My Top 10 Portfolio Highlights from 2021

Some long-running trends continued, but rising inflation and the specter of higher interest rates prompted a few reversals.

At a high level, the year 2021 was another great year to be an investor. Under the surface, though, there were a few notable changes that could affect investors’ portfolios in the years ahead.

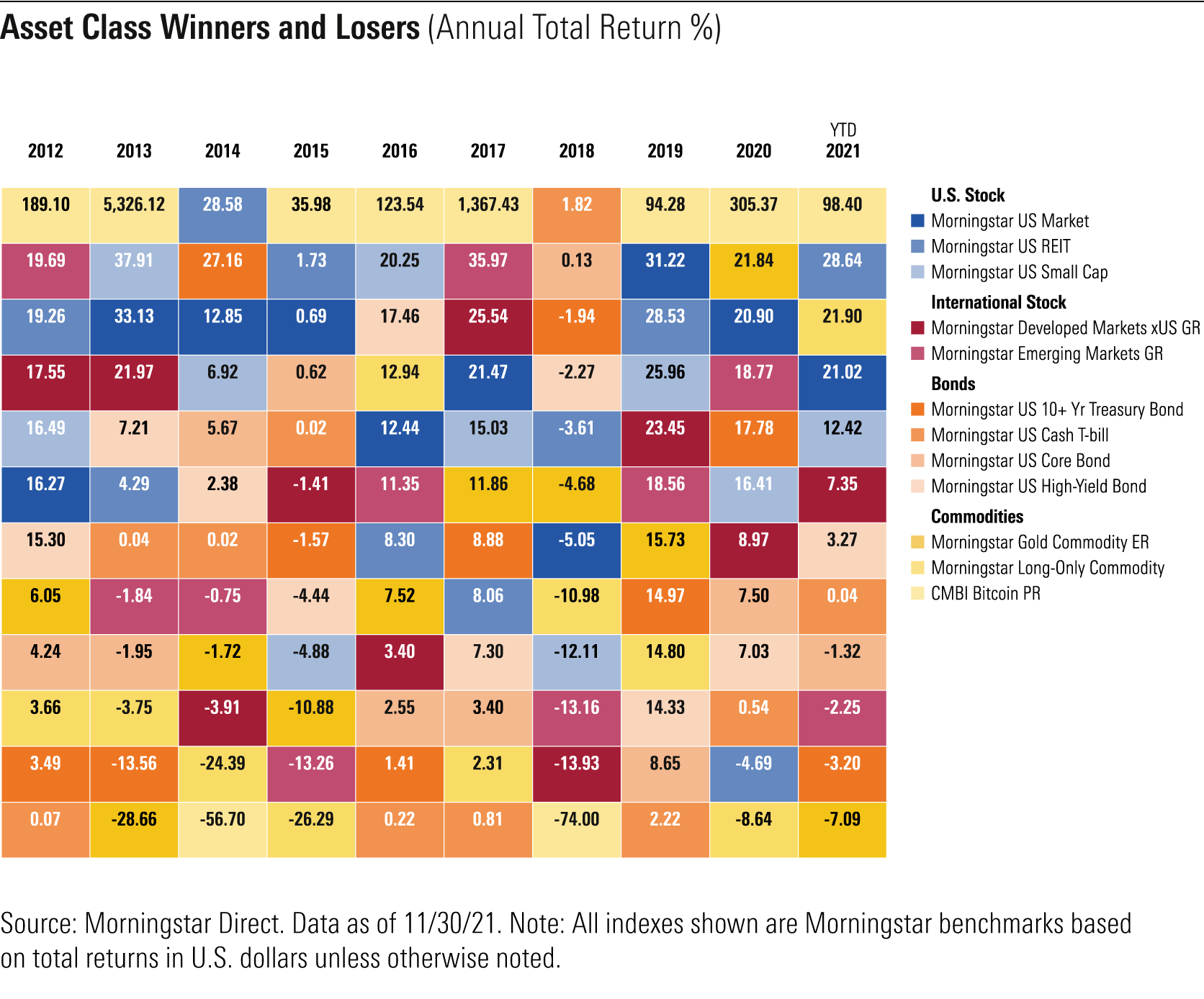

FOMO and TINA drive another year of double-digit equity-market returns. The long-running bull market continued mostly unabated in 2021, although there were a few market bumps in September and November thanks to market fears about the twin threats of sharply higher inflation and the Omicron coronavirus variant. The market owes some of its strength to individual investors, who have been increasingly active market participants on no-fee brokerage platforms such as Robinhood RH. Part of this trend also seems driven by "FOMO"--fear of missing out--a reaction to high returns earned by other investors that can lead to higher asset prices and speculative bubbles. Another plausible explanation is "TINA"--there is no alternative. Many investors have cited ultra-low yields on cash and fixed-income securities as a reason to continue investing in stocks or even increasing their portfolios' equity allocations, despite historically steep valuation levels.

U.S. stocks continue to dominate. The U.S. market continued its long-running winning streak in 2021 thanks to rebounding economic growth and generally strong corporate earnings. Most other major international markets also generated positive returns but fell behind the Morningstar US Market index's 21% gain for the first 11 months of the year. Asian stocks, meanwhile, have suffered losses due to the ongoing economic effects of the global coronavirus pandemic. From a valuation perspective, Morningstar's equity analysts continue to find better values in non-U.S. markets.

Bonds go from hero to zero. Bonds have been a great place to be for most of the past four decades as interest rates have steadily declined. As a result, fixed-income securities have not only excelled in their usual role as buffers against market volatility, but also generated higher-than-average returns compared with long-term historical norms. This trend started reversing course in 2021 thanks to worrisome inflation trends and the growing market realization that the Fed will eventually have to start hiking interest rates in response (which the Fed recently confirmed). As a result, Morningstar's US Core Bond index slipped 1.3% for the year to date through Nov. 30, 2021--its weakest showing since 2013.

Momentum falters. Momentum stocks (typically defined as issues that have showed persistently strong near-term performance) have dominated the market over the past several years. With only a few exceptions--such as the fourth quarter of 2018 and the novel coronavirus-driven bear market in February and March 2020--the long-running bull market has created ideal conditions for the best-performing stocks to go from strength to strength. That trend started to falter in September 2021, when the market's sharp drop prompted a downfall in previously high-flying stocks with steep valuations. For the year to date through Nov. 30, momentum stocks have generated total returns of 13.5%, compared with 21.0% for the Morningstar US Market Index.

Smaller-cap stocks continue to underwhelm. Academic research has often found a performance edge for smaller-cap stocks over longer time periods. But this advantage has been hard to find in recent years. Over the trailing five-year period ended Nov. 30, 2021, the Morningstar US Small Cap index has generated annualized total returns of just 11.5%, compared with 15.3% for the Morningstar US Mid Cap index and 18.9% for the Morningstar US Large Cap index. Smaller-cap stocks had a brief resurgence in late 2020 and early 2021 as it appeared that market sentiment was shifting but have since retreated.

The value comeback peters out (sort of.) With growth stocks dominating the market for most of the past five years, many observers predicted that cheaper value stocks, which typically fare better during periods of economic recovery, eventually would pull ahead. Value stocks did show some signs of strength in the fourth quarter of 2020 and the first quarter of 2021, but that trend proved short-lived. The Morningstar US Growth index gained 13.9% in the second quarter of 2021, compared with just 4% for the Morningstar US Value index. Growth stocks also pulled ahead in the third quarter, albeit by a smaller margin. However, some pockets of value stocks--notably small-cap value names--have continued to perform well in recent months.

Commodities pull ahead. With inflation hitting higher levels than we've seen in nearly 40 years, commodities have been a major beneficiary. Commodities have historically performed well as a hedge against inflation, partly because commodities themselves are a major part of most inflation indexes. For example, the Morningstar Long-Only Commodity index gained 21.9% for the year to date through Nov. 30. That partly reflects the spike in energy prices, which make up about 40% of the index. Over the long term, though, commodities haven't been a great place to be for investors. The commodity benchmark has posted losses over the trailing 10- and 15-year periods, although it generated positive returns over the trailing 20-year period.

Gold loses its glimmer. Morningstar's Gold Commodity index ranked as the top-performing major asset class in 2020. The yellow metal lived up to its reputation as a safe haven in periods of market crisis during the market downdraft early in the year, and went on to generate double-digit returns as the price of gold edged up to about $1,887 per ounce by the end of the year. In 2021, though, the price of gold reversed course thanks to lower demand from central banks and other traditional buyers, such as jewelry makers. In addition, investors have recently favored other classes--including real estate, commodities, and cryptocurrencies--as hedges against inflation.

Real estate bounces back. I've been skeptical about the diversification value of REITs, but they fared surprisingly well in 2021. After dropping about 4.7% in 2020, the Morningstar U.S. REIT index gained 28.6% for the year to date through Nov. 30, 2021. REITs have benefited from increased demand from yield-hungry investors, as well as those seeking protection against resurgent inflation. From a portfolio perspective, though, I'm still dubious about real estate's role as a portfolio diversifier. Real estate's correlation with the broader equity market has continued steadily rising, reaching 0.95 for the first 11 months of 2021. In addition, current valuations in the real estate sector are relatively steep.

Cryptocurrency volatility is here to stay. Cryptocurrency has moved to the mainstream over the past couple of years and reached a key milestone with the recent approval of several U.S.-based exchange-traded funds that track bitcoin futures. Cryptocurrency remains far more volatile than nearly any other asset class, though; its standard deviation is roughly five times that of gold, for example. This volatility was on full display during 2021 as bitcoin enjoyed a price runup of 104% in the first quarter, then plummeted 41% in the second quarter, only to surge back to an all-time high in mid-November.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)