Basic Materials Stocks Look Expensive

After a strong performance in 2021, the sector offers little opportunity today.

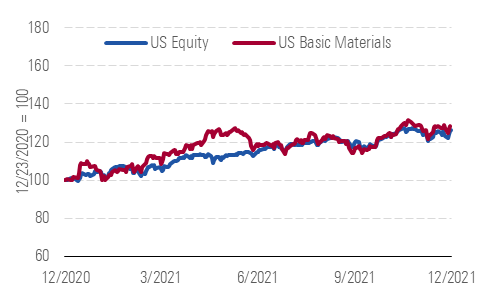

The Morningstar U.S. Basic Materials Index outperformed the broader market during the fourth quarter of 2021 by roughly 460 basis points. The excess return in the fourth quarter resulted in the basic materials sector outperforming the market by nearly 310 basis points on a trailing 12-month basis. We see limited opportunities across the sector with a few undervalued names trading in 4-star territory, but none trading in 5-star territory.Basi

Global Materials Index versus Global Equity Index

Source: Morningstar analysts

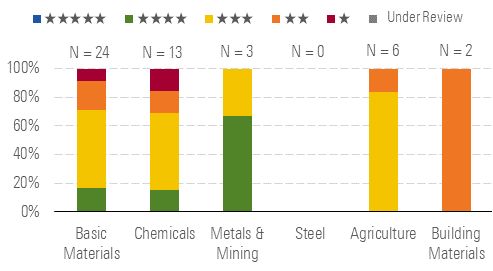

Most Materials Stocks Trade Near or Above Their Fair Value Estimates

Source: Morningstar analysts

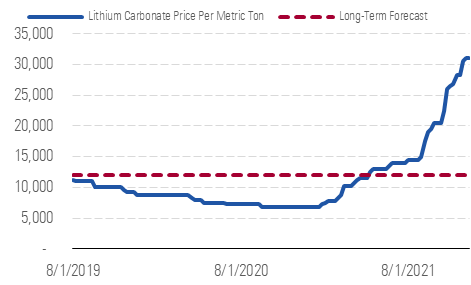

Lithium is one of the best ways to invest in greater electric vehicle adoption as all EVs need batteries and all EV batteries require lithium as the energy storage component. As lithium demand outpaces the ramp-up of new supply, we expect prices will remain elevated over the next several years. Over the long term, we forecast prices will settle at $12,000 per metric ton for lithium carbonate, below current prices but above the recent cyclically low levels in 2020.

We Forecast Long-Term Lithium Prices Below Current Spot Prices

Source: Morningstar analysts

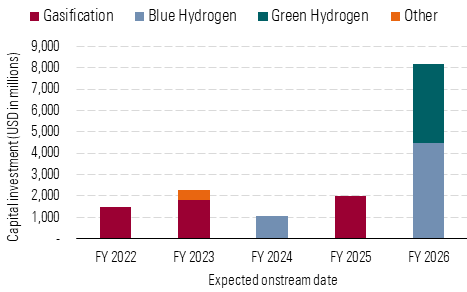

Air Products Is Making Major Investments in Blue and Green Hydrogen

Source: Morningstar analysts

Industrial gas firms are well-positioned to navigate inflation and energy price volatility. Industrial gas producers have resilient business models, particularly in the on-site business, which benefits from long-term customer agreements with take-or-pay clauses, prices indexed to inflation, and energy cost pass-through mechanisms. In the long run, we also see potential upside from hydrogen as we expect industrial gas firms to participate across the entire spectrum of hydrogen production (including gray, blue, and green hydrogen) and distribution (including trucks, pipelines, and shipping).

We see long-term growth for specialty chemicals producers that sell to electronics end markets. As 5G and "Internet of Things" technologies require more advanced semiconductors and electronic components, specialty chemicals products should be able to sell more content per device, generating revenue growth at a mid- to high-single-digit annual average rate.

Top Picks

DuPont de Nemours

DD

Star Rating: ★★★★

Economic Moat Rating: Narrow

Fair Value Estimate: $96.00

Fair Value Uncertainty: Medium

Our top pick to play specialty chemicals demand growth is narrow-moat DuPont. The stock trades at a nearly 20% discount to our $96 per share fair value estimate. DuPont has been investing heavily in its electronic materials business. The company acquired Laird Performance Materials in July and plans to acquire Rogers Corp. next year. The company also plans to divest the majority of its mobility and materials portfolio. This should result in the electronics end market generating the majority of profits going forward. In its legacy water and protection business, DuPont should also benefit from the growth in U.S. housing starts. We view the current share price as an attractive entry point for the quality specialty chemicals producer.

Star Rating: ★★★★

Economic Moat Rating: Narrow

Fair Value Estimate: $98

Fair Value Uncertainty: Medium

Lithium Americas is our top pick to play growing lithium demand from increased EV adoption. The stock trades at a more-than 35% discount to our $45 (CAD 57) fair value estimate. Lithium Americas does not currently produce any lithium but is developing three lithium resources that should enter production by the end of the decade. Once all projects are fully ramped, we forecast the company will become a top five producer by capacity globally. We reiterate our very high uncertainty rating on the name. However, for investors that can tolerate the volatility, we view the current share price as an attractive entry point for the company.

Air Products & Chemicals APD

Star Rating: ★★★★

Economic Moat Rating: Narrow

Fair Value Estimate: $340

Fair Value Uncertainty: Medium

Air Products is our favorite pick in the industrial gas space. The stock currently trades in 4-star territory at a more-than 10% discount to our $340 per share fair value estimate. We believe that Air Products has emerged as a leader in clean hydrogen with recent announcements of several multibillion-dollar blue and green hydrogen mega projects. We expect these new investments to fuel strong growth, helping the company more than double its EPS over the next five years.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)