Why Did a Star Manager Take His Boutique Fund Firm Public?

After stunning growth and a successful IPO, what’s next for Rajiv Jain’s GQG Partners?

Mutual fund managers who leave large corporate firms to start their own boutique know there are risks involved. Plenty have taken the plunge nonetheless. Some have succeeded, while others have found the going rough. With thousands of investment options clamoring for attention--many backed by hefty advertising and marketing budgets--it’s exceedingly difficult to stand out.

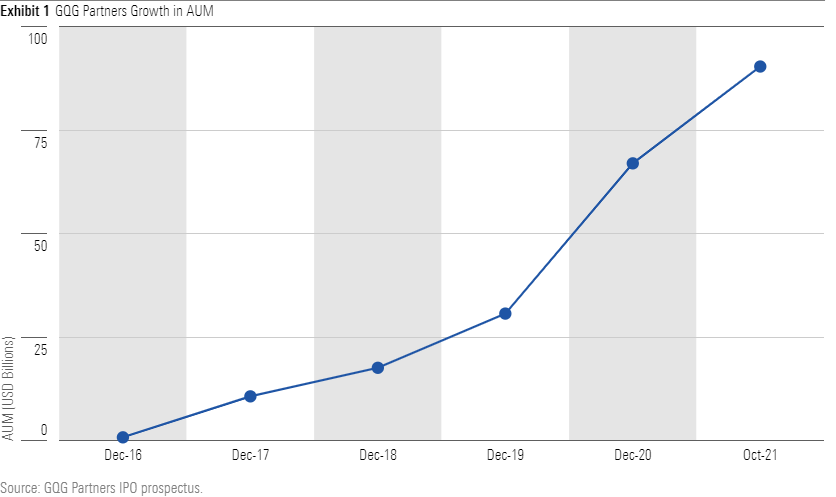

In just over five years, though, former Vontobel international-fund manager Rajiv Jain has not only established his own firm on a solid foundation but has seen it grow far beyond his expectations. At the end of October 2021, GQG Partners, founded in mid-2016, had $90.4 billion in assets under management.

This trajectory shouldn’t come as a complete shock. Although Jain is not a household name on the level of a Peter Lynch or Bill Gross, he’s well-known in advisor circles after building an enviable record running successful international and emerging-markets portfolios for more than two decades. At Vontobel Asset Management, he rose to the level of CIO and then, shortly before he left, co-CEO.

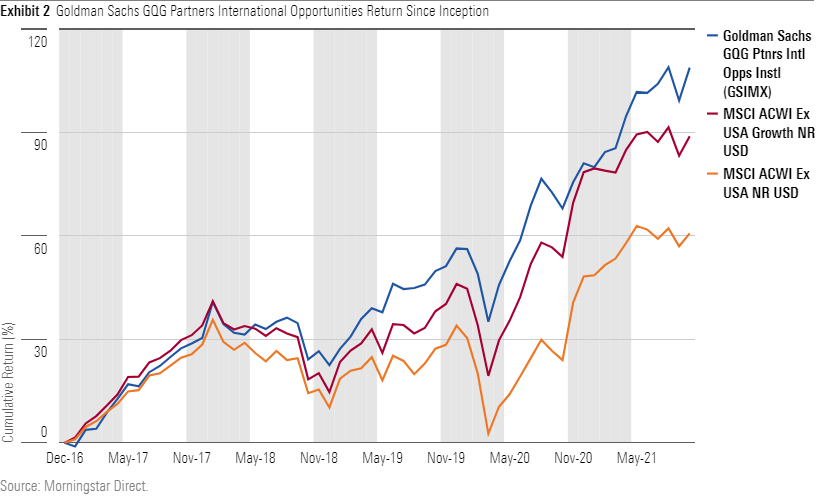

Moreover, although they’ve hit a few bumps in the road during the tumultuous market environments since launch, the two most prominent GQG funds have posted index-beating performance over their history.[1]

That said, even with the benefit of name recognition and fine performance, accumulating $90 billion in assets in less than 5.5 years is quite a feat. For the sake of comparison, one can look at probably the most successful shop (judged by level of assets) founded by a manager who left an established firm: DoubleLine, founded by former TCW bond-fund manager Jeffrey Gundlach. That firm now has $137 billion in assets but has been around more than twice as long as GQG Partners. Another success story, Causeway Capital Management, founded by international-stock managers Sarah Ketterer and Harry Hartford after leaving Hotchkis & Wiley, boasts a collection of highly regarded funds, but after 20 years its roughly $45 billion AUM is just half of GQG’s assets.

Even the enormously popular and on-trend ARK Investment Management, founded by the charismatic Cathie Wood in 2014 after leaving AllianceBernstein, had less than GQG Partners ($78.9 billion) under management as of its most recent report.[2]

A Curious Next Step

Recently, GQG Partners diverged from the path taken by most manager-founded firms. In October 2021, it listed 20.1% of its shares on the Australian Stock Exchange. However, this move doesn’t signal a major transition of leadership or direction: Control remains firmly in the hands of the founders. After the listing, Jain holds 68.8% of the firm’s shares, and co-founder and CEO Tim Carver owns another 5.6%.

Still, questions abound. Why go public? What are Jain’s plans for the firm? What does the IPO mean for his own future? Should the resounding success of GQG in a relatively short period, and the bounty that’s accrued to its founders as a result, mean other managers should contemplate building their own firms they can then take public?

Surely managers contemplating such a step couldn’t help noticing that the 20.1% portion of GQG Partners listed on Australia’s exchange is now valued at nearly $800 million (in U.S. dollars), meaning that Jain’s stake is worth more than $2.5 billion.

Why Go Public?

Considering that GQG Partners has enjoyed such impressive growth in its first five-plus years, why did Jain list the firm’s shares on the market? GQG’s funds were attracting substantial inflows in an era when even well-known and successful actively managed funds were battling outflows. The growth wasn’t limited to assets, either: The firm’s employee count had roughly doubled in the past 12 months.

Jain explains it this way. It’s true that GQG Partners didn’t need additional funding; in fact, the IPO did not bring any money to the firm, as GQG didn’t issue new shares to the public. Rather, the shares offered on the market came proportionally from Jain, Carver, and the other 15 partners in the firm. He says the main motivation was to enable the firm to provide shares to all employees, which recently numbered about 125. (After the IPO, all employees now have ownership in the firm, with the new awards issued as restricted stock units with six-year vesting periods.) Equally important, having publicly traded shares allows GQG to create a more tempting package to offer to potential future staffers.

Specifically, Jain cites the possibility of wooing successful fund-management teams willing to listen to offers to leave their current employers (a lift-out, in the industry vernacular) or attracting a “rock-star analyst” (Jain’s words) who’s itching to run his or her own fund and has a variety of options as to how to do that. The allure of ownership in publicly traded stock will help GQG compete against hedge funds or other potentially lucrative opportunities for established managers or top-level analysts, Jain said.

But why does Jain feel the need to attract new talent in the first place? He already has 17 or so hand-picked analysts (he didn’t bring any over from Vontobel), and nearly all came with impressive experience. When he launched the firm, Jain told Morningstar he wanted GQG to “outlast its founders,” as opposed to being an entity overly reliant on a single person. He cited Dodge & Cox as a model in that respect. He reiterated that feeling now, adding that bringing a few exceptional investors to GQG to run their own funds also would raise the overall intellectual climate and provide fresh ideas and approaches.

Why Australia?

Australia seems a curious choice for the IPO: Only about eight employees are located there, and GQG’s headquarters is in Fort Lauderdale, Florida, where Jain and most of the analysts and portfolio managers reside.

Jain and Carver say reporting requirements for public companies are a bit less onerous in Australia, but more importantly Carver spent many years as CEO of Australian investment firm Pacific Currents (the only major shareholder of GQG Partners pre-IPO besides Jain and Carver) and thus has extensive experience with, and knowledge of, that country’s public markets. Another attraction is Australia’s mandatory retirement-savings program (known as the superannuation scheme). That makes the country an appealing destination for any investment firm; GQG’s funds already had a presence there. GQG representatives and the offering prospectus point out that one goal of the IPO was simply to increase awareness of the firm in Australia.

Jain doesn’t rule out a future listing in the United States but says there are currently no plans to take that route.

Time to Take It Easy?

Jain’s personal wealth was already formidable after decades as a successful manager and investor. After the IPO, he owns more than two thirds of a firm valued in the billions. So it’s fair to wonder whether he will soon retire.

Jain scoffs at that idea, and there’s reason to believe him. First, although younger fund managers have retired, he’s only 53 years old. Second, if retirement was his aim, he didn’t need the IPO to get there. Third, investing--specifically, managing these funds--and building a firm that can stand the test of time appear to be his passions. (As an aside, he once pointed out that although he had lived in South Florida for years, he’d only played golf a handful of times and had no desire to increase that pace.)

A fourth reason to believe that Jain is “not going anywhere,” as he puts it, is that he and Carver invested 95% of their post-tax proceeds of the IPO into GQG’s funds, with a seven-year lockup period. In short, it seems unlikely that Jain plans to step down and buy an NBA franchise or start a space program anytime soon.

Hey, Maybe I Should Try That!

GQG’s eye-opening growth rate, and the commensurate rewards to its founders, must have attracted the attention of other fund managers. Successful investors dissatisfied with their current firm might be tempted to follow Jain’s lead. Why not start their own shop and--if things work out--go public?

They should think twice. While such a move could work, it’s not easy and success is far from guaranteed. For one thing, Jain did not make himself CEO of his own firm, saying that would add too much responsibility and would take his focus away from investing. His prior association with Carver, who remains CEO, made it easier for their partnership to work. Not every manager has such a trusted and experienced executive partner willing and ready to join up.

And even with that arrangement, Jain is loaded with responsibilities. In addition to running several funds, he also serves as chief investment officer and head of a team of about 17 analysts, not to mention being chairman of GQG Partners. Thus, though he may not be burdened with day-to-day executive duties, he certainly must devote time to important decisions concerning the firm.

A Cautionary Tale

Moreover, the experiences of other firms offer cautionary tales. One stands out. Managers Rudolph-Riad Younes and Richard Pell launched Artio Global Investors in 2009 after they enjoyed much success running funds at Julius Baer, which also became an owner of the new firm. Artio held its own for a short time, but as Younes later conceded, the investment success and the resulting deluge of inflows prior to the IPO had led him and Pell to expand the analyst pool too quickly and make unwise organizational changes. The performance of their flagship international funds stumbled when the managers’ macro-influenced style proved unsuited to a chaotic era of negative interest rates and unpredictable central-bank maneuvers. The firm’s two international funds--which contained more than 80% of the firm’s assets at the time of the IPO--began to suffer outflows.

The increasing outflows sharply reduced management fees and thus firm revenue. Artio responded by cutting costs, including several rounds of layoffs. Assets in the firm’s two international funds sank from $35 billion at the end of 2007—roughly two years before the IPO—to about $2 billion in early 2013. Artio’s stock price tumbled.

Artio Global Investors was eventually bought by Aberdeen in 2013 at a price about 90% below its level of just a few years earlier. To add insult to injury, it turned out that Aberdeen was mainly interested in Artio’s bond funds, which had performed much better than the international offerings. Aberdeen kept the bond-fund managers, but let Younes and Pell go. The duo later set up another new firm, called R Squared Capital Management, but that venture struggled, too, and appears to no longer be in operation.

A Future to Watch

GQG isn't Artio. Yet Artio’s experience illustrates the challenges posed by rapid growth. In GQG’s case, the burdens of managing that growth fall mostly on CEO Carver and the business executives he’s hired, but Jain, as executive chairman, isn’t isolated from these concerns. Meanwhile, Jain’s vision of publicly traded stock serving as an incentive to lure outside talent and retain current employees only works as long as the stock price seems likely to rise meaningfully over a period of years. A reversal of that expectation could reduce the stock's appeal.

All in all, it appears that Jain and Carver recognize both the risks and opportunities the firm faces and are making concerted efforts to steer GQG on a prudent course. Given its path thus far, this unusual firm’s future bears watching by anyone involved in the asset-management industry.

[1] Goldman Sachs distributes GQG’s broad international fund, with GQG serving as subadvisor, but Goldman Sachs has no involvement in the fund’s investment decisions.

[2] Assets under management for GQG Partners, Causeway, and DoubleLine are from the firms’ websites, with GQG’s as of Oct. 31, 2021 and Causeway and DoubleLine's as of Sept. 30, 2021. The ARK figure does not seem to be available on the firm’s website; the latest reported figure comes from ARK’s March 2021 ADV Part 2 filing, which reports assets of Feb. 28, 2021. The ARK figure includes $23.9 billion in nondiscretionary assets, a far greater percentage of nondiscretionary assets than the three firms above, all of which reported relatively small percentages of nondiscretionary assets or none at all.

Associate manager research analyst Anthony Thorn provided research and graphics assistance.

/s3.amazonaws.com/arc-authors/morningstar/657019fe-d1b1-4e25-9043-f21e67d47593.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/657019fe-d1b1-4e25-9043-f21e67d47593.jpg)