Which Consumer Defensive Firms Can Withstand Inflation?

The market underappreciates consumer packaged goods manufacturers.

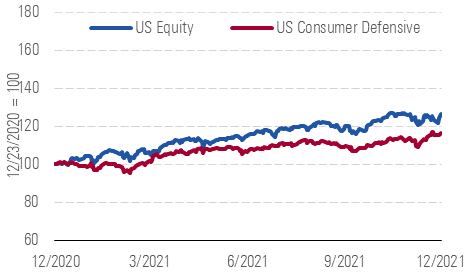

The consumer defensive sector generally performed in line with the broader market in the fourth quarter, chalking up an 8.8% quarter-to-date gain (as of Dec. 23) (Exhibit 6a).

Consumer Defensive Generally Paced the Broader Market in the Quarter

Source: Morningstar analysts

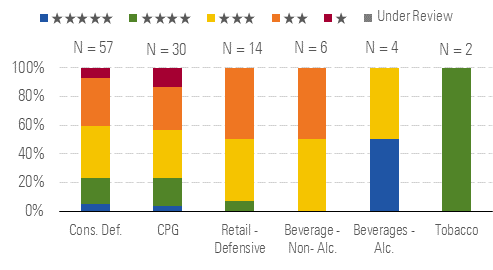

And although the median consumer defensive stock trades at a 6% premium to our assessment of intrinsic valuations (roughly in line with the 3% premium we witnessed in September), we see a few pockets of value (Exhibit 6b). In this context, nearly 25% of our consumer defensive coverage now trades in 4- or 5-star territory, half of which fall within the consumer packaged goods realm. Despite chalking up decelerating sales, we don't think the market appreciates the strategic enhancements CPG manufacturers made prior to the pandemic.

Investors Should Feast on Consumer Packaged Goods Stocks

Source: Morningstar analysts

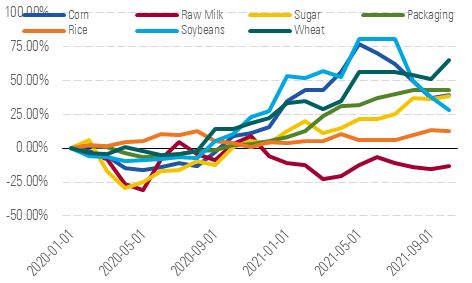

We also recognize that inflation has come barreling back (a direct offshoot of the COVID-19 malaise, in our view). We attribute the extensive depth and breadth to heightened demand for a plethora of offerings against a strained supply backdrop (stemming from labor shortages and plant closures to curb the virus' spread). In this context, soybean prices have soared 30% since the beginning of 2020, while corn and wheat have shot up at 40% and 65% respective clips (Exhibit 6c). Despite this, we've long held that operators have a number of tools at their disposal to buffer profits, including raising prices, pursuing cost savings initiatives (which could encompass the adoption of increased automation and thus a lower dependence on labor), and employing revenue management opportunities.

Cost Inflation Rages Among a Legion of Commodities, Hindering Profits

Source: Morningstar analysts

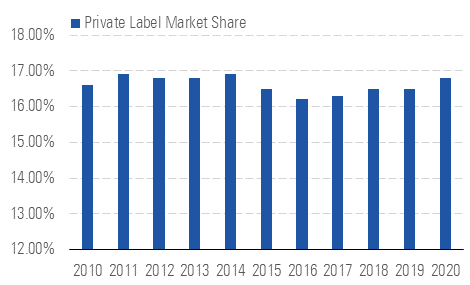

In addition, we don't subscribe to the belief that competitive pressures will lie dormant, as has been the case for much of the past two years. Rather, we anticipate that against a backdrop of pronounced price increases at the shelf, consumers could choose to add private-label fare to their baskets to a greater extent. Private label market share in U.S. packaged food has held steady over the past 10 years—at a mid- to high-teens level on a value basis (Exhibit 6d), but over a longer horizon, private label has won out in more commoditized categories or aisles where innovation has been lacking. As such, the onus remains on consumer product manufacturers to continue expending resources towards research, development, and marketing to ensure their products align with evolving consumer trends and stand out at the shelf.

Private-Label Share of U.S. Packaged Food Hasn't Oscillated Much

Source: Morningstar analysts

Top Picks

Kellogg

K

Star Rating: ★★★★

Economic Moat Rating: Wide

Fair Value Estimate: $85

Fair Value Uncertainty: Medium

At a 25% discount to our valuation, we think investors should consider wide-moat Kellogg. Years before COVID-19 came on the scene, Kellogg started taking steps to alter its mix toward more attractive alcoves (from a category and geographic perspective), which we believe the market fails to appreciate. More specifically, over the past decade, Kellogg has shifted its product mix away from the mature cereal aisle toward on-trend snacking. In addition, this wide-moat operator has pursued inorganic means to build out its reach in faster-growing emerging markets (which now account for more than 20% of its sales base).

SAM

Star Rating: ★★★★★

Economic Moat Rating: Narrow

Fair Value Estimate: $750

Fair Value Uncertainty: Medium

Shares of narrow-moat Boston Beer, a leader in U.S. high-end malt beverage and adjacent categories, trade about 30% below our intrinsic valuation. We posit the firm has shown a proclivity to augment its portfolio in alignment with the latest growth vectors and capture a disproportionate share of the economic rents generated from this growth by being one of the first movers. While seltzer trends have slowed, we surmise Boston Beer's sales will remain supported by secular consumption shifts (such as the desire for a low-sugar footprint and varied flavor profiles, and as evidenced by the launch of the malt cocktail Bevy Long Drink).

Star Rating: ★★★★★

Economic Moat Rating: None

Fair Value Estimate: $119.00

Fair Value Uncertainty: High

Beyond Meat shares are attractive, trading at a 42% discount to our $119 fair value estimate. We think investor fears about slowing U.S. retail demand for plant-based meat are unwarranted, as the slowdown appears to be the result of the pandemic-driven surge in 2020. In our view, growth should reaccelerate in 2022 when McDonald's McPlant launches across the globe, supported by Beyond Meat's first large-scale advertising campaign. We expect this product will ultimately amount to nearly $250 million in incremental global sales in 2022, accounting for 50% growth from the $480 million in total company sales we expect in 2021.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RZEYRM7QNVE63FSD5LZOBHHTTQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)