You Probably Need to Rebalance

If it’s been a while since you looked at your portfolio weightings, it might be time to adjust.

We’ve previously written about why rebalancing a portfolio at least once a year, or whenever the stock/bond split drifts significantly away from target levels, can help moderate volatility and keep downside losses in check.

In this article, I’ll look at specific asset classes that might need some adjustments if your last portfolio overhaul took place either one, three, or five years ago. To test the weightings, I started with a simple portfolio combining 60% stock funds and 40% in a bond fund. I allocated one third of the equity weighting to foreign stocks and split the domestic portion between value and growth funds. Over each period, I assumed that investors took a hands-off approach and simply held the underlying assets without making any changes in the interim. In all three cases, the portfolio weightings would have drifted away from target levels, especially with respect to the mix of stocks and bonds, but also when it comes to value and growth.

Note: In the discussions below, I assumed a rebalancing threshold of 5% above or below the target level, but there’s no hard-and-fast rule about how finely tuned a portfolio’s allocations need to be.

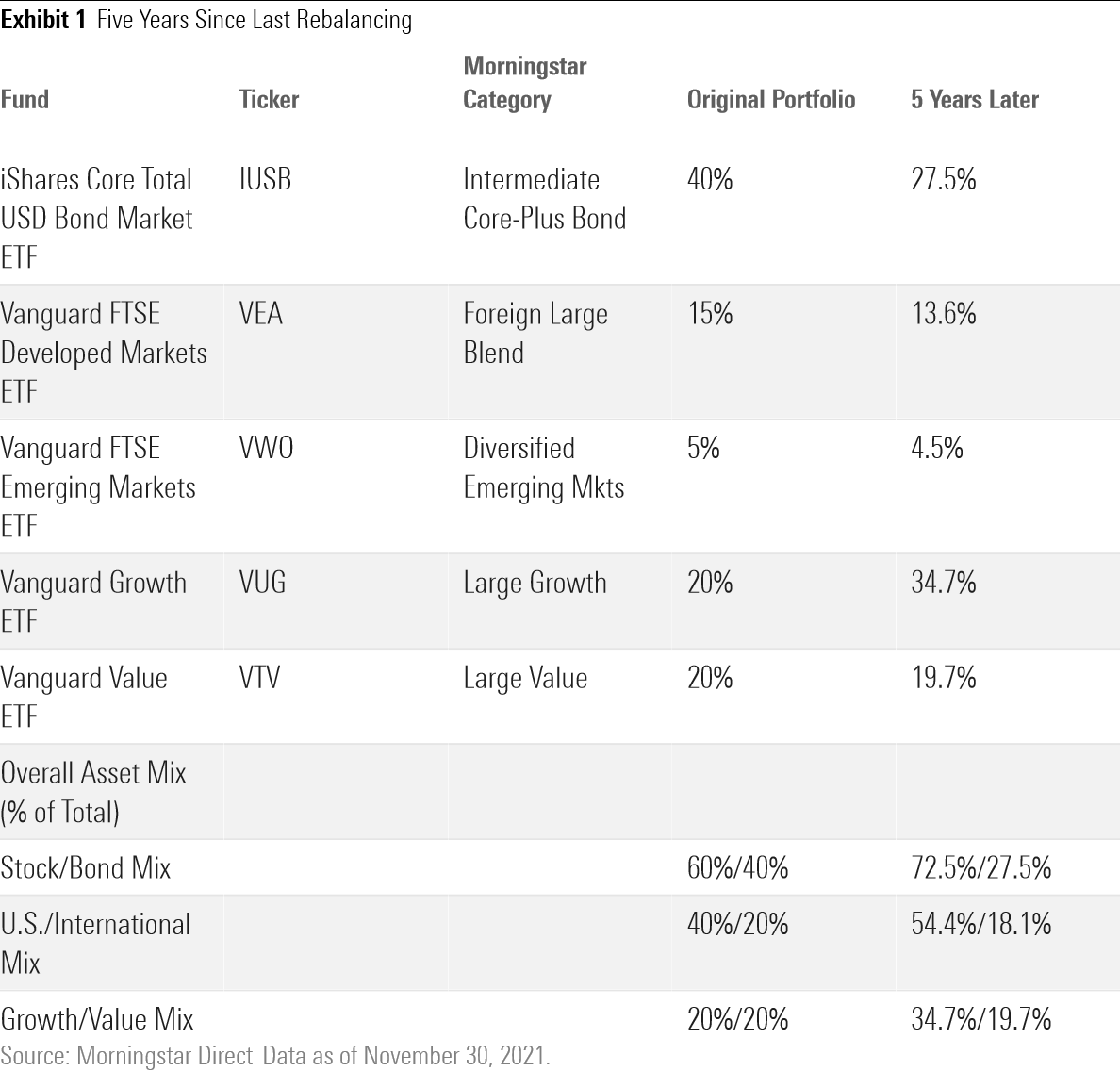

Five Years Since Last Rebalancing

If it’s been several years since your last portfolio rebalancing, your portfolio is probably significantly out of balance. Despite the short-lived bear market in February and March 2020, stocks have generally continued to rack up double-digit gains and significantly outpace bonds. As a result, the overall equity exposure would have continued creeping up, expanding from 60% at the beginning of the period to 72.5% by the end. That change would also have a significant impact on a portfolio’s risk profile. To get things back in balance, it makes sense to reallocate assets from stocks to bonds.

Because U.S. stocks have mostly continued to outperform, the mix between domestic and foreign stocks is also probably ready for some adjustments. By the end of the five-year period, U.S. stocks would have risen to about 54.4% of the overall portfolio--significantly above the original level. The mix between value and growth stocks would be significantly out of whack, with growth stocks accounting for 34.7% of total assets, up from 20% at the beginning of the period. That means growth stocks are a logical place to cut back; those assets can then be redeployed to shore up the fixed-income weighting.

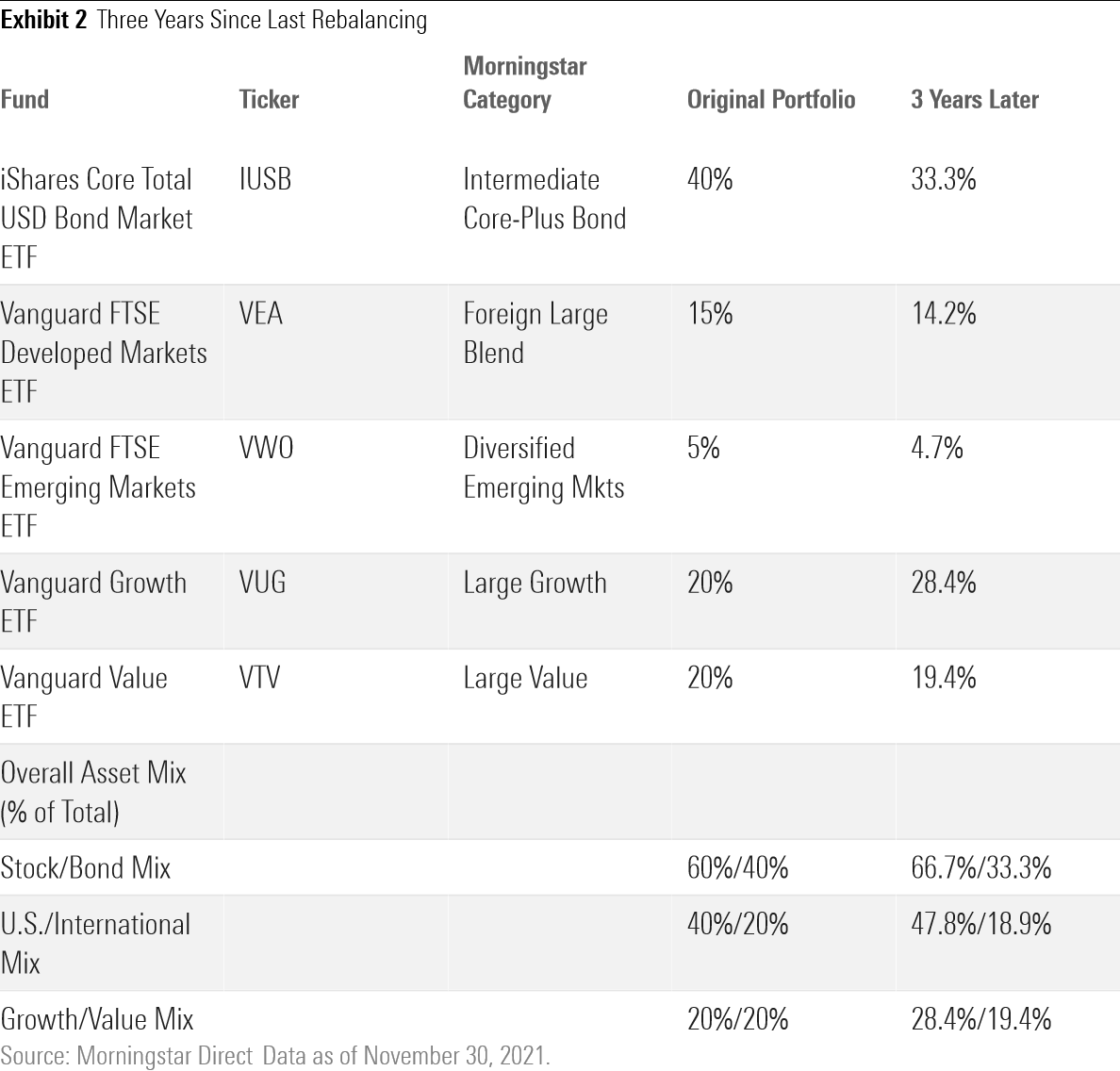

Three Years Since Last Rebalancing

If it’s been about three years since your last portfolio overhaul, it’s probably time for some adjustments. Stocks would have grown to about 66.7% of total assets, while bonds would be nearly 7 percentage points below the target level. U.S. stocks would have drifted up to 47.8% of assets, compared with 40% in the original portfolio. Growth stocks, in particular, continued to outperform, except for a brief resurgence of value in late 2020. As a result, the growth portion of the portfolio would be overweighted by about 8 percentage points, making it a logical place to trim back and redeploy the proceeds into bond funds.

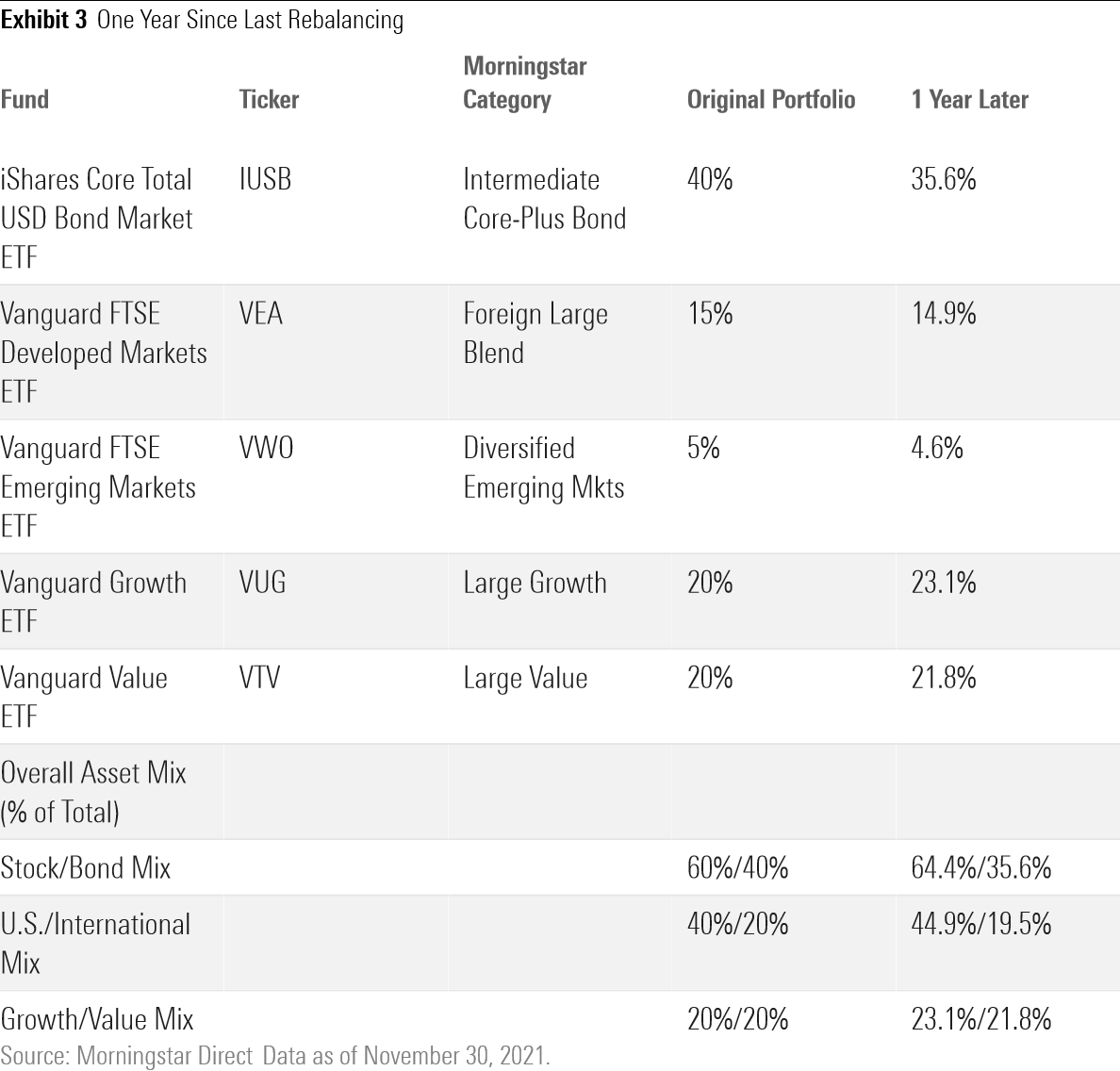

One Year Since Last Rebalancing

If it’s only been a year since you last rebalanced, your portfolio probably doesn’t need a major overhaul. Because U.S. stocks have gained about 21% for the year-to-date period through Nov. 30, 2021, while bonds have been flat to down, the portfolio’s overall equity exposure would have increased to about 64.4% of assets, up from 60% previously. To keep things in balance, it makes sense to prune back equity exposure (especially from the growth side of the portfolio) and redeploy some assets back into bonds. Because U.S. stocks have outperformed international issues by a wide margin over the past year, they would now consume nearly 45% of assets, up from 40% originally. Growth stocks, meanwhile, would also have drifted over the original target, but not by a huge amount.

How to Rebalance

If you suspect that it might be time to rebalance, the best way to start is by getting a handle on your portfolio's current asset mix. Morningstar's Portfolio X-Ray tool can provide a quick view of the combined asset exposure for your underlying holdings. If you find that certain areas have drifted away from target levels, some remodeling might be in order.

It’s easiest to make changes in tax-advantaged accounts, such as an IRA or a 401(k), because you can shift holdings around without any adverse tax consequences. As long as you buy and sell holdings within the same tax-deferred account, there should be no realized capital gains to worry about. Many 401(k) plan providers also allow you to put rebalancing on autopilot by selecting a target asset allocation and setting up preferences for automatic rebalancing.

Required minimum distributions, which are mandatory annual withdrawals that apply to investors age 72 and older who own tax-deferred accounts, are another logical opportunity to employ rebalancing strategies. Investors don't have a choice about taking at least the required minimum amount out of their accounts each year, so it makes sense to target appreciated asset classes when raising cash prior to taking the distribution.

Things get trickier with taxable accounts. Rebalancing typically means cutting back on winners, which are likely to have accumulated capital gains. Tax-loss harvesting, which involves selling assets with unrealized capital losses, can help offset some of the gains. (But because you’ll likely need to redeploy proceeds from the gains into the same areas that generated the losses, be careful not to get caught up in wash-sale issues.) If you’re still adding assets to a taxable account, steering those new monies to areas that are below your target level is another way to minimize the tax pain of rebalancing.

How Often to Rebalance

In a previous article, my colleague Maciej Kowara and I tested different rebalancing frequencies, as well as a static buy-and-hold approach, to see which approach had the biggest positive effect on downside risk and volatility control. We found that daily and monthly rebalancing led to slightly weaker results during market drawdowns because it meant repeatedly “buying the dip” even during periods of sustained market downturns. Quarterly and annual rebalancing, on the other hand, offered the twin benefits of protecting against downside risk while keeping downside volatility in check. A threshold rebalancing strategy--which involves setting 5% bands around each asset class’s starting portfolio weight and rebalancing whenever the weighting moved at least five percentage points higher or level than the target level--also made a significant positive impact.

Ultimately, as Vanguard has pointed out, the specific timing of rebalancing doesn't matter nearly as much as just embracing it in the first place. Any sensible rebalancing strategy is likely to lead to better risk-adjusted returns than a buy-and-hold approach, which can lead to a risk profile that's no longer in line with your comfort zone.

Conclusion

It’s important to note that portfolio rebalancing is mainly a tool for controlling risk--not necessarily for improving returns. Broad market trends can often persist for multiple years, meaning that simply letting a portfolio’s winners ride can pay off at times. For example, U.S.-based stocks have outperformed their non-U.S. counterparts by a wide margin over eight of the past 10 calendar years, so selling domestic winners to maintain a given weighting in international stocks has not led to better returns. That said, reversion to the mean is a powerful force, and even long-lived trends don’t last forever. One of the virtues of rebalancing is to avoid getting caught flat-footed when market trends eventually reverse course.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)