Black Friday Turns November Into a Cruel Month for Trend Followers

A rough Thanksgiving weekend shows these investment strategies don’t always zig when the market zags, as many expect.

Investors seeking protection from inflation and toppy markets have increasingly turned to systematic trend-following. The systematic trend Morningstar Category received $1.7 billion in net inflows for the year to date through October 2021, a 17% increase relative since 2021’s start, according to Morningstar Direct. These strategies trade futures and swaps contracts to profit from price trends across capital markets and try to add value in strong bull or bear markets. But these investments warrant caution; they can turn volatile when trends quickly reverse. The end of November rudely reminded investors of that risk.

Trend-following strategies have been riding a nice wave of momentum since the start of 2019 as strongly trending equity and fixed-income prices boosted returns. The approach looked especially compelling during the pandemic-related sell-off in the first quarter of 2020 when the systematic trend category average eked out a positive return (0.1%), beating most liquid alternative categories and the MSCI World Index’s 21% loss. Short commodity and long fixed-income positions were beneficial. After a relatively muted second quarter in 2020, the good times continued to roll through the second half of the year and into 2021 when long energy commodities and short fixed-income positions--a stance opposite from what succeeded in early 2020--fared well as inflation fears rose.

Market Reversals Typically Result in Losses

Though history has shown these strategies can benefit during crisis periods like 2008, abrupt market inflection points can be ugly for these funds because they’re designed to exploit long, pronounced trends. Leverage, which can sometime run high, can amplify these market reversals’ and their accompanying volatility spikes’ pain. When, for example, equity markets stumbled in 2018’s first quarter and the VIX (a measure of implied volatility) jumped from 10 to an intraquarter high of over 50, the Credit Suisse Managed Futures Liquid Index lost 5%. Similarly, in September 2019, volatility in energy commodities led to the index losing more than 8% through the end of the year. To be frank, the sudden market shift of 2020’s first quarter was a somewhat unusual and lucky situation because many strategies had already tamed their risk profiles coming into the quarter. Black Friday--a day known more for shopping deals than market turmoil--this year served as a reminder of trend following’s potential pitfalls. Some funds in the category lost their entire year-to-date gains in last three days of trading in November.

The Perfect Storm

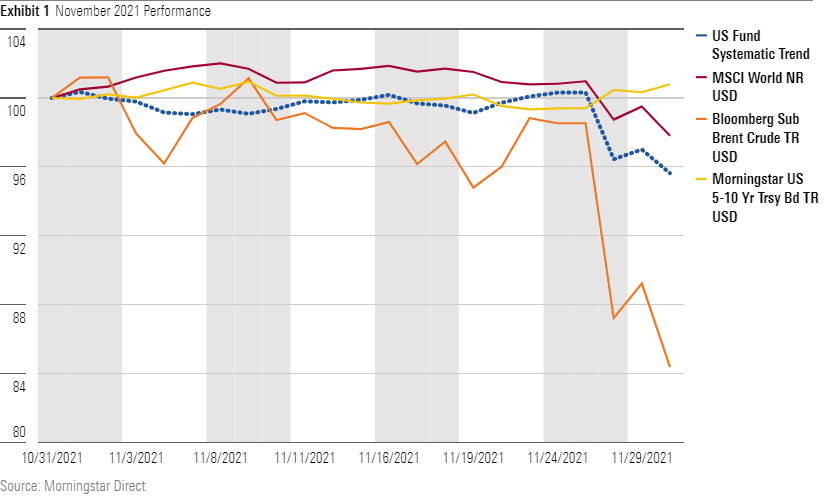

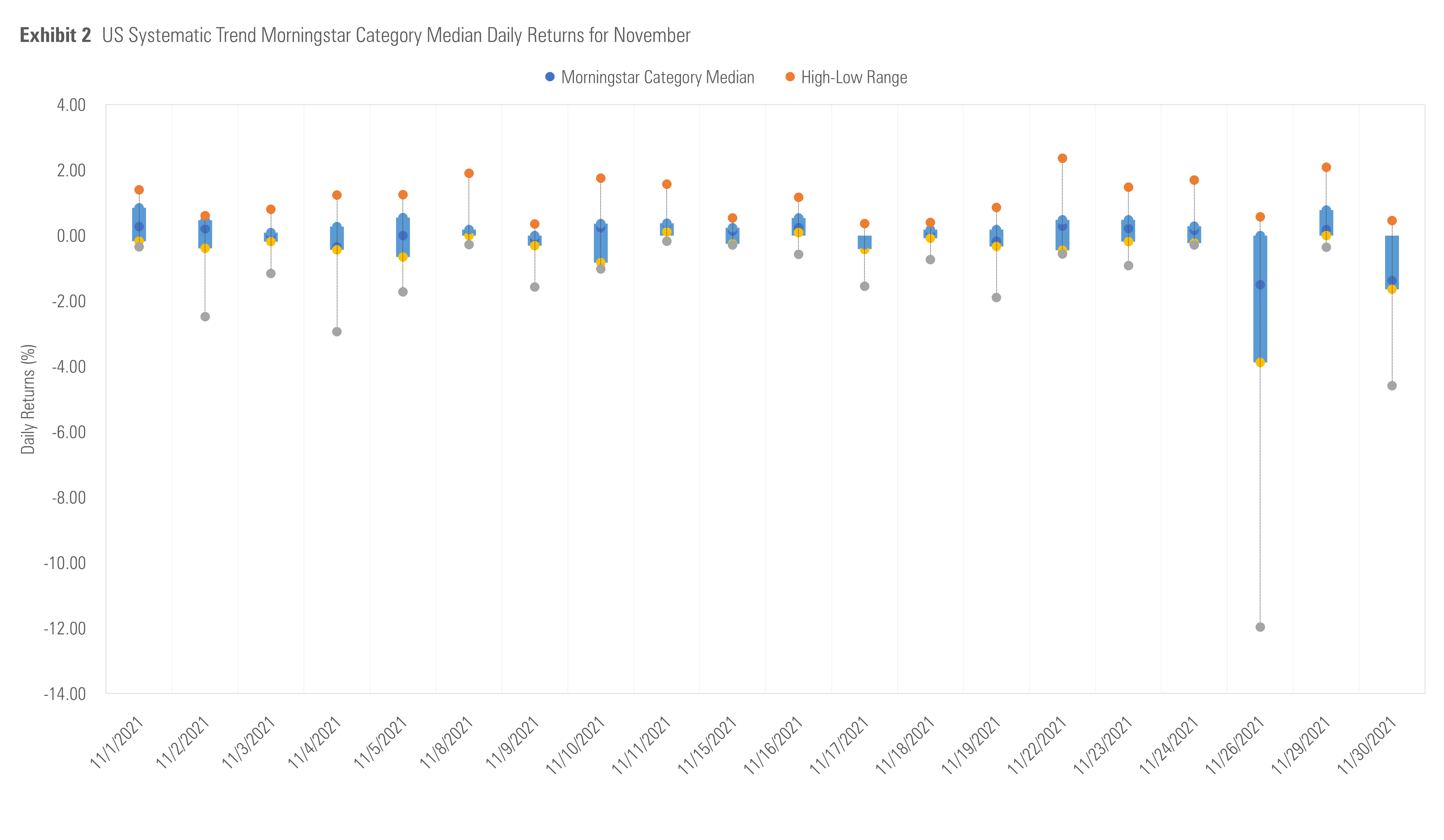

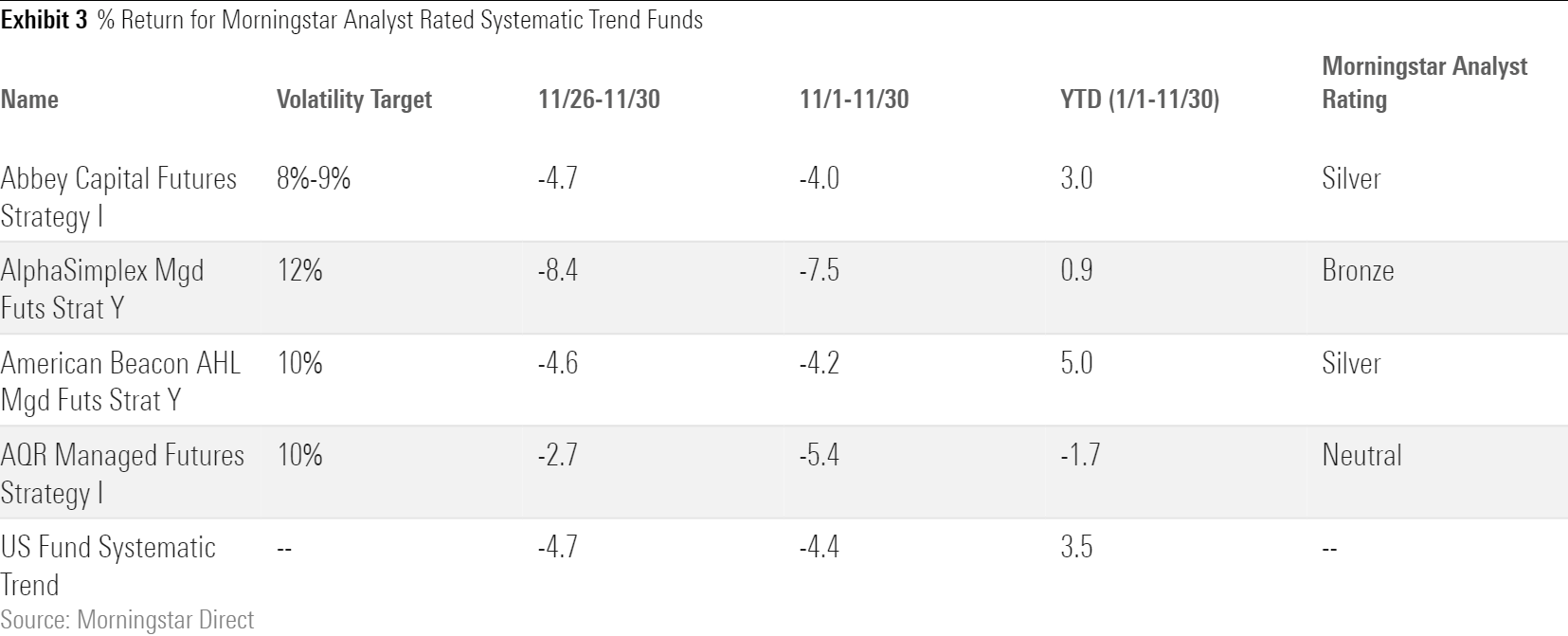

As news of the omicron coronavirus variant rattled markets at the end of November, trend-following strategies suffered. As Exhibit 1 shows, global equity markets had some of their worst losses on the year (the MSCI World Index lost 3.1%), energy prices tumbled (Bloomberg Sub Brent Crude TR declined 14.3%), and bond yields dropped (10-year yields fell 21 basis points), inciting a near-perfect storm for the cohort since long positions in energy commodities, long U.S. equities, and net short fixed income were common. The systematic trend category average was down 4.7% from Nov. 26 to Nov. 30. Exhibit 2 highlights the extent of this intramonth dispersion.

Hard-earned gains were quickly destroyed. Year-to-date returns for the category average went from 8.6% through Thanksgiving to 3.5% for the year to date through end-November. A fourth of the funds in the category (including open-end and exchange-traded funds) went from positive returns on the year to flat or negative following the rout over those same periods. Losses for this group of funds ranged from down 1.5% (ProShares Managed Futures Strategy FUT) to down a staggering 15.0% in two and a half trading days for the more volatile Arrow Managed Futures Strategy MFTNX. Further highlighting how challenging the period was for a category that typically sees a lot of dispersion over short periods, only two strategies posted positive returns from Black Friday through end of November.

The perfect storm may end up being short-lived, however, depending on the market’s assessment of the omicron variant. Markets are already showing signs of recovery as it digests news of the variant. These strategies could bounce back if the markets do, and managers can add risk to their portfolios. But more uncertainty could eat further into 2021’s gains. Alternatively, these funds could also shift their positions to take advantage of a negative trend should the market dislocation continue. These strategies still can help improve the risk-adjusted returns of broader portfolios, but investors must be aware they can be volatile at inflection points. They don’t always zig when the market zags.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)