Our Ultimate Stock-Pickers' Top 10 Buys and Sells

Funds see value in a diverse range of sectors.

For the past decade, our primary goal with Ultimate Stock-Pickers has been to uncover investment ideas our equity analysts and top investment managers find attractive, in a manner timely enough for investors to gain some value. As part of this process, we scour the quarterly and monthly holdings of 26 separate investment managers: 22 managers oversee mutual funds covered by Morningstar’s manager research group and four Stock-Pickers run the investment portfolios of large insurance companies. As the data from their holdings becomes available, we identify trends and outliers among their holdings as well as meaningful purchases and sales that took place during the period under examination.

In our last article, we walked through our Ultimate Stock-Pickers' purchasing activity during the third quarter of 2021. The piece itself was an early read on individual purchases--focused on high-conviction and new-money buys--that were made during the period, based on the holdings of almost all our top managers. Now that all but two Ultimate Stock-Pickers have reported their holdings for the period, we think it is appropriate to examine our managers' high-conviction purchases and sales in aggregate. As stock prices have changed since our Ultimate Stock-Pickers made their buying and selling decisions, we urge investors to analyze securities at current valuation levels before making any investment decisions--we will provide our fair value estimates, moat ratings, stewardship ratings, and uncertainty ratings to help them along the way.

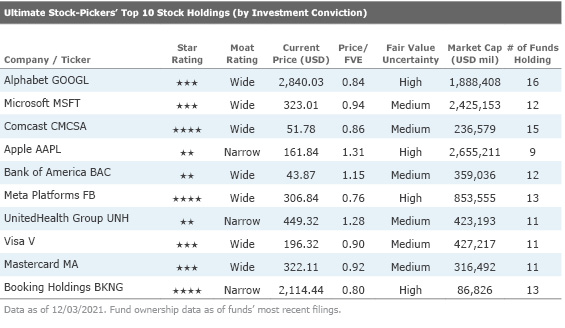

Morningstar's analysis shows that all the top 10 high-conviction holdings possess either a narrow or wide economic moat and that seven of them have a wide economic moat. Furthermore, eight of the 10 companies composing the top 10 high-conviction purchases have been granted either a narrow or wide economic moat by Morningstar analysts. Interestingly, only two of the top 10 high-conviction sales are considered by Morningstar to be moatworthy.

Given that many of the Ultimate Stock-Pickers are long-term investors, we were not surprised to see that the composition of our top 10 conviction stock holdings was largely the same as the prior quarter. As it did the quarter before, Alphabet GOOGL retained the top spot on our list. A majority of the funds that we analyzed (16) held Alphabet. Along with Comcast CMCSA and Meta FB, communication services rounded out three of the companies on our top 10 list. The other sector with three names was financials services, with Bank of America BAC, Mastercard MA, and Visa V all included. Our current fair value estimates imply that at the time of writing, three of the firms on our top 10 conviction holdings list are overvalued, with UnitedHealth UNH and Apple AAPL trading at about a 30% premium to our fair value estimates, and Bank of America at about a 15% premium. However, the remaining names on our top 10 conviction holdings list all trade at a slight discount to Morningstar fair value estimates.

All the names on our top 10 conviction stock holdings list were held by at least nine of the funds we looked at. Today, we’ll take a closer look at Alphabet, which continues to generate sustained interest and remains one of the market’s most popular names.

Wide-moat Alphabet was held by 16 funds at the time of writing. This high uncertainty stock currently trades at a discount to Morningstar analyst Ali Mogharabi’s fair value estimate of $3,400. According to Mogharabi, the company possesses a wide moat, thanks to sustainable competitive advantages derived from its intangible assets as well as the network effect.

Mogharabi believes that Alphabet has multiple characteristics that should draw investors’ attention. Alphabet dominates the online search market--with Google’s global share above 80%--in which it generates strong revenue growth and cash flow. With expected continuing growth in the firm’s cash flow, Mogharabi remains confident that Google will maintain its leadership in the search market. He foresees YouTube contributing more to the firm’s top and bottom lines and sees investments of some of that cash in moonshots as attractive. Whether they will generate positive returns remains to be seen, but they do present significant upside.

According to Mogharabi, Google’s ecosystem strengthens as its products are adopted by more users, making its online advertising services more attractive to advertisers and publishers. This results in increased online ad revenue that has the potential to grow at double-digit rates after the pandemic and during the next five years. The firm utilizes technological innovation to improve the user experience in nearly all its Google offerings, while making the sale and purchase of ads efficient for publishers and advertisers. Adoption and usage of mobile devices has also been increasing. The online advertising market has taken notice and is following its target audience onto the mobile platform. Google has participated in this on the back of its Android mobile operating system’s growing market share, helping it drive revenue growth and maintain its leadership in the space.

Mogharabi also makes note of the firm’s various investment areas, particularly applauding the effort to gain a stronger foothold in the rapidly growing public cloud market. Google has quickly leveraged the technological expertise it applied to creating and maintaining its private cloud platform to increase its market share in this space, driving additional revenue growth, creating more operating leverage, which we expect will continue. Mogharabi believes that the firm’s more futuristic endeavors (although most are not yet generating revenue) possess significant upside if successful, especially as the firm targets newer markets. Alphabet’s autonomous car technology business, Waymo, is a good example--based on various studies, it may tap into a market valued in the tens of billions of dollars within the next 10-15 years.

Mogharabi assigns Alphabet a stable moat trend, given the firm’s dominant position in online search, its continuing penetration of mobile device and fast-growing mobile ad markets with Android, and the lack of long-term threats to its main sources of economic moat--intangible assets and network effect.

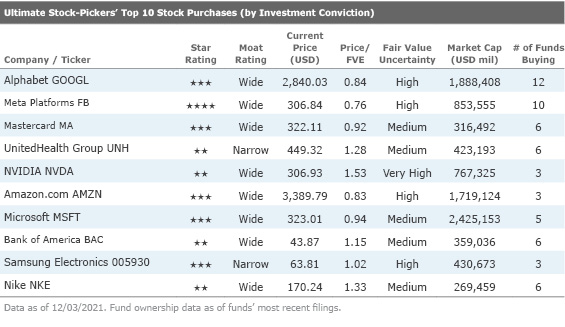

As we previously mentioned, our Ultimate Stock-Pickers' top 10 conviction stock purchases list is primarily composed of names that have been given moats by Morningstar equity analysts. The distribution of names is quite varied. We found that our Ultimate Stock-Pickers made three purchases in the technology sector, two in the consumer cyclical sector, two in financial services, and two in communication services. One of the consumer cyclical names that stood out to us was Nike NKE, a universally recognized name in the athletic apparel space.

Wide-moat rated Nike currently trades at about a 30% premium to Morningstar analyst David Swartz’s fair value estimate of $128. In summary, Nike is the largest athletic footwear and apparel brand in the world. It designs, develops, and markets athletic apparel, footwear, equipment, and accessories in six major categories: running, basketball, soccer, training, sportswear, and Jordan. Footwear constitutes approximately two thirds of Nike’s sales, and the firm has significant international reach. It sells products worldwide and outsources its production to more than 300 factories in more than 30 countries.

Swartz views Nike as the leader of the athletic apparel market and believes it will overcome the challenge of COVID-19 despite near-term supply issues. His wide moat rating on the company is based on its intangible brand asset, as he believes it will maintain premium pricing and generate economic profits for at least 20 years. Nike is the largest athletic footwear brand in all major categories and dominates categories like running and basketball with popular shoe styles. While it does face significant competition, Swartz believes it has proven over a long period that it can maintain share and pricing.

Swartz thinks that Nike’s strategies allow it to maintain its leadership position. He notes that in mid-2017, the firm announced a consumer-focused realignment. It is divesting its direct-to-consumer network while reducing the number of retail partners that carry its product. In North America and elsewhere, the firm is reducing its exposure to undifferentiated retailers while increasing distribution through a small number of retailers, like narrow-moat Nordstrom JWN, no-moat Dick’s Sporting Goods DKS, and Foot Locker FL, that bring the Nike brand closer to consumers, carry a full range of products, and allow it to control the brand message. Nike’s consumer plan is led by its Triple Double strategy to double innovation, speed, and direct connections to consumers. Triple Double includes cutting product creation times in half, increasing membership in Nike’s mobile apps, and improving the selection of key franchises while reducing its styles by 25%. According to Swartz, these strategies will allow Nike to hold share and pricing.

One of the big variables for Nike is its potential for global expansion. Swartz believes that Nike has a great opportunity for growth in China (where it is the market leader) and other emerging markets. Nike experienced double-digit annual growth in fiscal 2015-19 in greater China and should do so again in fiscal 2021 and beyond. He views investment in sports by the Chinese government as beneficial to Nike. Moreover, the firm, with worldwide distribution and huge e-commerce business that totaled about $9.3 billion in fiscal 2021, should benefit as more people in China, Latin America, and other developing regions move into the middle class and gain broadband access.

Lastly, Swartz notes the significant brand power that Nike possesses. Its performance shoes are the most expensive in the market, and it has been the preferred sportswear brand in the world since the 1980s. Swartz also notes the brand’s significant global reach, not only in terms of geography but throughout a multitude of different sports, is supplemented by a very recognizable lineup of athlete endorsers. According to Swartz, Nike’s brands have proven staying power, supporting his view that it can continue to earn economic profits for at least the next 20 years.

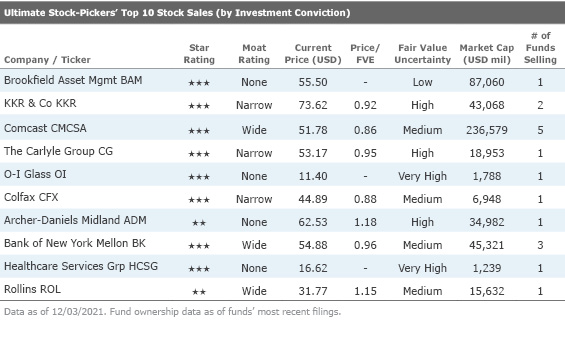

The Ultimate Stock-Pickers’ top 10 conviction sales list contains some new names compared with the previous quarter. Much of the selling activity came from the financial services sector, which contributed to four names on the conviction sales list. Three of the names fell under the consumer sector. Interestingly, only one of the 10 names on the conviction sales list trades at a premium to our fair value estimates. Bank of New York Mellon BK had three funds selling, according to our latest analysis.

BNY Mellon is a global investment company involved in managing and servicing financial assets throughout the investment lifecycle. The bank provides financial services for institutions, corporations, and individual investors and delivers investment management and investment services in 35 countries and more than 100 markets. BNY Mellon is the largest global custody bank in the world, with about $41.1 trillion under custody and administration (as of Dec. 31, 2020) and can act as a single point of contact for clients looking to create, trade, hold, manage, service, distribute, or restructure investments. BNY Mellon’s asset-management division manages about $2.2 trillion in assets.

According to Morningstar analyst Rajiv Bhatia, BNY Mellon’s investment servicing segment is much more than asset servicing; it offers issuers services that include corporate trustee and depositary receipts such as ADRs. Though it is the largest provider of depositary receipts, BNY Mellon has lost ground to competitors. BNY Mellon’s clearance and collateral management (about 7% of revenue) is unique in that it is the sole provider of tri-party repos for U.S. government securities. Pershing, which BNY acquired in 2003, provides broker/dealer clearing and registered investment advisor custody services and has been a bright spot for BNY Mellon. Bhatia expects Pershing to continue to benefit from the secular growth of RIAs.

The largest impact to the firm’s revenue from COVID-19 has been from low interest rates. Bhatia expects net interest income to continue to decline meaningfully in 2021 as low interest rates and a flatter yield curve weigh on net interest margins. He notes that fee waivers on money market funds had a net negative impact of $188 million in the first quarter of 2021, and the firm expects a $220 million impact in the second quarter.

BNY Mellon has faced criticism for a lack of cost control and integration failures in the Mellon merger. While Bhatia acknowledges some of the criticism and can see how BNY Mellon’s seven lines of business seem bulky, management in recent years has been aggressively focusing on expense control, and the firm consistently sees 15%-plus returns on tangible equity. Given pricing pressure and the low-interest-rate environment, he expects management to keep a lid on expense growth.

On the economic moat front, Bhatia assigns the firm a wide moat built on cost advantages and switching costs. The firm edges out State Street as the number-one custodian based on assets under custody or administration. There are large up-front costs to developing software systems and processes to serve a high amount of assets. As an example, State Street and BNY Mellon each spent over $2 billion on technology in 2019, a level that smaller firms cannot match.

However, Bhatia sees the firm’s moat trend as negative, due to fee pressure and client concentration. BNY Mellon is a large servicer of exchange-traded funds, and the two largest players (BlackRock’s iShares and Vanguard) continue to maintain or gain market share in the U.S. at the expense of competitors. At the end of 2019, BlackRock BLK had 38.4% of the ETF market by assets (virtually unchanged from 38.5% in 2016) and Vanguard VTI had 26.0% (up from 24.0% in 2016). Bhatia believes that as customers get larger, their negotiating leverage increases and that in some cases it may become viable for them to take certain functions, such as securities lending, in-house. While its asset-management business boasts more than $2 trillion in assets, BNY Mellon is still smaller than market leaders BlackRock, Vanguard, Fidelity FNF, and State Street STT.

Disclosure: Eden Alemayehu, Justin Pan, and Eric Compton have no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)