Fund Investors Seek Inflation Protection

Money is flowing into funds that provide a hedge against inflation.

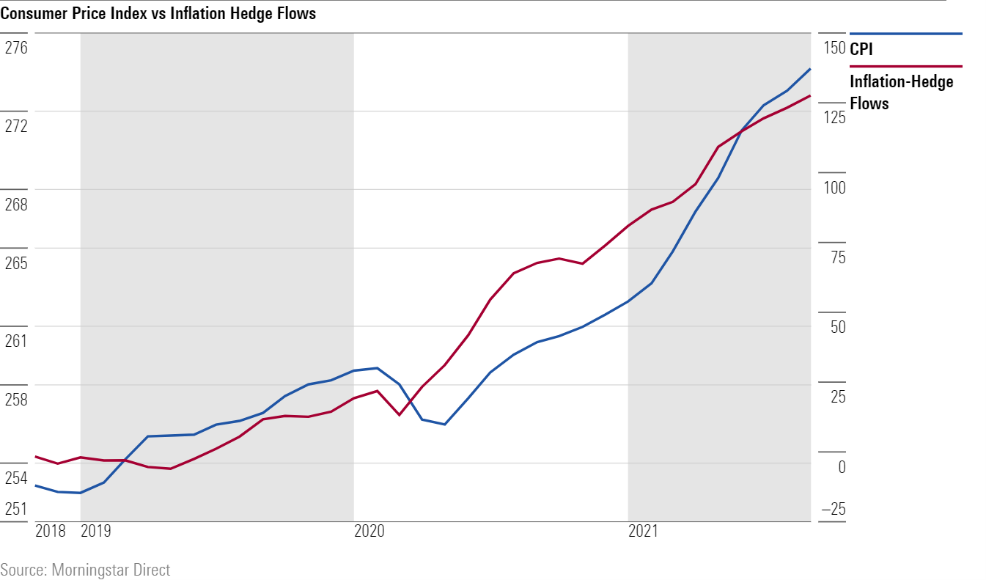

At the end of October 2021, the Consumer Price Index was up 6.2% from a year earlier. Meanwhile, investors have poured money into Morningstar Categories that provide a hedge against inflation: commodities broad basket, commodities focused, and inflation-protected bond. This increase has closely followed the Consumer Price Index over the past three years. As price levels increased, so did flows into these categories.

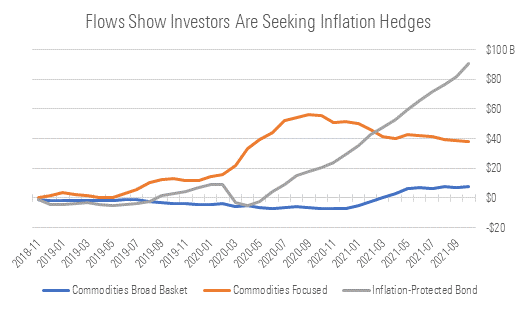

In the first half of this period, from the start of 2019 through June 2020, funds in the commodities-focused category received the bulk of the inflows. This category includes funds that specialize in one commodity, such as agriculture, precious metals, energy, and industrial metals. Precious-metals funds were the most popular, taking in almost $36 billion of the $38 billion of inflows to the category.

Starting in July 2020, investor sentiment changed, and money poured into inflation-protected bond funds. The category has received record inflows over the past year. Funds in the commodities broad basket category have not seen a large increase in flows during the three-year period, but investor interest has picked up in recent months.

Funds With Significant Flows

Among the strategies in these three categories, Vanguard Short-term Inflation-Protected Securities ETF VTIP, which has a Morningstar Analyst Rating of Gold, is the largest and has had the most net inflows over the past three years. It took in $25.9 billion for an organic growth rate of 46%.

Another inflation-protected bond fund, Gold-rated Schwab U.S. TIPS ETF SCHP, had the second-highest inflows. It received almost $14 billion for an organic growth rate of 65%.

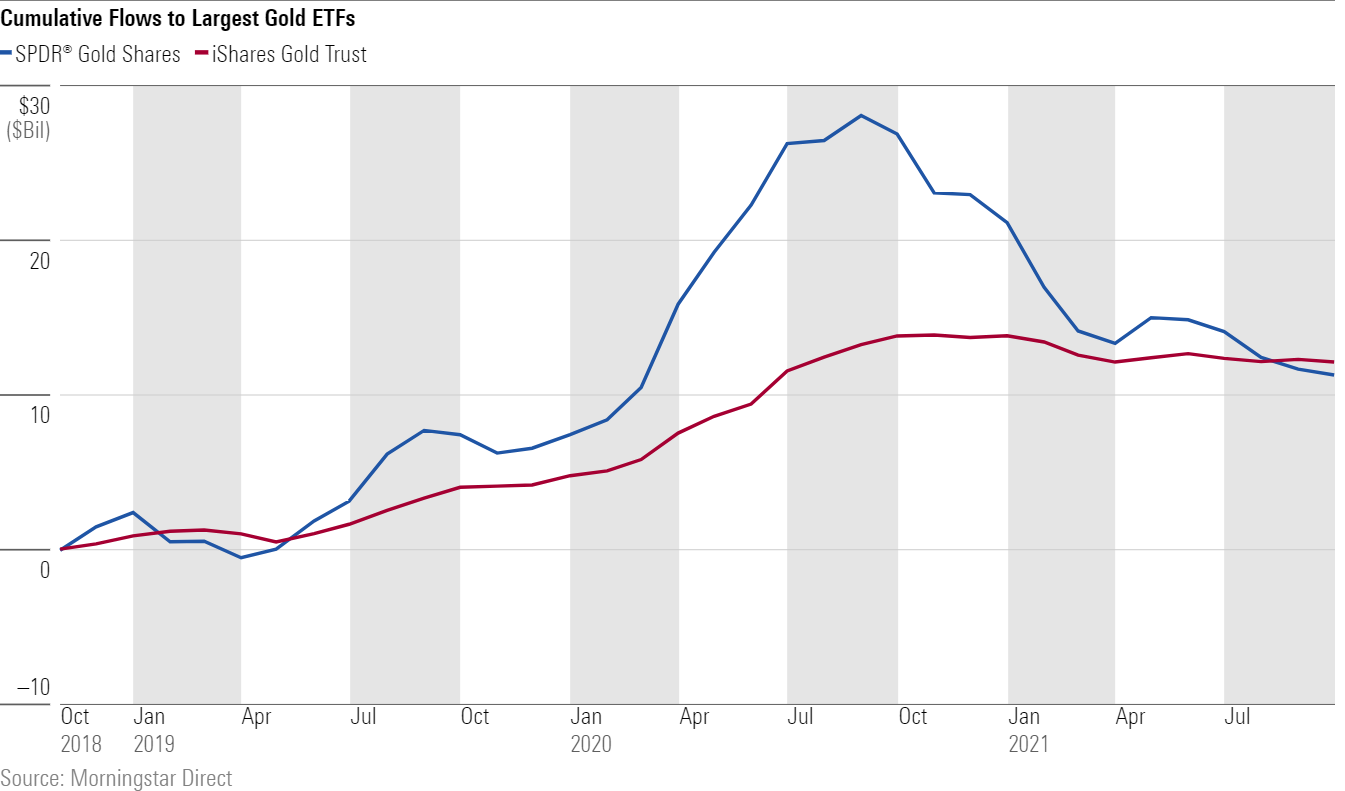

Two exchange-traded funds that invest in gold, iShares Gold Trust IAU and SPDR Gold Shares GLD, brought in the third- and fourth-highest inflows over the past three years, even though both funds have experienced outflows over the past year along with other precious-metals funds. (Neither fund has an Analyst Rating.)

A few funds in these categories had large outflows over the past three years, including a couple of highly rated strategies.

Pimco CommoditiesPLUS PCLIX had the most outflows of any of the strategies in these categories as investors pulled out almost $1.3 billion dollars over the past three years. The strategy, which invests in commodity-linked derivative instruments, now has just under $3.0 billion in total net assets. Most of its share classes earn a Silver rating; the two most expensive are rated Bronze.

T. Rowe Price Limited Duration Inflation Focused Bond TRBFX, which is not rated, was an outlier among inflation-protected bond funds, with outflows of $1 billion over the three-year period. It did have net inflows over the past year, in line with the broader trend. The fund now has just under $9 billion dollars in total net assets.

Pimco Real Return PRRIX, which has ratings ranging from Silver to Neutral on its share classes, also saw outflows over the past three years, losing $450 million, an amount second only to the T. Rowe Price fund's outflows within the inflation-protected bond category. That strategy has also had net inflows over the past year, however.

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)