The Problems With the World’s Biggest Bitcoin Fund

Grayscale Bitcoin Trust opened the floodgates but is structurally inadequate.

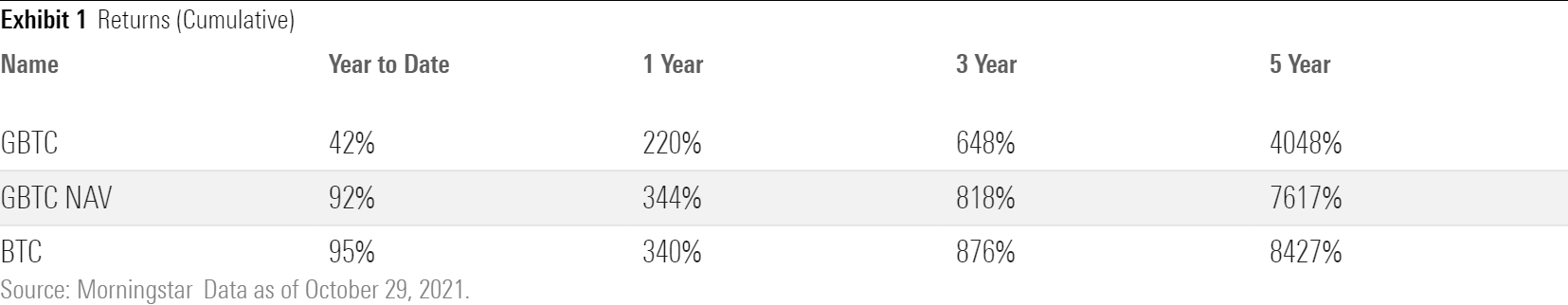

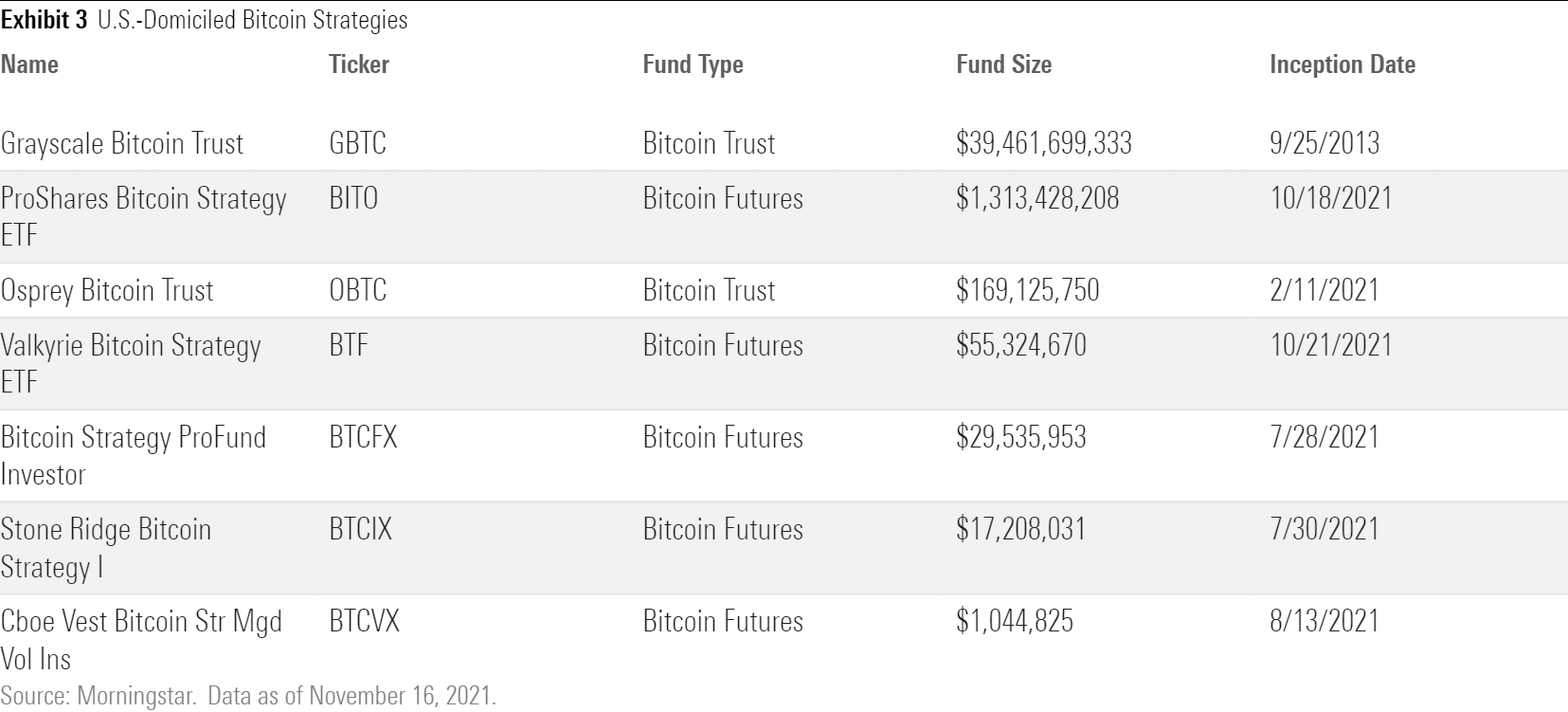

Investors’ interest in Bitcoin has risen commensurate with its price. Quickly chasing that sentiment is Wall Street, with a legion of products meant to satisfy investor demand. We’ve explored the problems with futures-based exchange-traded funds like ProShares Bitcoin Strategy ETF BITO, but the industry’s largest Bitcoin-adjacent product faces issues of its own. Grayscale Bitcoin Trust GBTC carries a whopping 2.00% price tag and, more notably, can sometimes fail to precisely track the price of Bitcoin because of its limitations as a trust. Both of these factors have led to large differences between the returns of the trust and the returns of Bitcoin itself.

Grayscale Bitcoin Trust: First-Mover Advantage

Grayscale Bitcoin Trust launched in September 2013 with the goal of providing investors access to Bitcoin in a managed vehicle. It’s legally designated as a grantor trust, which, for practical purposes, is similar to a closed-end fund. Unlike open-end funds, closed-end funds cannot efficiently add or remove shares from the market to deal with inflows and outflows, and the shares trade throughout the day at prices that can deviate from the vehicle’s net asset value. More on that later.

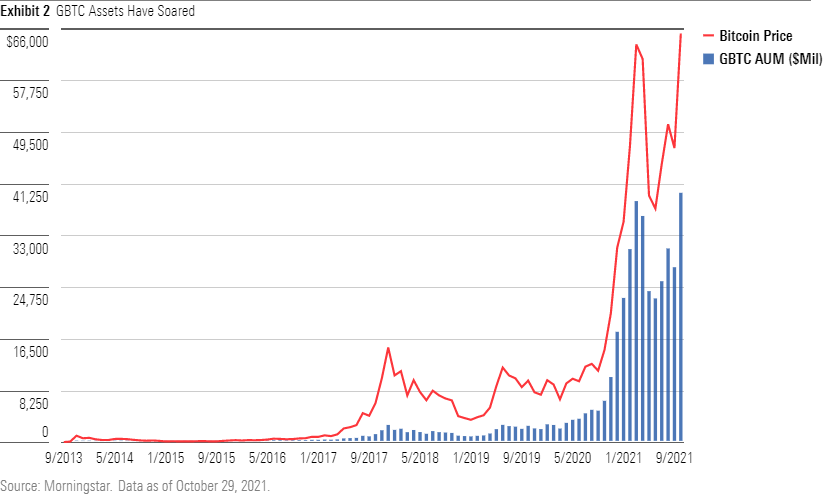

Grayscale Bitcoin Trust launched with just $3 million in assets. Acceptance was slow at first; it didn’t break the $100 million mark until September 2016 before reaching $1 billion in October 2017 as Bitcoin’s price flourished. Though its assets briefly stabilized in that range, the trust entered hyperdrive (aided by significant market appreciation) in mid-2020.

The now roughly $40-plus billion trust (give or take a few billion depending on the volatility of the day) is the largest Bitcoin investment product. ARK Invest is one of the largest holders, investing roughly $375 million through its ARK Next Generation Internet ETF ARKW and holding it in its ARK Innovation Separately Managed Accounts and model portfolios. In total, 47 mutual funds and SMAs held the trust as of September 2021, the most of any crypto-adjacent investment product.

Problems Persist

The widespread adoption of Grayscale Bitcoin Trust has come despite its shortcomings as a Bitcoin proxy. Though it invests directly and exclusively in Bitcoin, its trust structure leads to persistent deviations between the price investors pay for shares (market price) and the actual value of those shares (its NAV).

In a perfectly harmonized world, the number of shares outstanding for a closed-end fund would match the level of demand for those shares. This would keep the share price of the trust in line with its total NAV. Functionally, this is how ETFs trade, with market makers able to create and redeem shares to keep the NAV in line with the price.

Grayscale Bitcoin Trust and all other closed-end funds lack this flexibility. The only entity able to create and remove shares from the market is Grayscale. It does so through private placements and redemptions, which are only available to accredited investors on a periodic basis at the firm’s discretion. This process isn’t as seamless as ETFs’ creation/redemption mechanism and can lead to periods where there are too many/too few shares available to the market. When this occurs, the share price will trade at a discount/premium to the value that the share represents.

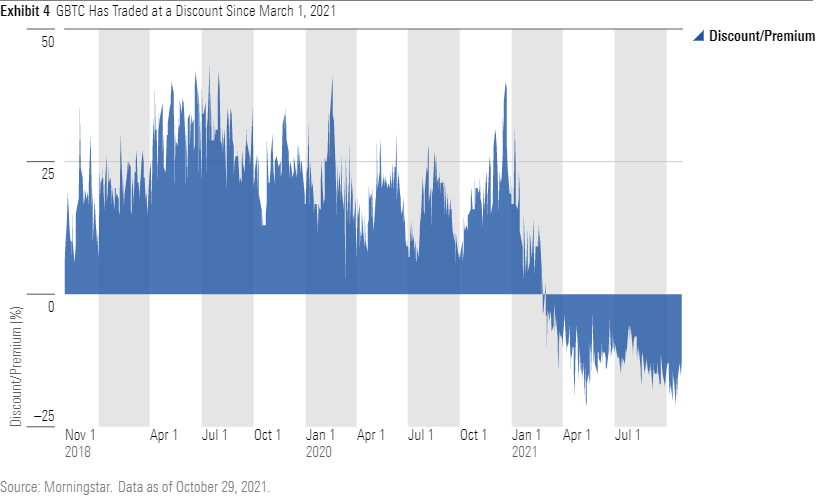

From the start of 2020 up to Feb. 23, 2021, Grayscale filed 35 reports[1] with the SEC indicating that it sold additional shares to accredited investors. Given the overwhelming demand for shares and the fact that the trust traded at a premium during this period, it’s not surprising that the firm would sell shares to meet the market’s demand.

Investors who gained access to the private placement during periods that Grayscale Bitcoin Trust traded at a premium reaped the lion’s share of the benefits. For instance, Grayscale sold[2] more than 59 million shares at NAV between Dec. 15 and Dec. 28, 2020, collecting approximately $1.2 billion in new assets from institutional investors, which it used to purchase Bitcoin for the trust. During that period, the trust's shares cost anywhere from 19% to 40% more than the NAV that the shares controlled. Those spreads represent how different experiences could be for investors in the trust; those stuck buying on the open market had to do so at a significantly marked-up price than those who had access to the private placement. Institutional investors couldn’t flip their shares immediately--they’re subject to a lockup of anywhere from six to 12 months on private placement investments--but the discount is still an advantage over buying shares of Grayscale Bitcoin Trust in the open market.

That dynamic flipped in February 2021, when shares of the trust began trading at a discount to their NAV, with different factors at play. Purpose Bitcoin ETF (a Canadian fund that invests directly in Bitcoin) began trading on Feb. 18 and quickly amassed more than $1 billion in assets in a month of trading. Its management fee of 1.00% is half that of Grayscale Bitcoin Trust, and its structure as an ETF allows it to track Bitcoin more closely, making it more appealing than Grayscale’s offering. Additionally, Grayscale may have simply issued too many shares, with institutional buyers of the private placement selling out to either gain access to Bitcoin in a different vehicle or to simply rebalance their portfolios.

There Is a Cost

The significant premium through February 2021 and the discount that persists through mid-November 2021 show the difficulties of managing the supply and demand for the trust, owing largely to the lack of the instantaneous creation and redemption mechanism that exists for ETFs. Grayscale needs to presciently forecast demand to balance supply; any unforeseen or abrupt changes to the trust’s cash flows can throw off its equilibrium and leave the firm with little immediate recourse.

The switch from premium to discount has had significant implications for investors that bought in on the open market when Grayscale Bitcoin Trust traded at a premium. An investor that top-ticked the premium on Dec. 22, 2020, would have pocketed a 64% return through October 2021--not bad by any stretch of the imagination. However, if that investor had invested directly in Bitcoin, their 160% gain over the same stretch would have been 2.5 times larger. That has had profound impacts on the longer-term returns of each asset.

The discount between the trust’s NAV and its share price drives most of that divergence. Its median spread since March 2 has been negative 12.5%, and it got as low as negative 21.2% on May 13, 2021. This discount has little to do with Bitcoin’s price fluctuations, rather signaling a surplus of Grayscale Bitcoin Trust sellers and not enough buyers.

Is There a Fix?

In theory, buying the Grayscale trust (or any closed-end fund) at a discount can be a good thing. If it trades at a 15% discount, you’re getting $1 worth of Bitcoin for $0.85. Of course, those gains will never be realized if the spread doesn’t narrow, and further widening would hurt investors.

Grayscale has the power to flip this dynamic. Issuers of closed-end funds can redeem shares at the NAV; this allows investors to sell their shares back to the trust, which would close the discount. Using the example above, investors could exchange their $0.85 trust shares in for the $1.00 of Bitcoin it represents.

Grayscale currently does not offer a redemption program, though it has in the past. The firm halted that in 2016 after the SEC charged it with violating Regulation M, which prevents Grayscale from repurchasing shares at the same time it is offering shares through private placements. However, Grayscale is not currently offering new shares. That means the firm can pursue a redemption program, which would help narrow the spread.

Grayscale has conducted buybacks in the past, including a recent $1 billion share repurchase program announced in October 2021. But there’s a big difference between share repurchases and redemptions. Repurchasing shares at the market price indeed creates demand for the shares, which typically helps narrow the spread. But the trust’s massive size is a hindrance, and thus far the repurchases haven’t made a visible dent.

Yet the redemption option might be unpalatable for Grayscale. It would result in lower assets under management, as Grayscale would need to deliver Bitcoin to investors trading in its shares. The firm charges a whopping 2.00% management fee on trust shares (another factor that drives differences between the share price and the underlying Bitcoin), which it may be reluctant to give up with a smaller asset base.

The ETF Question

The regulatory environment is at least partially to blame for Grayscale’s current work-around structure and subsequent issues. Indeed, the SEC has been reticent to approve an ETF that invests directly in Bitcoin. In a hypothetical world where Grayscale Bitcoin Trust could convert into an ETF (Grayscale filed to do so on Oct. 19, 2021), the supply/demand imbalances that have harmed investors would mostly disappear, which would lift the current price discount and propel shares higher to the NAV.

In the meantime, investors’ best hope is for Grayscale to institute a redemption program. Its failure to do so to this point explains the trust’s current dilemma, though the firm may be reluctant to pull that lever until there’s more clarity around a spot ETF. Surely Grayscale views its size as an advantage over peers, which is something it's likely keen to maintain. The roughly $840 million in run rate fees that Grayscale Bitcoin Trust generates at current asset levels is a nice incentive, too.

[1] See 8-k and Form D filings https://www.sec.gov/edgar/browse/?CIK=1588489&owner=exclude

[2] See https://www.sec.gov/Archives/edgar/data/0001588489/000156459020057273/gbtc-8k_20201211.htm

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HTLB322SBJCLTLWYSDCTESUQZI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)