10 Funds That Are Acorns

These funds have room to grow.

The article was published in the November 2021 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

Last month I wrote about the benefits of closing funds before they get too big, so this month I'm seeking out small funds with a long runway.

Ideally, they won't need to close for a good while, but I also looked at the firms' records for closing funds.

I began my search by looking for funds with the most-liquid portfolios. That means that for their Morningstar Category, the funds could easily manage a wave of redemptions because they have sizable amounts of assets in stocks where they only hold a modest amount of the average daily trading volume. We look at various redemption scenarios as well as fund turnover to identify signs of stress.

I've added a couple of new wrinkles to the process, however. First, I limited my search to funds where the lead manager has at least a few years before retiring, ideally more. Second, I excluded funds whose total strategy assets are quite large because of money in other vehicles or because the manager runs a lot more in different strategies that could overlap with the fund in question.

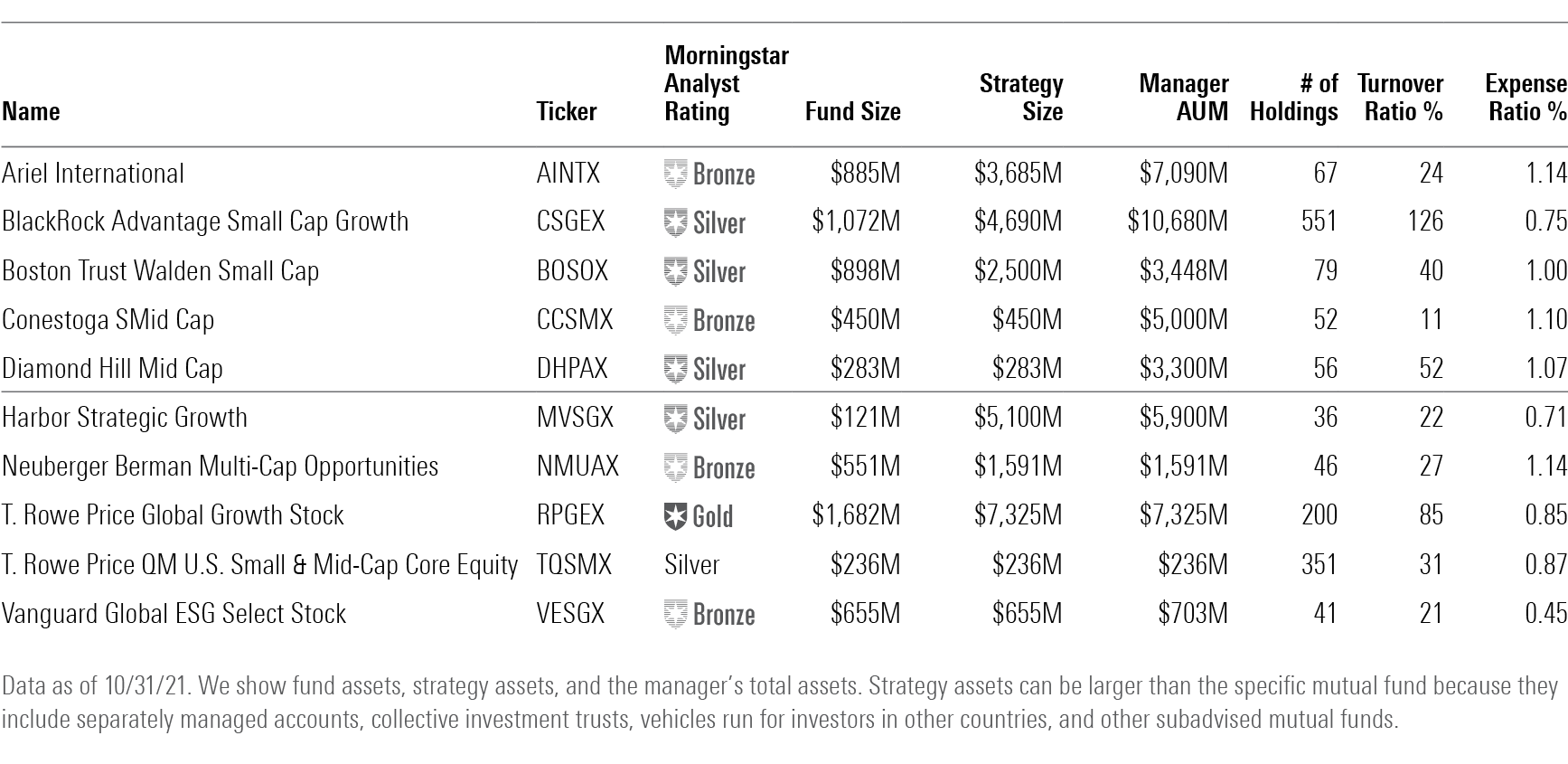

That left me with 10 Morningstar Medalists across the market-cap spectrum.

T. Rowe Price QM U.S. Small & Mid-Cap Core Equity TQSMX is that rare small/mid-cap fund where asset bloat is not a worry. This quantitative fund, which has a Morningstar Analyst Rating of Silver, has a diffuse portfolio of 350 holdings with none taking up even 1% of assets. Quant funds tend to be more diffuse because they seek out characteristics of successful stocks that should work most of the time, so they want to place a lot of bets for that to play out.

In addition, T. Rowe Price appears to have designed its QM funds with capacity in mind, so that it could run a lot of money at a time when some of its traditional small- and mid-cap funds are closed. T. Rowe Price closed this fund’s sibling T. Rowe Price QM U.S. Small-Cap Growth Equity PRDSX, and it has closed many others, so I think the firm would close T. Rowe Price QM U.S. Small & Mid-Cap Core Equity, but only after it grew quite a bit from here. (Interestingly, T. Rowe Price Mid-Cap Growth RPMGX announced it would reopen in late October.)

Sudhir Nanda recently left this fund, so the $10 billion that he runs in T. Rowe Price QM U.S. Small-Cap Growth Equity isn't included in the Manager AUM figure in the table below. Obviously, that does have some impact. I would imagine it limits the opportunities in small caps that T. Rowe Price QM U.S. Small & Mid-Cap Core Equity can take advantage of. However, quant managers also can more effectively run more money than fundamental managers, as it's a matter of designing quantitative screens rather than the more hands-on approach of visiting management, building models, and so on.

Large growth is the part of the market with the greatest liquidity. You can trade the likes of Apple AAPL and Alphabet GOOG all day. So, a fund like Harbor Strategic Growth MVSGX, which has $121 million in assets, clearly has plenty of room to grow. That figure understates the assets under management at subadvisor Mar Vista Investment Partners, as it has three versions of a growth strategy totaling $5.9 billion, and most of that is in this strategy. Mar Vista runs a focused portfolio of about 35 names, but its emphasis on wide-moat stocks means it has some giants like Amazon.com AMZN and Berkshire Hathaway BRK.B. We recently upgraded the fund's rating to Silver, and Brian Massey and Silas Myers are seasoned managers but are not approaching retirement.

Vanguard Global ESG Select Stock VESGX has the whole world to invest in and a modest $655 million to invest. Wellington tapped Mark Mandel and Yolanda Courtines to manage this environmental, social, and governance-driven fund. Both are running their first fund. Mandel has been with Wellington since 1994, and Courtines since 2006. They seek out companies with sustainable growth, solid returns on capital, and alignment with ESG principles. One big bonus here is that small funds sometimes have high costs, but of course Vanguard wouldn't do that. The fund charges just 0.45%.

Neuberger Berman Multi-Cap Opportunities NMUAX invests in small and mid-caps, but its mega-caps at the top mean the fund could easily handle a spate of outflows. With top holdings of Alphabet, Berkshire Hathaway, Microsoft MSFT, and Apple, the Bronze-rated fund can run $550 million quite comfortably. Richard Nackenson seeks companies with robust free cash flows and reasonable prices. He'll also take a flier on special situations and opportunistic plays. Nackenson has been running this fund since its 2006 inception, so the track record is a useful guide to what you can expect in a variety of markets.

It's great to see two T. Rowe Price funds qualify. Gold-rated T. Rowe Price Global Growth Stock RPGEX is a fundamental active fund, so it does come with the acknowledgment that it naturally overlaps with some large funds, making its modest $1.7 billion asset-base figure a little deceptive.

In addition, manager Scott Berg runs a fairly similar Australian version of this fund that adds quite a bit more. Even so, the AUM is not big by T. Rowe Price standards. Berg has done a great job of fundamental stock-picking in a diversified portfolio. The fund has 200 holdings, and none is all that large. Berg's valuation-sensitive growth strategy takes him off the beaten path a bit with emerging markets and small caps, but he still has a liquid portfolio and plenty of room to grow.

Diamond Hill Mid Cap DHPAX doesn't currently have to worry about closing. Assets have trickled out in the wake of a tough showing in 2020, leaving the fund with less than $300 million. Yet lead manager Chris Welch has an impressive record here and at Diamond Hill Small-Mid Cap DHMAX and Diamond Hill Small Cap DHSCX. The strategy here is deeply researched value with an emphasis on healthy balance sheets and cash flows. I appreciate that the fund stayed true to its value orientation even as growth stocks dominated in recent years. This Silver-rated fund has real potential. Diamond Hill has shown a willingness to close funds to new investors rather than dilute their process. While Welch runs $3 billion sibling Diamond Hill Small Cap, the universes are at least distinct in terms of the new names added to the portfolio, though the small-cap fund may let some holdings grow into mid-caps.

Conestoga SMid Cap CCSMX manages a modest $450 million in this growth strategy. The fund built on Conestoga's small-cap prowess by adding Derek Johnston and Ted Chang, who have expertise up the market-cap ladder. Robert Mitchell serves as lead manager and Johnston as co-lead. They look for steady growers with low debt that can grow earnings by at least 12% annualized over the ensuing three years. The 52-stock portfolio tops out at 3.7% in assets in top holding Casella Waste Systems CWST. Although it suffered a subpar 2020, the fund's five-year returns are in the top quintile of the mid-growth category. The strategy AUM is quite small, but its small-cap sibling is $4.5 billion and closed to new investment.

Ariel International AINTX runs a focused portfolio, but with $885 million in assets, Rupal Bhansali has plenty of room to maneuver. It’s actually about $3.7 billion across various vehicles, plus about $3 billion more in global strategies. Even so, those are very big ponds to fish in. With her low-turnover strategy, Bhansali should have room to grow. Bhansali is a very defensive investor who looks for companies that should endure recessions and other challenges. Thus, you get well established firms with moats, such as Roche Holding, Nintendo, and GlaxoSmithKline. Although returns have been sluggish in the strong bull market, Bhansali had a strong 10-year record before joining Ariel. We rate the fund Bronze.

BlackRock Advantage Small Cap Growth CSGEX is another diffuse quantitative effort. BlackRock has been ramping up its quantitative resources while cutting fees. We give the fund Above Average ratings for all three pillars and a Silver rating overall. The team uses multiple models to craft a huge 551-name portfolio where the top holding accounts for just 1.65% of assets. Since the quants took over in 2014, performance has been decent, not great. Shocks like the pandemic are very tough on quant funds, though, so that record is better than it seems at first look. Again, the total run by the quant team here is much larger than the fund (north of $10 billion), but I don't see that as an impediment for quant strategies as long as those particular strategies have room to grow.

Boston Trust Walden Small Cap BOSOX is a new addition to coverage. We rate the fund Silver owing to its experienced managers and skilled execution. The fund blends ESG criteria with an emphasis on stable, predictable earnings. Performance has been outstanding since the fund's 2005 inception. Although it's just a $900 million fund, the firm runs a total of $13 billion across 10 strategies. The total in this strategy is $2.5 billion (including separately managed accounts), and Boston Trust Walden estimates capacity at $3.5 billion. I'm encouraged that the firm has closed strategies in the past. The fund has 79 holdings, and turnover last clocked in at 40%. It's an appealing package all around.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)