Letting Your Money Work for You Into Later Life

This year is likely going to be a difficult environment for passive income generation, and it requires careful navigation.

This is the third in a series of four articles collected from Morningstar Investment Management's 2022 outlook, highlighting the most important issues facing investors in the coming year. Mike Coop is the group's CIO for Europe, the Middle East, and Africa.

One of the primary motives of investing is to fund a comfortable retirement, and a 2020 Morningstar Behavioral Research survey showed that this remains the number-one goal among individuals. So, while retirement planning remains a foundational pillar of the financial advice industry, we'd broaden it out as making your money work for you. This is a timely and relevant topic, as it is no secret that income generation is getting harder, with several trade-offs and potential pathways to navigate.

The Modern Dilemma for Retirees and Income Generators

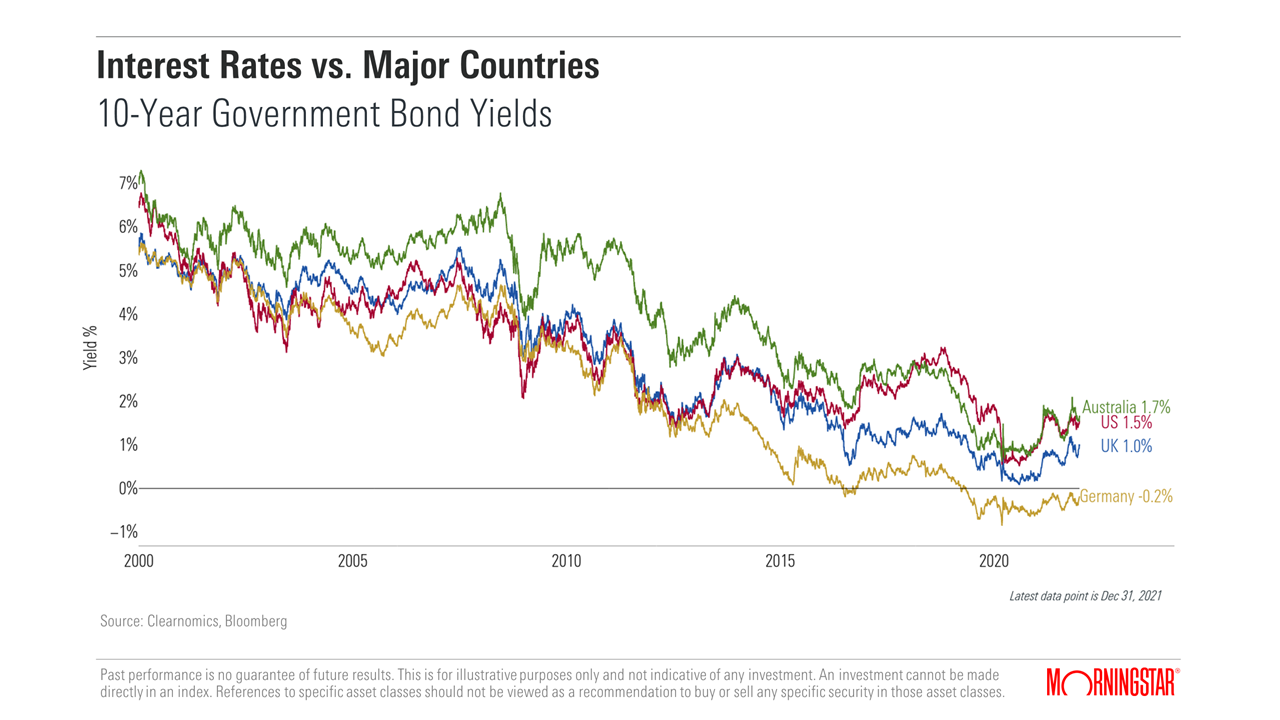

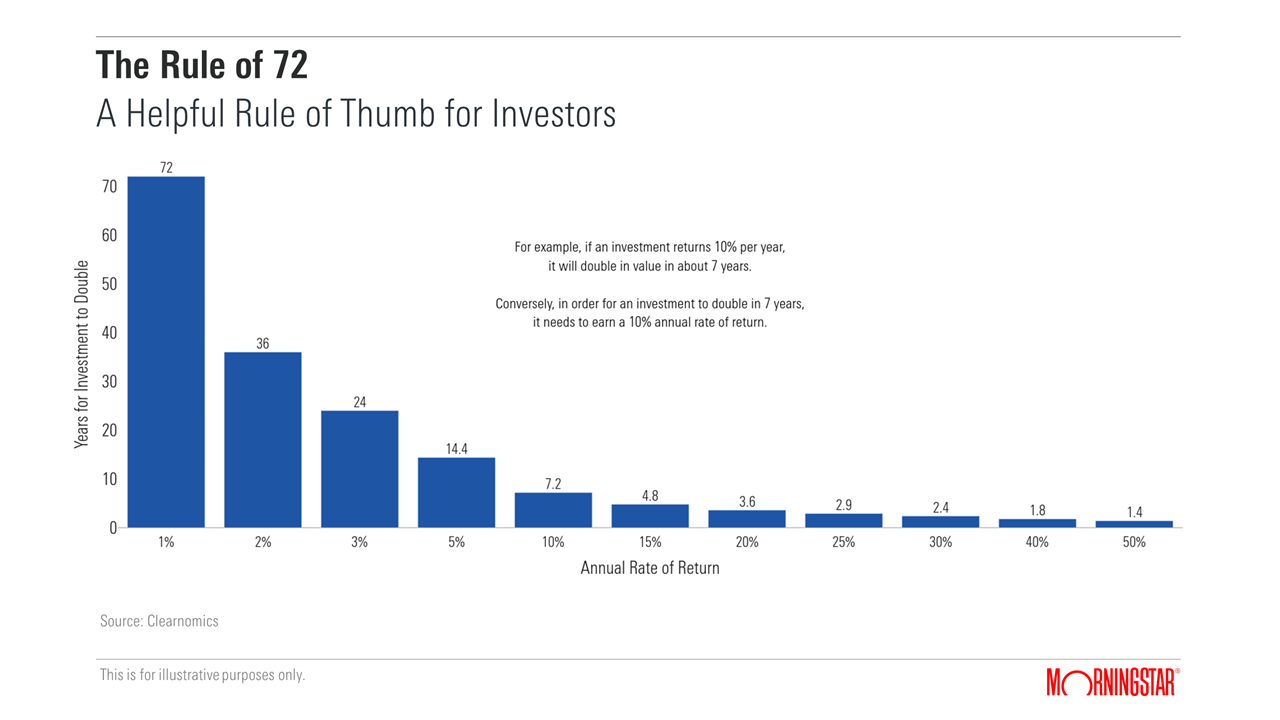

The past decade was a good one for investors of all types, with record-low volatility and record-high prices for most asset classes. For retirees, though, it was a period of declining cash rates, declining bond yields, and declining dividend yields. This remains one of the great challenges for investors trying to live off their assets in 2022, as income is so much harder to attain.

This might be about to change, with some expecting interest rates to rise. We aren't in the business of predicting interest rates, although the general consensus is that the most likely direction for interest rates is up. Our expertise is to build portfolios that can handle different possibilities, which is really a matter of portfolio robustness. In this regard, higher interest rates would have obvious implications for asset prices, with retirees particularly sensitive given their typically higher weighting in bonds. This is a double-edged sword, however, as higher rates would cause bond-price losses in the near term but could make income generation easier in a forward-looking context.

The harsh reality is that we are presented with a perfect storm against retirees--an environment that is low-yielding and generally unattractive, with rising inflation reducing their purchasing power. This requires a selective approach to empower investor success and presents a modern dilemma to solve.

What Approach Is Best for 2022?

Many timeless questions carry special weight in 2022. For instance, are retirees better positioned by focusing on a selective-income approach or a total-return approach in an environment of low current yields and higher risk? We did some interesting research on this in early 2021 and found that both approaches can be effective, although both carry risks, too.[1] The same learnings are applicable in 2022, though starting yields are slightly lower again and risks slightly higher.

- With a total-return approach in 2022, you would seek to accumulate further gains, then sell part of the portfolio periodically to meet the withdrawal needs. The obvious risk is that markets are expensive, so if you sell down assets that aren't rising (or worse, falling), you'll have a higher likelihood of running out of money. This is a risk many would like to avoid, especially those exposed to sequencing risk (the risk of a big decline early in your retirement wiping out a big part of your nest egg). Ordinarily, this would incline many toward an income approach, but the common mantra remains that "there is no alternative."

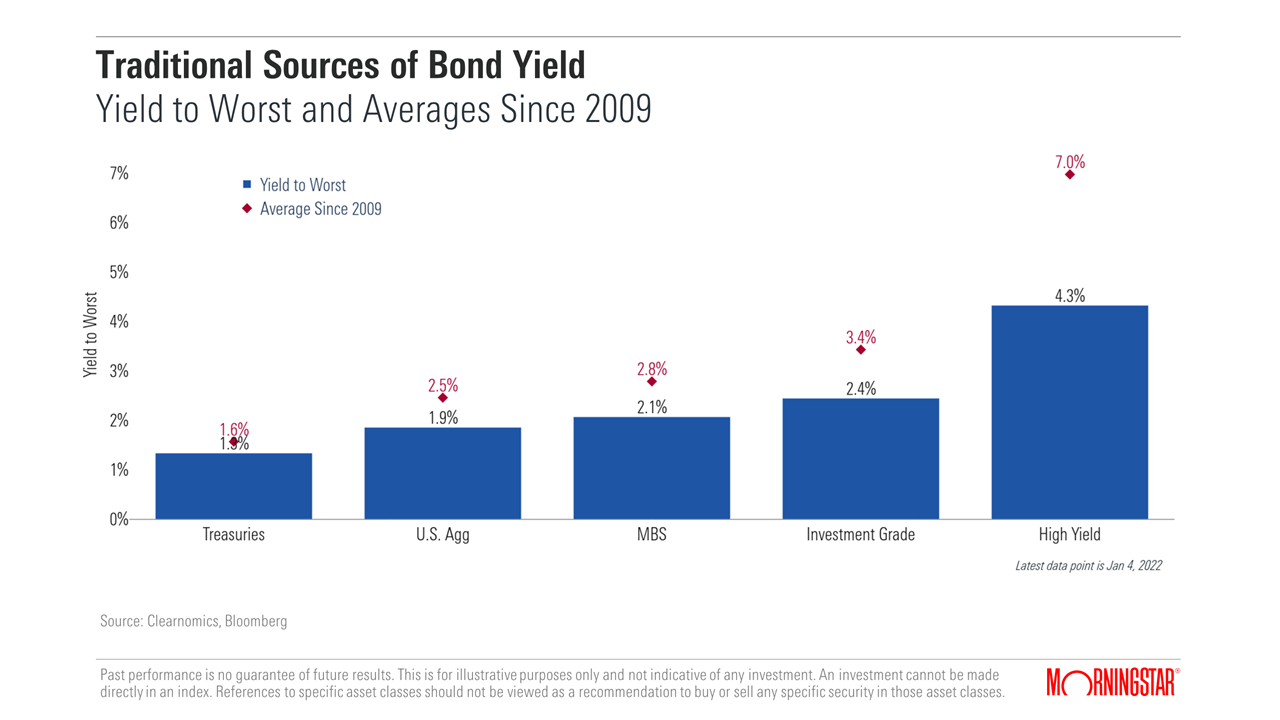

- The income approach requires one to be selective in 2022, as a focus on cash flow generation requires you to typically tilt portfolios toward asset classes with higher current income, such as high-dividend stocks and emerging-markets debt. However, some of the popular income assets can carry meaningful downside risk, and some exhibit no growth in income (a risk in the face of rising inflation). For example, we don't believe longer-dated bonds are an area that will serve income-hungry investors in 2022. We think yield-chasing is a cardinal sin when it is taken to the extreme, moving up the risk curve without a thorough understanding of what you own and why you own it. Patience is key, as 4%-plus yields will be difficult, if not impossible, to obtain in 2022 without accepting meaningful risk.

Natural Sources of Cash Flow in 2022

Some assets naturally lend themselves to stable income generation. The aim is for:

- Income growth

- Some capital growth to keep up with inflation

- Durability. Dividend cuts are an issue to avoid and technological obsolescence must be considered. Environmental, social, governance risks must also be assessed.

We look for these characteristics across our entire portfolio range, not just income-focused strategies, because natural income sources are a return driver with relatively reliable outcomes. For example, banks are a popular source for income and are an area we generally find attractive heading into 2022. We note that banking income isn't always natural, with durability a nuanced issue--capital adequacy is important, with debt issues to consider and excess capital that can cause overdistributing--but it does offer relative value.

When it comes to robustness, defensive equity sectors such as consumer staples and healthcare are also areas that we believe offer natural income sources. The yields aren't currently high in absolute terms, but they do help offset cyclical risk and provide durability. As you can see, selectivity is key for those wanting to live off their income in the current environment.

Key Takeaways for Living Off Your Assets

As was the case in recent years, 2022 is likely to be a difficult environment for passive income generation, with low rates and expensive assets a common challenge, and the additional difficulty of higher inflation eroding the purchasing power of your income.

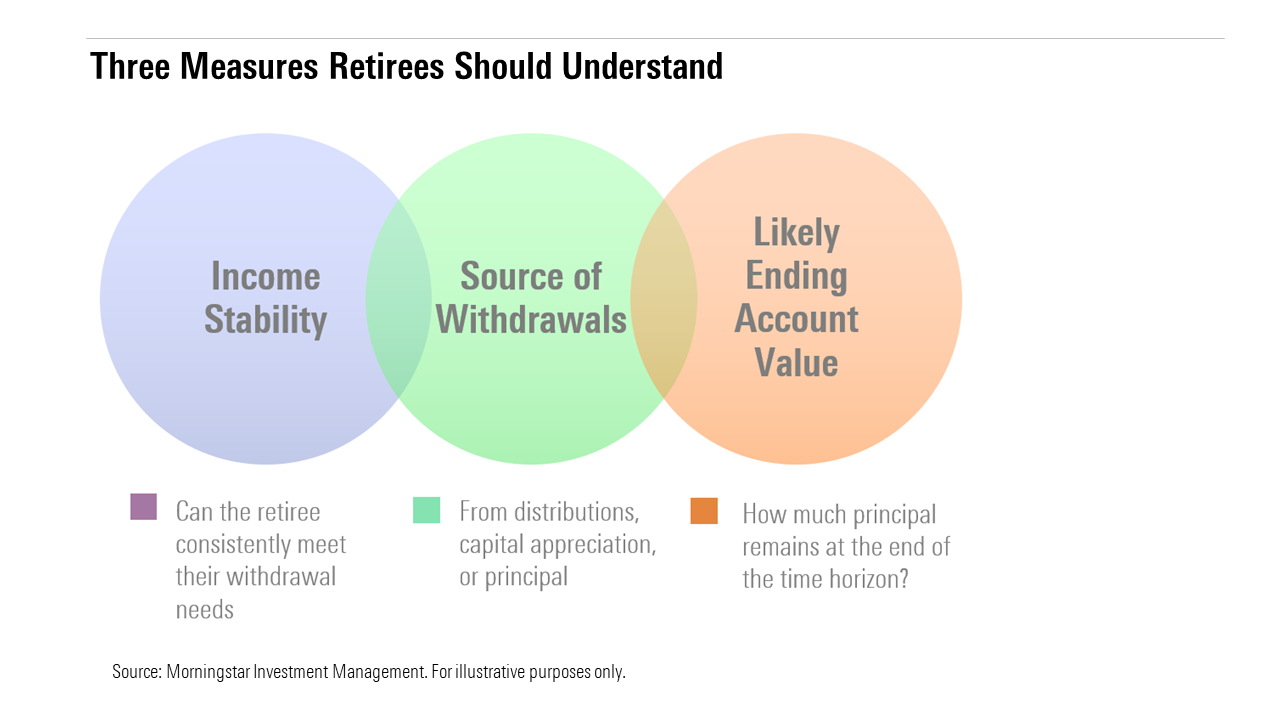

This requires careful navigation. On one hand, your primary role is to maintain your purchasing power with an inflation-beating portfolio that is robust and can handle different environments. On another, it makes sense to capture natural income sources, helping you with the three measures of retirement success: 1) cash flow stability, 2) source of withdrawals, and 3) likely ending account value.

We seek to do all of the above in the portfolios we manage, including some that are specifically targeted with inflation-beating or income-targeted objectives.

[1] Using U.S. data, we looked at 163 rolling periods, comparing the income and total-return approaches for a) income stability, b) the source of withdrawals, and c) the likely ending account value. We found that there is no best choice that works for everyone, with an income approach generally effective for a and b, but less clear for c. We also noted taxation and behavioral elements and highlighted the modern challenge of lower starting yields.

/s3.amazonaws.com/arc-authors/morningstar/778337d0-9238-4f54-8c8a-4f334271a3dc.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/778337d0-9238-4f54-8c8a-4f334271a3dc.jpg)