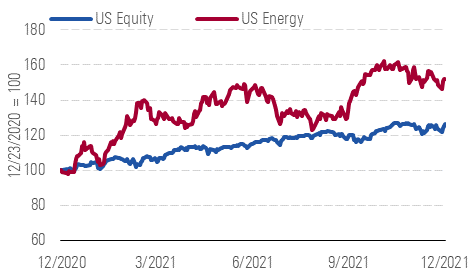

Despite Outperformance in 2021, Energy Stocks Look Undervalued

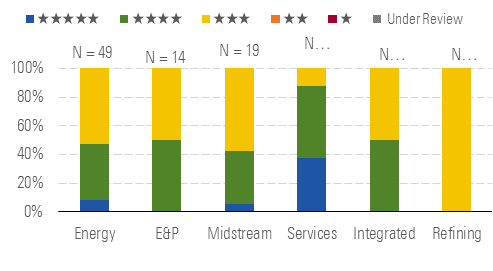

The oil services segment looks especially cheap.

The Morningstar US Energy Index underperformed the broad market in the fourth quarter, returning 6.15% versus the market's 8.6%. We view energy as undervalued, with the median stock trading at a 14% discount. Opportunities exist across all segments, but the much-maligned oil services segment stands out, trading at an average discount of 32%.

Energy Leads All Sectors Year to Date, Returning 52%

Source: Morningstar analysts

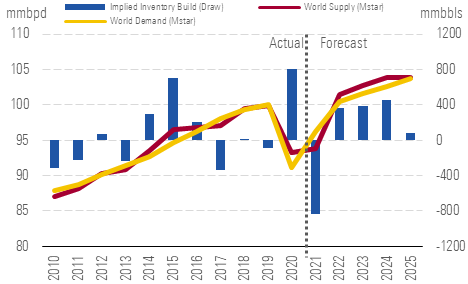

The introduction of the omicron variant is unlikely to disrupt energy markets, even though it appears to be highly transmissible and potentially capable of bypassing existing immunity. We do not see enough appetite around the world for sustained lockdowns, and without such restrictions the impact on global crude consumption will be limited. Countries with high vaccination rates can maintain normal travel rates and countries with low vaccination rates tend to have fewer white collar works with the freedom to work from home for sustained periods. In addition, the latest strain is likely to prompt greater vaccination rates and adoption of “booster” shots, further ameliorating the impact. Our demand forecast already incorporated periodic resurgences of COVID-19, and the omicron variant does not yet warrant a change. We continue to expect global consumption to shake out at 96.2 mmbpd and 100.4 mmbpd, respectively in 2021 and 2022.

The Oil Services Segment Offers the Best Value in Energy

Source: Morningstar analysts

In its Dec. 2 meeting, OPEC acknowledged the omicron variant, but declined to change its expansion plan calling for an incremental 400 mb/d supply each month until its COVID-related production cuts are unwound. But the cartel has been struggling to meet this target, and we think this is a trend that will continue. The underperformance is likely due to underinvestment and structural hurdles, especially in the two main laggards, Angola, and Nigeria.

Supply Will Lag Demand Next Year Due to Producer Capital Discipline

Source: Morningstar analysts

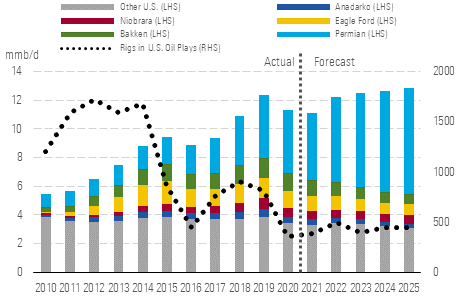

In the U.S., private oil producers continued to add rigs in the fourth quarter, but for the first time since March we saw a slight uptick from public companies as well. We view these public additions less as succumbing to higher prices, but rather it's more likely that as year-end approaches, the more efficient operators are realizing they can squeeze an extra rig or two into the budget. Across our upstream coverage, the message was consistent in the third-quarter earnings calls: shale firms are unwilling to pursue significant growth while latent supply remains within OPEC. Our updated estimates are 93.9 mmbpd and 101.5 mmbpd for 2021 and 2022, respectively.

A Modest Rig Count Recovery Will Limit the U.S. Supply Recovery in 2022

Source: Morningstar analysts

Top Picks

Schlumberger

SLB

Star Rating: ★★★★

Economic Moat Rating: Narrow

Fair Value Estimate: $49

Fair Value Uncertainty: High

Although rallying share prices have removed much of our oilfield-services coverage from deeply undervalued territory, investors can still get industry leader Schlumberger for a bargain. We expect industry activity to recover from COVID-19, with long-run activity in international markets (where Schlumberger focuses) even surpassing pre-pandemic levels. We think Schlumberger will continue its historical record of leading peers in technological progress and generating high returns on capital.

XOM

Star Rating: ★★★★

Economic Moat Rating: Narrow

Fair Value Estimate: $76

Fair Value Uncertainty: High

Exxon management responded to shareholder concerns and activist pressure by pulling the reins on its once-aggressive investment plan. However, it still plans to double earnings from 2019 levels by 2025 and double cash flow by 2027 on a combination of structural operating cost reductions and portfolio improvement and growth across its upstream, downstream and chemical segments. Exxon estimates under the current plan it will generate about $100 billion in surplus cash, after funding investment and paying the dividend, during the next five years. As such, we expect its current repurchase program of $10 billion over the next 12-24 months to be just the beginning. This combination of potential earnings growth and cash return is unrivaled elsewhere in the sector.

PXD

Star Rating: ★★★★

Economic Moat Rating: Narrow

Fair Value Estimate: $222

Fair Value Uncertainty: Medium

Historically one of the shale industry's more profligate capital allocators, Pioneer is now a poster child for capital discipline and intends to reinvest only 50%-60% of cash flows (still enough to keep output growing at 5% annually). Much of the remainder will be redistributed to shareholders via a variable dividend that will keep payouts calibrated with the commodity cycle, setting an example all peers should follow. Its zero-basis Midland Basin acreage contains enough top-tier drilling opportunities to support decades of high-margin drilling.

/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)