2 Sectors With the Largest Fair Value Increases

We raised our expectations for many energy and technology stocks, but are there any opportunities as a result?

As U.S. companies report third-quarter earnings that are on track to be among the strongest since 2008, energy and technology names are leading the pack when it comes to Morningstar analysts raising their estimates on the stocks' valuations.

The continued rise in energy prices, especially for natural gas, was a key driver of higher valuations pegged to companies in that sector. Meanwhile, tech stocks with the largest valuation boosts ranged among software, semiconductor, technology services, and solar.

Morningstar equity analysts conduct fundamental analysis and create a financial model to determine a company's intrinsic value and a fair value for its stock. While our analysts stick to a long-term approach to investing, they monitor quarterly earnings results to update their assumptions and potentially their estimates.

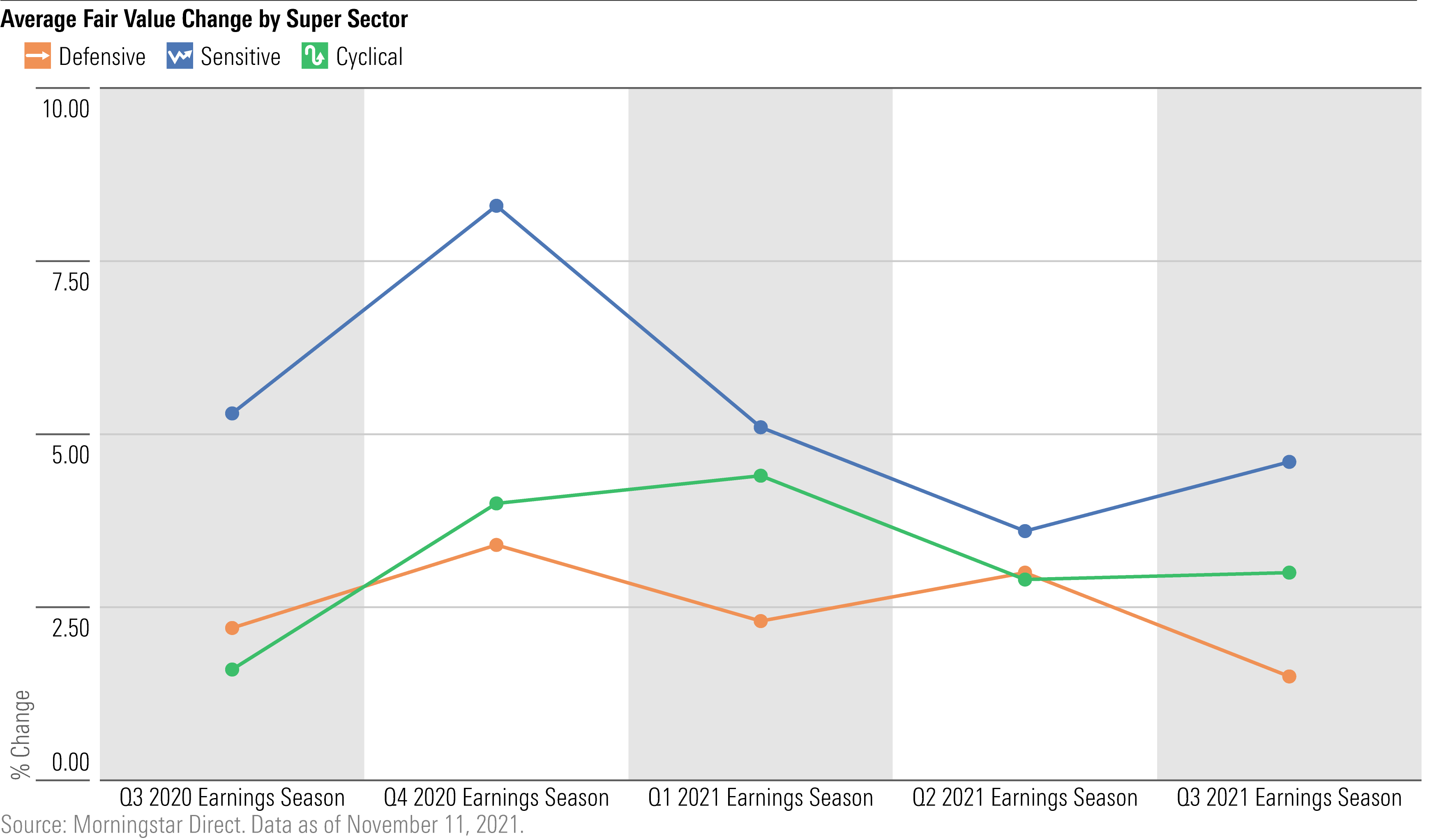

The chart below shows the average percentage change in fair value estimates throughout the past five quarters' earnings seasons. Fair value estimates were pulled from Morningstar Direct for the end dates of each quarter and compared against the estimates six weeks after each quarter. (For a detailed explanation of the methodology, see the end of this article.)

For this chart, we've broken the data down among what Morningstar calls the Supersectors: cyclical, defensive, and sensitive. Cyclical sectors are those that are heavily correlated with the business cycle. As the economy grows and expands, cyclical sectors follow. The defensive sector includes industries that are relatively immune to economic cycles. Sensitive industries ebb and flow with the overall economy, but not severely, and fall between defensive and cyclicals.

Sensitive sectors saw an uptick in fair value increases from the prior quarter, averaging 4.6%. Defensive sectors recorded an average increase of 1.5% in fair value estimates, down from the second quarter, while cyclical sectors kept pace with last quarter’s number with a 3% average increase.

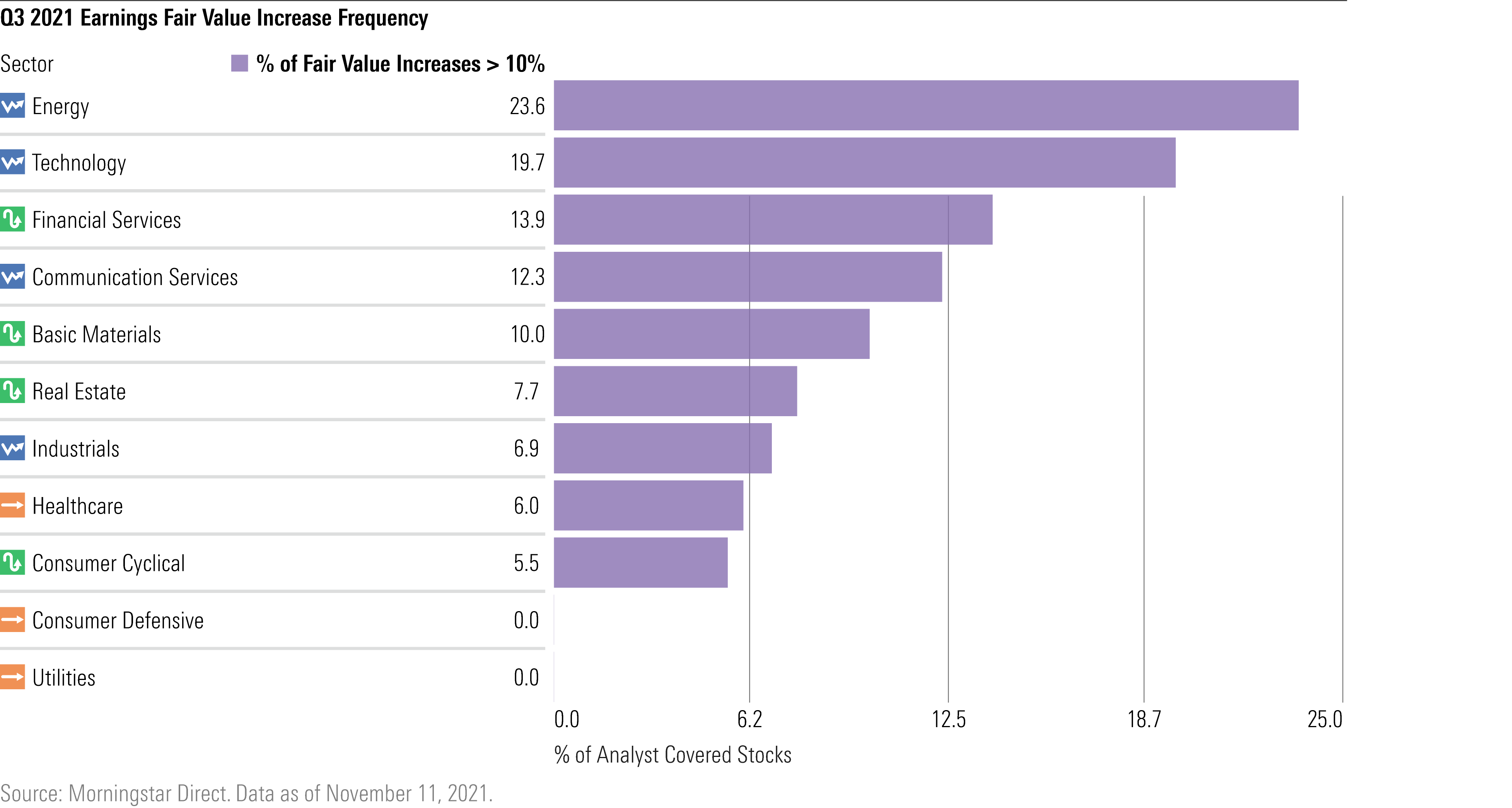

Drilling down further, we screened for fair value estimate increases of 10% or higher to capture the most meaningful changes.

Energy and technology sectors registered the most frequent large fair value raises. Energy led, with 23.6% of Morningstar’s stock coverage list seeing increases in fair value of 10% or greater. Tech followed, with 19.7% of stocks covered by Morningstar recording increased fair values. The financial service sector came in third at 13.9% amid an impressive performance of bank stocks this year.

Energy

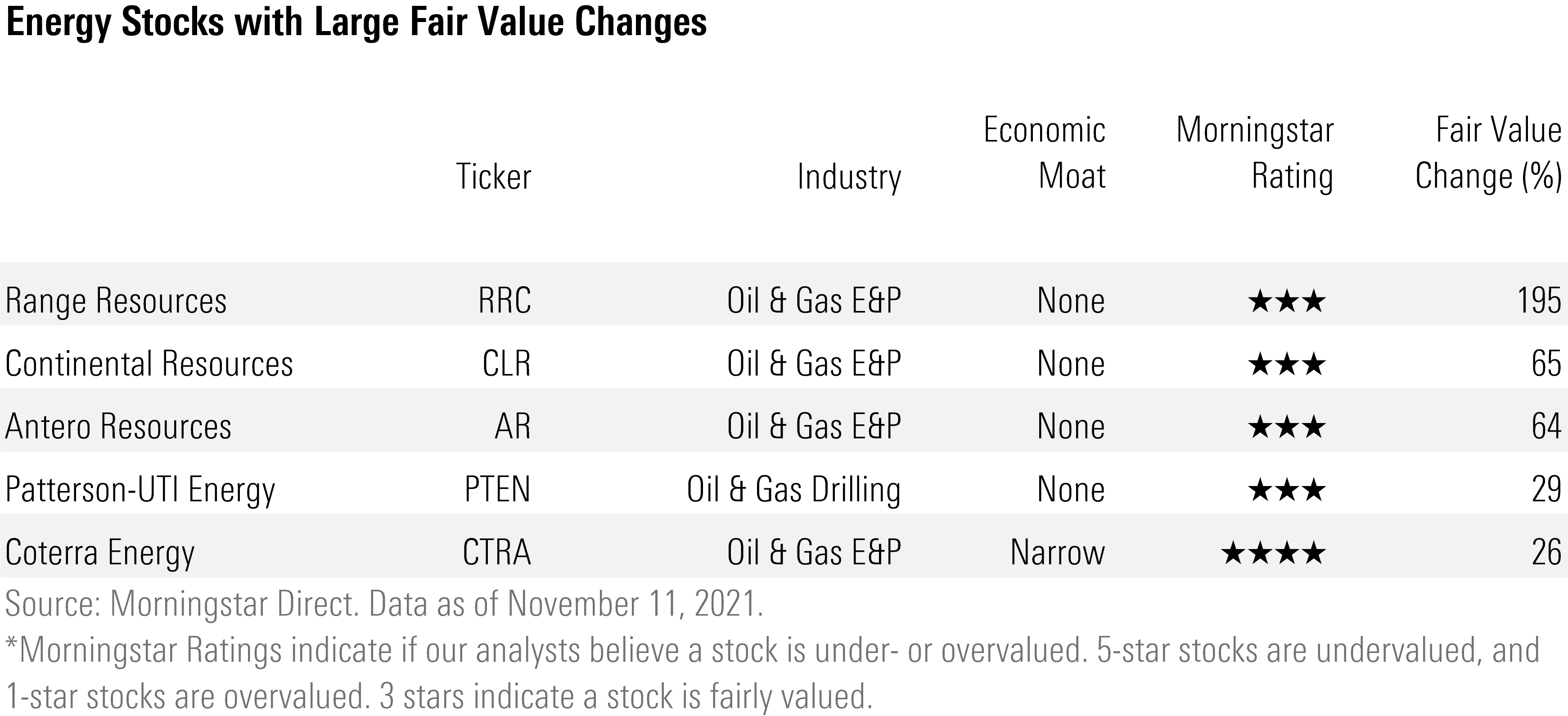

Energy stocks--particularly those in the gas industry--saw the largest increases in their fair values over the course of earnings season.

Range Resources RRC topped our coverage list with a fair value increase of 194%. One of the primary drivers was Morningstar's increased midcycle forecast for U.S. natural gas to $3.30 per million cubic feet from $2.80 per mcf. Morningstar Office and Direct clients can read the full forecast report here.

Energy sector director David Meats says that among the companies Morningstar covers, Range Resources’ valuation was the most sensitive to the forecast change because of its above-average leverage, jumping to $28 per share from $9.5. “The increase reflects our belief that liquefied natural gas exports will propel gas demand to 105 billion cubic feet per day by 2025, up 16% from 2020 forecasts” he says.

Also on the fair value increase list was Continental Resources CLR; its fair value was raised to $51 per share from $31, up 65%. Antero Resources AR rose 64% to $18 per share from $11. Coterra Energy’s CTRA fair value was increased 26% to $29 per share from $23. “The midcycle increase, coupled with a stronger near-term pricing outlook, catapults our valuations for natural gas producers,” Meat says. However, with the exception of Coterra, the energy companies remain fairly valued following the upgrades.

Land rig drilling contractor Patterson-UTI Energy PTEN saw its fair value raised 29% to $9 per share from $7. The firm posted top-line growth above 20% since the prior quarter for the second time in a row. “This quarter’s growth mostly came from a higher rig utilization rate, which has rallied since bottoming at 28% one year ago” says analyst Katherine Olexa. Rig utilization is expected to reach the mid-40s in the fourth quarter, and Olexa expects Patterson’s pricing power to improve in time, setting up potential boons to the firm’s top line.

Technology

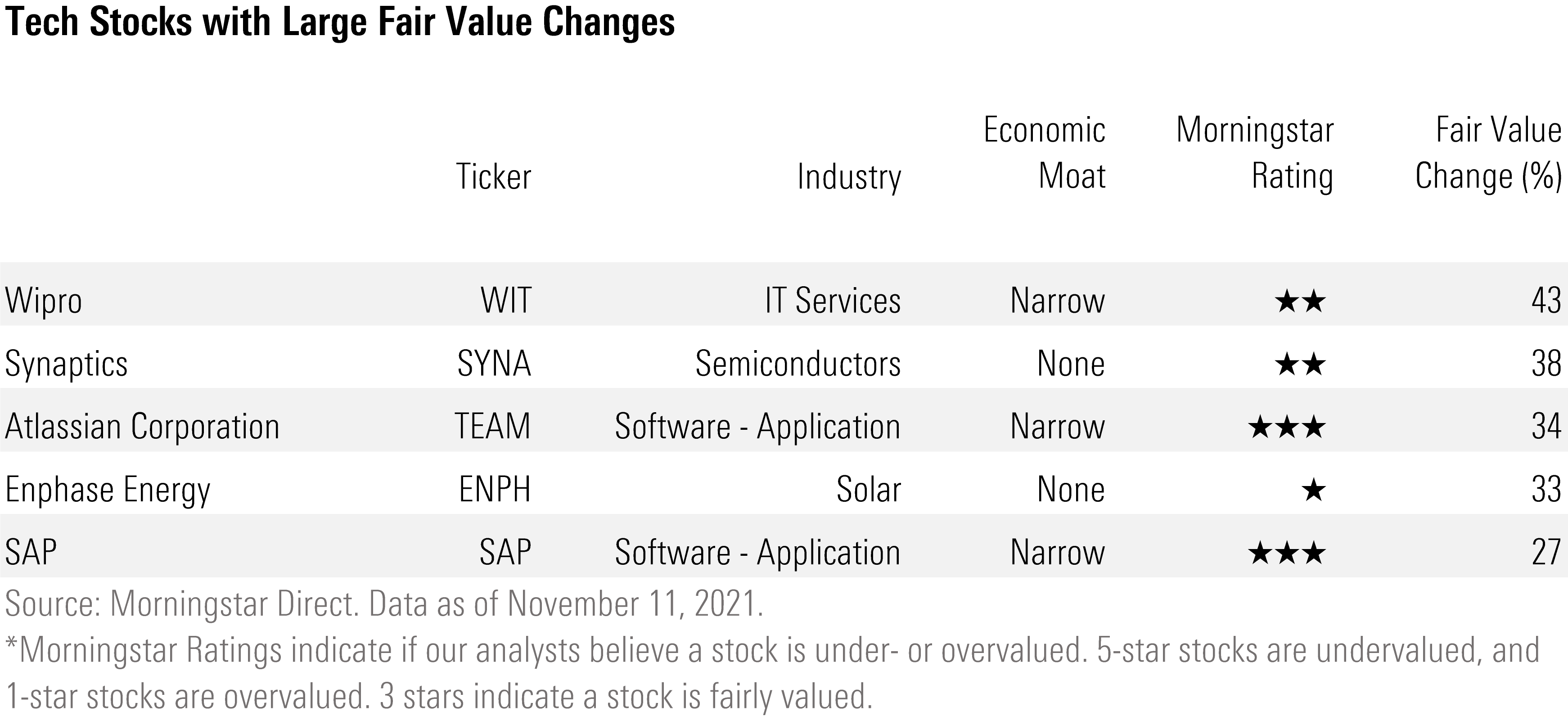

Wipro's WIT fair value rose 44% to $6.6 per share from $4.4. The Indian IT service provider’s third-quarter revenue grew 30% year over year. Atlassian TEAM, another company offering IT and business management products, had its fair value raised by 34% to $405 per share from $303. IT service stocks have skyrocketed over the last year, with both Wipro and Atlassian rallying over 60% for the year to date. Analyst Julie Bhusal Sharma attests this to pandemic-induced tailwinds, such as accelerated digital demand. “We also believe a substantial portion of the IT services market growth includes managed infrastructure from new workloads enabled by the cloud, which we also think will favor cloud-service providers like Amazon and Microsoft” says Sharma.

After reporting exceptional third-quarter results, Synaptics' SYNA fair value was raised 38% to $200 per share from $145. Enphase Energy ENPH rose 33% to $138 per share from $104. Both companies are overvalued based on their new fair values, however.

Analyst Julie Busal Sharma increased SAP’s SAP fair value to $152 per share from $120 a week prior to its earnings results. Despite announcing results that missed top-line expectations, Sharma maintained the increase as the primary driver of the upgrade was her updated view that the company now had a lower cost of equity: “We think the company will still see healthy top-line growth and margin expansion as both markets grow robustly, allowing it to benefit from a relatively lower cost of equity.”

Data notes: Fair value estimates were sourced from Morningstar Direct for the end dates of each quarter. In some cases, fair value adjustments may have been made prior to company earnings reports. Stocks without a fair value estimate at the beginning and/or end of the six-week period were excluded from data aggregation to account for any changes in our equity coverage list. The underlying list of stocks can change from quarter to quarter owing to changes in analyst coverage or other factors. Stocks portrayed in sector tables may not reflect those that had the largest fair value moves within the sector. Demonstrated stocks were selected to emphasize sectorwide trends and/or at the recommendation of Morningstar analysts.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)