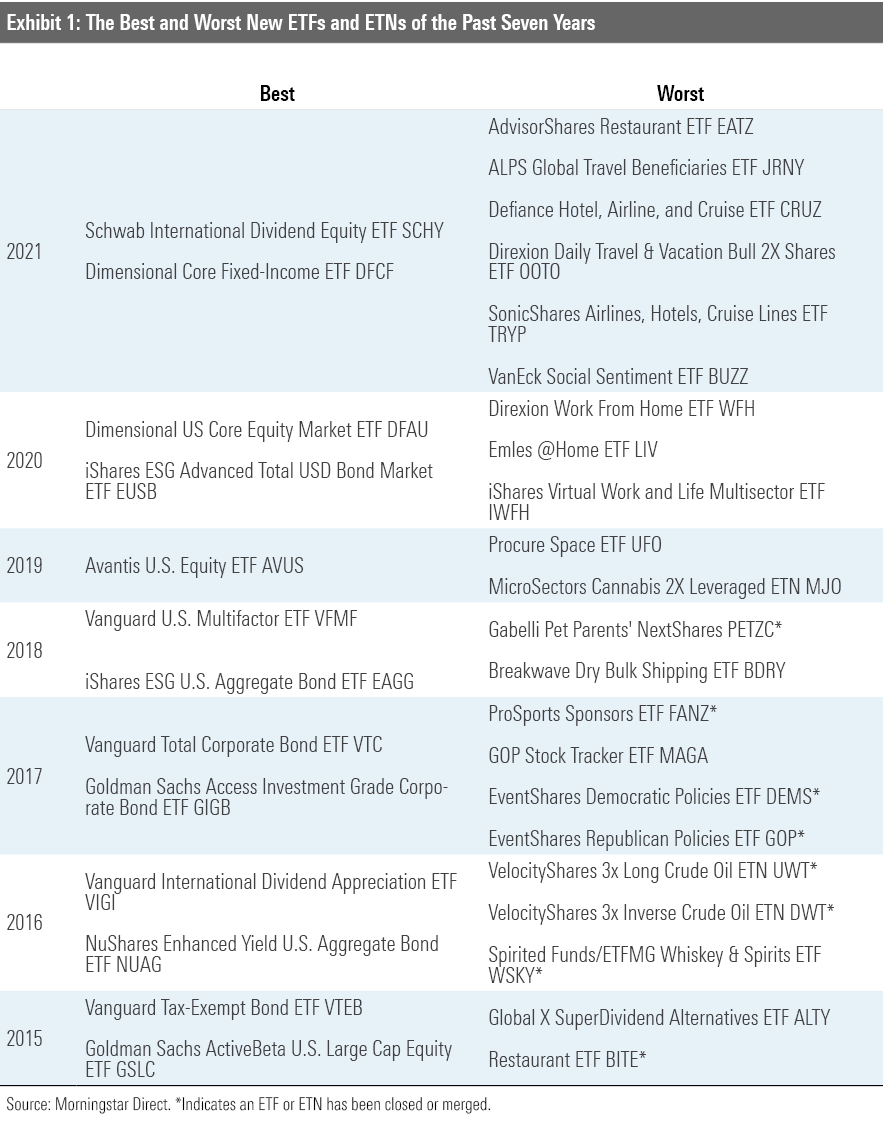

The Best and Worst New ETFs of 2021

There were a record number of new ETFs launched in 2021. These are our selections for the year's best and worst.

As of Nov. 24, a record 406 new exchange-traded funds were launched in 2021, blowing past last year’s high-water mark of 319 ETF debuts. There are now 2,688 ETFs available to investors. Since SPDR S&P 500 ETF SPY was launched in 1993, 3,751 ETFs have been brought to market. This means that about 28% of them have since been closed. In 2020, a record 190 ETFs shut down.

Though there are plenty of choices on the ever-expanding menu, investors' tastes are basic. Of the 2,688 ETFs currently on offer, the top 100 as measured by assets under management accounted for nearly 70% of the $7 trillion invested in ETFs at the middle of November. The top 100 are the Swiss Army knives of the ETF world. They are efficient multipurpose tools that do a lot of different jobs for a lot of different types of investors.

These figures are all fun fodder for banter among industry-watchers, but what do they mean for investors? First, they demonstrate that the best options have been on the menu for a long time, right in front of their noses. Second, it means that the odds of something better coming to market have grown slimmer over time. It's going to be awfully difficult to beat funds backed by solid sponsors that offer instant access to the entire U.S. stock market at a cost of 0.03% per year or the universe of U.S. investment-grade bonds for nothing.

With all this in mind, our ETF research team has taken a close look at the class of 2021 and voted on what we believe were the best and worst new ETFs launched this year.

The Best New ETFs

It's difficult to stand out in this cramped landscape. If anything, sticking out from the crowd can be detrimental. The traits of successful new entrants are often no different than those of existing best-of-breed funds: time-tested strategies, low fees, and a solid sponsor. Ideally, it is also good to see early signs of long-run viability as measured by AUM and flows. This helps instill confidence that these funds will be around to serve investors for a long time.

International Cousin

In April, Schwab introduced Schwab International Dividend Equity ETF SCHY--the Balki Bartokomous to Schwab US Dividend Equity ETF's SCHD Larry Appleton. SCHD's international cousin shares all the same traits that anchor SCHD's Morningstar Analyst Rating of Silver.

The fund tracks the Dow Jones International Dividend 100 Index. The index draws stocks from the Dow Jones Ex-U.S. Large-Cap and the Dow Jones Ex-U.S. Mid-Cap indexes. It kicks REITs to the curb and only invests in Chinese stocks that trade on developed-markets stock exchanges. Like its U.S. cousin, the benchmark looks for stocks that have paid dividends for at least a decade. It applies additional minimum market-cap and liquidity screens to ensure investability and then ranks stocks that make the cut by their indicated dividend yield. Stocks that have an indicated dividend yield that is greater than or equal to the median of this pool make it to the next round.

The pool of stocks that have paid dividends for at least 10 years, meet investability requirements, and have at or above-median forward yields is then scored and ranked based on four fundamental measures: free cash flow to total debt, return on equity, indicated dividend yield, and five-year dividend per share growth. The next step is where SCHY’s bogy is a bit different from SCHD’s. The index calculates the three-year U.S.-dollar-denominated price volatility of the top 400 stocks as ranked by the composite score calculated in the prior step. It then selects the 100 top-scoring stocks that have trailing three-year price volatility that is less than or equal to the 60th percentile of the top 400.

What comes out in the wash is a diversified portfolio of solid franchises that have built long track records of returning cash to shareholders in the form of regular--and in many cases growing--dividends. Like SCHD, the fund’s screens for 10 years of uninterrupted dividend payments (as opposed to a decade of steady growth) and forward dividend yield give it a pronounced value tilt versus close peers (most notably Vanguard Dividend Appreciation ETF VIG and Vanguard International Dividend Appreciation ETF VIGI). But the benchmark’s fundamental screens and emphasis on less-volatile stocks should help to curb the risk associated with leaning toward higher-yielding names. And at 0.14%, the fund’s annual expense ratio isn’t going to take a big bite out of returns. All told, SCHY is a solid option for investors looking overseas for equity income.

DFA Bolsters its Lineup

Dimensional Fund Advisors finally entered the ETF fray in late 2020. In 2021, the firm expanded its ETF offering, converting six of its tax-managed mutual funds to ETFs and launching four new bond ETFs in mid-November.

Our favorite among the brand-new members of the firm’s ETF lineup is Dimensional Core Fixed-Income ETF DFCF. The fund can invest in domestic and foreign investment-grade bonds. It leverages DFA’s systematic approach to taking on incremental credit and interest-rate risk in those cases where the firm’s research and quantitative screens deem it likely to be rewarded. A thoughtful and measured approach to risk-taking and a very reasonable 0.19% fee are good reasons to give this core bond offering a good long look.

The Worst New ETFs

There were plenty of suspect newcomers in the crowd in 2021. A common thread among many of them is that they prey on investors' impulse to chase what's hot. These funds tend to offer narrow and/or overly complex exposures, charge high fees, and have sponsors that prioritize salability over staying power.

Thematic funds tend to feature prominently on our list of the worst new launches. This year has been no different. These funds generally attempt to leverage a compelling narrative into something that sells--though isn’t always worth an investment. These funds have a tall task, as they have to get three things more or less right to succeed for investors: 1) the theme, 2) the portfolio, and 3) valuations.

Not all themes have staying power. Many thematic funds don't have portfolios that align with their theme to the extent investors might expect. And even if the first two pieces of the puzzle are in place, if investors’ enthusiasm for the narrative has stretched valuations, then long-run returns are likely to disappoint.

Getting Back to Work

After the world went into lockdown in 2020, not just one, but three work-from-home themed ETFs were launched: Direxion Work From Home ETF WFH, Emles @Home ETF LIV, and iShares Virtual Work and Life Multisector ETF IWFH. All three made our list of last year’s worst new launches.

As we got back to work in 2021, ETF sponsors pivoted from work-from-home themed funds to let’s-get-back-out-into-the-world themed ones. Among them were AdvisorShares Restaurant ETF EATZ; ALPS Global Travel Beneficiaries ETF JRNY; Defiance Hotel, Airline, and Cruise ETF CRUZ; Direxion Daily Travel & Vacation Bull 2X Shares ETF OOTO; and SonicShares Airlines, Hotels, Cruise Lines ETF TRYP. When investors see asset managers chasing themes like billboard lawyers chase ambulances, it should send up a red flag. By the time these stories have gone from the headlines to being the basis of a handful of thematic ETFs, odds are that investors’ enthusiasm has been priced in and future returns are going to be lackluster.

Buzz Off

In March, the BUZZ NextGen AI US Sentiment Leaders Index got a second chance. The index had previously underpinned the BUZZ U.S. Sentiment Leaders ETF BUZ, which lived from April 2016 until March 2019. BUZ failed to resonate with investors, having amassed just $8.9 million in assets before it was liquidated.

Fast forward to March 2, 2021, when the strategy was reborn as the VanEck Social Sentiment ETF BUZZ. The fund tracks the same index, added another "Z" to its ticker, and also brought a celebrity spokesperson along for the ride: Dave Portnoy. Portnoy's involvement boosted early interest, and the fund quickly amassed just over $500 million in assets. But his support raised eyebrows, and subsequent questions regarding his already-questionable character have squashed any buzz there once was about this fund. More importantly, all this hoopla is a distraction from the fact that this is a complex and opaque strategy designed to build a portfolio of stocks leveraging social media sentiment. If there's anything that the past year has taught us, it's that social media might not be the best place to figure out which stocks have the most promising long-term prospects, and that there's a fine line between the wisdom and the madness of the crowd.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)