10 Wide-Moat Stocks on Sale

Undervalued high-quality stocks may be just the ticket in a choppy market.

The Morningstar Wide Moat Focus Index tracks companies that earn Morningstar Economic Moat Ratings of wide and that are trading at the lowest current market price to fair value. How has this cluster of high-quality names performed over time? Pretty well: The index has beaten the broad-based Morningstar US Market Index during the trailing one-, three-, five-, and 10-year periods as of this writing.

Moreover, wide-moat companies--those with unassailable competitive advantages--may be the place to be today, given the market's recent choppiness and ongoing questions about inflation in the new year. "These stocks typically hold their value better to the downside during market corrections," explains Morningstar's chief U.S. market strategist Dave Sekera. "In addition, if inflation is persistent, these companies typically exhibit strong pricing power to quickly pass-through cost increases to maintain margins."

The Morningstar Wide Moat Focus Index is therefore a fertile hunting ground for investors looking for high-quality stocks trading at reasonable prices.

In an effort to keep the index focused on the least-expensive high-quality stocks, Morningstar reconstitutes it regularly. The index consists of two subportfolios containing 40 stocks each, many of which are overlapping positions. The subportfolios are reconstituted semiannually in alternating quarters on a "staggered" schedule. We re-evaluate the index's holdings and add and remove stocks based on a preset methodology. Because stocks are equally weighted within each subportfolio, the reconstitution process also involves rightsizing positions.

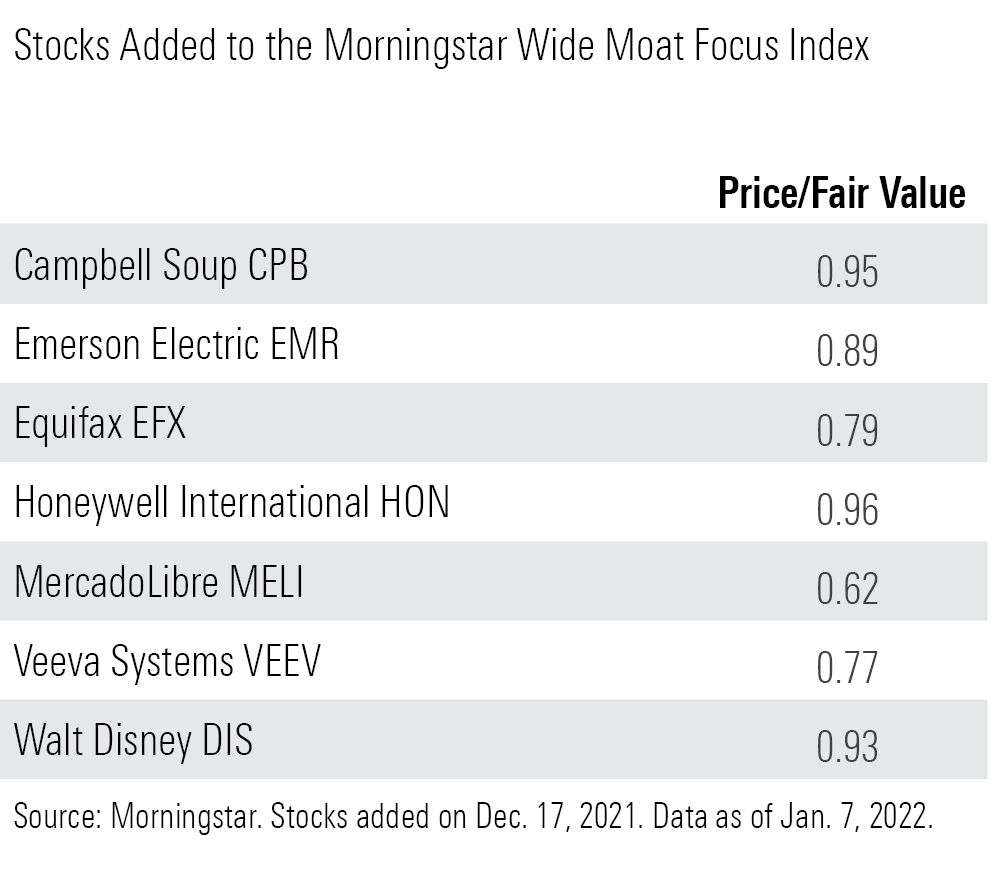

After the most recent reconstitution on Dec. 17, 2021, half of the portfolio added seven positions and eliminated seven.

Additions

Three stocks from the industrials sector were added to the index.

One of the big three credit bureaus, Equifax EFX enjoys strong operating leverage from incremental revenue, thanks to the fixed costs inherent in its business, says analyst Rajiv Bhatia. Its workforce solutions segment has been a standout in recent years, he adds.

Despite near-term headwinds, multi-industrial conglomerate Emerson Electric EMR is primed for several years of positive organic growth, argues analyst Josh Aguilar. And with a new CEO in place, we wouldn't be surprised to see management and the board revisit a potential breakup.

Honeywell HON, another multi-industry behemoth, is capable of mid-single-digit top-line growth, incremental operating margin growth of 30%, and about 10% adjusted earnings per share growth, says Aguilar. Portfolio refreshes, new products, and strategic partnerships should drive growth.

The remaining additions hail from a hodgepodge of industries.

Campbell Soup CPB faces cost headwinds, but we think this well-known brand is following a prudent strategic playbook focused on driving profitable growth in its meals and snacking areas, says sector director Erin Lash.

Veeva Systems VEEV is the leading provider of cloud-based software solutions in the life sciences industry. Analyst Dylan Finley says the firm will likely extend its leadership position through high retention of and deepening relationships with existing customers, as well as by expansion into industries outside of life sciences.

Walt Disney DIS is successfully transforming its business to keep pace in the evolving media industry, says senior analyst Neil Macker. Its media networks and collection of Disney-branded businesses have demonstrated strong pricing power, and its streaming services will be drivers of long-term growth.

MercadoLibre MELI is a one-stop e-commerce solution for Latin American buyers and sellers. Customer expectations for quicker shipping times and increased fulfillment penetration should make the firm's services all but irreplaceable, says analyst Sean Dunlop.

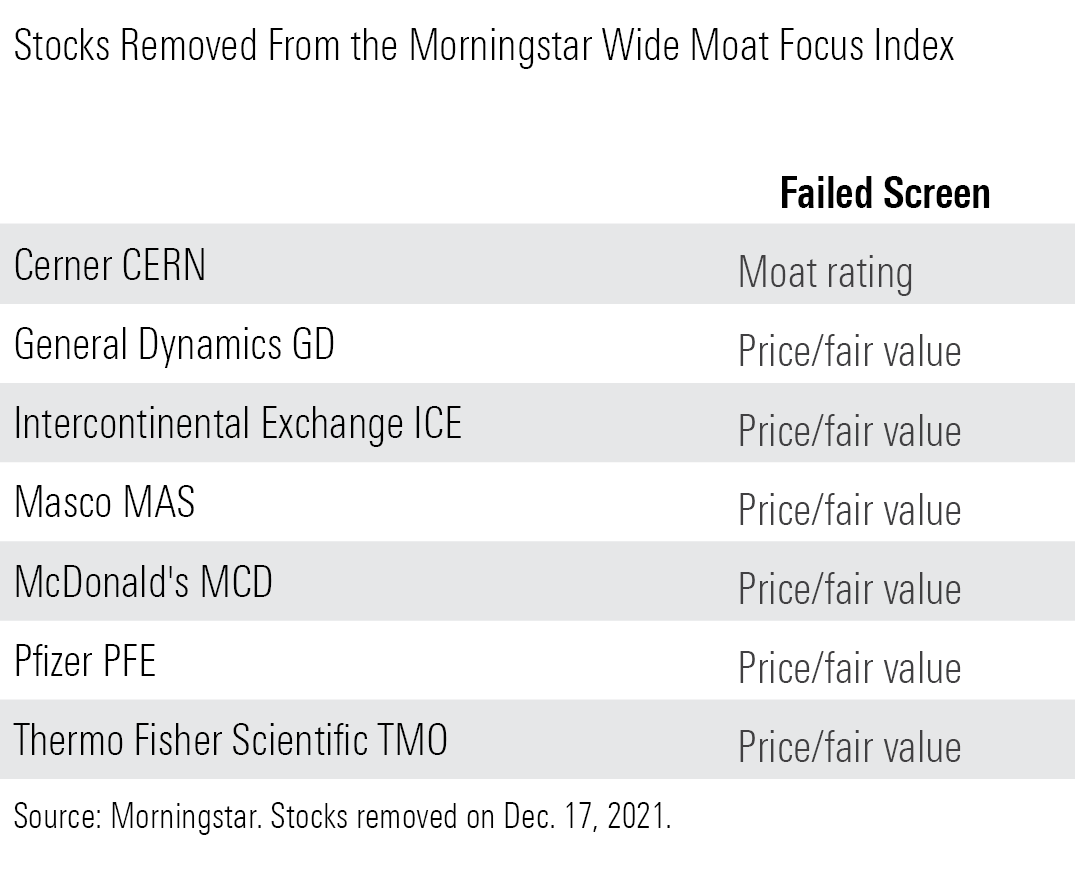

Removals

Stocks can be removed from the index for a few reasons: If we downgrade their economic moats or if their price/fair value ratios rise significantly. Most of the removals in the latest reconstitution were pushed out by stocks that were trading at more attractive price/fair value ratios at the time of reconstitution.

The exception: Cerner CERN, a long-standing leader in the electronic health record industry. We lowered our economic moat rating to narrow last year after re-evaluating the company's growth areas and recent market share losses, explains analyst Dylan Finley.

High-Quality Stocks in the Bargain Bin

Here are the 10 cheapest stocks in the Morningstar Wide Moat Focus Index as of Jan. 7, 2022.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/D2M6HBDLIZD3RLWRUR7IPUIVIU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2UWGQD7LCJCYNF3WQ5HHLP7UBE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)