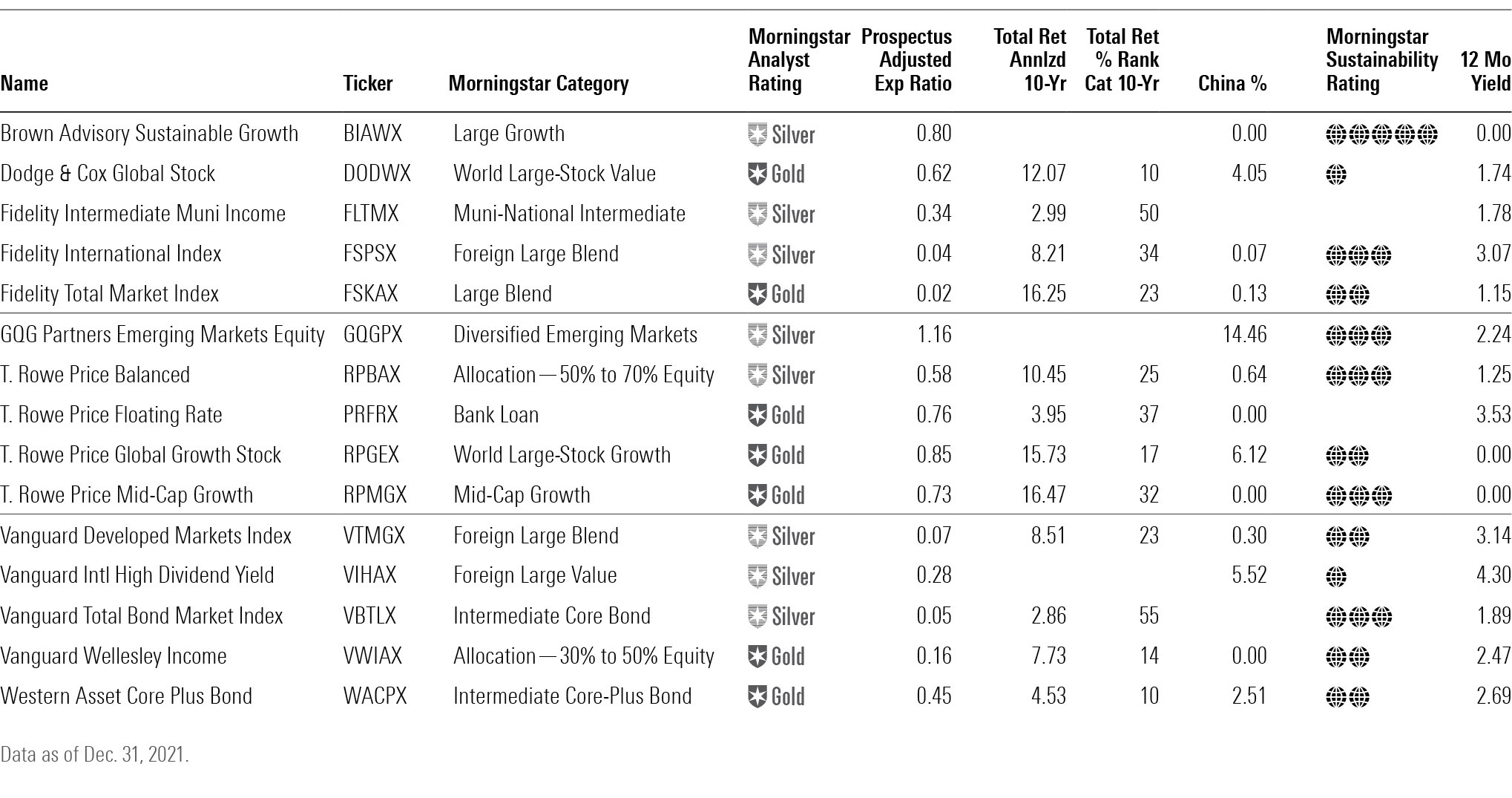

15 Funds for 2022 and Beyond

Here are some great funds for the long haul.

The article was published in the January 2022 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

Well, that was a strange year. From an investment standpoint, it was a better year than 2020. Most equity markets were up nicely, and the U.S. economy came roaring back with tremendous job growth thanks to the breakthrough with coronavirus vaccines.

And yet we don't lack for things to worry about. The omicron variant is causing new shutdowns and filling up the hospitals once more. Rising inflation has caused the Federal Reserve to taper bond buying and announce that it expects to raise interest rates in 2022.

In addition, that stock rally means U.S. equities have rather high valuations based on most measures, even though not much time has passed since a brutal but short bear market in 2020.

So, where should we invest in 2022? I have some ideas, though they come with two caveats. First, these are long-term ideas, not picks for just 2022. Second, I go light on the macro calls here, but those I make certainly come with the idea that you shouldn't tilt your portfolio too much because of macro factors. The main things to focus on are your plan and good fundamentals. Those are much more important than top-down considerations.

Let's Get Cheap

I'm going to start with the very humble idea of cutting your fees regardless of the market's ups and downs. You can get Fidelity Total Market Index FSKAX for only 0.02% in fees. Foreign index funds used to be costly, but now you can get Fidelity International Index FSPSX for 0.04% and Vanguard Developed Markets Index VTMGX for just 0.07%. Likewise, Vanguard Total Bond Market Index VBTLX costs just 0.05%. The bond index fund is nice ballast for stock market sell-offs.

Vanguard, Fidelity, and iShares all have super cheap index options that are worth a look. The cheapest and best are wide-reaching total-market funds like those mentioned above. Besides fees, these are also nice and simple low-maintenance funds that don't require much monitoring. If you have relatives asking for advice, and they don't want to spend much time on research, these are solid options.

For a cheap actively managed bond fund, consider Western Asset Core Plus Bond WACPX. The fund charges only 0.45% and earns a Morningstar Analyst Rating of Gold. It takes on more credit risk and is generally willing to accept more risk than a core bond index fund for more returns.

Let's Get Cheap II

You can also go cheap based on valuations. Emerging markets have lagged by quite a bit the past decade. Most global valuation measures say they are quite cheap. But I must admit I'm a little squeamish about the big China weightings that most emerging-markets funds have.

In July, China declared that for-profit education companies could not make profits, and the stocks were crushed. Extraordinary risks of government intervention come with China's growth potential. You can see the China weighting of every fund I'm suggesting in the table below. I chose GQG Partners Emerging Markets Equity GQGPX, which is run by the skilled Rajiv Jain, who has an excellent track record. The Silver-rated fund has just 14% in China.

A New Shot at T. Rowe Price Mid-Cap Growth

Brian Berghuis' T. Rowe Price Mid-Cap Growth RPMGX is one of the best growth funds you'll find, and it reopened on Dec. 1, 2021, after having been closed since 2010. I find it compelling. The Gold-rated fund is a great way to invest in emerging growth names, and Berghuis is a great stock-picker. The one downside is that even though the fund is reopening, it still has a hefty $37 billion in assets, making it far from nimble. Berghuis looks for companies with strong management and healthy margin growth but tempers that by paying attention to valuations.

Let's Get Cautious

One of the biggest mistakes investors make is getting out of the market. Yes, there are real concerns and risks out there, but the opportunity costs are big. Rebalance if your stock weighting has grown too big or if your high-risk bond funds have outstripped your conservative funds. Here are a few cautious funds you can move into that will maintain some exposure to stocks and bonds. These dependable funds should weather a downdraft well.

Silver-rated T. Rowe Price Balanced RPBAX is a 65/35 fund that you might find appealing if you want to sell one of your all-equity funds. T. Rowe Price has the depth in stocks and bonds to make funds like this one a winner, and it only costs 0.58%. The fund owns seven underlying funds, including T. Rowe Price Blue Chip Growth TRBCX, T. Rowe Price Overseas Stock TROSX, T. Rowe Price High Yield PRHYX, and T. Rowe Price Value TRVLX. The firm makes some shifts among the funds, but the adjustments are modest.

You can dial that equity risk back even more with Vanguard Wellesley Income VWIAX, which is 35% equities and 65% bonds. That really mutes volatility, and yet subadvisor Wellington still produces appealing returns with a dividend-equity strategy and an investment-grade corporate credit emphasis on the bond side. With fees of just 0.16%, it is one of the best bargains in active management.

Fidelity Intermediate Municipal Income FLTMX is a good way to get some yield and returns with modest risk. A strong economy makes near-term municipal defaults unlikely, and the intermediate duration keeps interest-rate risk modest, though not at zero. We rate the fund Silver and consider Fidelity's muni team to be among the best.

Sustainability Is the Future

ESG investing is supposed to point investors toward businesses that manage environmental, social, and governance risks well and away from companies that court trouble by ignoring or paying lip service to those perils. We’ll have to see if ESG achieves its goals, but in the meantime, there are some funds that marry fundamental investing and ESG quite well.

Silver-rated Brown Advisory Sustainable Growth BIAWX has proved to be quite good on both fronts and held up well in the March 2020 COVID-19 decline. Karina Funk and David Powell seek companies with ESG-driven competitive advantages that can cut costs and boost value and sales. Those kinds of companies can be good for returns and ESG measures. So far, that strategy has worked nicely.

In Search of Foreign Dividends

Foreign dividend payers haven't rallied nearly as much as those in the United States. As a result, you can get a nice yield from some foreign dividend-focused funds. Moreover, value looks historically cheap relative to growth even after a year of outperformance, so this seems enticing. Interestingly, the two funds I'll highlight here also score poorly on sustainability factors.

Vanguard International High Dividend Yield VIHAX boasts a robust 12-month yield of 4.30% as foreign dividend payers in sectors like energy and financials have lagged markets the past few years.

If you prefer active, Dodge & Cox Global Stock DODWX is a Gold-rated gem charging just 0.62%. The yield is a more modest 1.74% because of the U.S. equity weighting and the fact that the strategy doesn't emphasize dividends as much as at the Vanguard fund above.

Let's Buy the Upgrade

Always pay attention to analyst upgrades because it signals improving situations among strategies' people and processes. As it happens, there are two funds from T. Rowe Price that I'll highlight.

T. Rowe Price Floating Rate PRFRX improved to Gold from Silver as it now gets High marks for its People, Process, and Parent Pillars. This fund invests in bank loans, which adjust to changes in interest rates. It's a timely choice for investors who want some protection against rising rates. Manager Paul Massaro has done a great job since taking the reins in 2013. He has a deep team of 17 leveraged finance analysts, and that's a big deal because bank loans require a lot of legwork to avoid blowups.

T. Rowe Price Global Growth Stock RPGEX likewise rose to Gold in 2021. Scott Berg has run the fund since it was launched in 2008 and continues to impress. He seeks out great earnings compounders, but he is wary of individual stock risk and keeps a diffuse portfolio of around 150 names. The fund's returns are nicely ahead of peers and the benchmark over the past 10 years.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)