Which Retail Stocks Are Well-Positioned for 2022 Holiday Sales?

Investors can pick through the bin of discounted stocks.

This holiday season, we expect that the return to in-person celebrations will gain steam as the pandemic becomes less of a concern among the public. However, for businesses that are heavily reliant on holiday spending, the combination of high inflation and a sluggish economy are poised to dampen gift-giving this year.

Total Retail Sales Growth to Slow in 2022 Holiday Season

We forecast fourth-quarter total modified retail sales will only rise 3.2% this year as compared with the fourth quarter last year, when they rose 14.1%. Modified retail sales is how we measure goods that are subject to holiday sales, bought either in a physical store or online. (This metric excludes categories such as automobiles, fuel, building materials, and groceries.)

In breaking the total down, we estimate that sales conducted in a store will only increase by 1% whereas online sales will grow 8.5%.

- In-store sales rose 15.7% last year as shoppers flocked back to in-person shopping. Over the past five years, in-store sales growth has averaged 4.6%.

- Online sales rose 10.3% last year and grew an astounding 45.5% during the fourth quarter of 2020 as the pandemic limited in-store shopping. Online sales growth has averaged 20.1% over the past five years. We estimate that 30.2% of total modified sales will be conducted online this year, an increase from 28.8% last year and only 11.6% a decade ago.

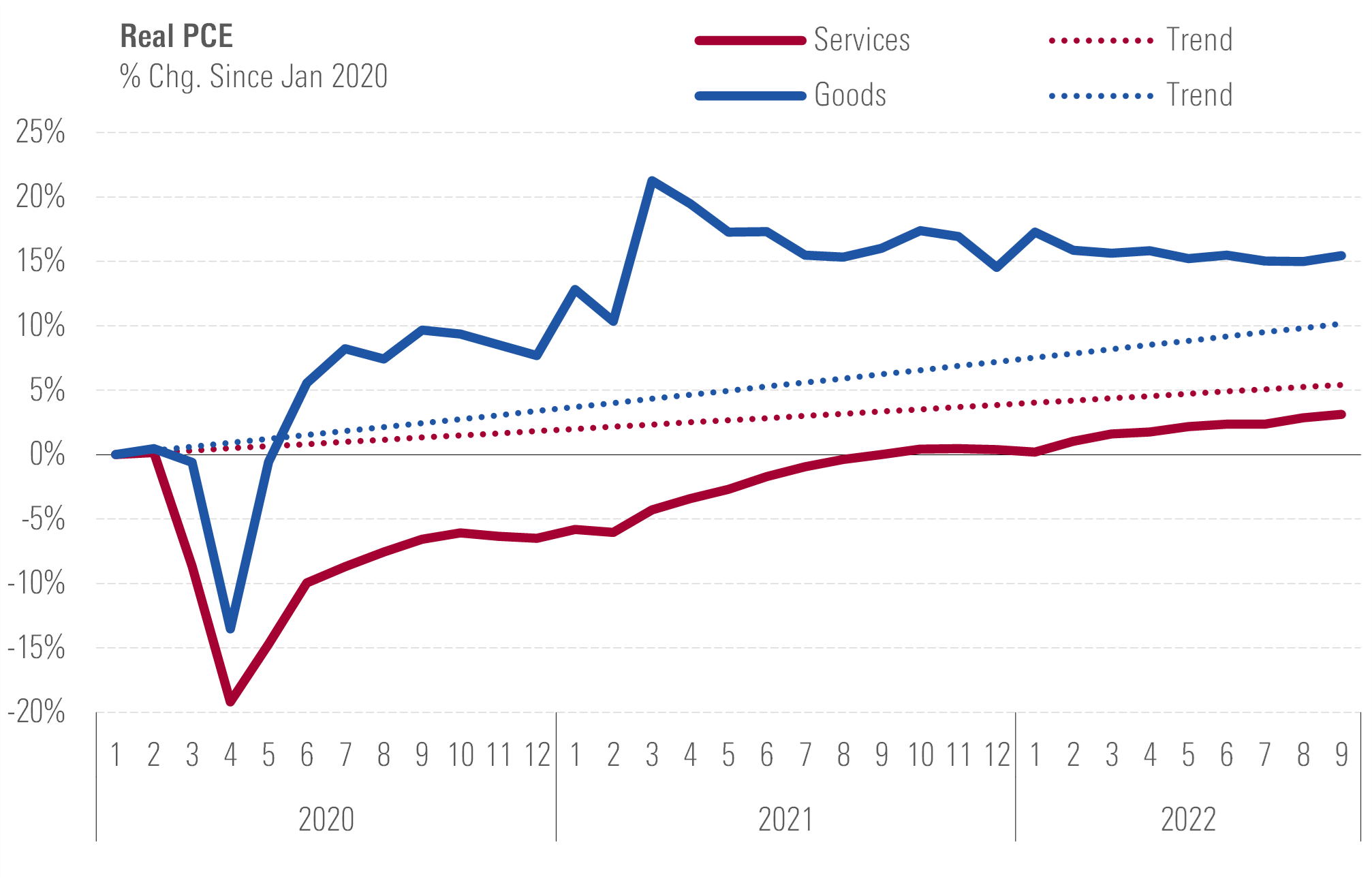

What Consumer Behavior Normalization Means for Holiday Spending

Our total modified retail sales forecast is a nominal number (not inflation adjusted). With inflation running at 7.7% annualized rate, our forecast implicitly projects that real sales on goods will decrease on an inflation-adjusted basis.

There are several trends that support this assumption. For instance, high inflation and lagging wage growth is taking a bite out of everyone’s wallet, and rising prices of nondiscretionary items is lowering real disposable income. Those households in the lower income brackets or on fixed budgets will be hit especially hard by these factors.

In addition, a broader trend of consumer normalization has been playing out over the course of the year. As the pandemic recedes, consumer behavior has been gradually normalizing. For this reason, we expect spending will continue to shift back into services, away from the goods that dominated sales when consumers were unable or unwilling to go out in public.

Consumer Spending

Since many consumers who previously traveled during the holidays elected to stay at home for the past two years, they were often able to reallocate those travel funds toward gifts. In addition, the three rounds of stimulus checks sent out during the pandemic were used to supplement purchasing goods. Sectors that benefit from consumer behavior normalization include those industries related to travel & entertainment, restaurants, ride-sharing, alcoholic beverages, and shopping malls.

We are finding that the downdraft in the markets this year has pushed many stocks well into undervalued territory.

In many of these cases, we agree that there is fundamental underlying short-term weakness—but from a longer-term perspective, we think the markets are pricing in this short-term weakness too far into the future.

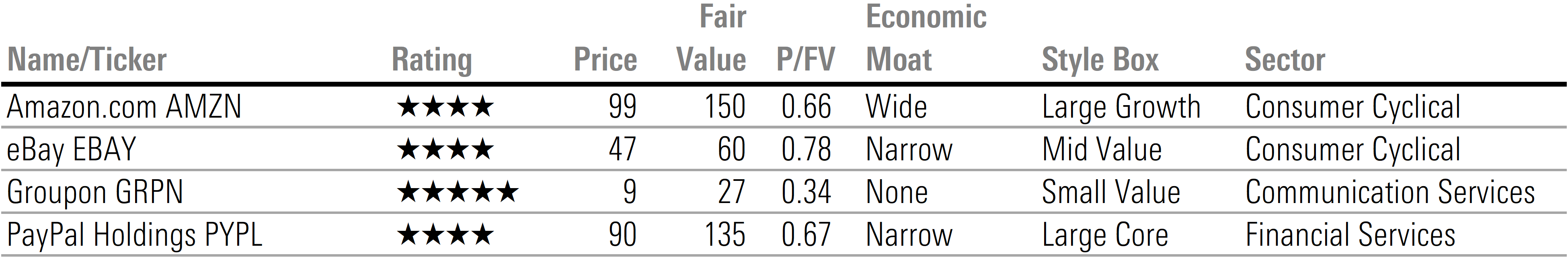

E-Commerce

No retailer is as synonymous with e-commerce and had been able to benefit as much from the shift to online sales as Amazon.com. Yet, as its growth rate has decelerated as compared with its rapid expansion during the pandemic, the market has soured on its stock. Over the past year, Amazon’s stock has dropped 44%.

Over the near term, its growth rate is clouded by a variety of macroeconomic issues, including currency headwinds, high inflation, soaring energy costs, and decelerating growth in AWS. However, for long-term investors, we continue to forecast that the combination of its e-commerce platform, Amazon Web Services (AWS) division, and its advertising sales will lead to a compound annual growth rate of 10% over the next five years.

After hitting new all-time highs last October, which resulted in the stock dropping to 2 stars in the Morningstar Rating for funds, eBay’s stock has dropped 36% over the past year and is now rated 4 stars. Ninety percent of eBay’s sales are for “non-new” products and, as such, the company’s revenue has very little seasonality. In fact, first-quarter sales are typically bolstered by users looking to resell gifts that they don’t want. While we expect inflation will continue to moderate in the months ahead, eBay may benefit from consumer trade-down. In addition, considering we expect the U.S. economy to remain relatively stagnant over the next few quarters, eBay may benefit from households “monetizing” used goods as an additional income stream.

PayPal’s stock has dropped 57% over the past year and the rating has moved up to 4 stars from 2 stars. Last year we noted that PayPal’s trajectory might not be completely smooth and that the market price had reflected a best-case scenario. PayPal’s growth has been supported over the years by the ongoing shift toward electronic payments and the rise of e-commerce; however, innovation in the financial technology space has given rise to new competitors. Overall, PayPal remains a somewhat unique player within the payments space, and we think the company will be able to hold its own.

Groupon is one of the most undervalued stocks under our coverage, but with its very high uncertainty rating, it should be relegated only to those investors who are able to undertake a high degree of risk. Our forecast is based on our assumption that the firm will benefit from consumer normalization. We project that a return to consistent local commerce growth and travel behavior will spur revenue growth in 2024 through 2026, averaging nearly 5% per year.

E-Commerce

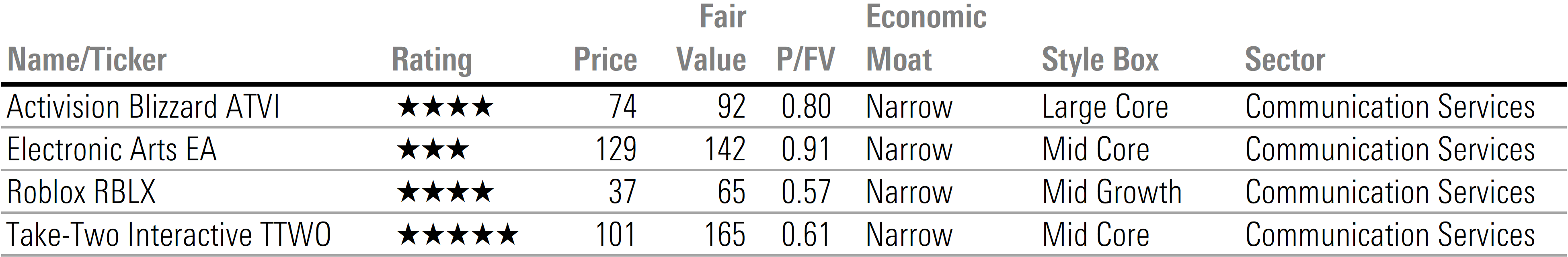

Electronic Gaming

The electronic gaming sector is lining up to be an unexciting, yet stable, story in 2022. After suffering from supply chain issues and semiconductor shortages last year, consoles are back in stock. However, there doesn’t appear to be any excitement regarding the consoles as there are no new major upgrades to prompt gamers to replace their current systems.

Activision released Call of Duty Modern Warfare II in October and sales are reportedly brisk, but across the rest of the e-gaming space there does not appear to be any other new releases of blockbuster games this holiday season. In January 2022, ATVI agreed to be purchased by Microsoft for $95 per share; the transaction is expected to close over the next few months.

Electronic Arts is probably the steadiest story in this sector. EA may see a slight boost in its FIFA soccer games as the impending World Cup heightens excitement, but not enough to meaningfully increase our intrinsic valuation. The stock trades at a slight discount to our fair value and is rated 3 stars.

Roblox stock is significantly undervalued, but an investment here should only be considered by those investors who are willing to undertake greater amount of risk. While we expect its top line to do well this year, the company has been suffering a widening loss as it continues to ramp up hiring and spending on capital expenditures to improve user experience. While we expect this investment will pay off over time, the market is taking a wait-and-see approach. In addition, Roblox stock has also been under pressure as general market sentiment has soured against stocks that are leveraged to the emergence of the metaverse. On the upside, we forecast that as Roblox matures, the average age of its users will continue to increase, which means its core user base will begin to have a greater amount of money to spend on the platform.

Take-Two Interactive stock has been under pressure, as the company has disappointed investors for the past two quarters. Take-Two completed its acquisition of Zynga, a major player in mobile gaming, in May 2022. However, growth in mobile gaming has been slowing and the company has yet to realize the benefits from this merger. Over time, we expect Take-Two’s proven franchises and extensive game pipeline on console, PC, and mobile will overcome its current challenges.

e-gaming

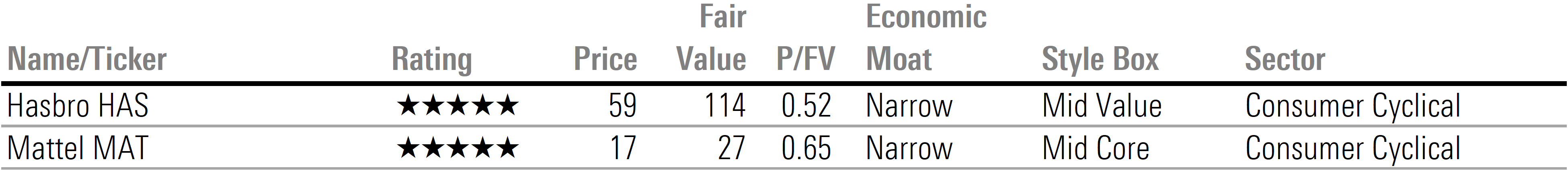

Toys

With the relentless pinch of inflation, investors are concerned that discretionary spending on goods like toys will be tempered in the 2022 holiday season. Making comparisons even more difficult, toy shipments were pulled forward into the second quarter this year instead of the third quarter to ensure that shelves would be stocked well in advance of the shopping season.

However, this is coming while point-of-sale metrics have slowed significantly to a low-single-digit rate in 2022. Even with slower point-of-sale growth ahead, we think some companies (like Hasbro) stand to capture structurally higher profitability ahead. This is because profit margins will increase from faster growth in the digital segment, which has higher margins than traditional categories.

Toys

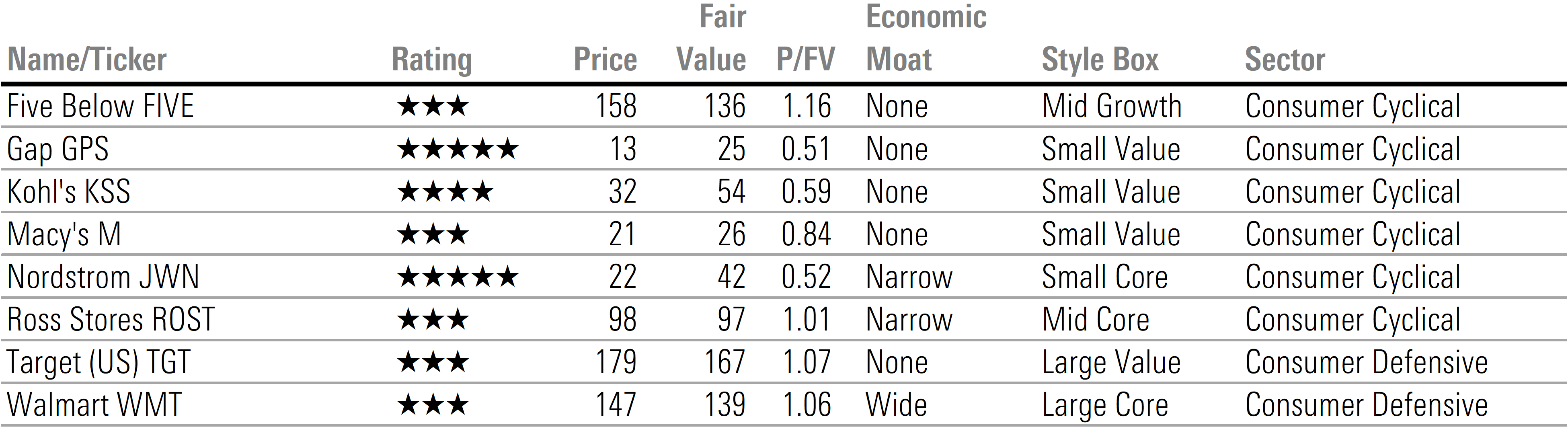

Retailers

In 2021, supply chain disruptions and the resulting lack of inventory resulted in slim pickings for shoppers. However, the low level of supply resulted in a higher percentage being sold at full price. Retailers realized high margins as there was very little inventory left over that had to be sold at deep discounts to clear the shelves.

This year is lining up to be the opposite story. Inventory levels are running high as there has been a mismatch in timing of inventory deliveries and seasonal demand. As an example, some shipping and manufacturing delays early in the year resulted in spring and summer products not being delivered until late summer. So, in order to make sure they had inventory delivered in time for the holiday season, retailers ordered winter merchandise early. But then shipping bottlenecks dissipated, which meant winter and holiday products that were ordered early were also delivered far ahead of the holiday season.

Compounding the inventory problem, sales have generally been lower than expected. Retailers have thus far spent the third quarter and early fourth quarter working through a deluge of inventory.

In the apparel segment, we suspect that a glut of inventory will result in deep discounting to clear out the excess inventory and, as such, margins will drop well below last year’s historically high levels. Both Kohl’s and Macy’s are up against tough year-over-year comparisons; however, for investors who can look through this season’s difficulties, may see, as we do, that both stocks are undervalued.

As for Gap, it has suffered through a very difficult year, but sales appear to be stabilizing and management has laid out plans to address its key problems. Discounting is likely to affect its margins in the holiday season, but it is cutting operating costs and shipping rates are falling, so margins should begin to recover going into 2023. Gap’s best opportunities are in Old Navy, which has new leadership, and Athleta, which should benefit from the same women’s athleisure trend that has propelled Lululemon.

Retailers

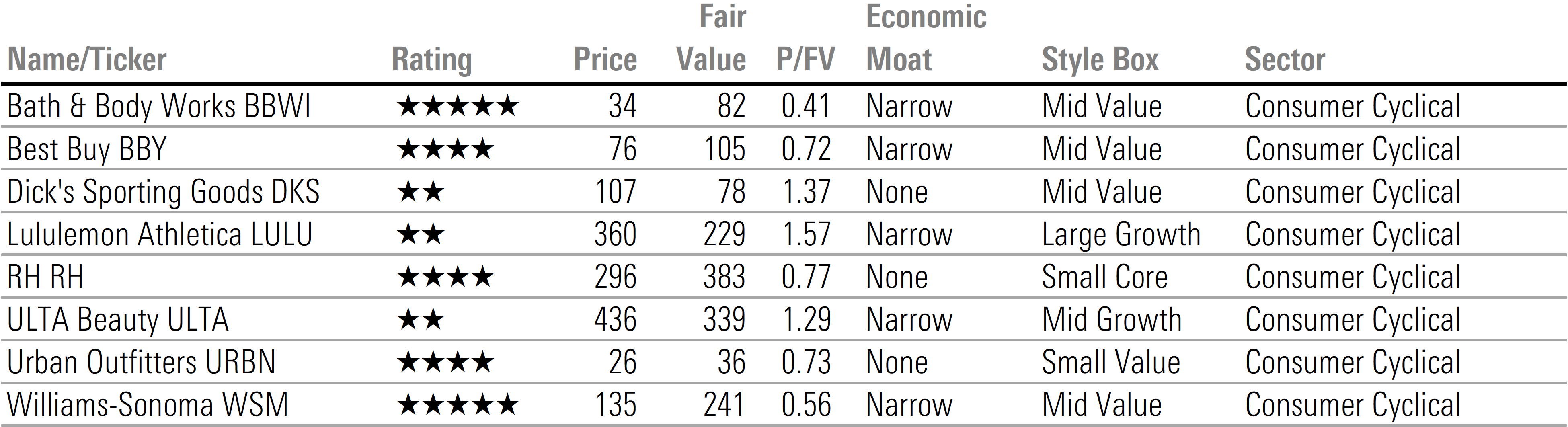

Specialty Retailers

Going into the 2021 holiday season last year, the specialty retail space contained some of the most overvalued stocks under our coverage. Since then, most of the stocks in this category have significantly underperformed the broader market as these retailers failed to meet investor expectations.

For example, in the home furnishing space, Restoration Hardware and Williams-Sonoma were both significantly overvalued last year and were rated 1 star and 2 star, respectively. As consumer behavior normalizes, spending in the home goods category is shifting back to other discretionary areas. At the same time, higher interest rates have led to a significant slowdown in existing home sales, which has reduced spending around the relocation process. After falling 53% and 36%, RH and Williams-Sonoma are now rated 4 stars and 5 stars, respectively.

Similarly, Bath & Body Works stock has dropped 55% over the past year. For investors with a longer time horizon, we expect product innovation (in existing and new categories) and productivity gains of new store formats will lift top- and bottom-line performance in these locations over time. Furthermore, gains from omnichannel improvements (buy online/pick up in store, for example) should remain a mainstay, while other digital enhancements support both conversion and profit upside.

In the electronics space, Best Buy may not see the same demand it did last year, but we think the company is one of the better examples of a retailer successfully transforming its business from brick and mortar into a true omnichannel retailer. While general sales of electronics may be under pressure this holiday season, we think the stock has fallen too far. After falling 44% over the past 12 months, the stock has moved into 4-star territory as it trades at an almost 34% discount to our fair value.

While we see value for long-term investors in much of the specialty retail sector, it also contains some of the more overvalued stocks under our coverage. For example, 2-star Dick’s Sporting Goods had been a beneficiary of the pandemic as sales of exercise equipment, outdoor, and sporting goods surged. However, we think investors have overextrapolated the strong results of the past two years too far into the future and that earnings growth will slow as sporting goods sales return to a normalized rate.

The athleisure category had already been surging before the pandemic, but it took another leg higher as remote workers changed out of their business casual clothes and into more comfortable clothing. While Lululemon may be the industry standard for athleisure wear, the growth of this category has attracted even more competition across stores and additional channels. At a 57% premium over our valuation, Lululemon stock is one of the most overvalued stocks across our U.S. coverage.

Specialty Retailers

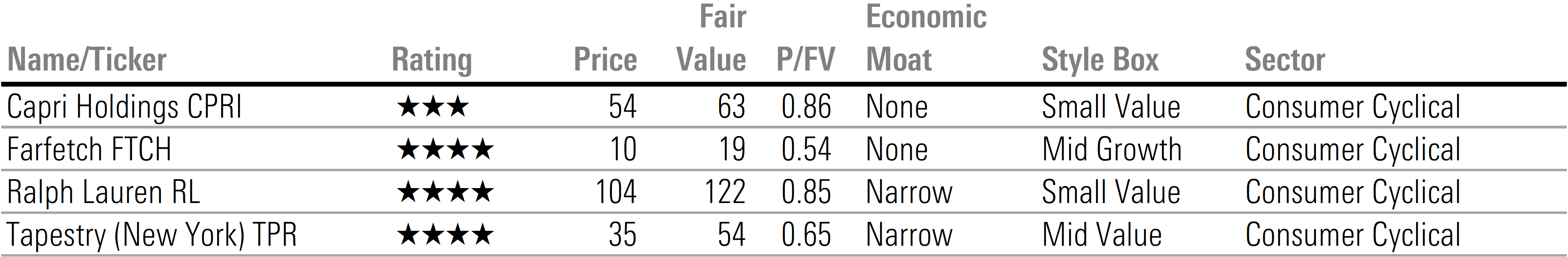

Luxury Retailers

Luxury retailers were richly valued last year, and three of the four stocks were rated 2 stars. These stocks have sold off more than the broader markets this year, and three of the four are now rated 4 stars.

While we don’t forecast the luxury retailers to realize the same strong growth as they did last year, we do expect that they will continue to do well. Inflation has not had as much of a negative impact on upper-end consumers who are still willing to pay a high price for high fashion. For example, Ralph Lauren has pushed through price increases that have stuck and resulted in little reduction in demand. Among luxury categories, handbags reportedly continue to be outperforming, which should bode well for both Capri and Tapestry.

Luxury Retailers

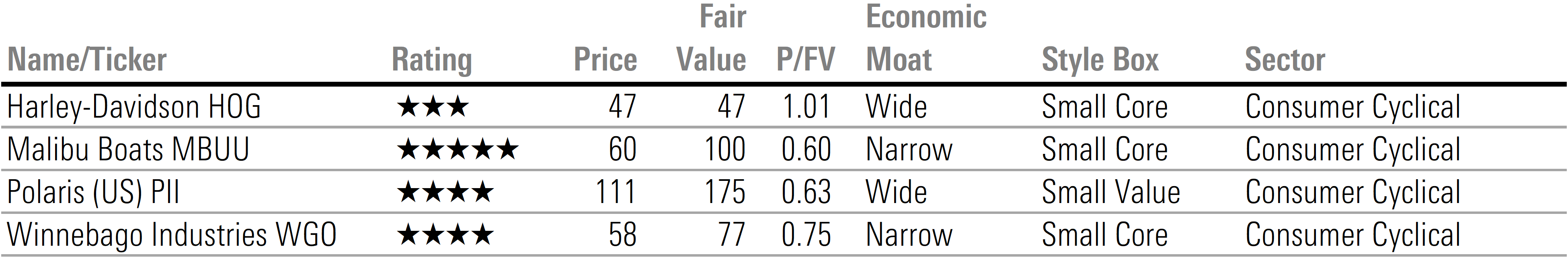

Powersports & RVs

While we expect spending in the goods categories will be under pressure, one area that has been holding up is the recreational goods category—in particular, outdoor powersports. Many consumers continue to prefer outdoor activities, and the impact of the pandemic had helped to expand demand for powersports outside of its historical core markets and end users.

During the pandemic, supply could not keep up with demand and now the manufacturers are still working to fulfill the backlog and resupply their dealers. Even once this backlog is filled, we expect longer-term demand to remain robust as the targeted demographic group continues to expand. Two undervalued companies that we think stand to benefit from these trends are Polaris, which manufactures off-road vehicles, and Malibu Boats, which manufactures recreational boats.

Powersports

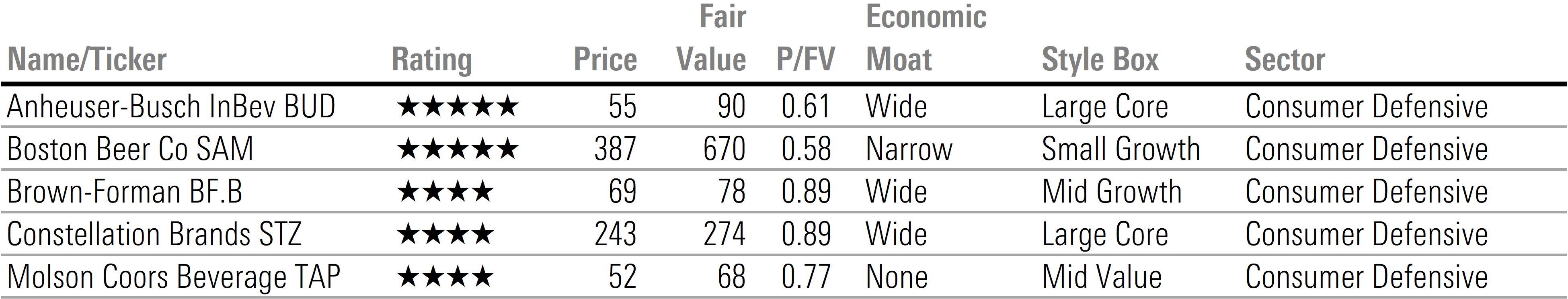

Alcoholic Beverages

During the pandemic, alcoholic beverage consumption shifted from on-premises to at-home drinking, where consumers often traded down to lower margin brands. When consuming in public, consumers tend to choose higher-end brands, which in turn drives higher margins. We think this shift to higher margin brands could be a catalyst to reinvigorate investor interest in the alcoholic manufacturers that are trading at significant margins of safety from our intrinsic valuations.

Beverages--alcoholic

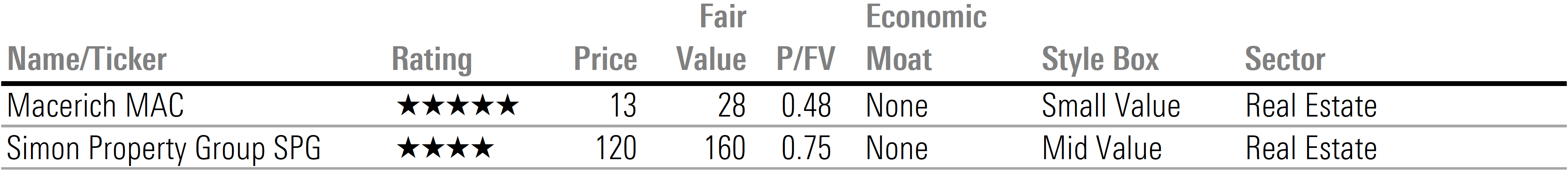

REITs--Shopping Malls

Finally, we think the death of the shopping mall has been greatly exaggerated. Shoppers continue to value the in-person shopping experience, and malls continue to evolve.

This is happening so they can refine the portfolio of stores located within the malls themselves, as well as redevelop their footprints to include more experiential offerings. Experiential offerings are those that cannot be re-created online, such as restaurants, gyms, physicians’ offices, and other services. These experiential offerings are not only a way to compete against online sales, but a way to change the mall into a lifestyle center and drive foot traffic.

REITs--Shopping Malls

A version of this article previously appeared on Nov. 22, 2021.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FNDLNORUIBFD5KKEXASUD67L6Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BHGJBKNFZRB7NHXO3ZLRNAHOIY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RENAPI2NVVDIDCNNAGV6XAUCM4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)