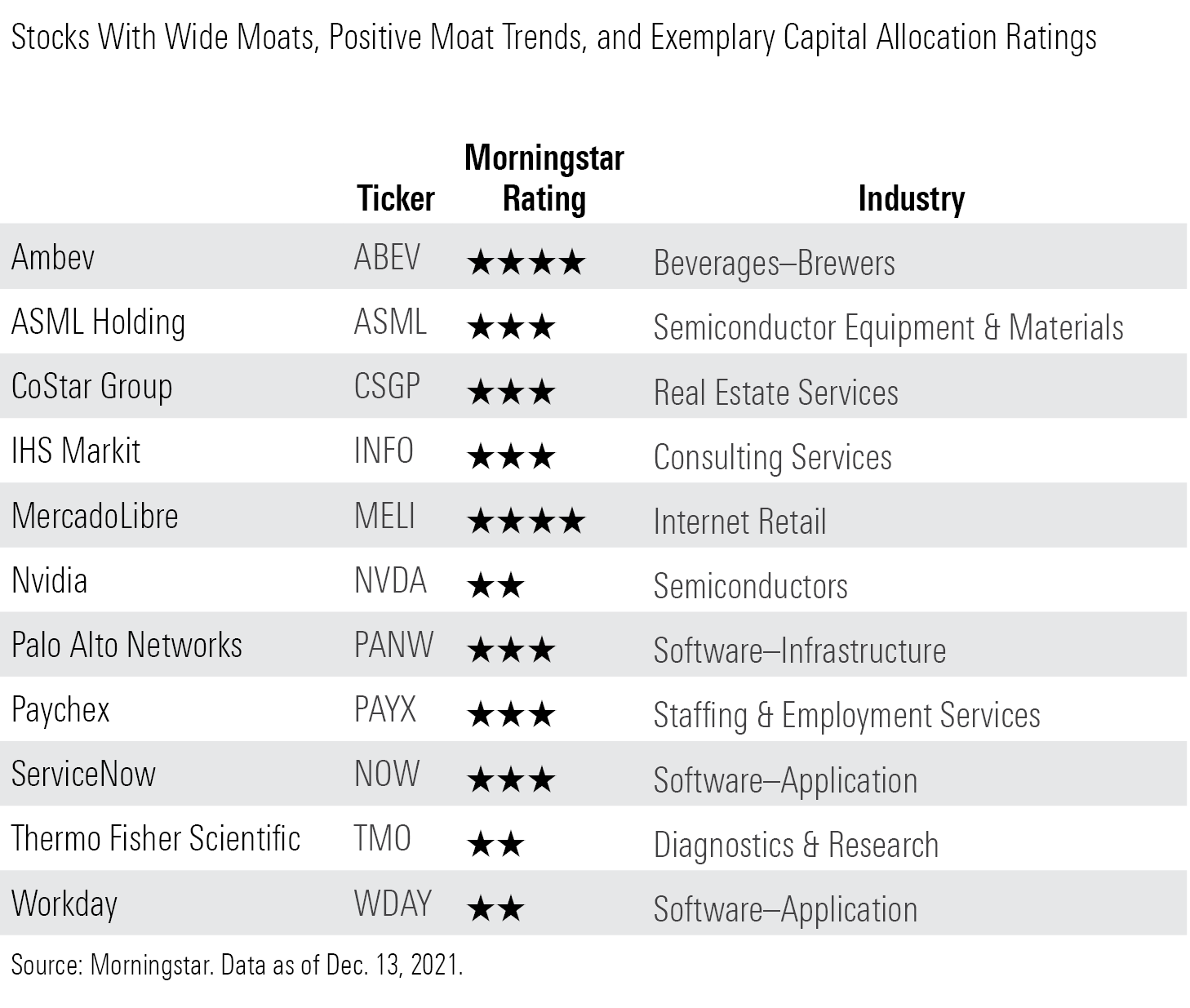

11 Top Stocks for 2022 and Beyond

These wide-moat companies have positive moat trends and exemplary capital allocation ratings.

In our view, good businesses have competitive advantages. They're tough to beat, whatever market they're in, and they've carved out economic moats that should allow them to generate excess returns for the next decade.

Great businesses, meanwhile, have unassailable competitive advantages--they have wide moats that should allow them to generate excess returns for the next two decades.

And the top businesses are those wide-moat firms that are strengthening their existing competitive advantages and are run by adroit capital allocators.

Finding the best businesses by this definition means zeroing in on firms that do well on three particular Morningstar metrics: they have wide Morningstar Economic Moat Ratings, positive moat trends, and Exemplary Morningstar Capital Allocation Ratings.

The 11 businesses included here have hit the trifecta. Their stocks may not all be trading in buying range today, but they're certainly stocks to watch. And when trading below our fair value estimates, they're great stocks to invest in.

Here's what our analysts have to say about the two undervalued companies on the list.

Ambev ABEV

"Brahma, the Brazilian brewer, was the first foray into the consumer product manufacturing industry by private equity group 3G. In 2000, it merged two Brazilian brewers; Brahma and Antarctica, creating Ambev. The company has gone on to roll up brewers throughout Central and South America and holds several monopolylike positions in large markets, including an 81% volume share in Argentina, 68% in Brazil, and 61% in Peru.

"In part because of the favorable industry structures, and in part because of its 3G heritage, Ambev is a highly profitable business. The company has a well-entrenched cultural focus on cost management, and it implemented zero-based budgeting over a decade ago. Ambev's largest market is Brazil, which represented 52% of total beverage net revenue and 59% of earnings before interest and taxes in 2020. Until the coronavirus-related social distancing measures prompted the closure of the on-trade in some markets, EBIT margins in Brazil had been at or above 45% since 2010, among the highest in the global beer industry. While the entry of Heineken to Brazil may limit margin potential, we expect Ambev's margins to rebound to the high-30% range when the macroeconomic picture improves.

"In addition to its strong focus on costs, Ambev is pursuing a two-prong growth strategy. First, its core markets, with the exception of Canada, offer solid long-term consumption growth opportunities. According to GlobalData, annual per capita beer consumption in the low 40 liters is below the global average of around 54 liters. Even in Brazil, Ambev's most mature market outside Canada, annual per capita consumption of 65 liters offers some upside for volume growth. Consumption per capita is generally around 80 liters or more annually.

"Another opportunity for revenue growth lies in the long-term premiumization of the market. Currently, the premium beer segment represents just 5% of Brazil's beer volume, versus almost 15% in Argentina and Chile, and we think Ambev's portfolio of local premium brands, as well as its access to Anheuser-Busch InBev's global portfolio, positions it to benefit from a strong mix effect in the medium term."

--Philip Gorham, director

MercadoLibre MELI

"MercadoLibre continues to position itself as a one-stop e-commerce solution for Latin American buyers and sellers. The firm has quietly developed a comprehensive ecosystem of mutually reinforcing services, with its core marketplace supported by a payments and lending arm (Mercado Pago), a best-in-breed shipping solution (Mercado Envios), a robust advertising platform (Mercado Clic), and a volume-generating classifieds business. With 95% of platform gross merchandise volume funneled through proprietary payment rails and 90% of items sold shipped through Envios, the marketplace operator has effectively addressed two of the biggest pain points in e-commerce.

"MercadoLibre's strategy lines up closely with that of the largest global e-commerce players: attracting users to the platform with shipping subsidies and membership rewards, offering sellers a simple and convenient user interface to ease listing friction, and reducing incentives to multihome for all platform participants as fulfillment speeds grow ever quicker and per-unit shipping costs fall ever further. While we expect platform monetization to increase only gradually, we anticipate that swelling customer expectations around sub-48-hour shipping times, increased fulfillment penetration, and small merchant credit tied to gross merchandise volume should render MercadoLibre's services all but irreplaceable.

"We also appreciate a move toward faster-moving consumer goods, grocery partnerships, and first-party sales, particularly as a cohort of customers maintains COVID-19-driven purchasing habits outside the traditional e-commerce decision set. While these products maintain lower average selling prices, they lend themselves to repeat purchase behavior, better positioning MercadoLibre to compete for customers' first online product search--driving better conversion rates and improved advertising monetization.

"Finally, we view the firm's main challenges moving forward as consistent with those of the past; increasing fulfillment penetration, generating operating leverage in shipping and payments solutions, and continuing to improve the user experience on the platform, driving barriers to success ever higher for competitors."

--Sean Dunlop, analyst

Start your free 14-day trial of Morningstar Premium. Understand the difference between a good company and a great opportunity. Unlock our analysts' fair value estimates and get continuous research and analysis to help you make the best decisions.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2UWGQD7LCJCYNF3WQ5HHLP7UBE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)