ETFs Cap Off Another Record Year of Flows With a Stellar December

2021 was a year of milestones for exchange-traded funds.

ETFs Cap Off Another Record Year of Flows with a Stellar December

Global stock markets punctuated a strong year in December. The Morningstar Global Markets Index--a broad gauge of global equities--shook off a rocky November and advanced 4.02% last month. The benchmark finished the year 17.8% higher than it started, marking its third consecutive year of double-digit returns. The Morningstar Core Bond Index did not see the same success, however, pulling back 1.61% for the year after a 0.29% loss in December.

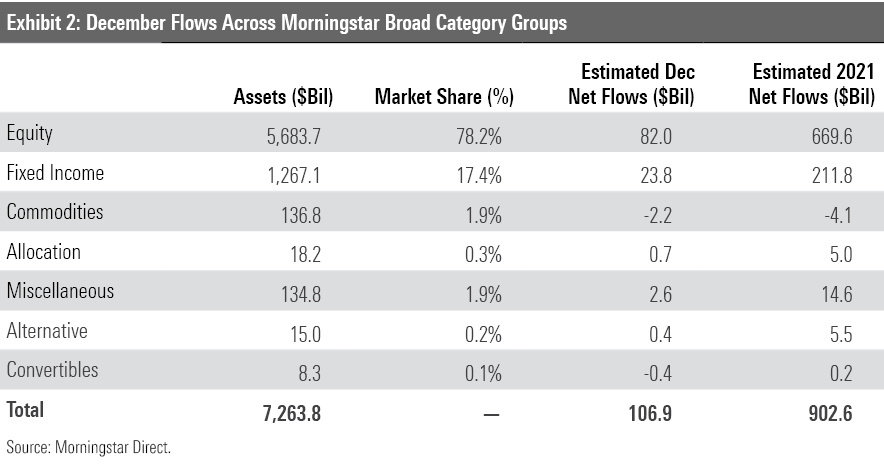

When the calendar turned to 2022, U.S. exchange-traded funds had reeled in $902.6 billion of net flows and held more than $7.2 trillion of investors’ money. That comfortably eclipsed the $500 billion they collected in 2020, the previous annual flows record. Stock ETFs led the charge, finishing with a record $669.6 billion in net flows after raking in $82 billion in December.

Here, we’ll take a closer look at how the major asset classes performed last month, where investors put their money, and which corners of the market look rich and undervalued at month’s end--all through the lens of ETFs.

Finishing Strong

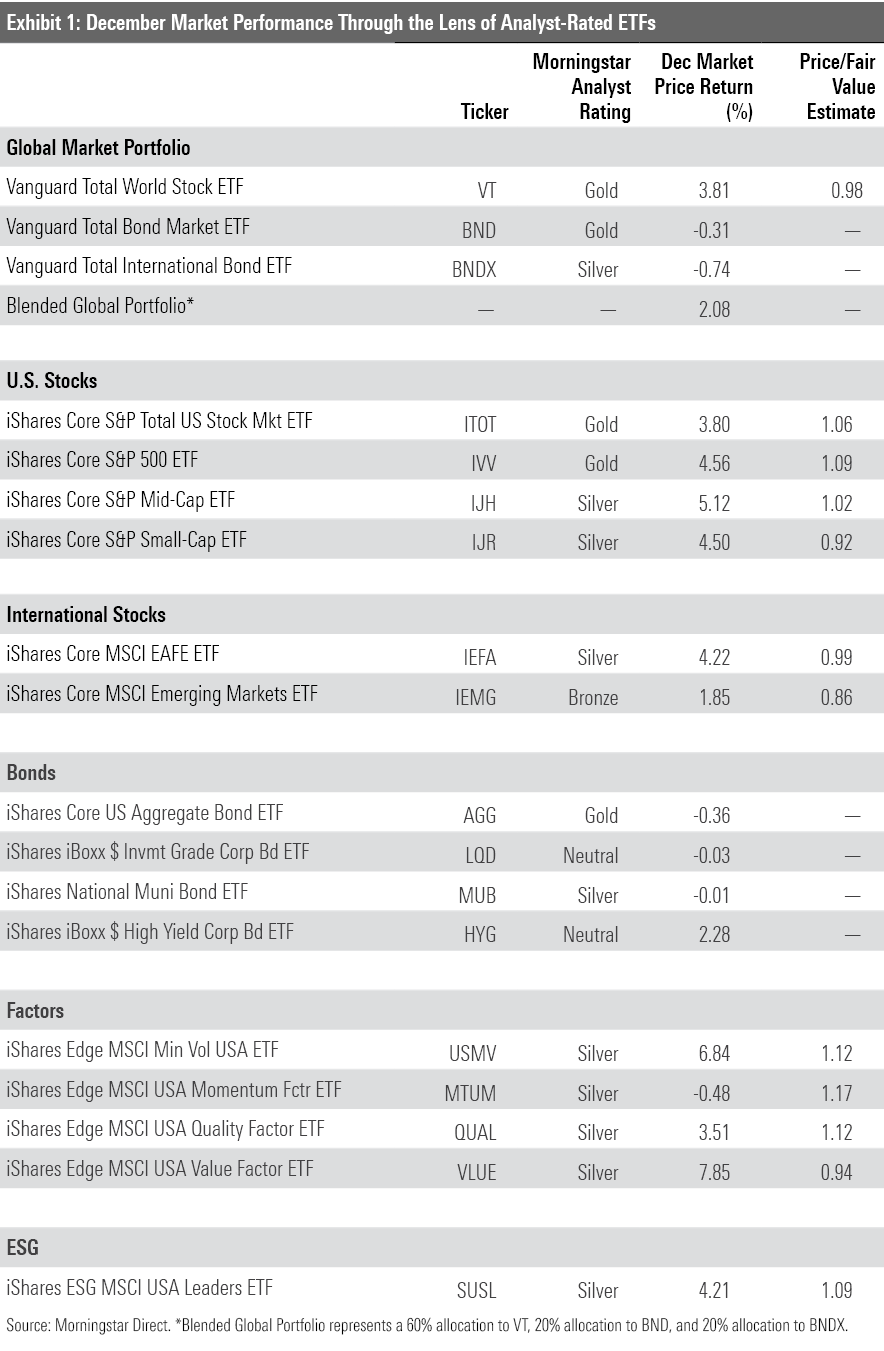

Exhibit 1 shows December returns for a sample of Morningstar Analyst-rated ETFs that serve as proxies for major asset classes. Investors in a blended global portfolio added 2.08% last month. As was the case for most of 2021, the portfolio’s stock sleeve shouldered the load. Vanguard Total World Stock ETF VT advanced 3.81% in December. Vanguard Total Bond Market ETF BND and Vanguard Total International Bond ETF BNDX, which shape the portfolio’s fixed-income allocation, slid 0.31% and 0.74%, respectively.

International stocks rebounded nicely last month after a lackluster November. Vanguard Total International Stock ETF VXUS climbed 3.58% in its best month of the year. Its stocks that reside in developed markets--particularly the United Kingdom, Switzerland, and France--steered its stellar performance. VXUS concluded an up-and-down year with a 9% gain.

U.S. stocks drove much of the blended portfolio’s growth for the year. IShares Core S&P Total U.S. Stock Market ITOT finished 2021 with a 25.67% return. Some of the uncertainty surrounding the Omicron variant of the coronavirus spilled into the first few days of December, but ITOT weathered that turbulence and added 3.8% for the month. Despite the continued pandemic and promise of several interest-rate hikes in 2022, investors appear confident that U.S. firms are poised to plow ahead.

December performance was quite even along the market-cap spectrum. IShares Core S&P 500 ETF IVV climbed 4.6% last month, and iShares Core S&P Small-Cap ETF IJR added 4.56% of its own. That same story unfolded over the course of the year. IVV notched a 28.76% gain for 2021 compared with 24.71% for IJR. Many of the S&P 500’s largest companies lived up to their billing in 2021; companies like Microsoft MSFT, Alphabet GOOG, and NVIDIA NVDA all posted annual returns greater than 50%. Small-cap stocks have not outperformed their larger brethren on an annual basis since 2016, when IJR led IVV by about 14.5 percentage points.

Each sector of the stock market finished December in the black for the second time in the past three months. Consumer Staples Select Sector SPDR ETF XLP led the way with a 10.45% gain, boosted by excellent months from firms like Procter & Gamble PG and Coca-Cola KO. Real Estate Select Sector SPDR XLRE notched a 10.27% December return. Consumer discretionary stocks barely cracked positive returns, however, as its two largest holdings, Amazon.com AMZN and Tesla TSLA, both finished last month in the red. No sector posted stronger growth in 2021 than energy. After the onset of the pandemic made for a dreadful 2020, Energy Select Sector SPDR ETF XLE rebounded to the tune of a 53.26% gain last year.

Consumer staples and real estate stocks tend to be popular choices for value strategies, so it’s no surprise that value funds stacked up well in December. Vanguard Value ETF VTV advanced 6.95% last month, compared with 1.57% for Vanguard Growth ETF VUG. Value stocks have tended to respond more harshly to adverse pandemic-related news than their growth peers, but record U.S. case levels and some renewed travel restrictions didn’t stunt their returns in December. While more twists and turns likely lie ahead, last month seems to indicate that investors may not have been as quick to respond to pandemic-related news as in previous months.

Returns between value and growth stocks see-sawed all year, and growth stocks finished on top. VUG’s 27.34% annual return edged out VTV’s 26.51% gain. While not the comeback that value investors hoped for when value stocks busted out of the gates in 2021, it marked value’s best relative performance since 2016, when VTV led its growth counterpart.

Another value fund, iShares MSCI USA Value Factor ETF VLUE, posted an even better finish to 2021. It advanced 7.85% in December--its best month of the year. VLUE led the iShares suite of single-factor strategic-beta funds with a 28.94% return in 2021, while iShares MSCI USA Momentum Factor ETF MTUM finished last with a 13.37% gain. Those roles were reversed in 2020, which underscores the case for multifactor funds that target an array of factors simultaneously.

Another Banner Year

In December, stock ETFs added an exclamation point to what was a year of milestones for ETFs. Investors poured $82 billion into these funds, which pushed their record-setting 2021 collection to $669.6 billion. That sailed past stock ETFs’ previous annual flows record of $332 billion, set in 2017. Stock ETFs claimed 74% of all inflows for the year, compared with 46% last year.

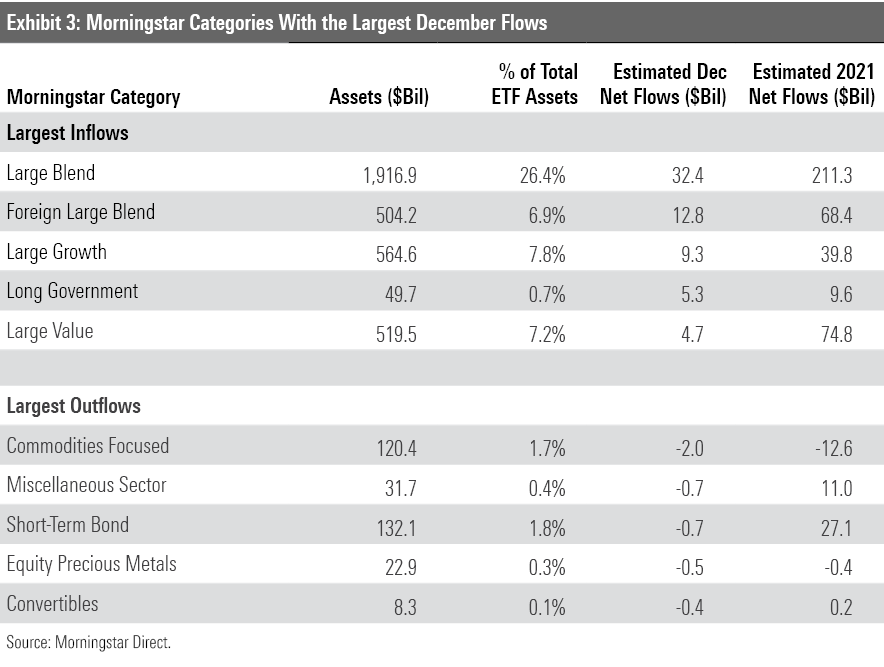

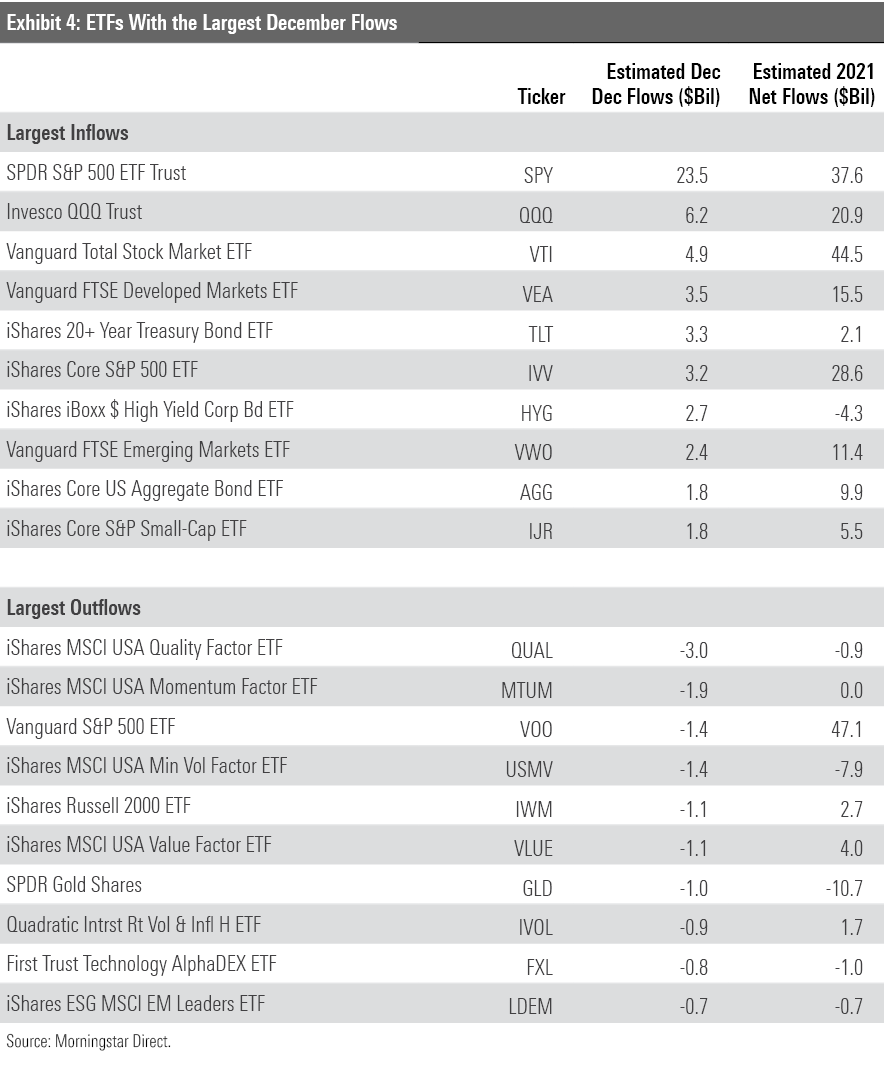

In keeping with the 2021 trend, U.S. large-blend ETFs led the way with $32.4 billion of net flows in December. When the book closed on 2021, the U.S. large-blend Morningstar Category had absorbed $211.3 billion of new money: 23% of all ETF inflows for the year. That reflects investors’ steady appetite for low-cost, broadly diversified index funds. Three of the top-four 2021 flows leaders (Vanguard S&P 500 ETF VOO, SPDR S&P 500 ETF Trust SPY, and IVV) track the S&P 500. The one that doesn’t (Vanguard Total Stock Market ETF VTI) is broader still.

International stock ETFs fared well in 2021. After raking in $12.8 billion in December, foreign large-blend funds had collected $68.4 billion for the year, third-most among all categories. Like in the stateside arena, broad, low-cost funds tended to attract most new money. Vanguard FTSE Developed Markets ETF VEA, iShares Core MSCI EAFE ETF IEFA, and VXUS--a trio of vast market-cap-weighted portfolios--led the way with between $12 billion and $16 billion of net flows apiece.

While performance between value and growth strategies was quite even in 2021, flows tipped decidedly toward value funds. U.S. large-, mid-, and small-cap value funds hauled in $91.3 billion for the year, compared with $48 billion for their growth peers. Flows have seemed to follow performance, though. Over the first five months--a stretch characterized by value stocks’ outperformance--U.S. broad-based value funds collected $61 billion of new money to growth funds’ $5 billion. Growth stocks mostly outstripped their value peers in the following months, however, and growth funds added about $43 billion to value funds’ $30 billion over the remainder of the year.

The year 2021 belonged to stock ETFs, but bond ETFs quietly came close to notching a fresh flows record of their own. They pulled in $211.8 billion last year, falling just short of the $212.2 billion record set in 2020. The $23.8 billion they absorbed last month was the most since April and provided a solid boost.

Inflation-protected bond ETFs capped off a landmark year with a strong December. These funds ended 2021 with $40.2 billion of new money to their names, a new flows record that shattered the previous record of $13 billion from 2020. Whether investors’ concerns about inflation persist throughout next year remains to be seen, but funds like iShares TIPS Bond ETF TIP--which led the category with $12.1 billion in net flows--certainly benefited from them in 2021.

Inflation-protected bond funds’ lucrative year masked weaker flows from other corners of the bond market. U.S. long-term bond ETFs collected a relatively modest $836 million, as interest rate uncertainties steered investors toward short-term options. Corporate bond ETFs bled $4.9 billion on the year, which marked the second-steepest outflows of all categories.

No category suffered more outflows in 2021 than focused commodities funds. These funds, which seek to replicate specific exposure to commodities like gold or oil, collectively leaked $12.6 billion over the course of the year. SPDR Gold Shares GLD was hit particularly hard, surrendering $10.7 billion on the year.

Active ETFs pulled in $3.8 billion in December, which raised their 2021 haul to $83.4 billion. About 9% of flows into all ETFs went into active funds. That may sound modest, but these funds represent only about 4% of the total ETF market. As more firms continue to roll out active ETF offerings, this number may continue to creep up in the years ahead.

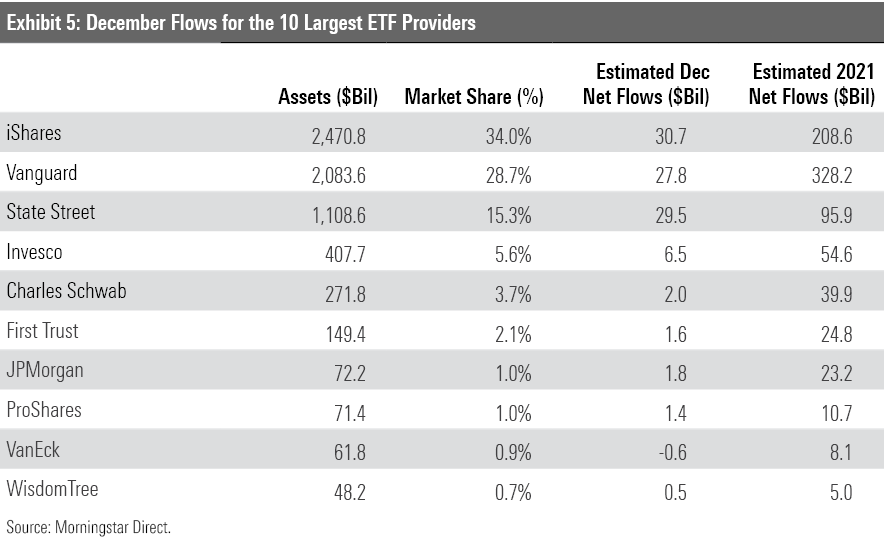

Vanguard Is the Victor

IShares topped the ETF provider flows league table for the second consecutive month in December, as it pulled in $30.7 billion. IShares 20+ Year Treasury Bond ETF TLT led the way with a $3.3 billion haul, which pushed the fund into positive flows territory for the year.

Still, the 2021 flows crown belongs to Vanguard. The firm, which specializes in broadly diversified, low-cost index funds, raked in $328.2 billion on the year, well ahead of its next-closest competitor iShares ($208.6 billion). Vanguard led all ETF providers in net flows in each month from January through October. Nine Vanguard ETFs pulled in more than $10 billion last year, headlined by VOO and VTI, which hauled $47.1 billion and $44.5 billion, respectively.

The same 10 firms to start 2021 on the list of 10 largest ETF providers also finished the year there. JPMorgan was the lone firm to move up on the list; the $23.2 billion the firm collected in 2021 bumped it up to seventh place from ninth place. Strong inflows into the firm’s BetaBuilders suite of funds, which offer broad exposure to an array of international markets, helped move it up the list. The firm’s active ETF offerings helped its cause as well. JPMorgan Equity Premium Income ETF JEPI and JPMorgan Ultra-Short Income ETF JPST collected $5.4 billion and $3 billion in 2021, respectively; both ranked within the top five of all active ETFs last year.

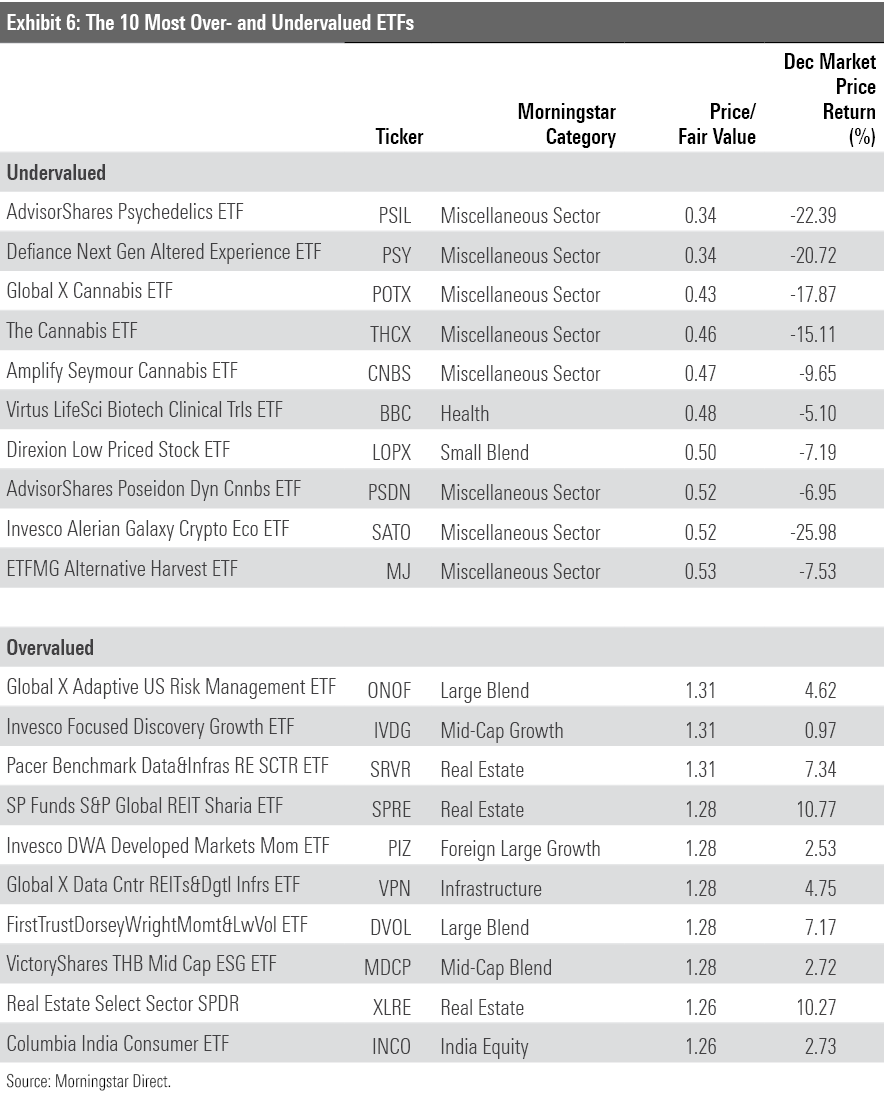

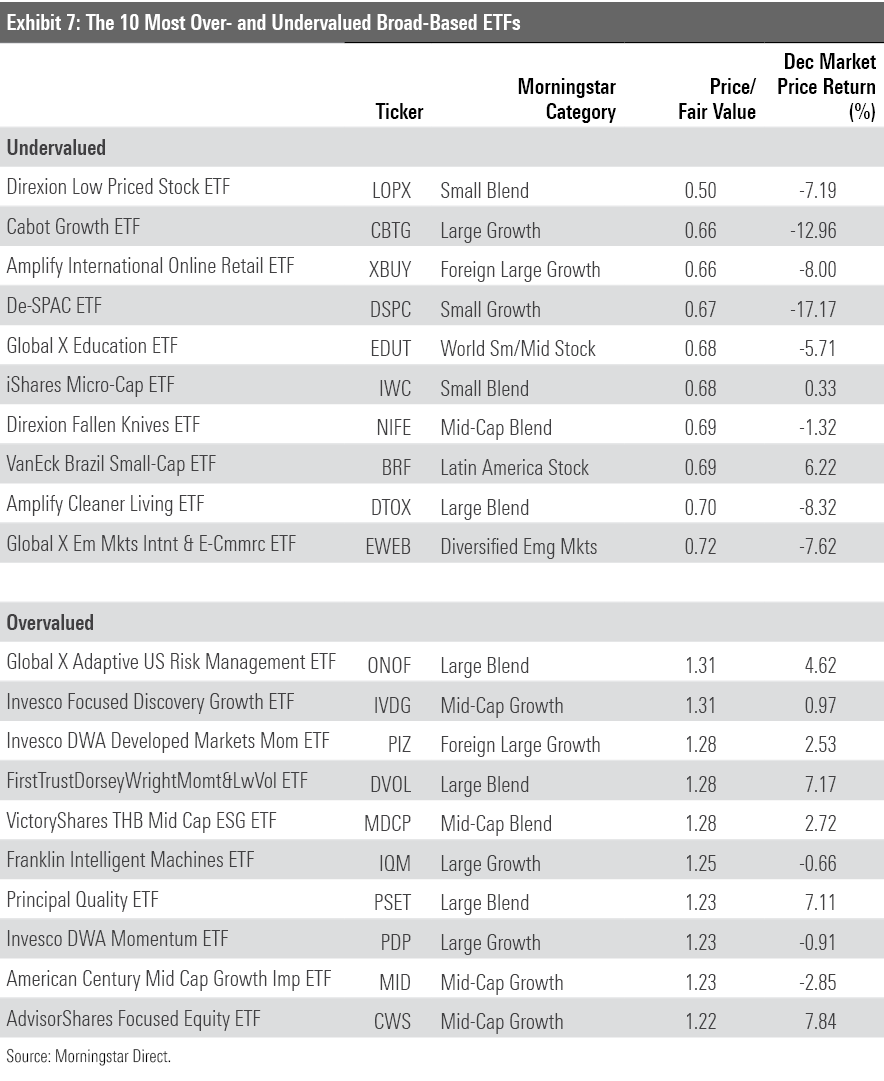

Cannabis Funds Look Cheap

The fair value estimate for ETFs rolls up our equity analysts’ fair value estimates for individual stocks and our quantitative fair value estimates for stocks not covered by Morningstar analysts into an aggregate fair value estimate for stock ETF portfolios. Dividing an ETF’s market price by this value yields its price/fair value ratio. This ratio can point to potential bargains and areas of the market where valuations are stretched.

ETFs that aim to leverage the legalization of cannabis or other drugs are heavily featured on the cheaper half of Exhibit 6, which shows funds that traded at the lowest prices relative to their fair value at the end of 2021. It was a painful year for these portfolios. Global X Cannabis ETF POTX, the largest of the bunch, dropped 39.27% in 2021. It slid at least 5% in each of the final seven months of the year. Cannabis stocks have broadly lost steam as legalization efforts have been placed on the back burner in Washington. Should they become a renewed priority down the road, these funds’ low valuations will leave them with plenty of room to run.

VictoryShares THB Mid Cap ESG ETF MDCP makes its third consecutive appearance on the pricier side of Exhibit 7. This active fund, born at the start of October 2021, features about 30 stocks with sound profitability and environmental, social, and governance characteristics. Investors should not be surprised to see ESG portfolios trade at lofty valuations. Funds that score well in ESG metrics also tend to be high-quality businesses--and those rarely come cheap. ESG strategies also tend to favor technology stocks, whose valuations usually exceed the energy and utilities companies that these funds often avoid. To be sure, tech stocks represented about 27% of MDCP at the end of December compared with 19% of the Russell Midcap Index, its category benchmark.

Editor's Note: This version has been corrected to indicate that U.S. long-term bond ETFs collected $836 million, not billion.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)