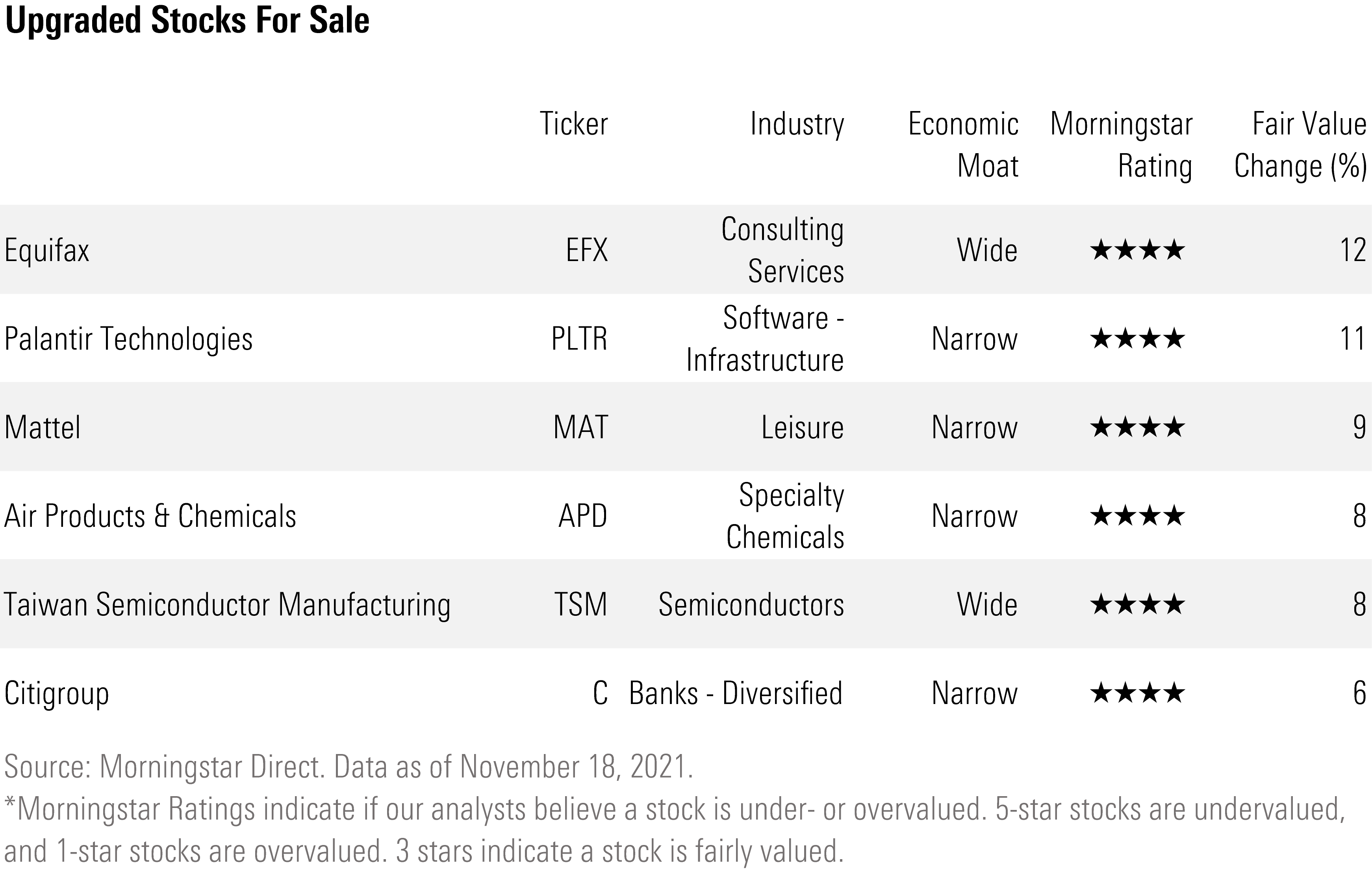

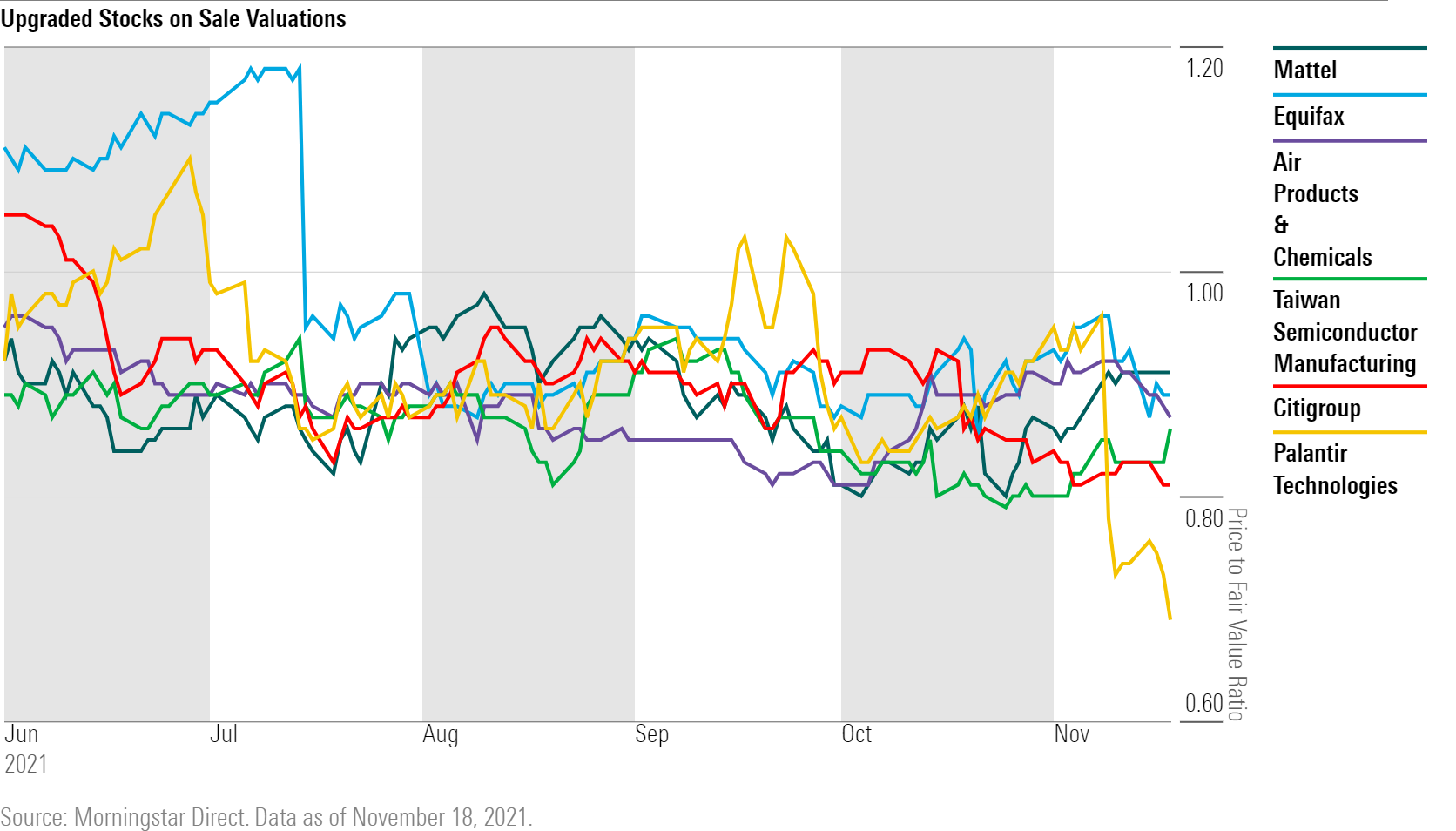

6 Upgraded Stocks on Sale

We’ve raised the fair value estimates on these undervalued stocks.

With the stock market pushing to new record highs, it’s becoming even tougher to find stocks that haven’t inflated beyond reasonable valuations. That’s especially the case coming out of a strong run of corporate earnings for the third quarter.

We screened the Morningstar coverage list for cases where our stock analysts believe the values of cheap stocks are moving higher.

Our screen started off by looking among the 846 U.S.-listed stocks followed by Morningstar analysts for companies that recently saw their fair values increased. We zeroed in on companies that held a 5- or 4-star Morningstar Rating to screen for stocks that are deemed undervalued. Last, we narrowed our picks to those with a fair value increase of 5% or more since the end of the third quarter.

Many energy names remain undervalued despite the increase in oil prices this year; they dominated the list of biggest fair value increases during third-quarter earnings season. However, to give investors a more varied set of options, we excluded them from this article.

The results of our screen are shown below.

One additional stock worth mentioning is Lloyd’s Banking Group LYG, a bank stock whose fair value was raised by 8% following the end of the third quarter. We covered Lloyd’s as an undervalued stock pick that crushed earnings earlier this month.

As for today’s picks, our analysts’ thoughts on third-quarter results and their reasonings for raising their fair value estimates are below.

Equifax EFX

Morningstar raised Equifax’s fair value 12%; it trades at an 11% discount to its fair value. The company beat the FactSet third quarter earnings consensus by 7% and revenue by 3%.

“Equifax generated $404 million of adjusted EBITDA off revenue of $1.22 billion. The $1.22 billion of revenue represents 14% year-over-year growth. Driving the revenue growth was a 35% increase in Workforce Solutions revenue. U.S. credit bureau revenue was flat, while international credit bureau revenue increased 10%. We are increasing our fair value estimate for Equifax to $325 from $300 as we increase long-term revenue growth estimates for its workforce solutions segment.”

-Rajiv Bhatia, equity analyst

Palantir Technologies PLTR

Palantir topped consensus earnings estimates by 8% and revenue by 2%. The company trades at a 31% discount after its fair value was increased 11%.

“We are raising our fair value estimate for narrow-moat Palantir Technologies to $31 per share from $28 after third-quarter results provided us with increased conviction in the company's strong growth prospects, even while amassing scale. Year-over-year sales growth of 36% matched our expectations, while adjusted earnings per share of $0.04 came in slightly higher than we anticipated. Shares fell as much as 10% after Palantir reported results, which we believe is attributable to government revenue declining 6% sequentially, although against a tough comparison, and the fourth-quarter outlook potentially being conservative. Taking a longer-term view and being upbeat about Palantir’s tailored-use-case software modules making its software more easily consumable across industries and organization sizes, we believe the negative reaction creates an attractive entry point for investment.”

-Mark Cash, senior equity analyst

Mattel MAT

After a 9% fair value increase, Mattel trades at a 9% discount. The toymaker reported earnings that came in 16% above consensus estimates and exceeded revenue forecasts by 5%.

"The domestic toy industry remains mature and stable, and global demand is expected to grow at more than 5% on average through 2025 according to Euromonitor. Mattel should be able to largely maintain global market share as product improvement and emerging-markets growth should bolster moderate domestic growth. We project more than 16% sales growth in 2021 up from both our prior forecast and management’s guidance of 15%. We are increasing our fair value estimate to $25 per share from $23 after incorporating solid third-quarter performance that included 8% net sales growth and a higher corporate tax rate beginning in 2022 (25%)."

-Jaime M. Katz, senior equity analyst

Air Products & Chemicals APD

Air Products & Chemical’s third-quarter earnings were within estimates, but revenue came in 6% above expectations. Morningstar raised its fair value estimate on the stock by 8%, leaving the company around 13% undervalued at recent prices.

“We are raising our fair value estimate for Air Products to $340 from $330 after the company posted solid fiscal fourth-quarter results. For full-year fiscal 2022, management expects earnings per share in the range of $10.20-$10.40, which implies roughly 14% growth at the midpoint.

"Air Products’ resilient business model makes it well-equipped to navigate inflation and energy price volatility. In its on-site business, which accounts for roughly half of the firm’s sales, Air Products has long-term customer agreements with energy cost pass-through mechanisms. In the merchant business, Air Products’ narrow moat gives it solid pricing power, as evidenced by consistently strong merchant pricing in recent years. Given the magnitude of energy cost increases in Europe, management expects a roughly three-month lag on the merchant side, but we are confident in Air Products’ ability to implement price actions to protect its margins.”

-Krzysztof Smalec, equity analyst

Taiwan Semiconductor Manufacturing TSM

Taiwan Semiconductor Manufacturing trades at 14% discount to its fair value estimate, which was increased by 8%. The firm beat consensus earnings estimates by 4%; revenue was reported in line with expectations.

“The stock continues to be undervalued in our view, as we think there is still upside in its capital expenditure budget, a proxy of its future revenue, and blended ASP after customers become receptive to price hikes and making prepayments to secure capacity. We now think the chip shortage will remain for the whole of 2022, as structural growth from the likes of data centers, computing systems, and 5G-related content prevent the company from fully clearing backlogs from industrial applications. Short-term corrections in smartphone and PC shipments are not enough to dampen these trends that TSMC is enjoying, in our view.”

-Phelix Lee, equity analyst

Citigroup C

Citigroup’s fair value estimate was increased by 6% and trades at a 19% discount. The bank beat consensus earnings estimates by 26%; however, revenue was in line with estimates.

“The fair value increase to $83 from $78 was driven by a combination of several factors. The time value of money added roughly $2 per share, while additional fee income based on the bank’s strong quarterly results, the movement of interest-rate hikes forward into 2022, and some slight adjustments to our balance-sheet growth assumptions added the remaining $3 per share. Stronger-than-anticipated fee results were mostly driven by the strong investment banking fee environment. The bank remains heavily tied to a recovery in card balances in the U.S. and Latin America. So far, the recovery in Latin America has not been great. But if the bank can grow balances faster than we currently expect, there could be more upside in the name.”

-Eric Compton, senior equity analyst

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)