Existing Trends in U.S. Fund Flows Hold in November

Equity and fixed-income funds experience modest flows for the month.

Editor's note: This is adapted from the Morningstar Direct U.S. Asset Flows Commentary for November 2021. Download the full report here.

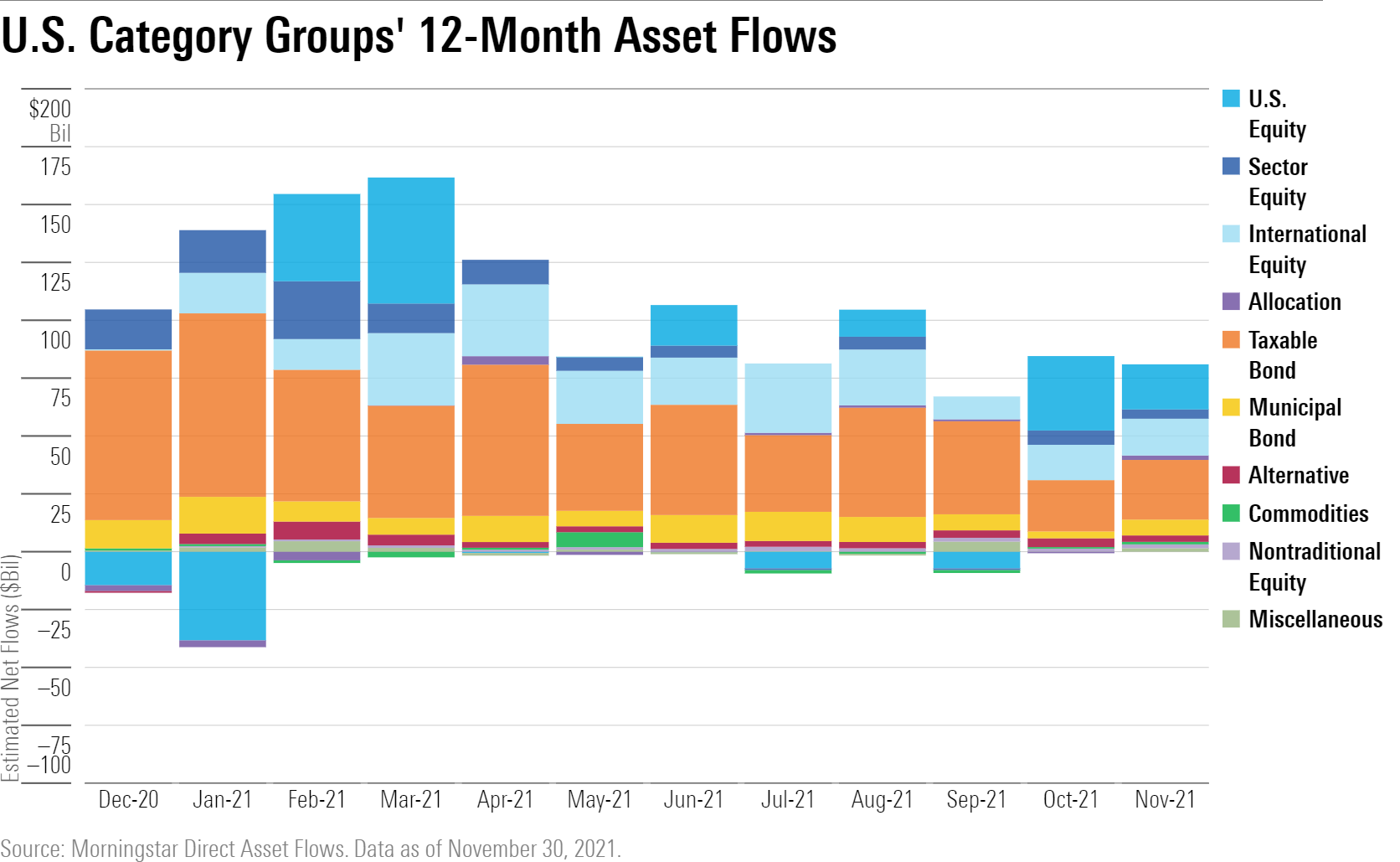

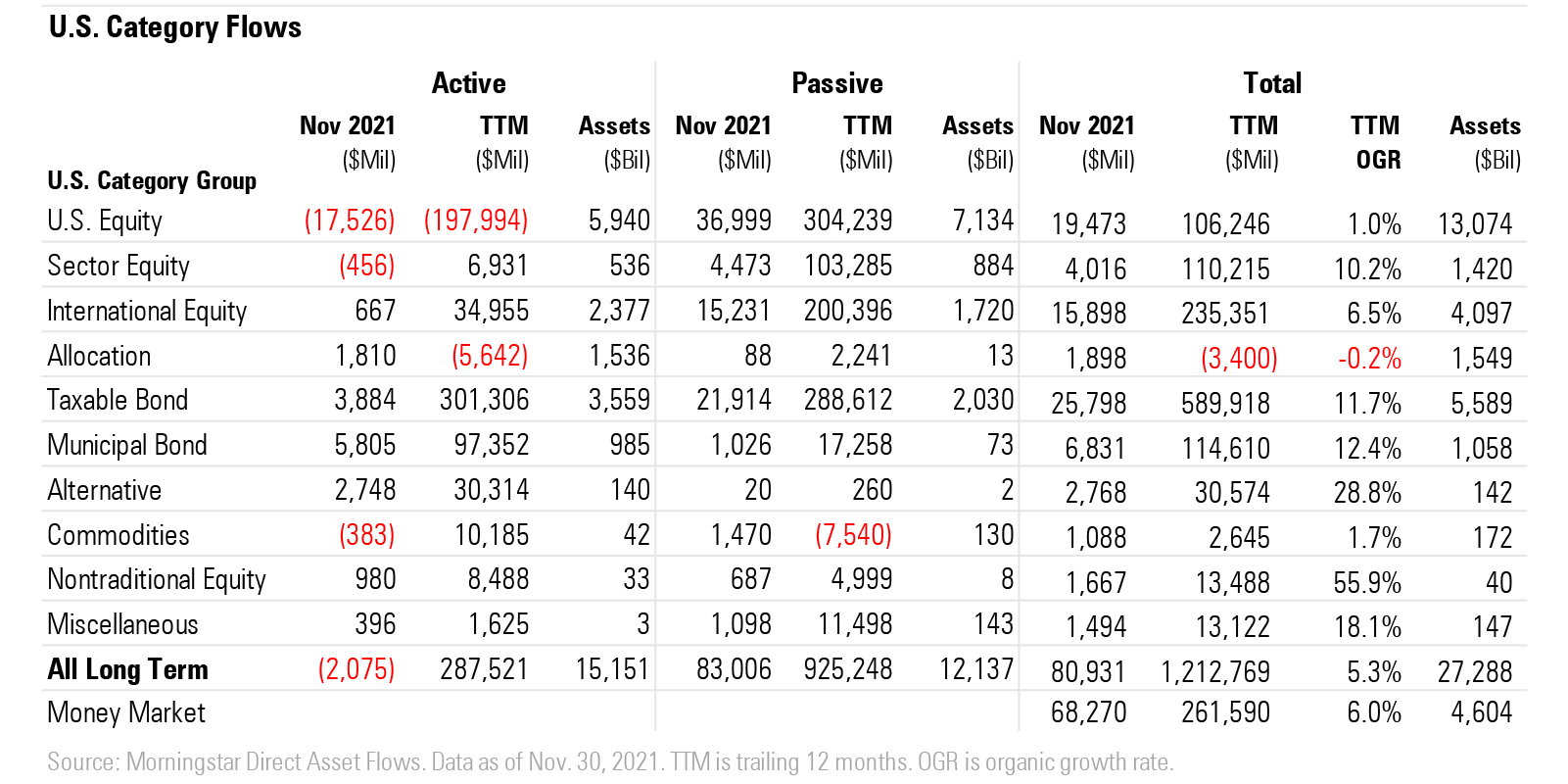

Long-term mutual funds and exchange-traded funds gathered $81 billion in November 2021, roughly in line with October's $84 billion intake but less than the roughly $100 billion average monthly rate set through the first 10 months of the year. Passively managed strategies' $83 billion intake represented virtually all of November's inflows, while active strategies shed $2 billion in aggregate. ETFs, the vast majority of which are passively managed, gathered $78 billion, leaving about $3 billion to open-end funds.

After a strong run through the first half of 2021, actively managed strategies have since collected paltry totals. Flows into active funds peaked at $56 billion in February 2021--their highest total since 2013--and declined modestly in the months to follow but only averaged about $9 billion per month from July through November. A decline in fixed-income fund flows was one contributing factor as their active offerings tend to attract a greater percentage of inflows compared with equity funds. For the second consecutive month, taxable-bond funds set a new low for monthly inflows in 2021. While the $25.8 billion these funds collected in November led all category groups, it was only the sixth highest on an organic-growth basis.

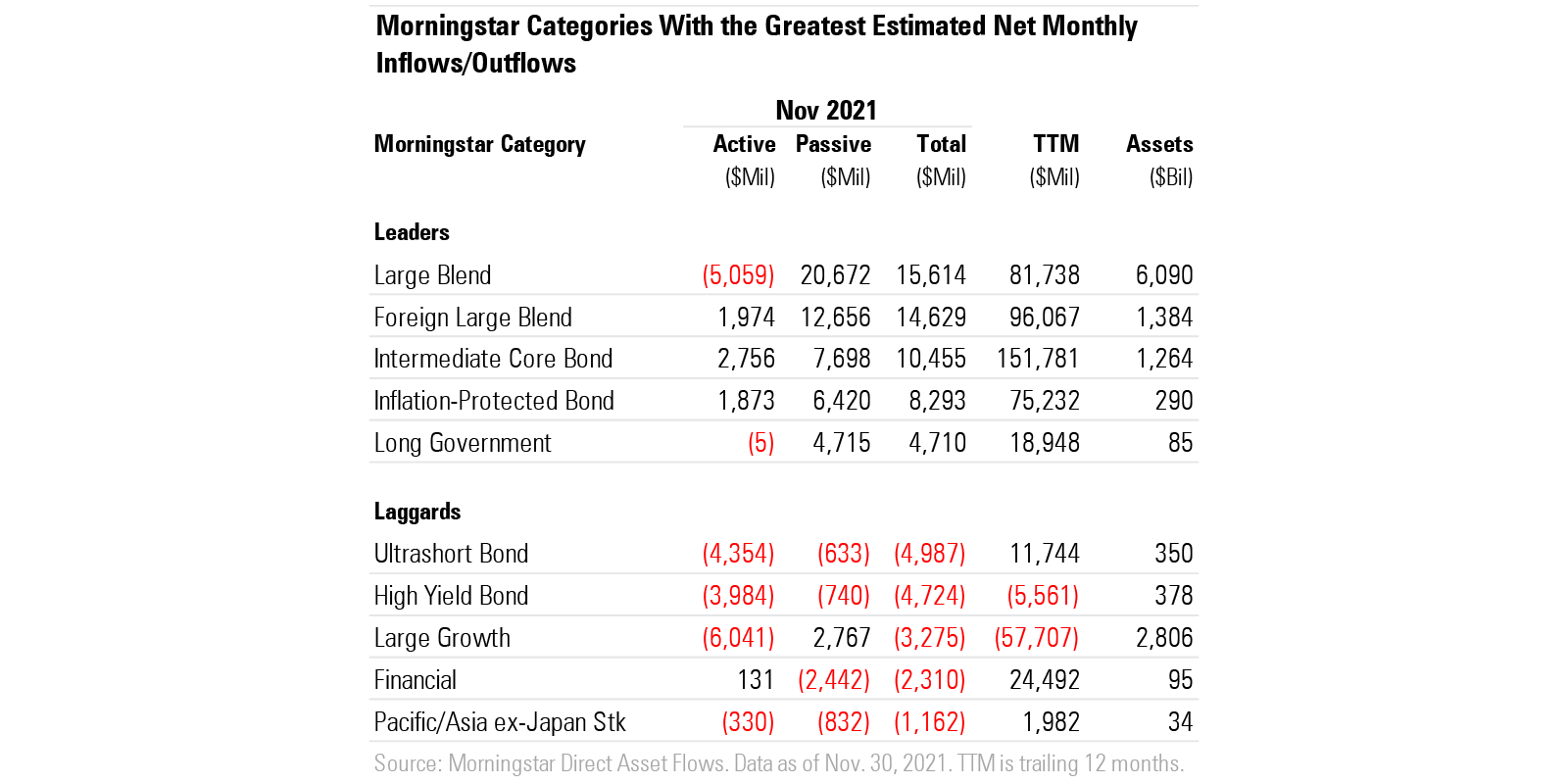

Inflation-protected bond funds remained the star of the fixed-income show in November, raking in a fresh $8.3 billion. Their $69.6 billion year-to-date inflow ranks fifth among all long-term Morningstar Categories--an impressive feat considering inflation-protected bond funds rank 22nd in total assets. Another stellar month puts these funds' previous annual flows record of $29.1 billion (set in 2009) even further in the rearview.

Investors have showed more of an appetite for longer-duration bond portfolios, while short-term bond funds have lost some momentum. Long-government funds' $4.7 billion intake was their healthiest of 2021 on an absolute basis. Meanwhile, the $821 million that short-term bond funds gathered in November marks the first month all year that inflows didn't eclipse $1 billion. Short-government funds posted their worst month of the year, too, leaking about $1.1 billion.

U.S. equity funds gathered $19.5 billion in November. They've collected positive flows in eight months so far in 2021 after enjoying just two such months in 2020. Large-blend funds dominated the group's intake, pulling in $15.6 billion. Passive large-blend funds gathered $20.7 billion, while their actively managed counterparts shed $5 billion--their 30th consecutive month of outflows dating to June 2019.

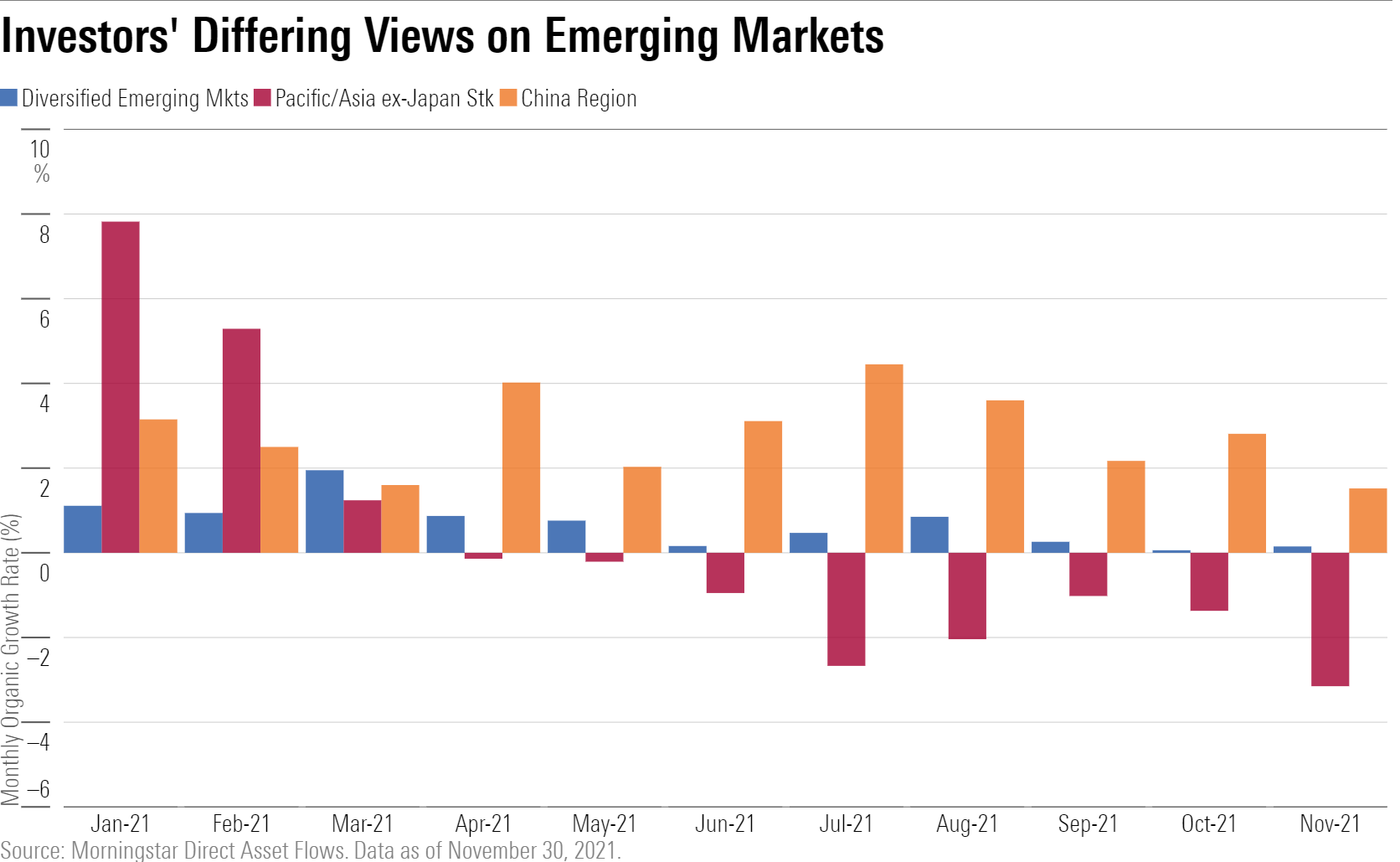

For the second consecutive month, international-equity funds did not gather more assets than U.S. equity funds, perhaps signaling a shift in sentiment after leading equity U.S. category groups through the first nine months. Notably, diversified emerging-markets funds--which are the second-largest cohort within the category group--collected just $1.1 billion in November. Demand for offerings in this segment has declined markedly since the first quarter of 2021, particularly relative to March's record $14.5 billion haul.

Along similar lines, Pacific/Asia ex-Japan stock funds, which invest heavily in emerging-markets stocks, suffered a $1.2 billion outflow in November, their eighth consecutive month of outflows. However, attitudes toward China-region funds have been much more sanguine despite broader economic and political concerns stemming from Beijing. Investors have piled into those funds in 2021 to the tune of $12.9 billion, good for a strong 35% year-to-date organic growth rate.

Sector-equity funds have also experienced a decline in demand in 2021. After taking in between $10 billion and $25 billion from January through April, they have topped out at about $6 billion in monthly flows, while mixing in two months of outflows in July and September. November's modest $4 billion collection was split between cyclical and secular growth themes, as has been the case since July. Technology funds led all categories in the group with $2.2 billion of inflows.

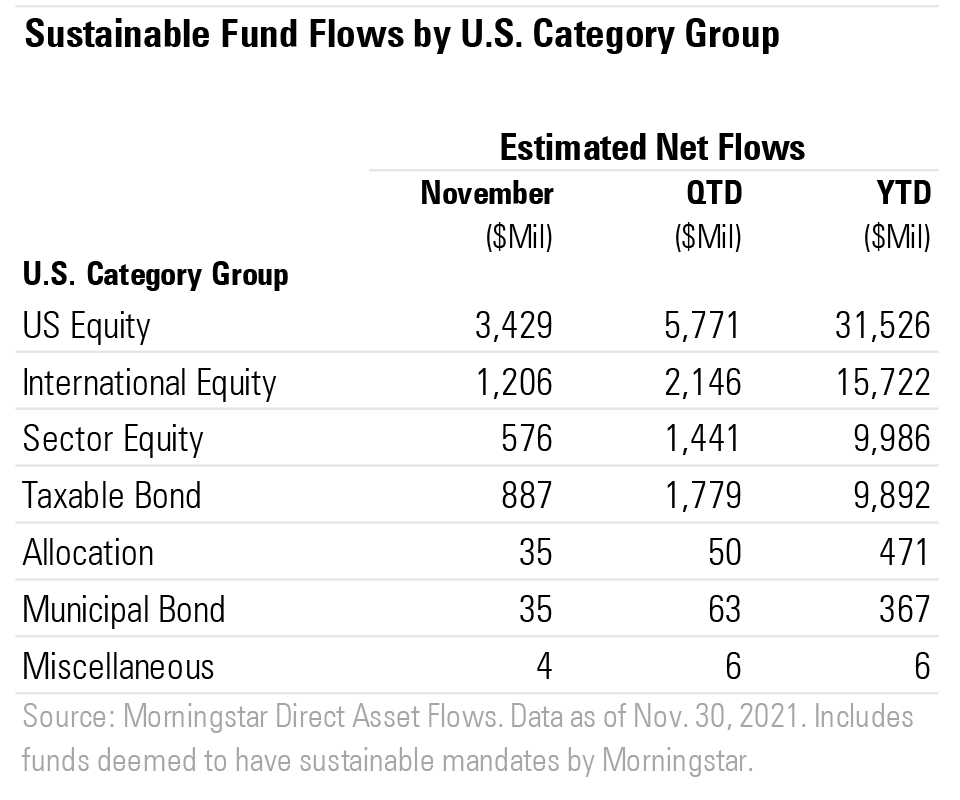

Interest in funds with environmental, social, and governance objectives remained broad-based in November with $6.2 billion of inflows. In fact, flows into funds with sustainability mandates incorporated into their prospectuses, as measured by Morningstar, were positive across all seven U.S. category groups offering such options.

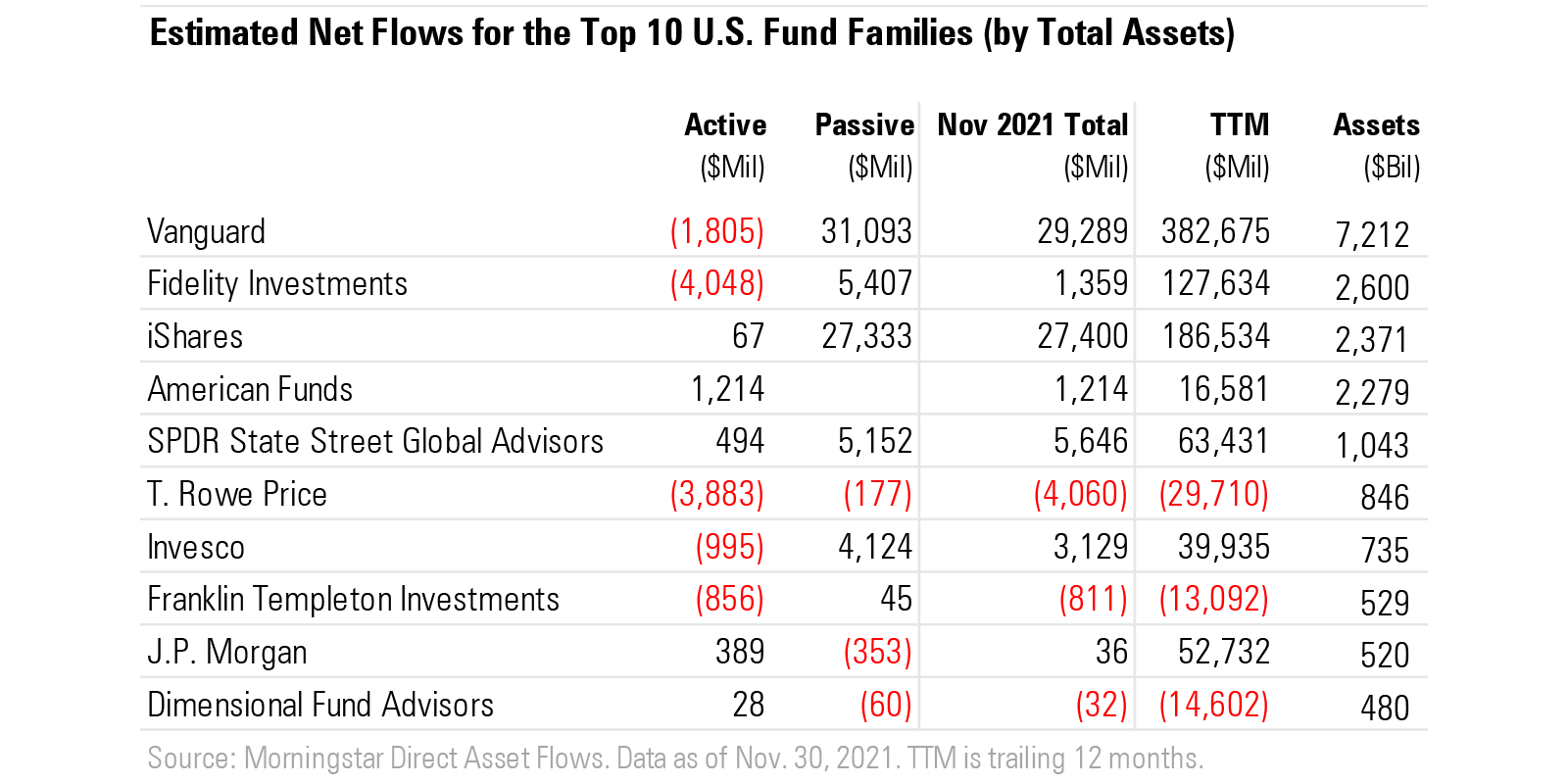

Vanguard reclaimed its seat atop all fund families last month. Its $29.3 billion inflow narrowly edged out the $27.4 billion that iShares absorbed. Vanguard has pulled in more money for the year to date ($357 billion) than its three next-closest competitors combined: iShares, Fidelity, and State Street ($353 billion). A pair of broadly diversified index funds, Vanguard Total Bond Market II Index VTBNX and Vanguard 500 Index VFIAX, led the way with inflows of $4.8 billion and $4.1 billion, respectively.

Note: The figures in this report were compiled on Dec. 13, 2021, and reflect only the funds that had reported net assets by that date. Artisan had not reported. Morningstar Direct clients can download the full report here.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)