Growing a Client's Portfolio With High-Conviction Positioning

Scarce opportunities require a more focused approach to portfolio construction. Here are a few ideas worth exploring in 2022.

This is the second in a series of four articles collected from Morningstar Investment Management's 2022 outlook, highlighting the most important issues facing investors in the coming year. Philip Straehl is the group's global head of research.

Investors are entering 2022 with stocks at or near all-time highs--up over 100% from the market bottom in the United States, for example. Kick-started by unprecedented fiscal and monetary stimulus and sustained by rising investor exuberance--special-purpose acquisition companies, IPOs, and meme stocks, for example--sharp gains across risk assets such as equity and credit have left investors with only a small number of investment opportunities. That requires an increasingly focused approach to portfolio construction.

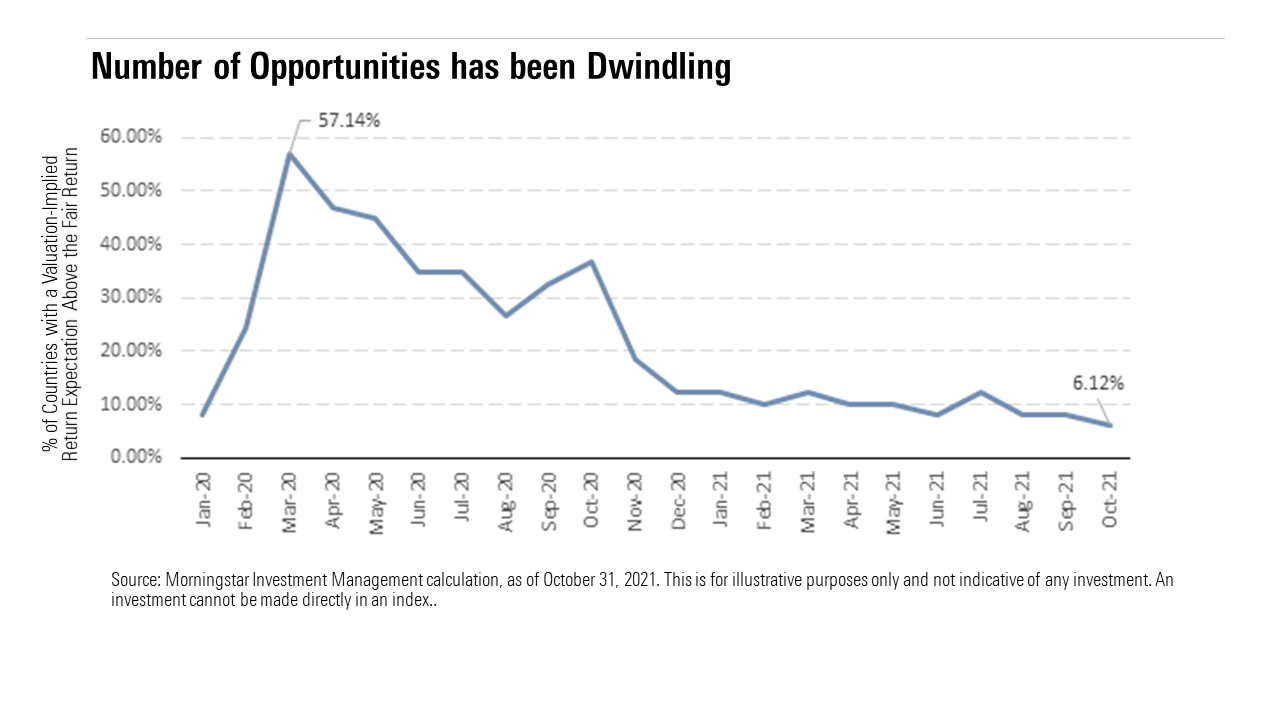

When assessing the number of attractive asset-class opportunities, we tend to look at the percentage of assets that trade above their fair return, which is the return we expect to realize when the asset is trading at fair value.

The number of assets that are fairly valued based on our valuation models has declined since last year. For instance, in March 2020, 57% of all country equity markets that we track traded at a discount to their intrinsic value, and that fell to only 6% of all country markets as of the end of October 2021.

In this context, it is prudent to recall Warren Buffet's guidance: "Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble." During the height of the pandemic-induced sell-off in March 2020, we were in an environment where opportunities were plentiful, and a very targeted approach wasn't required. Today, the situation is different. Investors ought to take a more measured approach to constructing their portfolios: that is, put out the thimble and save the proverbial bucket for a period with heavier rain.

Because of the scarcity in opportunity out there, the work that our global investment team does to uncover the opportunities that present the best potential reward for the risk becomes more critical. Looking ahead to 2022, we are highlighting three investment ideas for investors to consider in their portfolios.

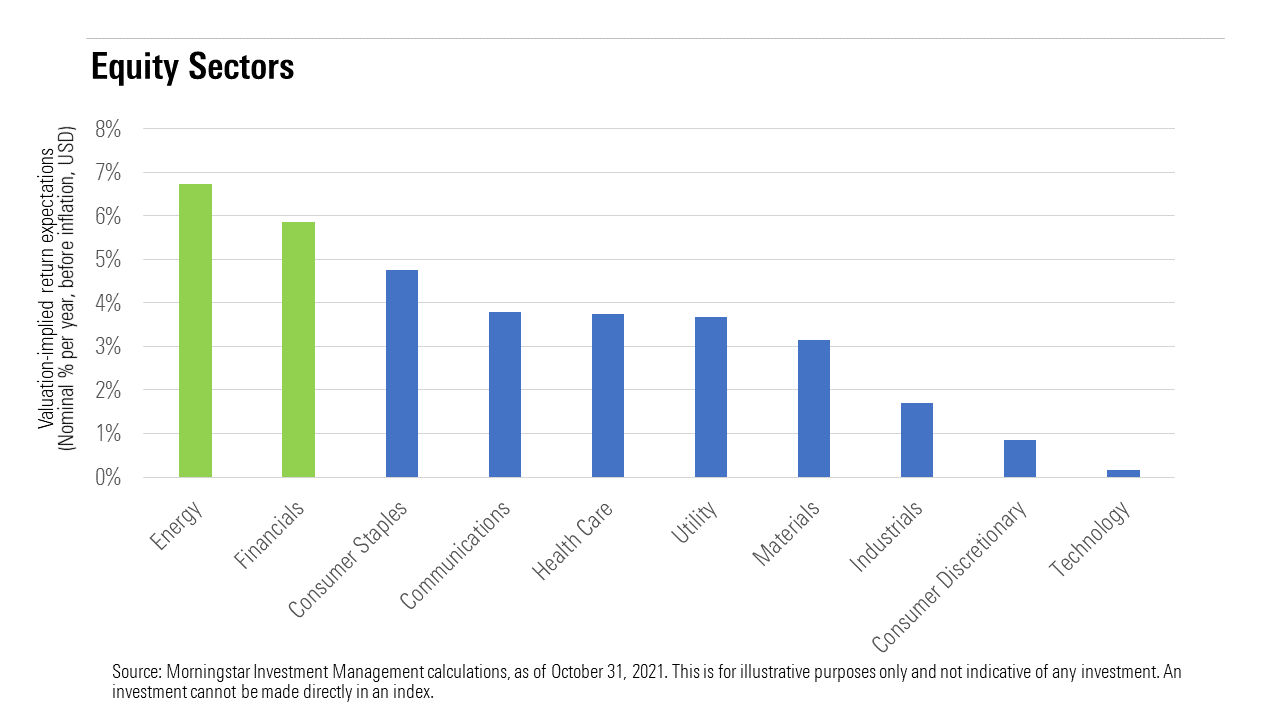

1) The Recovery Play: Relative Value in Energy and Financials

While there are a number of headwinds on the horizon, not least uncertainty about inflation and the emergence of a resistant coronavirus variant, the global economy is poised to continue its recovery, fueled by the normalization of economic activity globally.

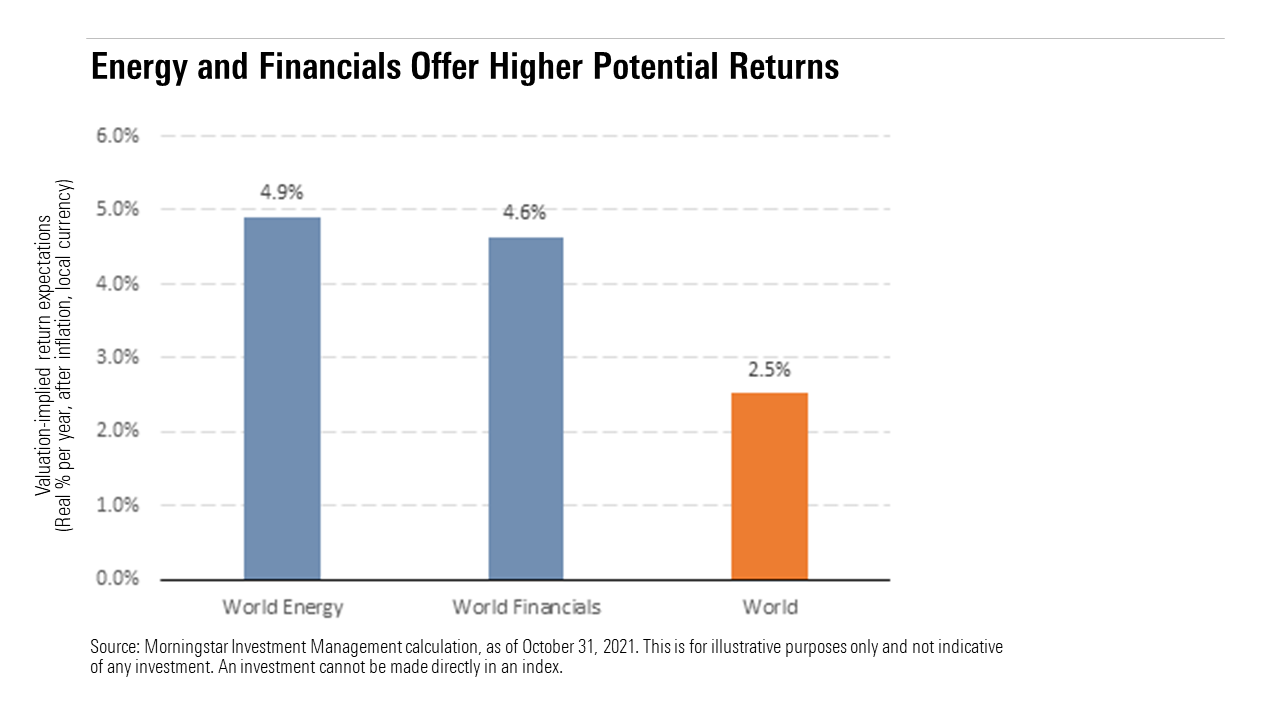

At current prices, global equities look expensive overall, according to our analysis, both in absolute terms and relative to international markets. However, there are pockets where we continue to see opportunity. These opportunities tend to cluster in more cyclical (or economically sensitive) areas of the market, including energy and financials, which have both done exceptionally well recently.

- Energy stocks: Despite recent strength, we continue to believe integrated energy companies with diversified business models and strong balance sheets provide significant potential upside for investors. The global energy sector has survived its darkest days, which saw a negative oil price at one point. Additionally, the longer-term transition toward cleaner energy remains broadly on track despite some concerns about the profitability of clean energy. This development is particularly interesting when we consider climate-change risk, with European energy companies making a meaningful pivot toward renewables.

- Banks: Our research also leads us to believe that banks are still relatively attractive. Lower-than-expected loan losses and a potential acceleration of loan growth as we enter 2022 provide a favorable medium-term backdrop for the sector. For banks, we believe risks are skewed to the upside in the next year or two, driven by fundamental improvements that include solid economic growth, low loan losses, and a higher capital return. Our valuation models suggest that energy and financial stocks have the potential to outpace the broad global equity market by more than 2% over the next decade.

Energy stocks and financials also have attractive inflation-fighting properties, given their ability to pass on price increases to their clients. Inflation tends to boost interest rates and a steeper yield curve, which benefits banks. Oil is a commodity, and any price increases are passed on to consumers. In the event of a continued rise in inflation, energy and banks stand to benefit.

2) Growth Companies at a Lower Price: The Case for China Tech

Investors have been bidding up prices of so-called "big tech" in recent years amid scarce growth elsewhere and falling interest rates, propelling an increase in stocks with the prospect of long-term growth. This runup in prices, in addition to the risk of stretched valuations, has also increased concentration of the U.S. equity market in a handful of technology companies. As of September 2021, Meta Platforms (Facebook) FB, Amazon.com AMZN, Apple AAPL, Netflix NFLX, Google (Alphabet) GOOG, and Microsoft MSFT made up approximately 24% of the U.S. market, creating a need for U.S. investors to diversify away from single stocks.

A sell-off in Chinese equities over the course of 2021, which was triggered by a regulatory crackdown, presents investors with an opportunity to purchase shares of big-tech companies at low valuations. At current prices, China offers better absolute and relative value than any other major market, even after accounting for the potential impact that the regulatory crackdown may have on growth and profitability. Chinese stocks have an attractive growth profile and the major tech names have low financial leverage, providing diversification against some of the cyclical stocks that are also trading cheaply. Therefore, we think there is a growing case for investing in China.

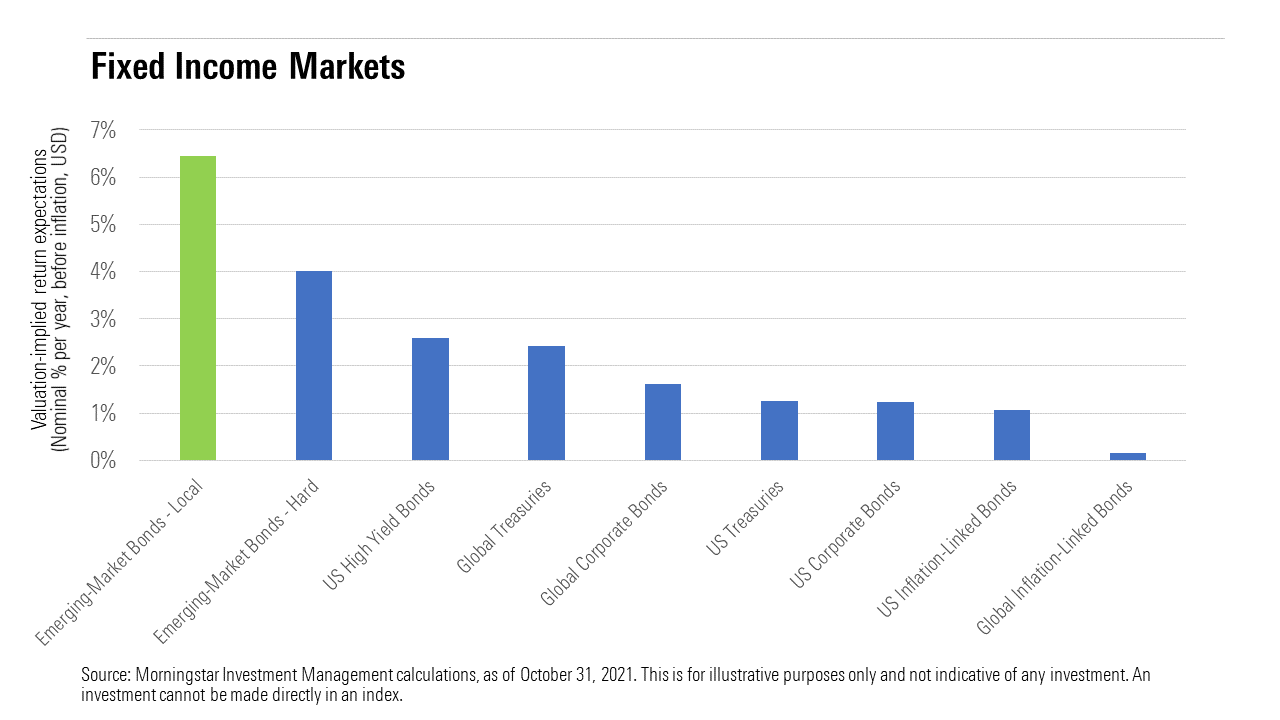

3) Emerging-Markets Debt in Local Currency: The Only Place for Positive Real Return in Fixed Income

With negative yields on government bonds (after adjusting for inflation) across developed government-bond markets and corporate credit spreads at multiyear lows, the fixed-income universe is looking at paltry returns over the next decade. Emerging-markets debt in local currency (which we prefer over hard currency) continues to offer positive real yields and is a notable exception. Our view remains that emerging markets' sovereign fundamentals are broadly stronger than in the past. Improved current-account balances, enhanced reserves, movement to orthodox monetary policy, and a build-out of a local investor base allow for a shift to local-currency funding, though there are ongoing concerns surrounding an increase in debt levels and a lack of fiscal discipline in some countries.

In aggregate, emerging markets were slower out of the blocks in opening up their economy than developed markets were. That said, the majority of emerging-markets central banks have started increasing central-policy rates as inflation remains elevated. In addition, an aggregated view of emerging-markets currencies also looks undervalued and should be a tailwind over time. The area can be volatile, yet even allowing for some pessimistic assumptions, our research suggests that investors could earn a decent premium over similar-duration U.S. Treasuries if they're willing to risk short-term loss. Stated differently, we think investors are likely to be compensated for the risk of investing in emerging-markets bonds over time, especially for local-currency bonds.

/s3.amazonaws.com/arc-authors/morningstar/571f02f7-3d9f-40ca-a254-c1ae121baeab.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/571f02f7-3d9f-40ca-a254-c1ae121baeab.jpg)