Cheap Stocks With 2021's Largest Fair Value Upgrades

These undervalued stocks had the largest valuation increases by Morningstar analysts during 2021.

In a year with a booming economy, surging earnings, and a big bull market for stocks, its only natural to see a wide range of companies be upgraded by Morningstar analysts when it comes to their fair value estimates, and in many cases by a substantial amount.

But some stocks saw super-sized fair value increases while remaining undervalued based on Morningstar estimates. So not only are these businesses worth more in the eyes of Morningstar’s stock analysts--they’re still trading at a discount.

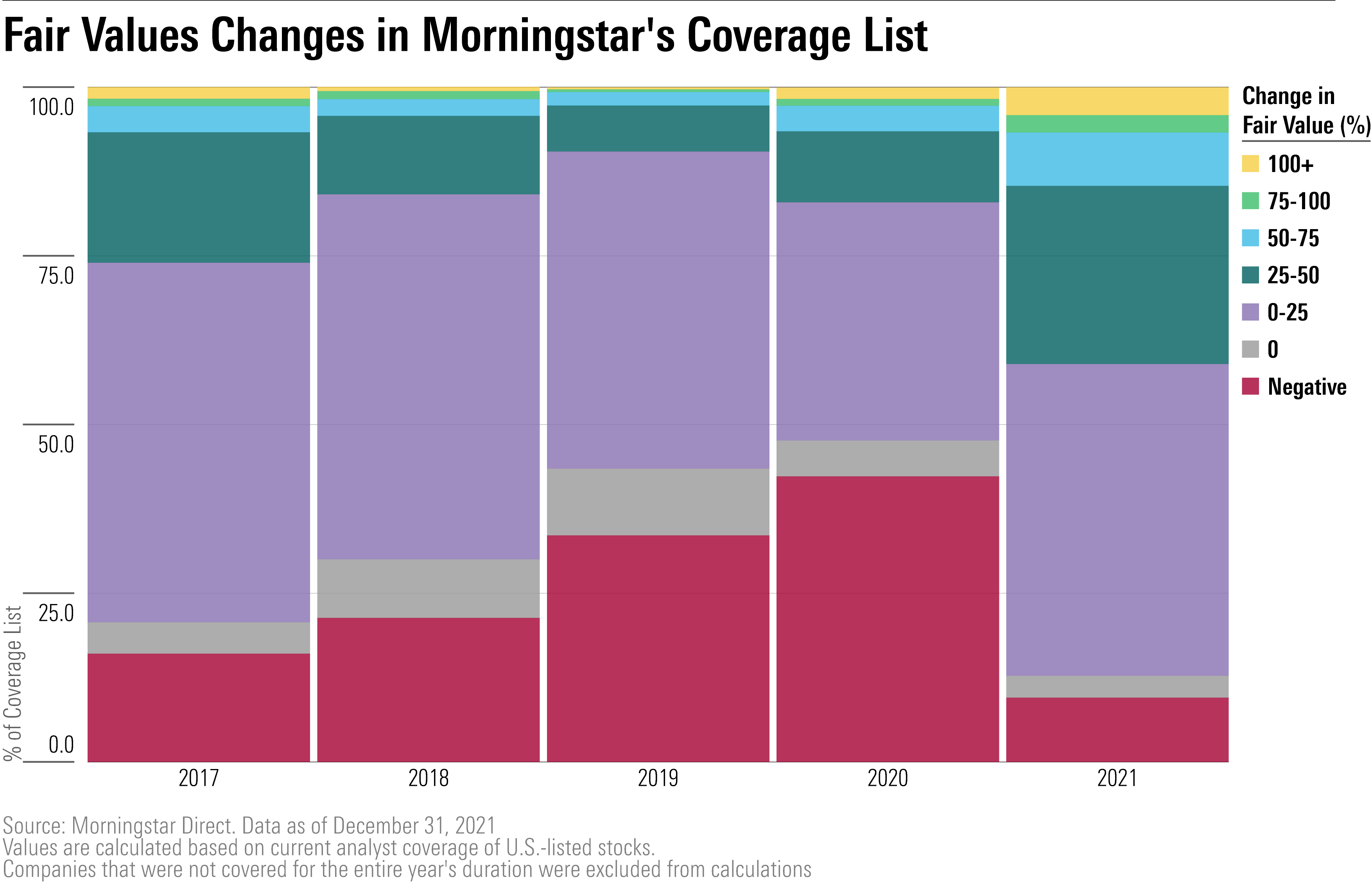

We screened our U.S. coverage list of 858 equities for those with the largest percentage increase in fair value estimates during 2021. It turns out that last year saw more fair value estimate increases of 25% or more than any time in the past five years.

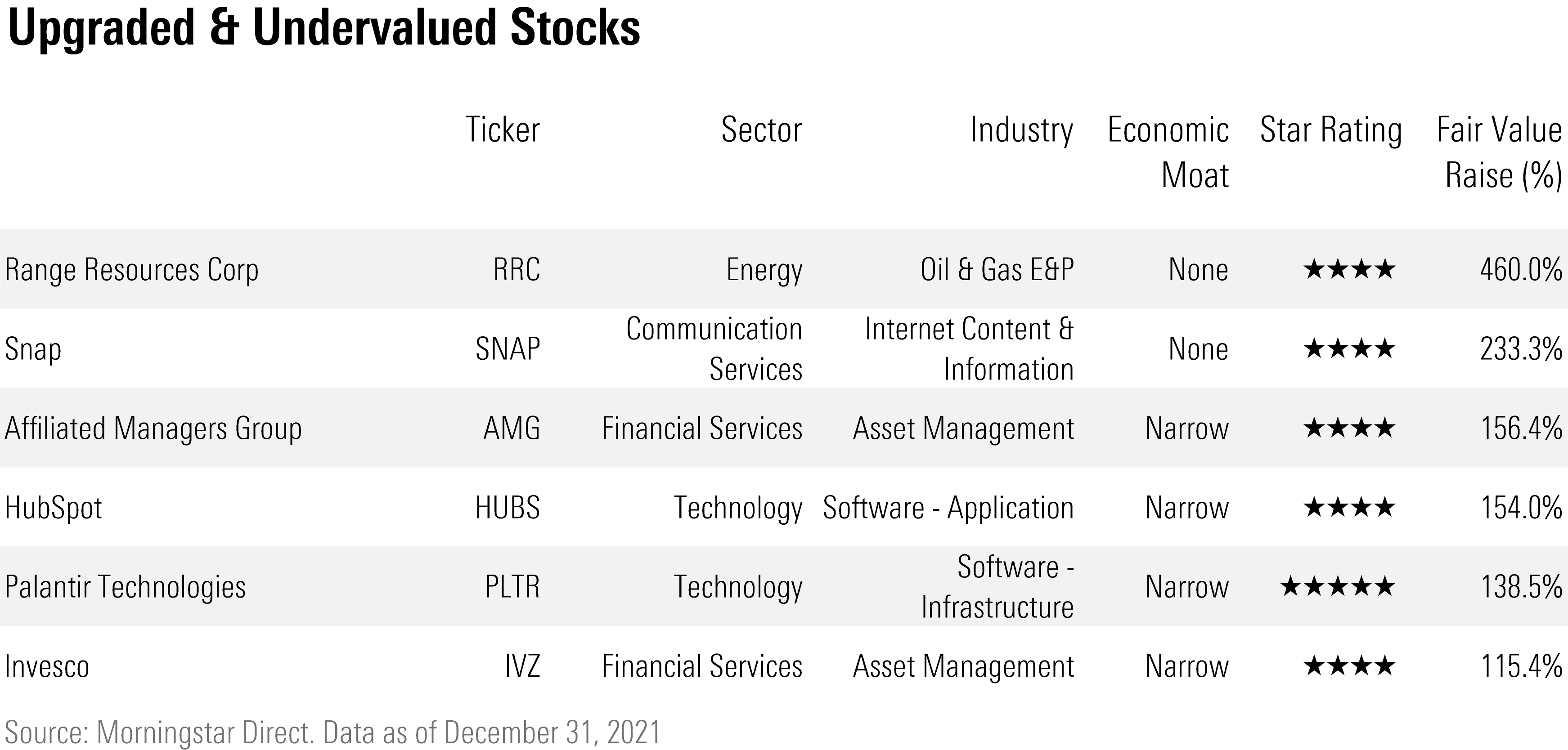

From there we screened for companies that are trading at prices below Morningstar’s fair value estimates, measured by those changing hands in the 5- or 4-star Morningstar Rating territory. A list of 25 undervalued stocks with the largest 2021 fair value increases can be found at the end of this article, but we’re highlighting six of those with the largest upgrades.

Here’s a close look at these six stocks:

Range Resources Corp RRC

As was the case for many energy companies, rising gas and oil prices translated into a sharply higher fair value estimate for Range Resources in 2021. Early in the year, energy sector director David Meats raised Range Resources’ fair value estimate to $9.25 per share from $5 per share. Behind this increase were higher oil and gas prices, along with news from the company that it had higher-than-expected production during 2020’s fourth-quarter earnings, resulting in higher cash flows.

Meats raised the fair value estimate again in late October after he and his team raised their long-term forecasts for natural gas prices to $3.30 per cubic thousand feet from $2.80/mcf.

“The increase, coupled with a stronger near-term pricing outlook, catapults our valuations for natural gas producers. Range Resources, which still has above-average leverage despite much improvement, is particularly sensitive,” Meats says. Range Resources trades at a 33% discount.

Snap SNAP

Snap, the parent company to Snapchat and Spectacles, had a volatile 2021, with the stock rallying as high as 68% before finishing the year down 4.7%. Along with that came a big increase in its fair value estimate, but one that analyst Ali Mogharabi scaled back before year's end.

Mogharabi raised Snap’s fair value estimate four times during the first half of 2021, lifting it from $28 per share to $74 after second-quarter earnings. While Mogharabi is skeptical of Snap’s ability to maintain 50% growth in the face of competition for advertisers from TikTok, Google GOOGL, Facebook FB, and Pinterest PINS, he remains bullish on the stock.

However, Snap’s third-quarter results sent the stock sharply lower as the company reported lower user monetization rates despite better-than-expected user growth.

In response, Mogharabi lowered his fair value estimate back to $70 per share. However, he is bullish on the stock, expects the company to turn a profit in 2023, and still sees the stock as undervalued.

“We project tremendous revenue growth for Snap at a 10-year average rate of 30%. Revenue growth will be driven primarily by growth in the firm’s daily active users, user engagement, overall online advertising spending, more adoption of the augmented reality ad format, and an increasing allocation of online ad dollars toward mobile and social network ads, in addition to the firm’s more aggressive monetization of Snap Map, communication, and camera,” says Mogharabi. Snap trades at a 40% discount.

HubSpot HUBS

HubSpot, a cloud-based markets, sales, and customer service platform, beat earnings expectations throughout 2021. The company has established itself as a customer service and engagement software provider for small to medium-size businesses, a demographic that analyst Dan Romanoff sees as underserved by enterprise-level competitors. While Romanoff says HubSpot excels in serving these businesses, he sees it gradually expanding to serve enterprise customers as well. “Enterprise customers generate higher revenue and higher retention. We estimate the enterprise tier makes up approximately 10%-15% of the paying customer mix, which has slowly ticked up over time. As customer size increases, switching costs will strengthen,” he says.

The company announced several new products during its 2021 investor day, which Romanoff says is building the foundation for additional sources of revenue in the future. He highlights a new payment solution HubSpot announced as a significant opportunity capable of potentially adding hundreds of millions of dollars in annual revenue. Romanoff raised HubSpot’s fair value estimate a total of five times in 2021 from $248 per share, to $630. The CRM provider currently trades at a 17% discount.

Palantir Technologies PLTR

Over the course of 2021, analyst Mark Cash raised the fair value estimate for Palantir five times, from $13 per share to $31.

Palantir provides a combination of software and consultation services for big data analytics working with the U.S. government's military, intelligence, and police on areas such as counterterrorism. The company recently turned its attention to the commercial market.

As of the third quarter, Palantir reported a 20% increase in its customer base, with commercial customers up 46% from the prior quarter. Cash notes that Palantir has been building up strategic partnerships to expand the reach of their software--such as a partnership with IBM IBM to allow their software to be available on IBM’s hybrid-cloud data and AI platform.

“We believe a robust growth trajectory comes from new commercial ventures on top of a strongly expanding government base, and that installation efficiencies and the strategic shift toward a software-as-a-service model will be conducive to margin expansion throughout the 2020s,” says Cash. Palantir trades at 46% discount.

Affiliated Managers Group AMG and Invesco IVZ

Asset managers Affiliated Managers and Invesco both saw their fair value estimates raised four times in 2021 by sector strategist Gregory Warren. The strong rebound of the stock market from coronavirus pandemic lows improved the outlook for the nine U.S.-based asset management firms covered by Morningstar, Warren says. AMG and Invesco both registered fair value estimate increases of 110%, above the average fair value increase for asset managers of 74% in 2021 and north of those for Warren calls “best in class operators,” such as BlackRock and T. Rowe Price TROW.

“We are always fond of saying that where the asset and wealth managers are today has a big impact on where they will be five to 10 years from now, so we have to not only be cognizant of where things are today but where we expect them to be going in the long run,” says Warren. Both AMG and Invesco now trade in 4-star territory, with AMG at a 19% discount and Invesco 14% below its fair value estimate.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GPEM2ZD3M5BZDLXHI7WZ7SAP3M.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBSOLE2V55DCJIG6UOO5DM45MY.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)