Healthcare Stocks Dogged by U.S. Policy Concerns

Large biopharma names are undervalued while device and diagnostic industries look pricey.

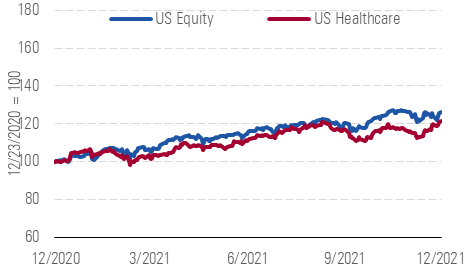

As the markets have remained optimistic over the past 12 months, the Morningstar's US Healthcare Index has increased 21%, but this underperforms the broader equity market's 26% gain. We believe already high valuations in the devices/diagnostics industry combined with U.S. drug policy concerns lingering around biopharma stocks have both contributed to the lower relative performance of the healthcare segment. A long process around potential U.S. drug policy changes is likely weighing on the valuations of global stocks since the U.S. market represents a disproportionate share of profits for many global healthcare companies. We continue to expect only modest policy change.

Healthcare Sector Index Versus Market Index

Source: Morningstar analysts

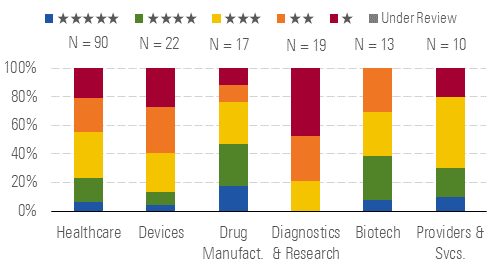

We view the healthcare sector as slightly overvalued. Our coverage trades at a premium to our overall estimate of intrinsic value with the median price to fair value at 1.09. We see fewer "buys" in the sector, with roughly 25% of our coverage rated 4 or 5 stars.

Star Rating Distribution and Average P/FV for Sector and Key Industry Groups

Source: Morningstar analysts

However, we view the valuation in the sector as split between a general undervaluation in the larger biopharma group and an overvaluation in the device and diagnostics industries. The biopharma valuations imply a high degree of risk involving potential changes in U.S. healthcare policies targeting drug prices. While changes in U.S. drug pricing policies to help reduce out of pocket costs are likely, we don't envision major changes like international reference pricing due to the strong biopharma lobbying group, concerns about disrupting innovation, and a razor thin Democratic majority with different views than Republicans on addressing drug prices. Despite the uncertainty on drug policy, the outlook fundamentally for biopharma firms remains strong with low patent exposure and several new innovative drugs launching and gaining market share.

Conversely, many diagnostic companies look overvalued as they directly benefit from pandemic-related testing and vaccination activities. While the latest virus variants will likely continue driving higher testing volume, we anticipate this revenue to fade over the next few years, as testing becomes increasingly commoditized and vaccination levels grow.

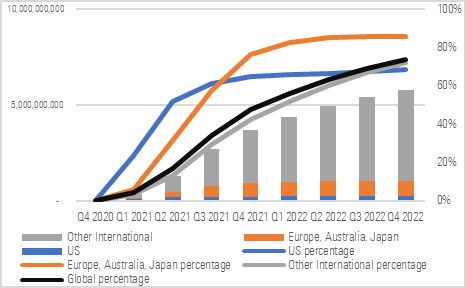

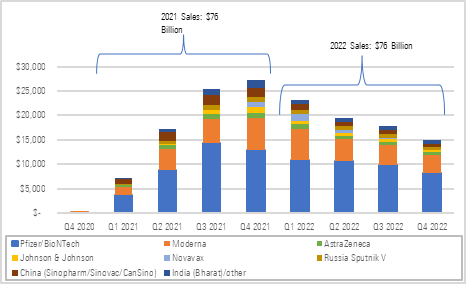

While the coronavirus variants raise the bar to achieve herd immunity, we expect a return to near normal over the next two years in most developed markets as vaccinations climb and new effective oral treatments reach the market. Several players in the biopharma group will gain a windfall of cash from COVID vaccines, but we don't forecast a long tail of this revenue, which limits the valuation impact.

Global Vaccination Rates Continue to Grow

Source: Morningstar analysts

Massive Cash Windfall of COVID-19 Vaccines Through 2022

Source: Morningstar analysts

Top Picks

Biomarin Pharmaceutical

BMRN

Star Rating: ★★★★

Economic Moat Rating: Narrow

Fair Value Estimate: $105

Fair Value Uncertainty: Medium

We view BioMarin as undervalued as the market overreacted to the delayed launch of hemophilia A gene therapy Roctavian. BioMarin's orphan-drug portfolio and strong late-stage pipeline continue to support a narrow moat rating, and despite Roctavian's delay (launch likely in 2022 instead of 2020), we're still bullish on the launch of achondroplasia drug vosoritide in 2021. In addition, we still think Roctavian data support the drug's safety and long-term efficacy, and competitors are just entering phase 3 trials. Similarly, BioMarin is far ahead of competitors in achondroplasia, which has no approved treatments.

MRK

Star Rating: ★★★★

Economic Moat Rating: Wide

Fair Value Estimate: $94

Fair Value Uncertainty: Medium

Merck's combination of a wide lineup of high-margin drugs and vaccines along with a pipeline of new drugs should ensure strong returns on invested capital over the long term. Merck is well-positioned to gain further entrenchment in immuno-oncology with Keytruda, which holds a strong first-mover advantage in the large first-line non-small-cell lung cancer market with excellent data. Also, we expect Keytruda to gain approvals in early-treatment settings, which should open up underappreciated sales potential. Merck's vaccines look ready to drive further gains, led by human papillomavirus vaccine Gardasil.

Star Rating: ★★★★★

Economic Moat Rating: Wide

Fair Value Estimate: $192

Fair Value Uncertainty: Medium

With the addition of smaller competitor Biomet, Zimmer is the undisputed king of large joint reconstruction, by far. We expect favorable demographics, which include aging baby boomers and rising obesity, to fuel solid demand for large-joint replacement that should offset price declines. However, Zimmer stumbled into a series of pitfalls in 2016-17, including integration issues, supply and inventory challenges, and quality concerns that have caught the attention of the U.S. Food and Drug Administration. But new management has tackled these issues, and the firm is poised to ramp up its growth.

MORN DODFX VINIX VWILX TSVA EGO WU Brightstart429plan MRO VZ MOAT T NKE CMCSA GOOG

/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)