The Best Stocks of 2021 in Morningstar’s Coverage List

Moderna and BioNTech were among a top performers list dominated by tech, energy, and consumer names.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

There was no escaping the continued impact of the pandemic in 2021, even among the lists of best performing stocks for the year.

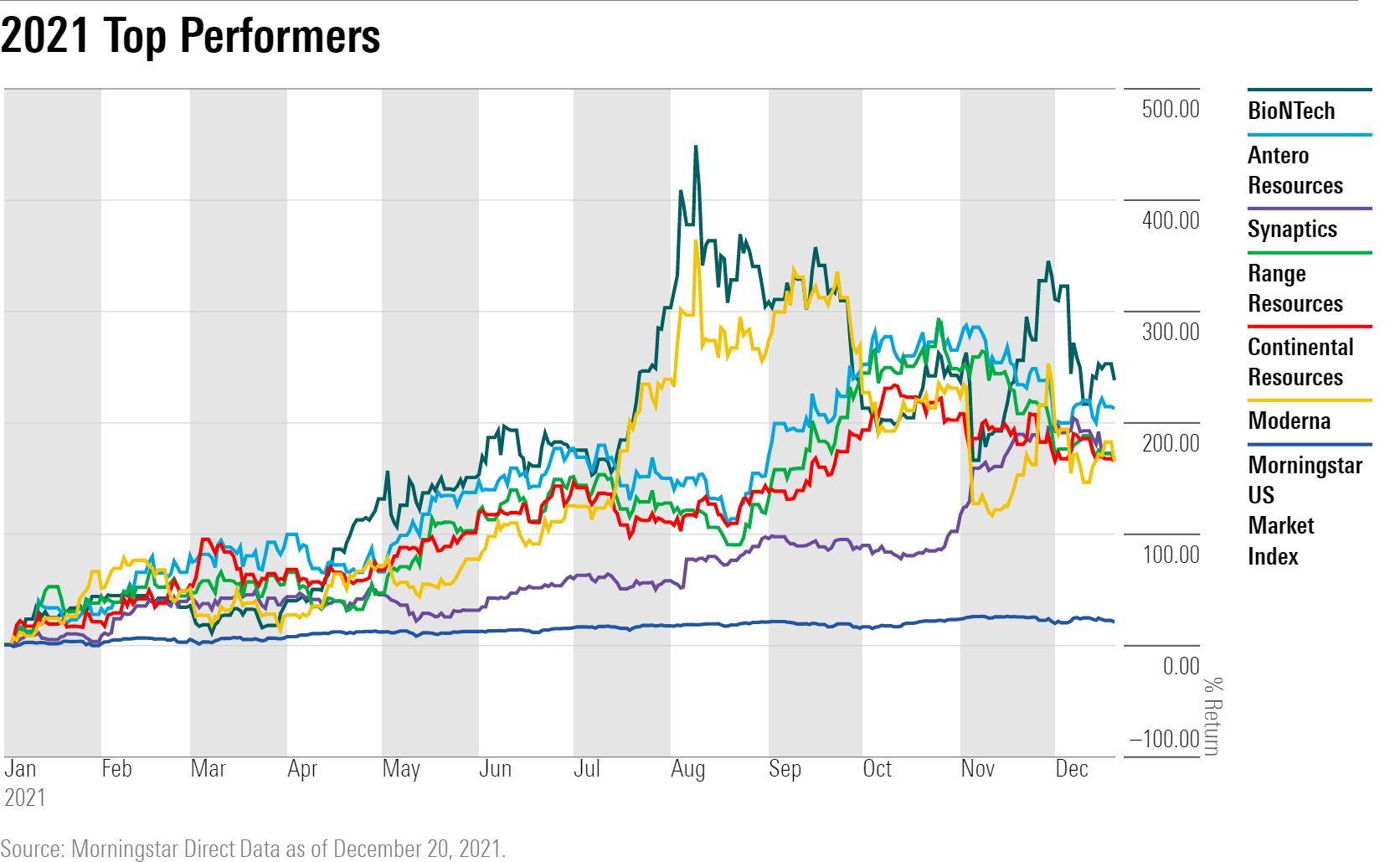

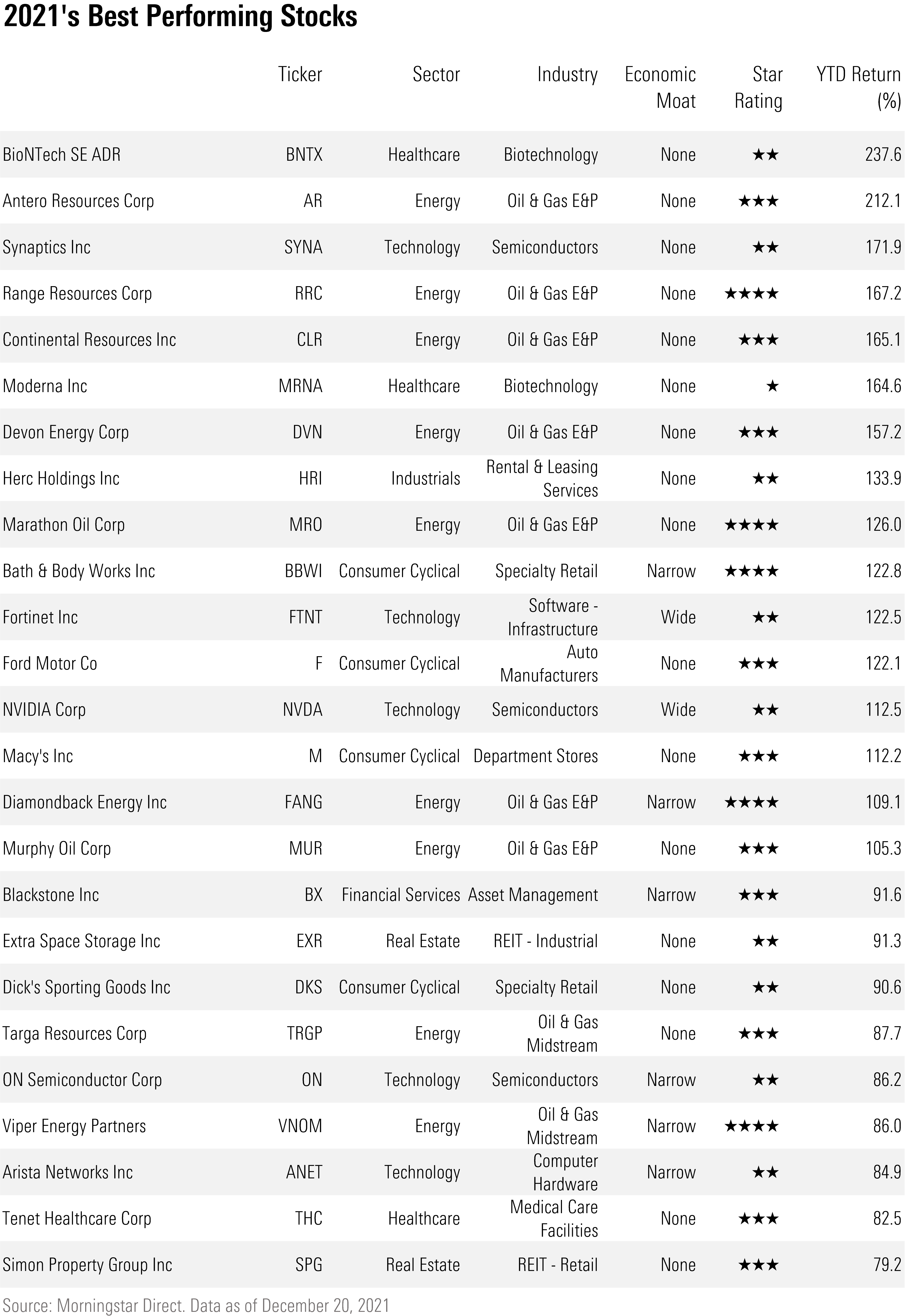

Among 2021’s biggest winners in the list of stocks covered by Morningstar’s analysts were BioNTech BNTX and Moderna MRNA. BioNTech topped the Morningstar coverage list with a year-to-date return of 237.8%, while Moderna has rallied 164.6% as our sixth-best performing stock. Investors sent both stocks rocketing this year after the release of their high-efficacy mRNA coronavirus vaccines and two rounds of COVID-19 variants that fueled the ongoing pandemic.

Volatility in both vaccine stocks has increased significantly in recent weeks because of uncertainty around the long-term demand for vaccines and the emergence of the omicron variant. BioNTech and Moderna now sit below 40% of their 52-week highs. Nonetheless, Morningstar analyst Karen Andersen views both companies as overvalued at recent prices, with BioNTech trading at a 55% premium to its fair value and Moderna at a 74% premium.

More broadly, in a year where stocks up are some 25%, energy, technology, and economically sensitive consumer stocks dominated the list of best performers. That included oil- and gas-exploration company Antero Resources AR, up 212.1%, and semiconductor manufacturer Synaptics SYNA, up 171.9%.

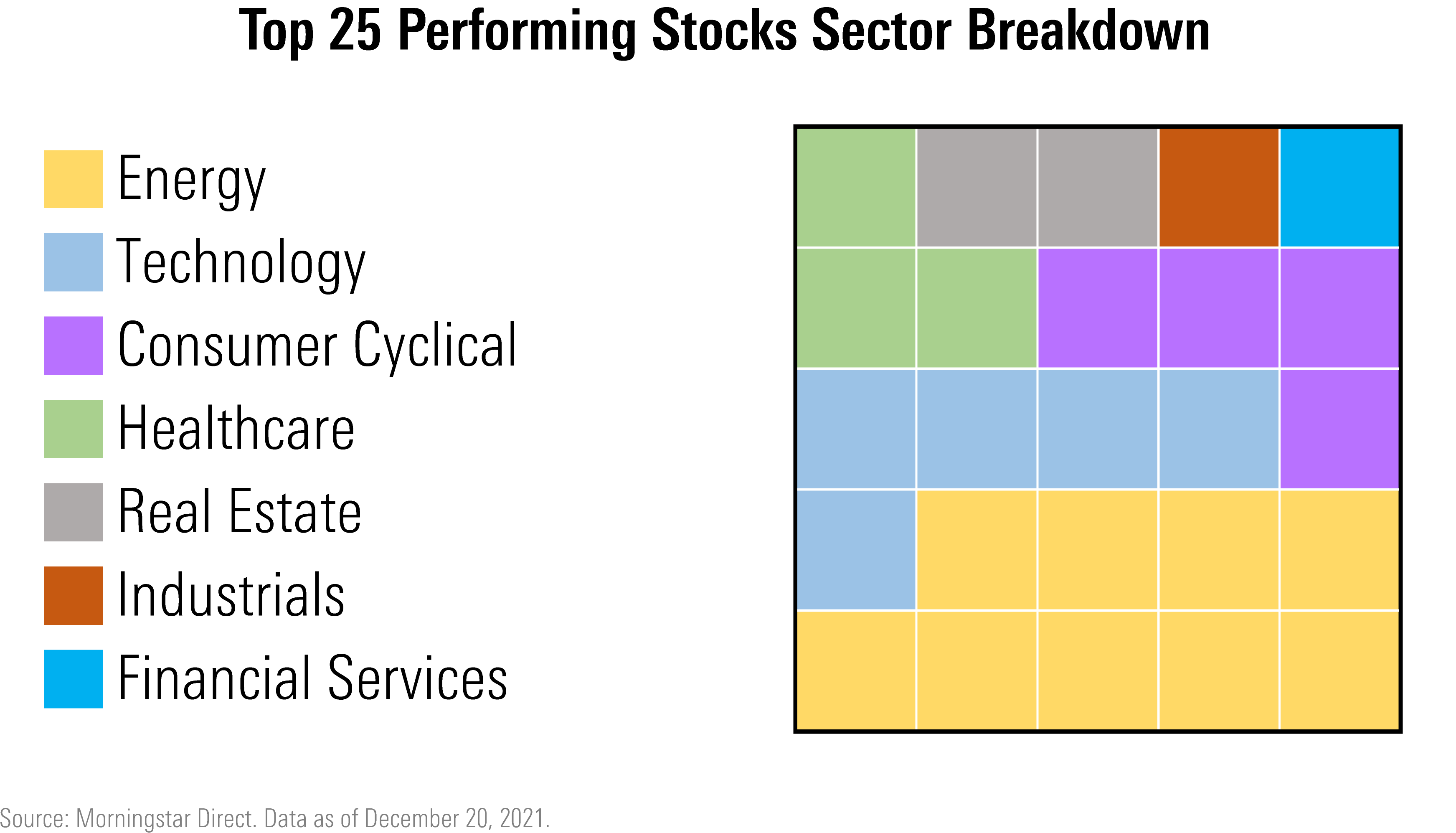

Energy, Tech, and Consumer Cyclical Stocks Lead in 2021

With vaccine rollouts as the backdrop to economic reopenings around the world before the emergence of the omicron variant, 2021 extended the fastest recovery from a recession in United States' history, paving the way for many business-cycle-sensitive sectors to grow rapidly.

Tech, energy, and consumer cyclical stocks make up more than half of the top-performing stocks in our coverage list this year (a full list of the top 25 can be found at the end of this article).

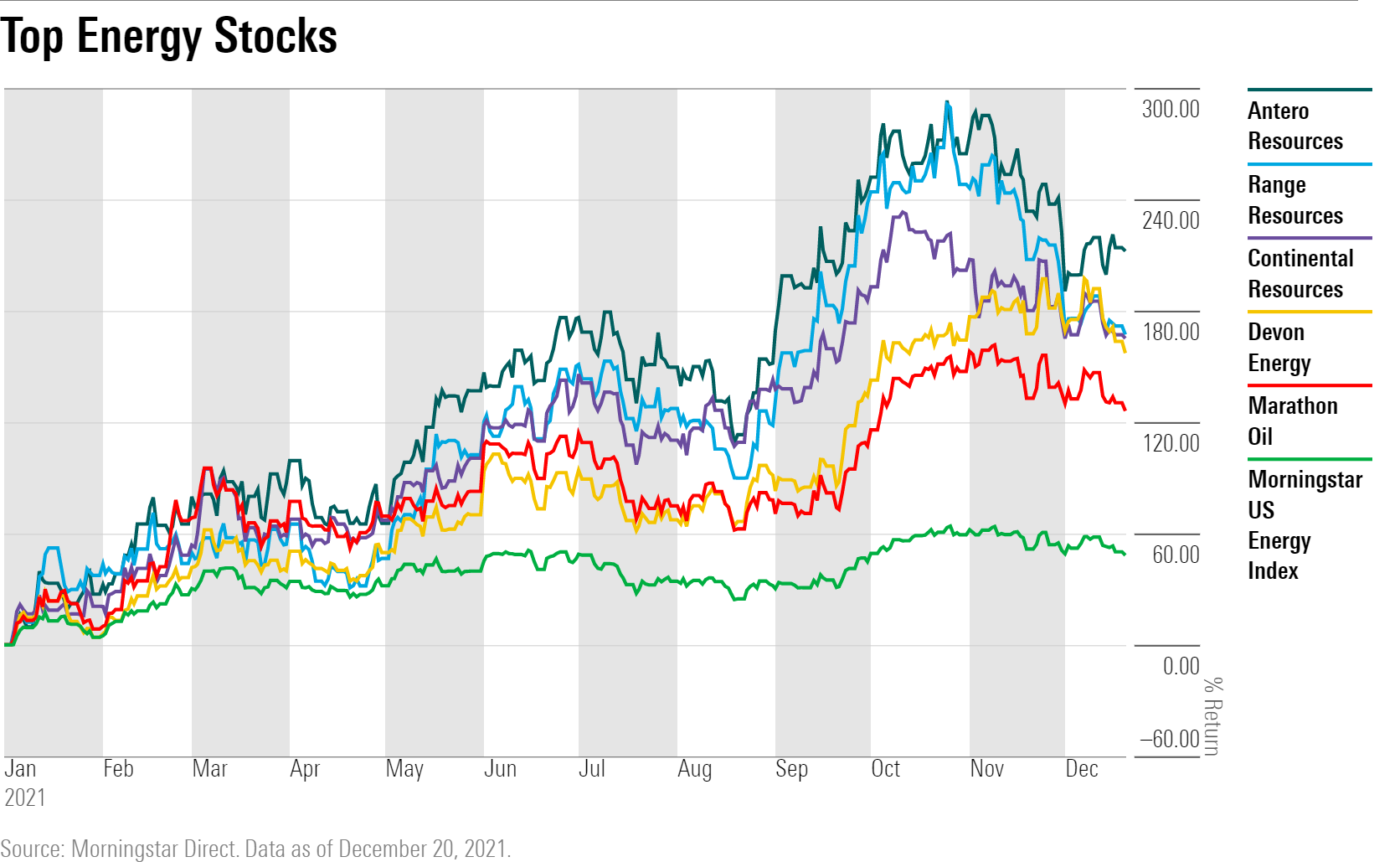

Energy stocks dominated our list in performance, with oil drillers taking the lion’s share of returns. The sector overall returned 48.3% thanks in part to a 41% rise in the price of oil. Antero Resources rallied 212.1% this year. Range Resources RRC is up 167.2%, going toe to toe with Continental Resources' CLR year-to-date return of 165.1%. Devon Energy DVN is up 157.2%, while Marathon Oil MRO has risen 126%.

Of these top performers, Morningstar analysts see value in only two of the stocks: Range Resources, which trades at a 36% discount to its fair value, and Marathon Oil, which is at a 22% discount. The remaining stocks are viewed as fairly valued at recent prices.

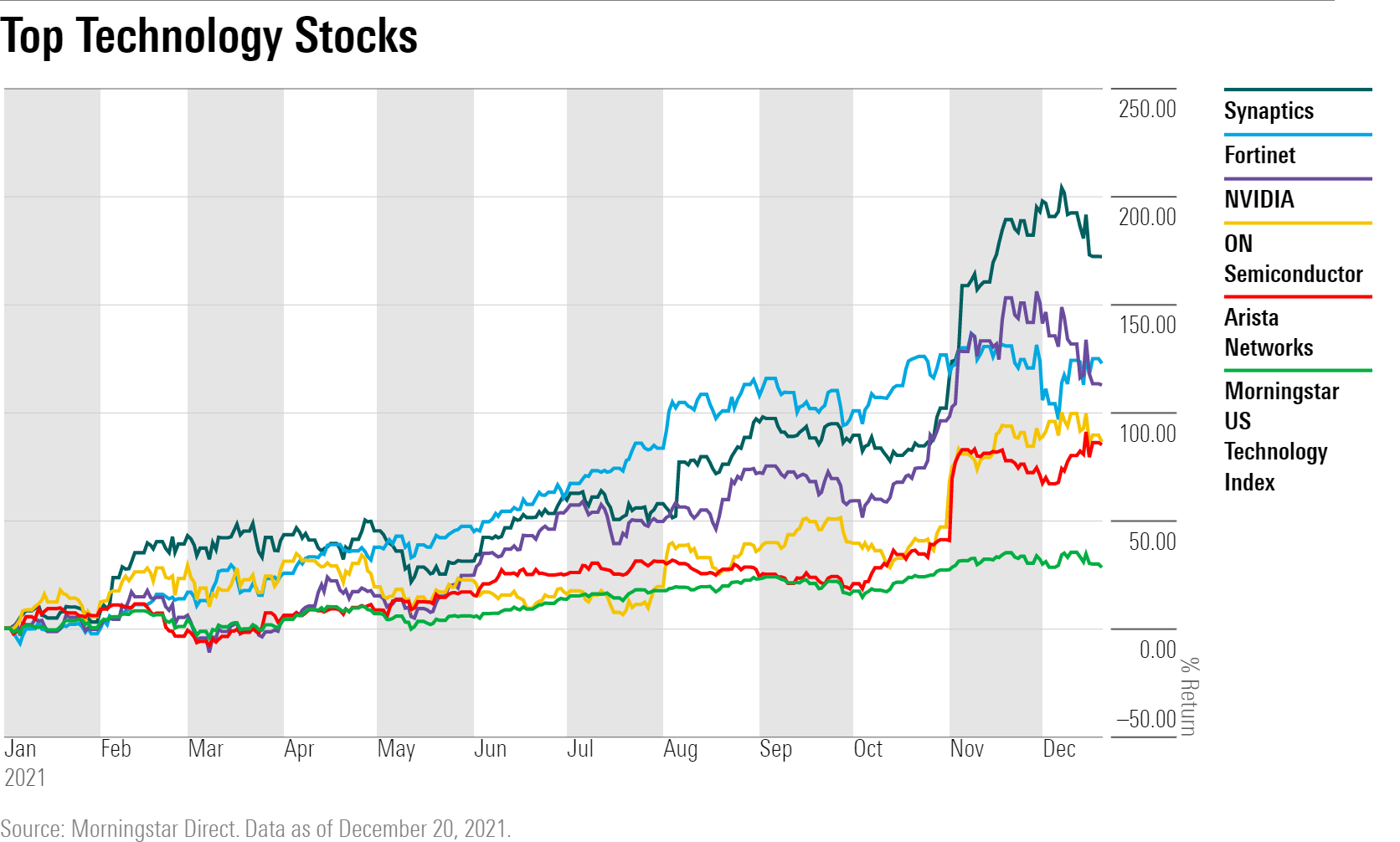

Technology stocks continued their strong performance during the fourth quarter of 2021. Leading the pack is Synaptics SYNA, which is up 171.9% this year. Semiconductor company Nvidia NVDA is returning 112.5%, while ON Semiconductor ON is up 86.2%. All three companies are viewed as overvalued, trading at a 27% premium or more to their fair value estimate.

As the world continues its increasing dependence on cloud-based tools and resources, companies providing these services showed strong growth in 2021. Cybersecurity firm Fortinet FTNT has rallied 122.5%, while networking solutions provider Arista Networks ANET is up 84.9%. Fortinet trades at a 16% premium to its fair value, while Arista is at a 41% premium.

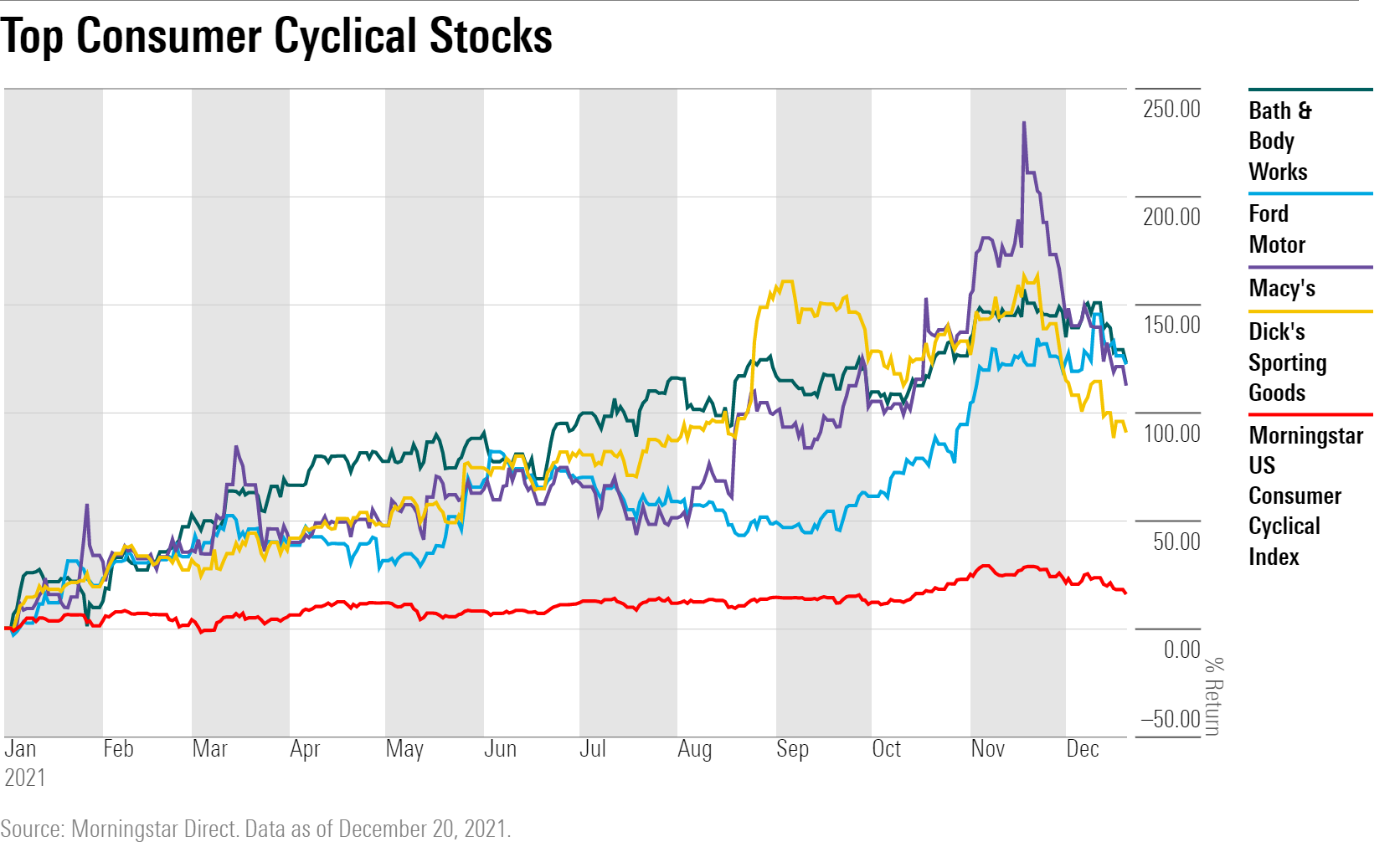

Consumer cyclical stocks made a big comeback this year. While U.S. retail sales have petered out in recent months, they have rebounded strongly from pandemic lows and are up 16.1% from a year ago.

Bath & Body Works BBWI led retail stocks with a 127.8% return this year, followed by Macy’s M, up 112.2%, and Dick’s Sporting Goods DKS, which has risen 90.6%. Only Bath & Body Works remains undervalued of these top performers, currently trading at a 20% discount to fair value. Macy’s is currently viewed as fairly valued, with Dick’s Sporting Goods considered 47% overvalued by their Morningstar analyst.

On the auto side of the sector, Ford Motor F is the best performer. Ford Motor more than doubled its stock value, with a 132.7% return this year. Shares benefited from the company increasing full-year profits twice in the last few quarters in addition to restoring its dividend. The company is considered fairly valued at recent prices.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)