Value vs. Growth Funds: Value's Revival Is Uneven

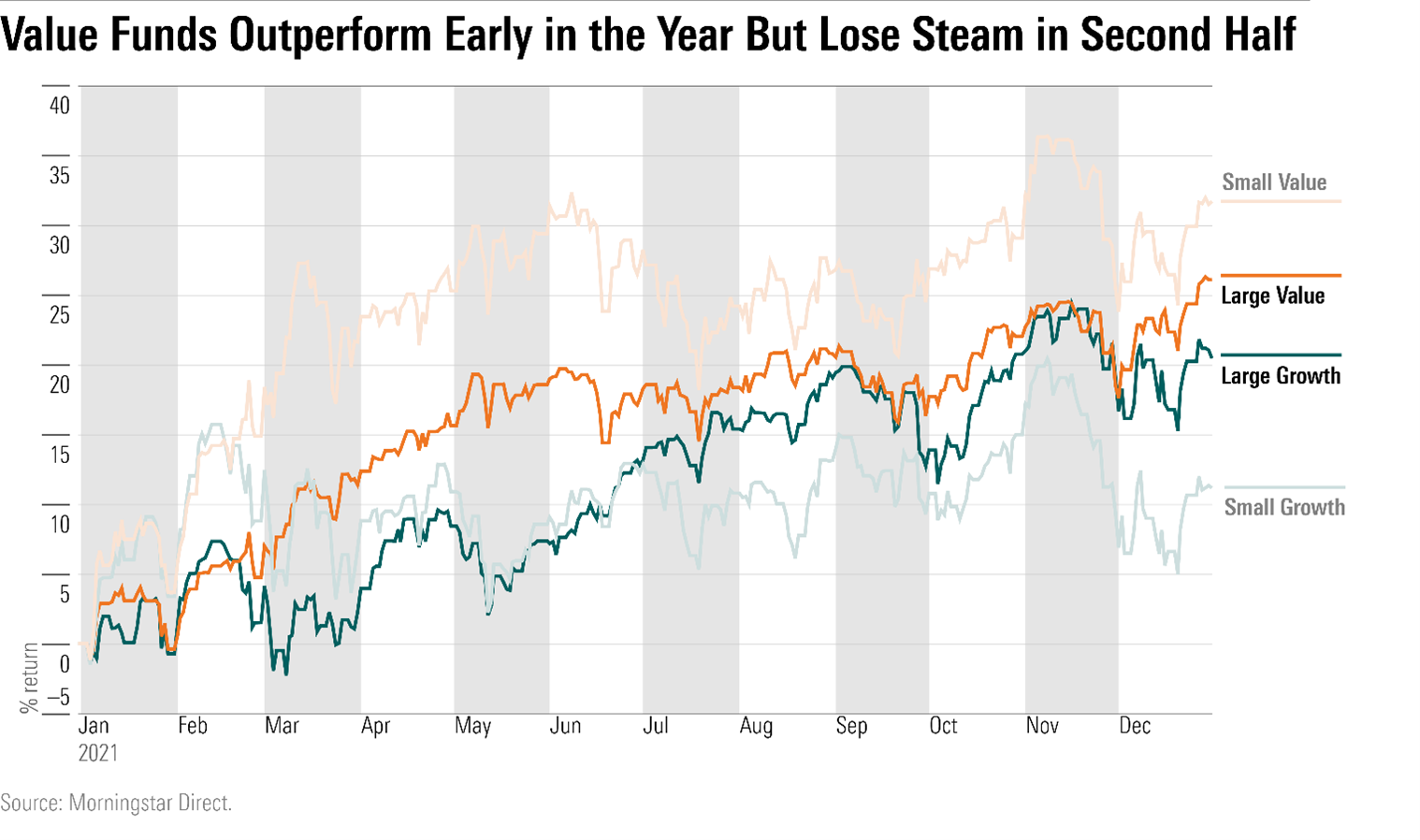

Value funds outperformed growth in 2021, but their advantage waned over the course of the year.

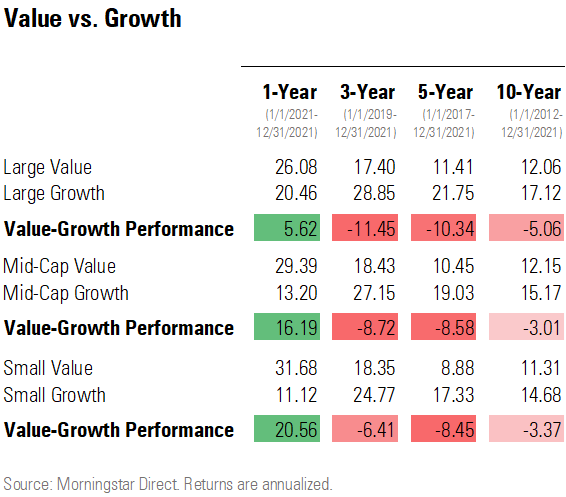

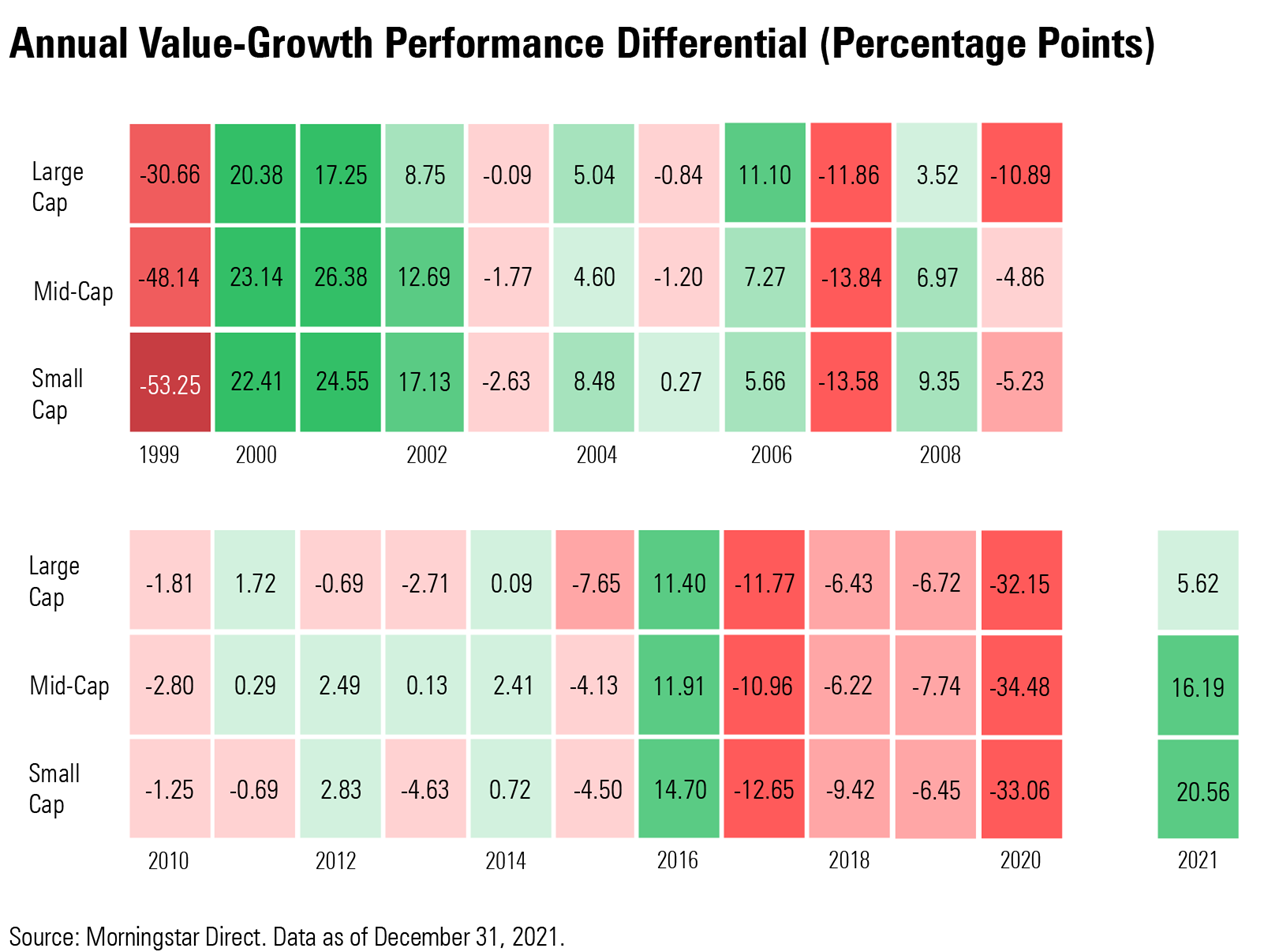

Value funds made a long-awaited return in 2021, though the comeback might not have been as dramatic as some hoped. Following their worst year relative to growth funds, value funds of every market capitalization outperformed their growth counterparts for the year.

The comeback was most evident in small-cap funds. Small-value funds on average gained 31.7%, the most of any Morningstar Style Box category, while small-growth funds only advanced 11.1% in 2021, a 20.6-percentage-point difference. Strong performance from regional banks boosted small-value funds, while struggling biotech firms hurt small-growth funds.

Value's outperformance was less extreme among large-cap funds. Large value and large growth both ended the year up more than 20%, with large value besting growth by only 5.6 percentage points. In 2020, large-growth funds trounced their value counterparts by more than 30 percentage points.

Value funds recorded their worst year versus growth in 2020 as technology and communication-services companies, which are more commonly held in growth-oriented funds, led the U.S. market rebound from its March lows. This year, as the economic recovery broadened, oil prices rallied, and the housing market heated up, every sector recorded gains and some long-struggling value stocks came to life.

In 2021, value funds beat growth funds for the first time since 2016. For mid-cap value and small-cap value funds, it was their best year relative to their growth counterparts since 2001, when value funds rallied following the burst of the dot-com bubble. (Morningstar Direct clients can download a PDF version of our value vs. growth heatmaps here.)

Value funds handily outperformed growth for the first six months of the year but stayed even with growth in the second half as the outlook for U.S. markets became more uncertain, with investors weighing the impact of supply-chain problems, inflation, new coronavirus variants, and a less accommodating Federal Reserve policy.

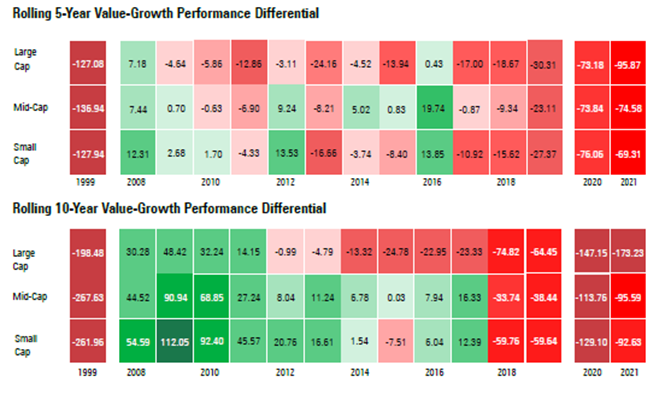

Though the gap slimmed in 2021, value investors are still at a disadvantage over the longer term. Small-value funds trail small-growth funds by 92.6 percentage points over the past 10 years.

The long-term gap for large-value investors is even wider. Large-value funds have lagged large-growth funds by 173 percentage points since 2012.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)