Where to Invest in Bonds for 2022

Corporate bonds should continue to outperform amid strong economic growth and rising interest rates.

Investors busy enjoying another year of big gains in the stock market may not have noticed what’s happening on the bond side of their portfolios: They’re most likely losing money.

With just three weeks to go left in the year, the Morningstar Core Bond Index is down 1.71%, the first decline since 2013.

As we head into 2022, the outlook is similar to what we expected for this year: We believe bonds will be under continued pressure from rising interest rates as the economy works its way toward a recovery from the pandemic.

So, as rates rise and push bond prices down, how can investors position their fixed-income allocations to minimize the impact of rising rates?

Across the spectrum of fixed-income securities, we expect medium-term corporate bonds will outperform the broader bond market.

Here's why: Corporate bonds trade at a higher yield--known as a spread--over comparable maturity U.S. Treasuries to provide extra compensation to investors to offset the credit risk of the corporate issuers. Considering how low interest rates are, this extra credit spread provides a significant amount of extra yield for investors. For example, with the 10-year U.S. Treasury yielding approximately 1.50%, the yield on the average BBB rated corporate bond is almost double at 2.60%.

Within the corporate bond market, investors can benefit from one of 2021’s trends. Over the course of this past year, interest rates have risen the most among intermediate maturity bonds. But from here, we expect that medium-term bonds will provide the most yield with less price sensitivity from changes in interest rates as compared with longer-dated bonds.

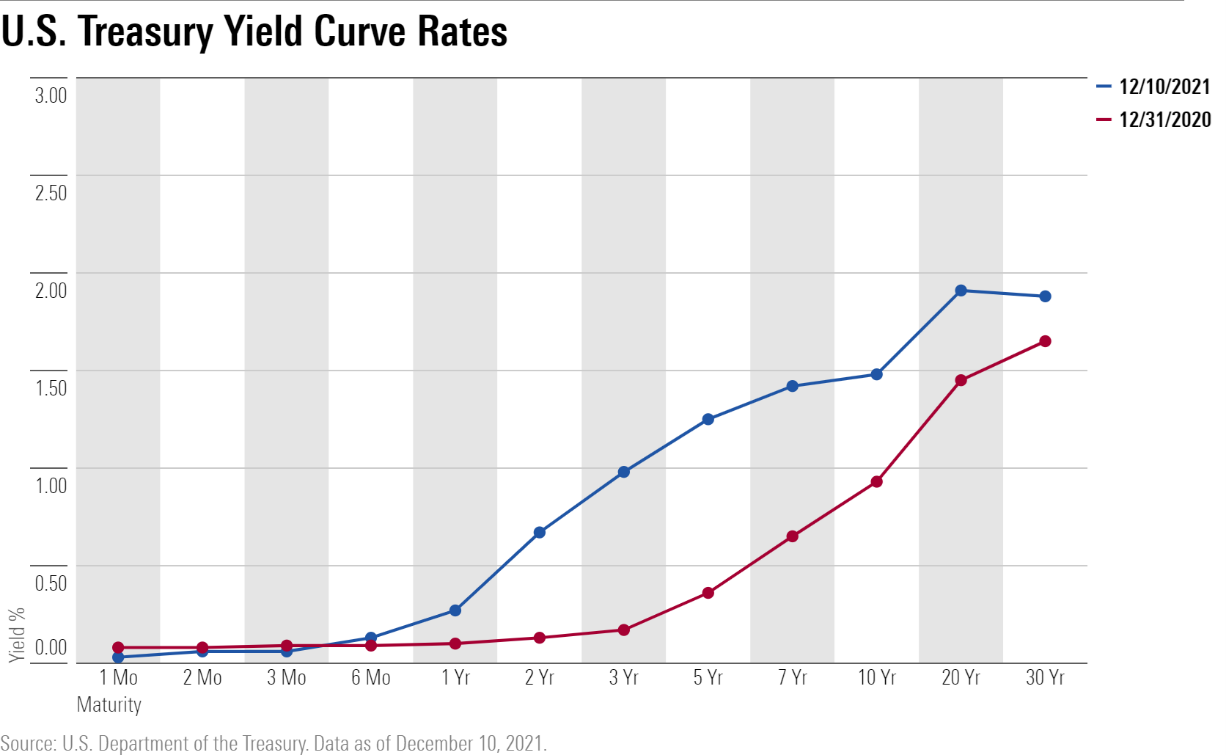

Fixed-Income Struggles in 2021 Fixed-income markets have generally performed poorly thus far this year because of the increase in interest rates. The amount that bond prices have fallen this year because of rising rates has more than offset the amount of interest earned. Among shorter-term maturities, the interest rate on the two-year U.S. Treasury bond has risen 54 basis points to 0.67%; among intermediate bonds, the five-year has increased 89 basis points to 1.25%; and at the long end of the spectrum, the 10-year has increased 55 basis points to 1.48%, and the 30-year has risen 23 basis points to 1.88%.

The Morningstar Core Bond Index, our broadest measure of the U.S. fixed-income market, has declined 1.71% through Dec. 10. With its longer duration--a measure of interest-rate sensitivity--the Morningstar U.S. Treasury Bond Index has performed even more poorly and has lost 2.33%.

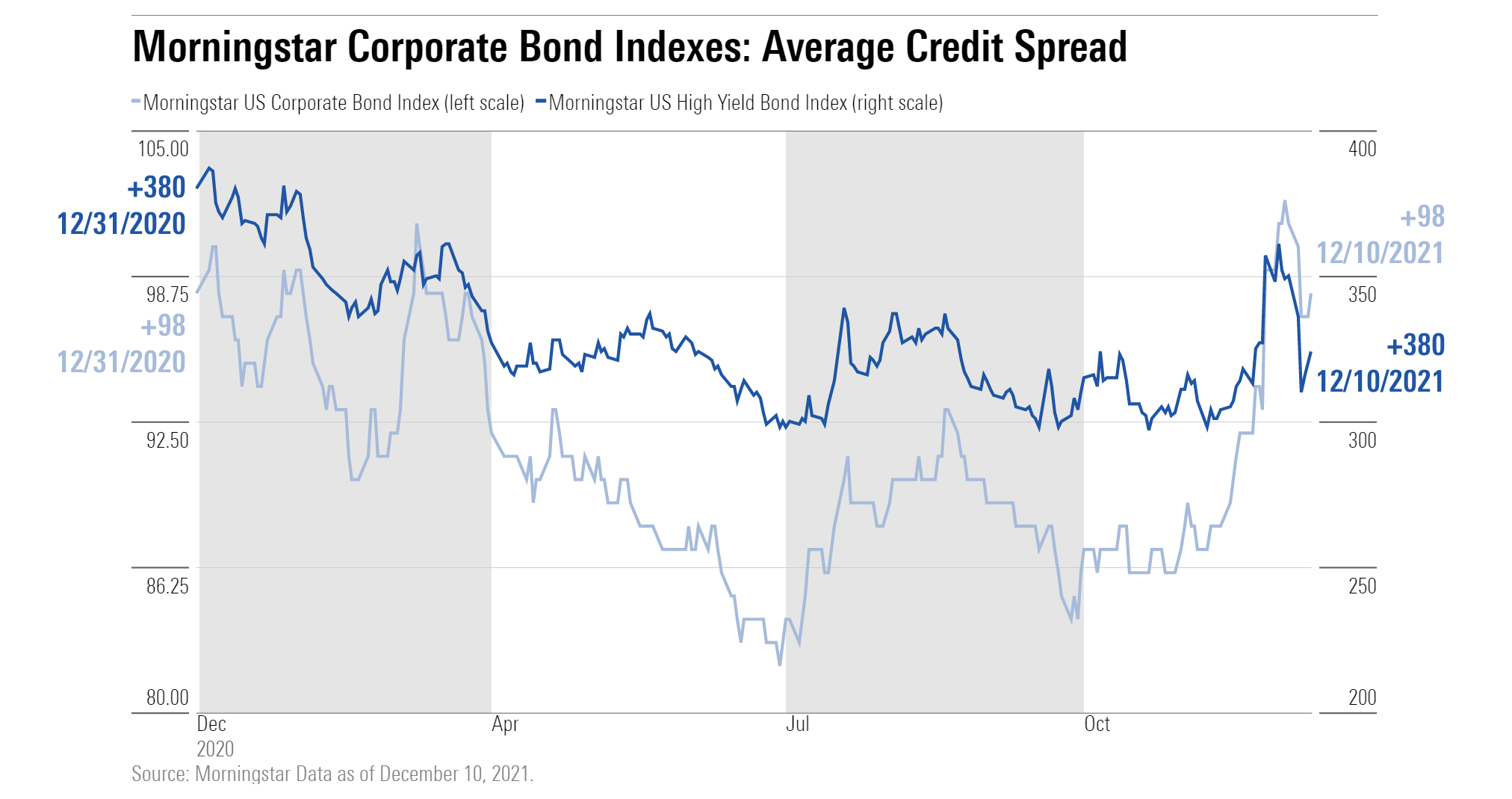

Given the extra yield provided by the credit spread on corporate bonds, both investment-grade and high-yield bonds have outperformed on both an absolute and duration-adjusted basis. The Morningstar Corporate Bond Index, our proxy for the U.S. corporate bond market, has lost only 1.32% thus far this year. The outperformance appears even better when you realize that the average maturity of the Corporate Bond Index is even longer than the Core Bond and U.S. Treasury indexes. The duration of our corporate bond index is 8.7 as compared with the Core and U.S. Treasury indexes at 6.6 and 7.3, respectively. In the junk-bond market, the Morningstar High Yield Index has risen by 4.40%. The positive return is based on the combination of its higher yields and tightening credit spreads, which were only partially offset by rising interest rates, as the duration of this index is only 4.2.

As the economy has normalized over the past 18 months and default risk has declined, corporate credit spreads have narrowed significantly since the emergence of the pandemic. In fact, credit spreads are trading within their lowest quintile over the past 20 years. However, credit spreads are tight for a reason.

Although the delta variant of the novel coronavirus delayed the economic normalization that we expected in the second half of 2021, we forecast that momentum from the ongoing economic rebound will result in several years of above-average economic growth. This strong economic growth will continue to bolster corporate balance sheets and should lead to more credit rating upgrades than downgrades; the resulting default rate will remain low.

Interest rates have risen across the spectrum of bond maturities this year, and we expect rates will continue to rise further in 2022. We project that inflation will subside to 2.8% in 2022 from 3.8% in 2021, moderate further toward the Fed’s goal, and average 2.2% over the 2022-25 time period. Yet, the yield on the 10-year U.S. Treasury bond is currently only 1.48%. With yields below the rate of inflation--a negative real interest rate--investors will continually lose purchasing power over time.

Furthermore, demand for U.S. Treasuries has started to decline as the Federal Reserve is scaling back its asset purchase program, which was used to pump additional liquidity into the markets and the economy during the pandemic-sparked recession. The Fed announced in November that it would begin to reduce the pace of its $120 billion monthly asset purchases by $15 billion per month. At that rate, the Fed would conclude its purchases in eight months. Recently, Fed chair Jerome Powell has intimated that, with inflation running hotter than the Fed prefers and no longer describing inflation as transitory, the Fed may consider accelerating the rate of tapering and ending the purchases faster than originally anticipated.

Taken all together, we suspect that investors will only be willing to accept negative real interest rates for so long, and with demand from the Fed waning, interest rates will continue their upward trend.

With the prospect for a combination of rising interest rates but strong economic growth, we think investors should either remain in, or consider moving to, an overweight position in corporate bonds in their fixed-income portfolio allocations. For investors with higher risk tolerances, we expect that high-yield corporate bonds, with their shorter duration and higher yield, will continue to outperform investment-grade as they derive the most benefit from the ongoing economic rebound.

Considering we expect interest rates to rise over course of 2022, investors should consider keeping their portfolios tilted toward the middle of the U.S. Treasury yield curve. In our view, this is the most attractive part of the yield curve as it provides the greatest amount of yield but carries much less interest-rate risk than the long end of the curve.

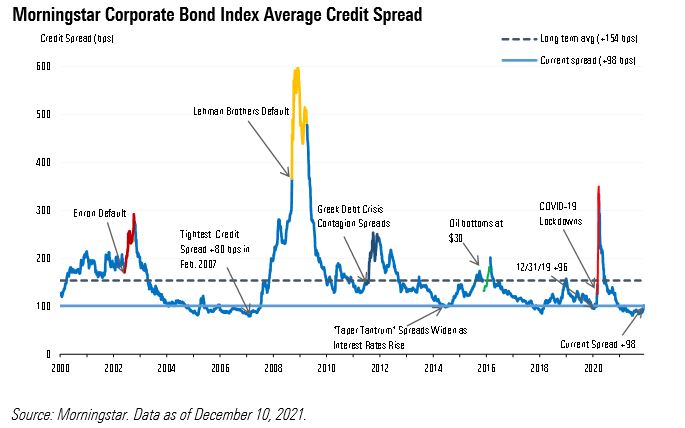

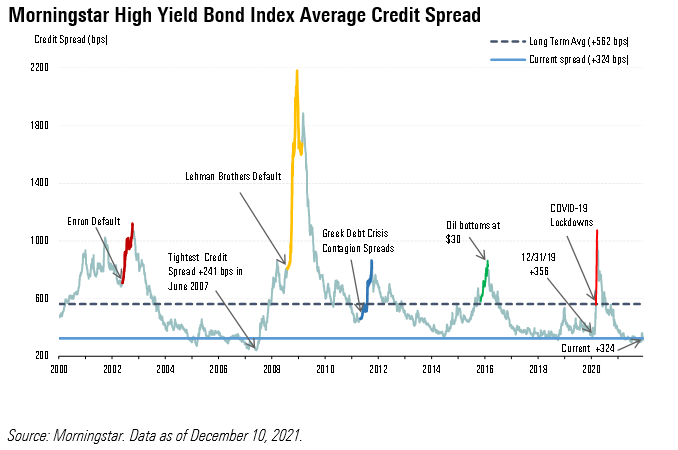

How Do Current Corporate Credit Spreads Compare With Historical Averages?

In bond vernacular, corporate credit spreads are “tight” as the low spreads provide only limited compensation for credit risk. Over the past 20 years, investment-grade spreads have been lower than they currently are only about 19% of the time. In the high-yield market, credit spreads have been lower only about 16% of the time. As such, even with credit metrics improving, there is not much room for credit spreads to tighten from here. Based on our economic outlook for the next few years, spreads should continue to remain tight over the foreseeable future. That means that investors in corporate bonds should be able to avoid the drag on returns that could come with a widening of spreads.

Currently, the average corporate credit spread of the investment-grade index is plus 98 basis points. As shown below, this is substantially tighter than the average we have seen over the past 20 years; however, we note that the average is skewed about 10 basis points higher from the worst of the global financial crisis. The tightest that this index ever traded was plus 80 basis points in February 2007.

The current corporate credit spread of the high-yield index is plus 324 basis points. As shown below, this is also substantially tighter than the average we have seen over the past 20 years; however, the average is skewed about 40 basis points higher from the worst of the global financial crisis. The tightest that this index ever traded was plus 241 basis points in June 2007.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)