This Year’s Outperforming Large-Growth Fund Managers

Few funds have been able to beat their benchmark as high-flying companies like Tesla drive benchmarks.

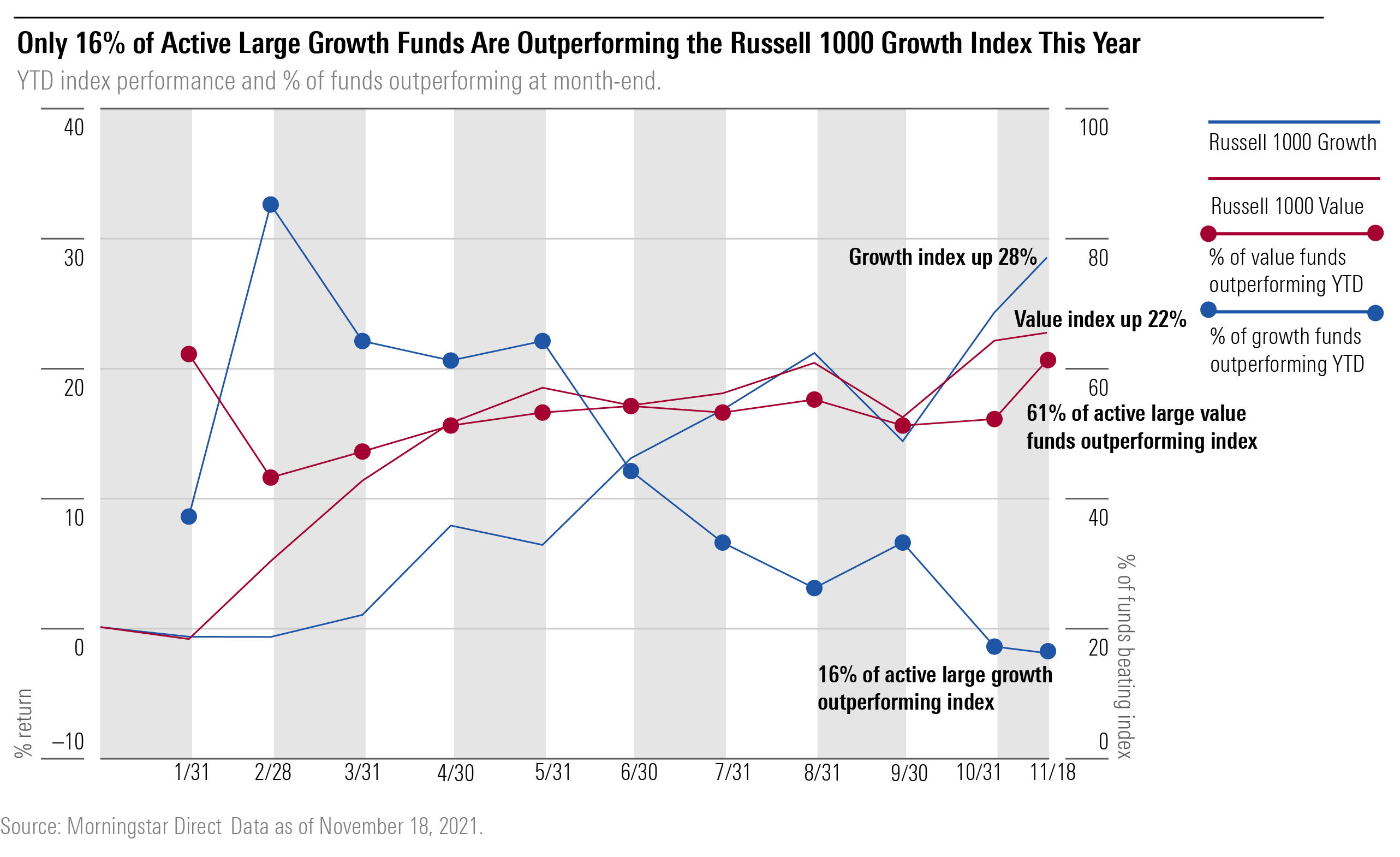

Both large-growth stocks and large-value stocks have turned in respectable returns so far this year: The Russell 1000 Growth Index was up 28.4% through Nov. 18, and the Russell 1000 Value was up 22.6%. Actively managed large-growth funds, however, struggled to beat their benchmark, while large-value managers were more likely to come out ahead: Only 16% of active large-growth funds beat the Russell 1000 Growth index through Nov. 18, while 61% of active large-value funds landed ahead of the Russell 1000 Value.

Growth managers' woes are nothing new. Morningstar's Ben Johnson wrote in the latest Active/Passive Barometer that "Active managers in the large-growth category have had a particularly difficult time delivering value for investors. Just 10.5% of funds have managed to both survive and outperform their average passive peer over the past 20 years."

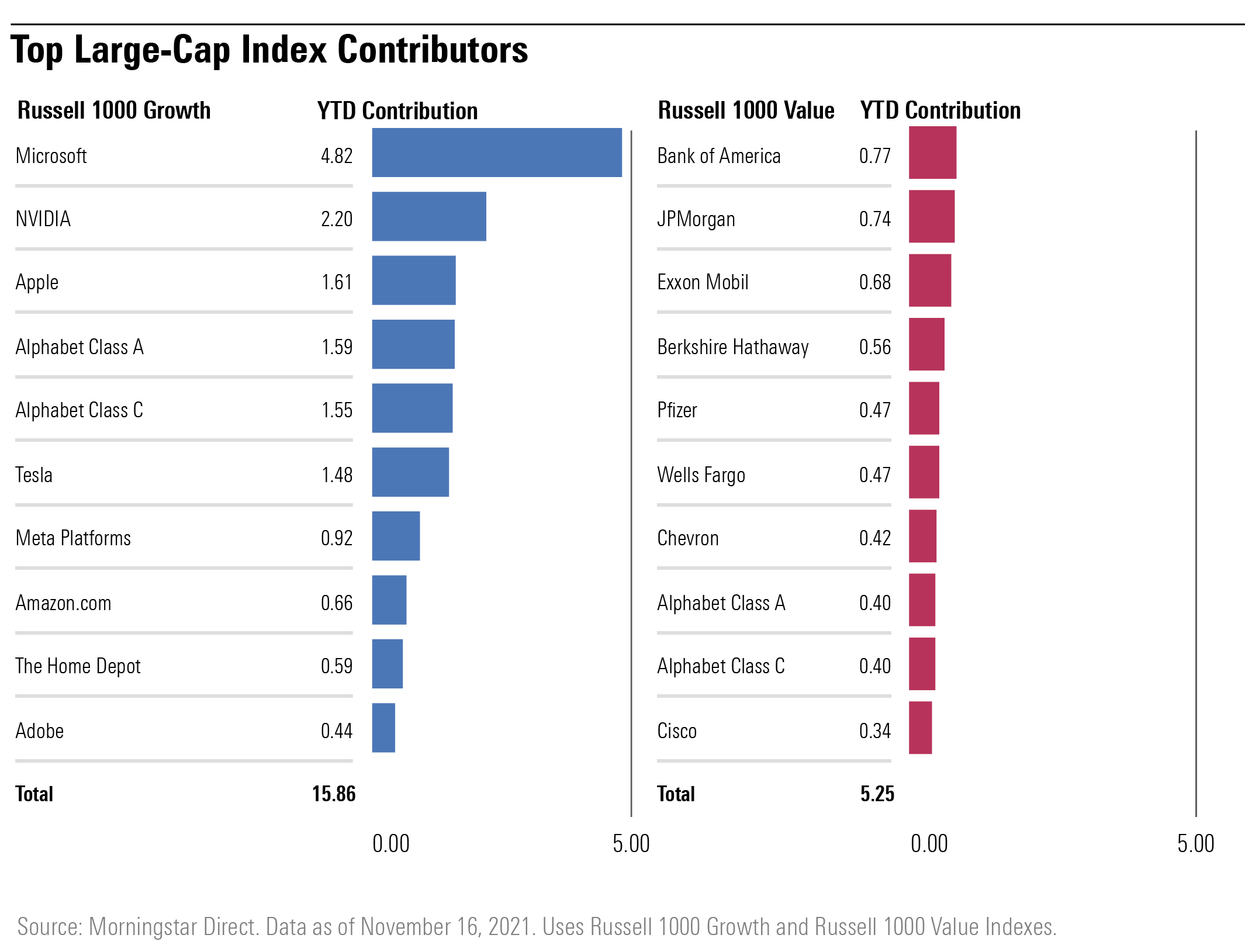

One explanation for growth managers' struggles is that their benchmark is concentrated in a few high-flying stocks that have been tough to beat, such as Tesla TSLA (up 55.4% this year), NVIDIA NVDA (up 142.8%), and Microsoft MSFT (up 54.7%). Ten stocks account for more than half of the Russell Large Growth index's 28.9% return so far this year.

The pool of investments contributing significantly to the Russell 1000 Value index’s return this year is much wider: The top 10 contributors to the index account for about one fourth of the index’s 22.6% return. As no one stock makes up more than 3% of the Russell 1000 Value Index, value managers aren’t at as big a disadvantage if they don’t own a top-performing name.

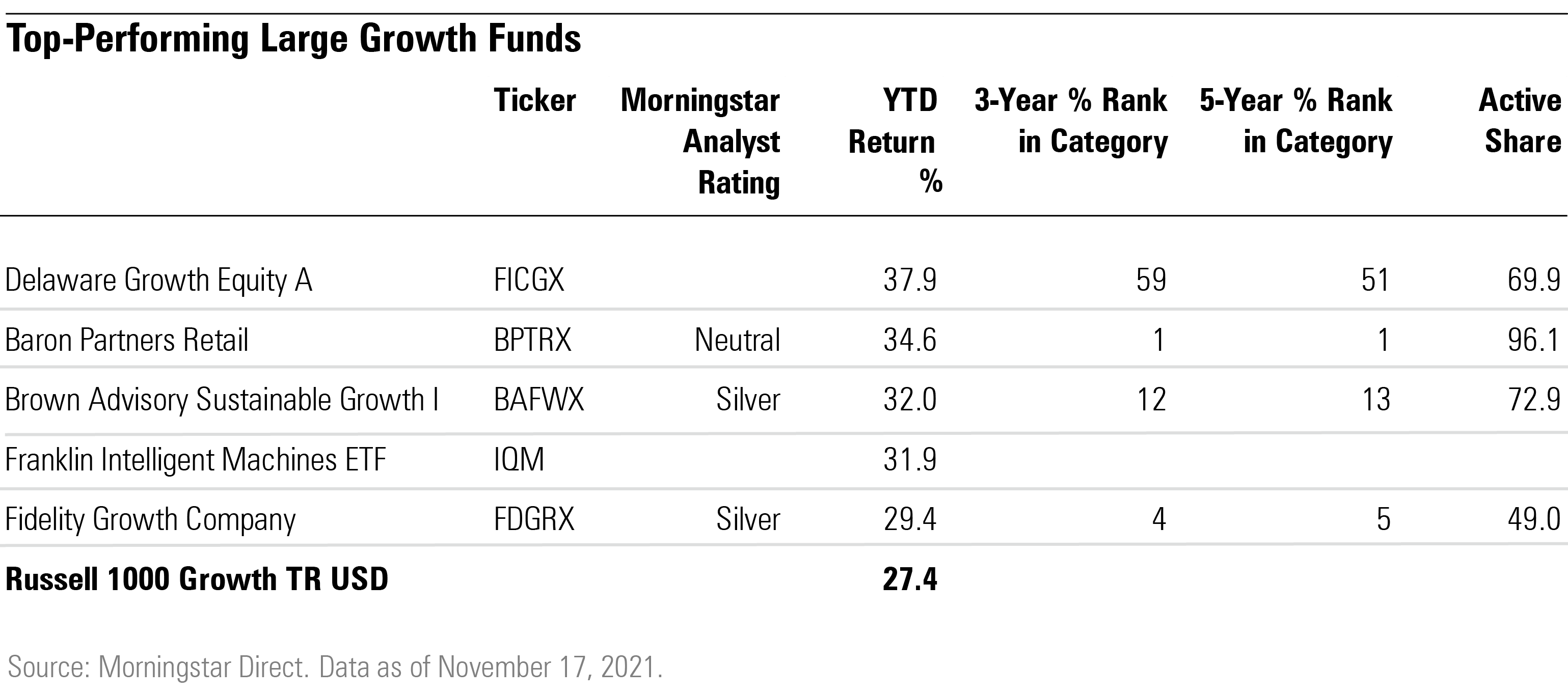

Only 80 of the 456 active funds in the large-growth Morningstar Category are ahead of the Russell 1000 Growth index so far this year. Some of the funds that outperformed held outsize stakes in some of the year’s high-flying stocks like Tesla and NVIDIA. Others, however, underweighted high-tech favorites and made smart investments elsewhere.

The most drastic example is Baron Partners BPTRX, which held nearly half of its portfolio in Tesla as of Sept. 30 and is up 34.6% so far this year. The fund ranks among the best in the category over the trailing three-, five-, and 10-year periods. However, the strategy’s Morningstar Analyst Rating was downgraded in January to Neutral from Bronze. As analyst Adam Sabban noted, “the continued growth of its top position highlights lax risk controls.”

Similarly, Fidelity Growth Company's FDGRX large stake in NVIDIA propelled its performance. The Morningstar Medalist held 8.7% in the semiconductor company versus the benchmark’s 2.3% as of September. Morningstar strategist Robby Greengold notes that the fund has been a standout on manager Steve Wymer’s watch. Wymer has shown a knack for spotting and successfully investing in big winners such as NVIDIA, Roku ROKU, and Shopify SHOP. The fund’s track record is strong: It ranks in the top 5% of large-growth funds over the past three-, five-, and 10-year periods.

Large stakes in both companies benefited Franklin Intelligent Machines ETF IQM. The actively managed exchange-traded fund gained 32.4% through Nov. 18, well above the average passive fund. Tesla accounted for 8.3% and NVIDIA was 4.5% of the portfolio as of September.

Though the top-performing large-growth fund benefited from an above-benchmark stake in NVIDIA, it was the managers’ large bet on Fortinet FTNT, which is up 131.3% so far this year, that differentiated the fund and helped push it to the very top of the large-growth category. Delaware Growth Equity FICGX has gained 38.8% this year, 10 percentage points more than the Russell 1000 Growth. The fund held 3.3% of its portfolio in the cybersecurity company as of Sept. 30, while the Russell Large Growth index had only a 0.18% weight.

Brown Advisory Sustainable Growth BAFWX has outperformed so far this year without outsize stakes in the benchmark’s top performers. While Microsoft and NVIDIA contributed significantly to its returns, as of September, the Morningstar Medalist fund owned only 7.4% in FAANG stocks compared with the benchmark’s 28.4% stake, wrote analysts Claire Butz and Samiya Jmili. It hasn’t owned Meta Platforms FB since 2018 owing to governance and data privacy concerns.

Instead, the fund has found opportunities in the healthcare sector, which made up roughly 24% of the portfolio versus the benchmark’s 9% in September. Danaher DHR and West Pharmaceutical WST were both top-10 contributors to the fund’s year-to-date return. The fund’s outperformance isn’t limited to this year: It ranks in the top 20% of large-growth funds over the past three and five years.

Several of these leaders have high active share relative to the benchmark, which bucks a trend. In a recent Morningstar study, Greengold observed that "the large-growth category's median active share neared its 18-year low at the same time its index's weighting in its top holdings flirted with an 18-year high." The study found that a peer group's active share tends to fall as its benchmark concentration increases. As Greengold explains in a recent Fund Spy, the large-growth category is the only one in which highly active managers retained a meaningful edge over low-active-share fees after expenses--though he warns that "active share is fraught with pitfalls when used as a tool to identify superior active strategies."

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)