3 Lessons I Learned From ARK Innovation ETF

ARK Invest’s flagship offering might not be for me--and that’s OK.

Investing conversations can happen anywhere: at the dinner table, in an Uber, and even in your Instagram direct messages.

I found myself in this position earlier this year when a friend asked me whether ARK funds were a gamble.

ARK’s flagship investment strategy, ARK Innovation ETF ARKK, posted a mind-boggling 152% annual return in 2020, according to Morningstar Direct. Such eye-popping returns caught my friend’s attention. Meanwhile, others questioned whether these returns were sustainable and if there was any room left on the ARK.

So far this year, the skepticism has been justified. ARKK has lost 14.11% year to date as of Nov. 29, 2021, more than 33 percentage points below its Morningstar Category benchmark, the Morningstar Mid Growth Index. The fund's poor performance has landed it in the bottom 1% of its category.

Investors have begun to abandon ARK Innovation amid its underperformance. Fund flows into ARKK were positive, but showing signs of slowing, in the first quarter of 2021. Since then, $1.9 billion in assets have left the fund as of the end of October.

Morningstar analysts have dug into ARK Innovation’s portfolio, examined ARK Innovation ETF’s approach, and questioned whether the tail wags the dog. But when I asked myself whether ARKK is right for me, the following three reasons made me hesitant to buy shares.

One: I’m Already Overweight in Growth Stocks

If I'm adding a new fund to my portfolio, one of the first things I do is check my current asset allocation. There are few ways to do this, but one way is to use Morningstar's instant x-ray tool.

Enter your funds’ tickers and the total value you have in each. From there, click “show instant x-ray.” You’ll then see your portfolio plotted on the Morningstar Style Box, which shows a portfolio’s underlying stock size and style.

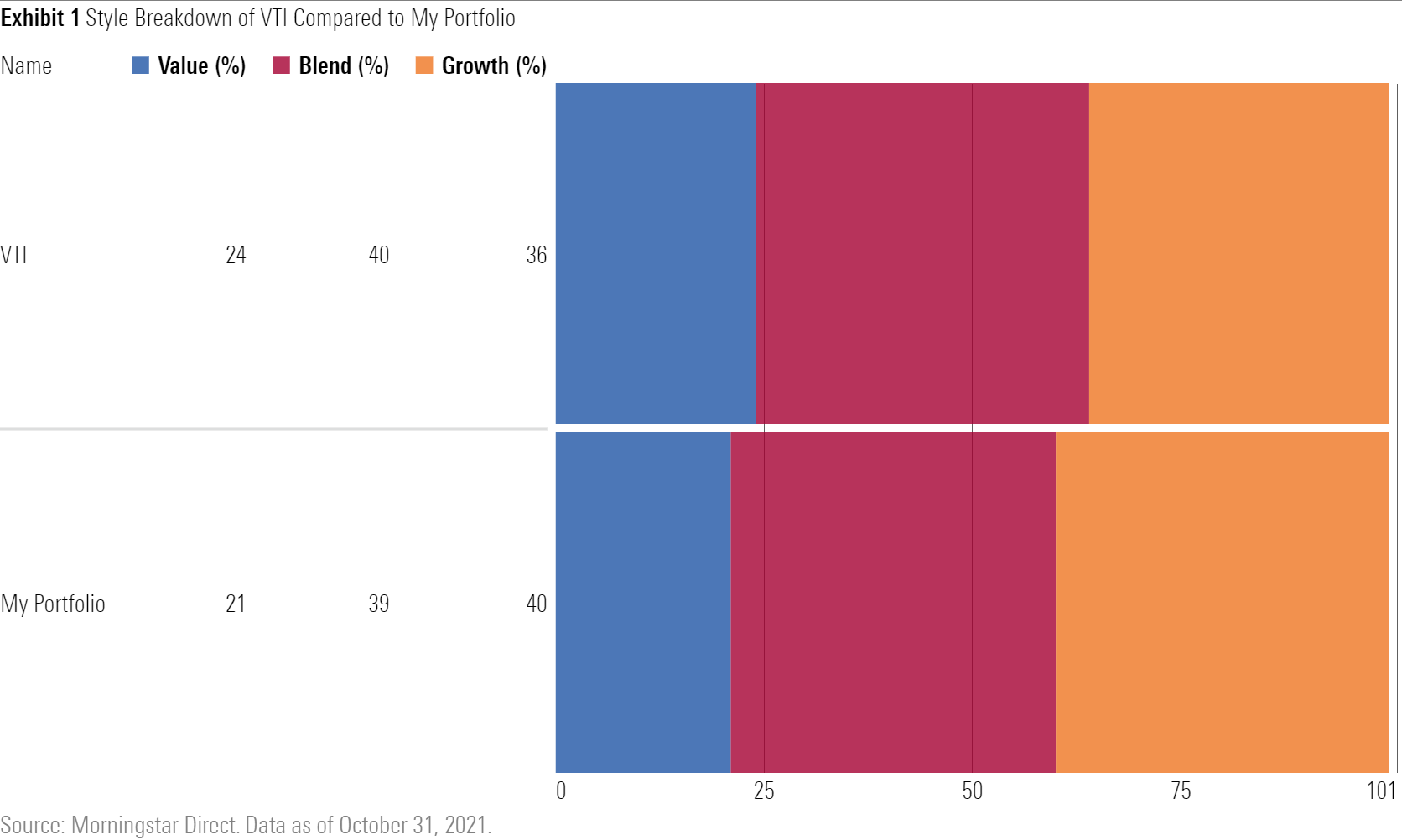

40% of my portfolio is in growth-oriented stocks, 21% in value-oriented stocks, and 39% in a blend of growth and value stocks. The growth number seems high compared with my value exposure, but it’s not too different compared with a broadly diversified U.S. stock index fund.

Here’s what my portfolio looks like compared with Vanguard Total Stock Market ETF VTI, which receives a Morningstar Analyst Rating of Gold.

Now let’s look at the style box-breakdown of ARKK--if I were considering buying shares.

It has a nearly 70% stake in growth companies, which is the opposite of what I need in my portfolio. If anything, I should consider a value-oriented fund to start chipping away at my growth tilt.

Two: I Don’t Have a Stomach for Volatility

Christine Benz recently explained that risk, not volatility, is the real enemy to accomplishing financial goals. She defines risk as the chance of not meeting financial goals or having to change them because an investor came up short when saving.

From this lens, I’m not too worried about risk--I’m luckily on track to save for my financial goals. But that doesn’t mean I’m not bothered by volatility, which Benz defines as price fluctuations in an investment, portfolio, or market segment over the course of one day, month, or year.

ARKK tends to be volatile. "The fund's relative results tend to be boom or bust," analyst Robby Greengold explains. "Its relatively concentrated and benchmark-agnostic portfolio means investors should have a stomach for volatility."

I don’t have a stomach for volatility--and that’s OK. Not everyone does.

Three: I Love Forget-About-Them Investments

ARKK belongs in my "too hard" pile. This is a phrase borrowed from Charlie Munger, one of Warren Buffet’s closest business partners. It generally refers to investments that aren’t worth the effort to understand or require more patience than an investor can handle.

Given my sensitivity to volatility, it’s easier to describe what’s not in my "too hard" pile than every investment that’s in it. Low-cost, broad-market index funds usually align with my investment preferences--but one that stands out the most are target-date funds.

What I like the most is their forget-about-them nature. No need to change your asset allocation as you get closer to retirement--the target-date fund does that for you. Why bother finding low-cost mutual funds when the best target-date funds can do that too?

These forget-about-them qualities are just the surface of target-date funds’ benefits. Here are the best target-date funds for 2021 and beyond.

My Instagram-Worthy Final Thoughts

It turns out my friend has most of his assets in an S&P 500 fund. Assuming he owns one that is low cost, that’s sound. But my friend wanted to use ARK funds as mad money, a small portion of his portfolio dedicated to more speculative, potentially high-returning investments.

Though ARKK isn’t for me, there are far wackier ways he could invest his mad money.

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)